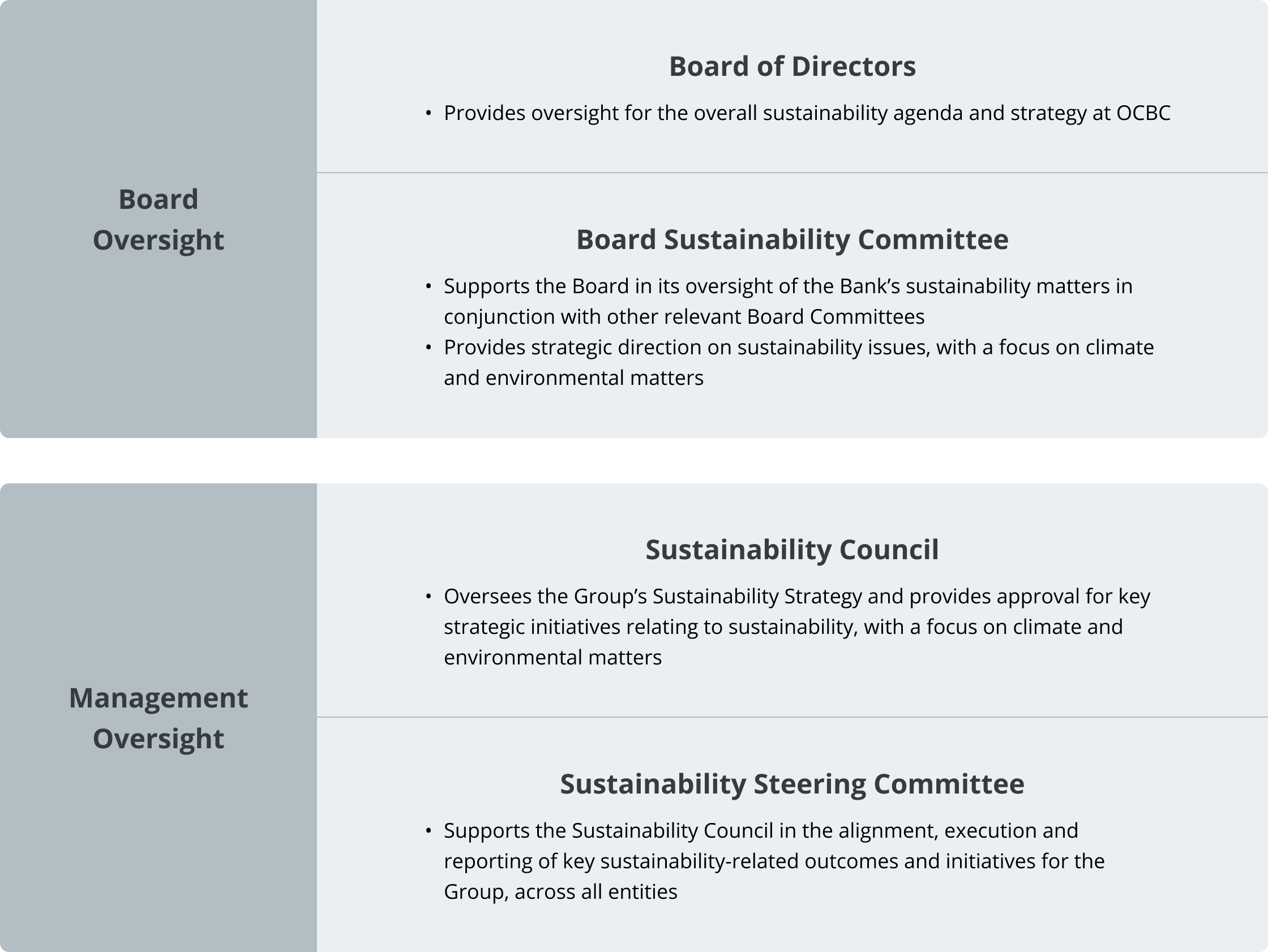

Sustainability Governance

Our sustainability governance structure

Strong corporate governance and risk management are the foundation of a sustainable business and are vital for long-term success. At OCBC, we are committed to upholding business integrity by integrating sustainability across the Board, Board Committees, Management and functional groups. This holistic approach enables us to pursue our sustainability ambitions through our Sustainability Framework.

- The Board1 is also supported by the Board Risk Management Committee which has oversight of the effective management of all the risks faced by the Bank, including ESG risks such as climate change. The management of ESG risks is described in our Responsible Financing frameworks, which are reviewed and approved regularly by our Board Risk Management Committee.2

- To keep abreast of current and emerging sustainability issues such as climate and the environment, all members of the Board have attended sustainability training.2 Beyond that, the Bank provides capacity building and training in sustainability-related topics across all levels of the organisation.

- OCBC regularly reviews the governance structure3 in relation to sustainability and ESG matters, including climate-related risks and opportunities to achieve long-term sustainable growth.

1 Find out more details on our Board

2 For more details on the Board Risk Management Committee or the Board’s training, please refer to our Annual Report

3 For more details on our Sustainability Governance, please refer to our Sustainability Report