Fifth OCBC Financial Wellness Index dips to 60, lowest since inception

Fifth OCBC Financial Wellness Index dips to 60, lowest since inception

- Improvements in Singaporeans’ ability to manage debt could not overcome the fall in other areas, especially retirement planning.

- Financial personality traits were found to correlate with financial wellness; the ‘Emotional’ trait correlated with lower Index scores.

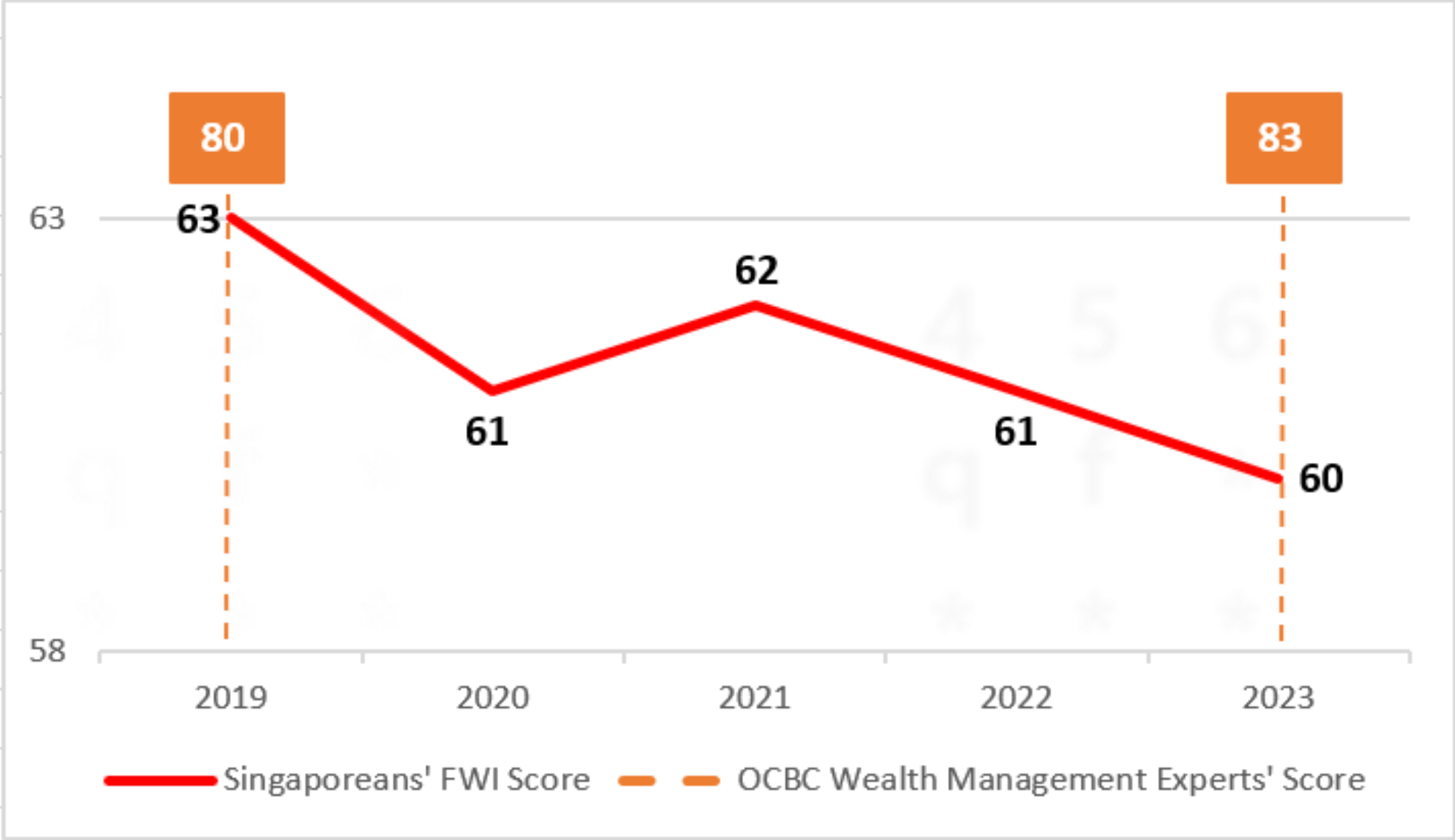

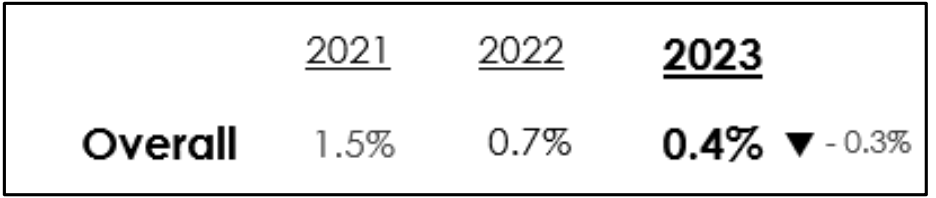

Singapore, 8 November 2023 – Given ongoing economic challenges since the outbreak of Covid-19, the annual OCBC Financial Wellness Index recorded its second consecutive dip to an all-time low of 60. The Index, which is in its fifth edition this year, surveyed 2,000 working adults in Singapore aged between 21 and 65 in August 2023. It assesses respondents on 10 pillars of financial wellness based on 24 indicators established by OCBC’s wealth management experts, to comprehensively determine financial wellness. Singaporeans deteriorated on 15 of the 24 indicators this year.

There were improvements in some areas. Amid a period of high interest rates, Singaporeans are prioritising debt repayments, with more being able to pay off their home loans and other personal debts on time. In addition, fewer Singaporeans practise undesirable habits like spending beyond their means to keep up with peers. However, these were insufficient to buoy the Index as longer-term financial plans have taken a back seat. Singaporeans said that they intend to start retirement planning at a later age, and fewer of those with retirement plans are on track with these plans (35% versus 42% in 2022). Overall, the average rate of return on investments also fell compared to last year, and fewer than half of Singaporeans have at least 6 months of their monthly salary in funds to overcome a crisis.

Figure 1. OCBC Financial Wellness Index (FWI) over the years

Personality traits impact financial wellness

Every year, in addition to the core questions of the OCBC Financial Wellness Index, different thematic questions are included in the survey to gain insights into prevailing trends or areas of interest related to financial wellness. This year, the thematic questions centred on understanding what other factors impact financial wellness – specifically, personality traits. OCBC wealth management experts determined a set of 16 financial behaviours that affect one’s financial wellness. These were then grouped into four distinct financial personality traits (‘Conscientious’, ‘Careful’, ‘Confident’ and ‘Emotional’).

Figure 2. 16 financial behaviours, grouped into 4 financial personality traits

|

Conscientious 1. Sets financial goals and develops a plan |

Confident 6. Not afraid to make big financial decisions |

|

Careful 12. Prioritises debt repayment |

Emotional 15. Finds it hard to put aside emotions |

Singaporeans with ‘Emotional’ as their most dominant financial personality trait have the lowest average Index score (54), performing especially poorly in areas such as having sufficient passive income, investing regularly and planning for one’s retirement. Conversely, those with ‘Conscientious’ as their most dominant financial personality trait have the highest average Index score (64). While the average annual rate of return on investments for Singaporeans was 0.4%, this plunged to -0.8% for those who were dominant in the ‘Emotional’ trait but jumped to 1.4% for those who were ‘Conscientious’.

Please refer to the OCBC Financial Wellness Index 2023 Report for more details on financial personality traits.

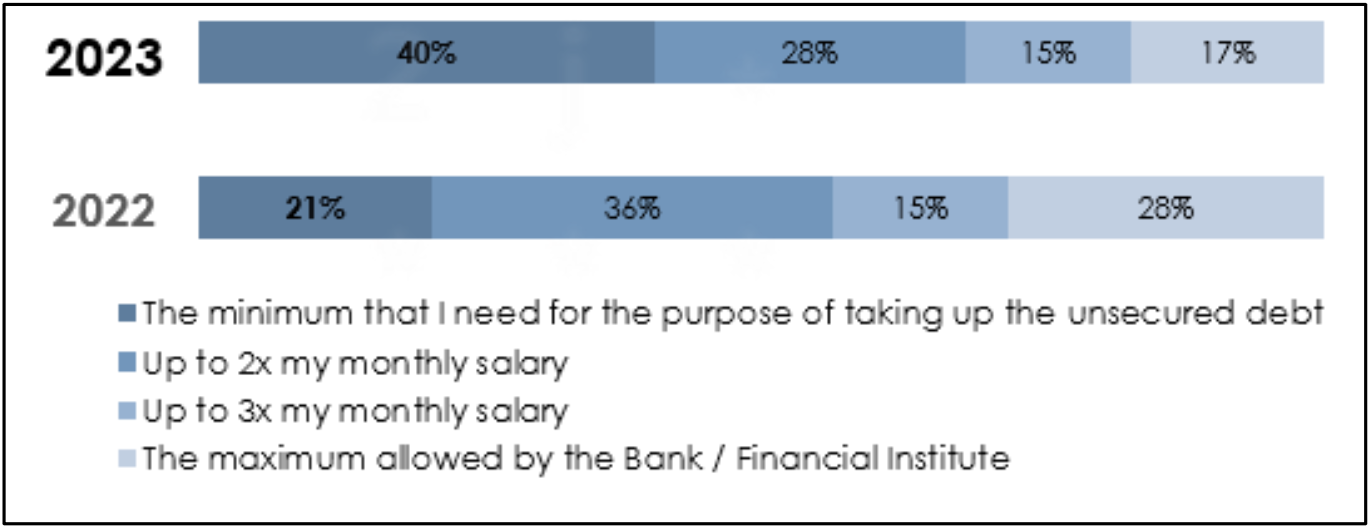

More Singaporeans are managing their debt better

The prolonged high interest rate environment, elevated inflation and GST hike may have triggered a shift in priorities, with more Singaporeans paying off their debts and fewer of them practising undesirable financial habits such as gambling more than they can afford to lose or only paying the minimum sum on credit cards. Almost two-thirds (64%) of Singaporean homeowners are on target with paying off their monthly mortgage instalments, compared to 60% in 2022. In addition, fewer Singaporeans (28%) have unsecured debt like credit card or education loans, down from 31% last year. Among those who have unsecured debt, 40% are borrowing only what is needed compared to 21% in 2022.

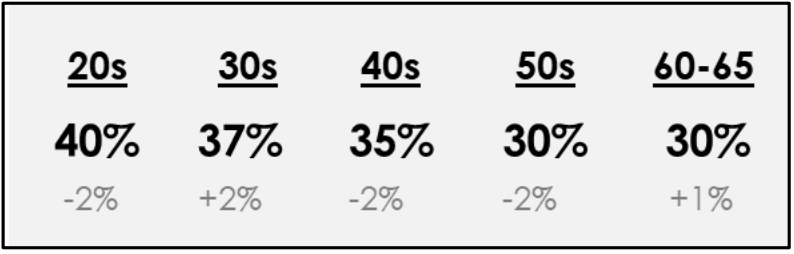

Figure 3. Amount of unsecured debt

That said, like last year, the proportion of Singaporeans in their 30s holding unsecured debt is the highest among all age groups at 35%, up from 33% in 2022. They were the only age group (compared to those in their 20s, 40s, 50s and early 60s) to see an increase. This could be a result of them spending beyond their means to keep up with their peers; 14% of Singaporeans in their 30s indicated that they do this, compared to 12% in 2022. This was the largest such increase among all age groups. In contrast, fewer Singaporeans in their 40s and 50s are spending beyond their means to keep up with their peers, with a drop of 3 percentage points and 5 percentage points respectively compared to 2022.

Retirement planning and ‘rainy day’ plans have been pushed back

With Singaporeans feeling the urgency to better manage their debt, retirement plans have been put on the backburner. In fact, out of the Index’s 24 indicators, ‘planning for retirement’ was the indicator that saw the sharpest decline (40 compared to 47 in 2022).

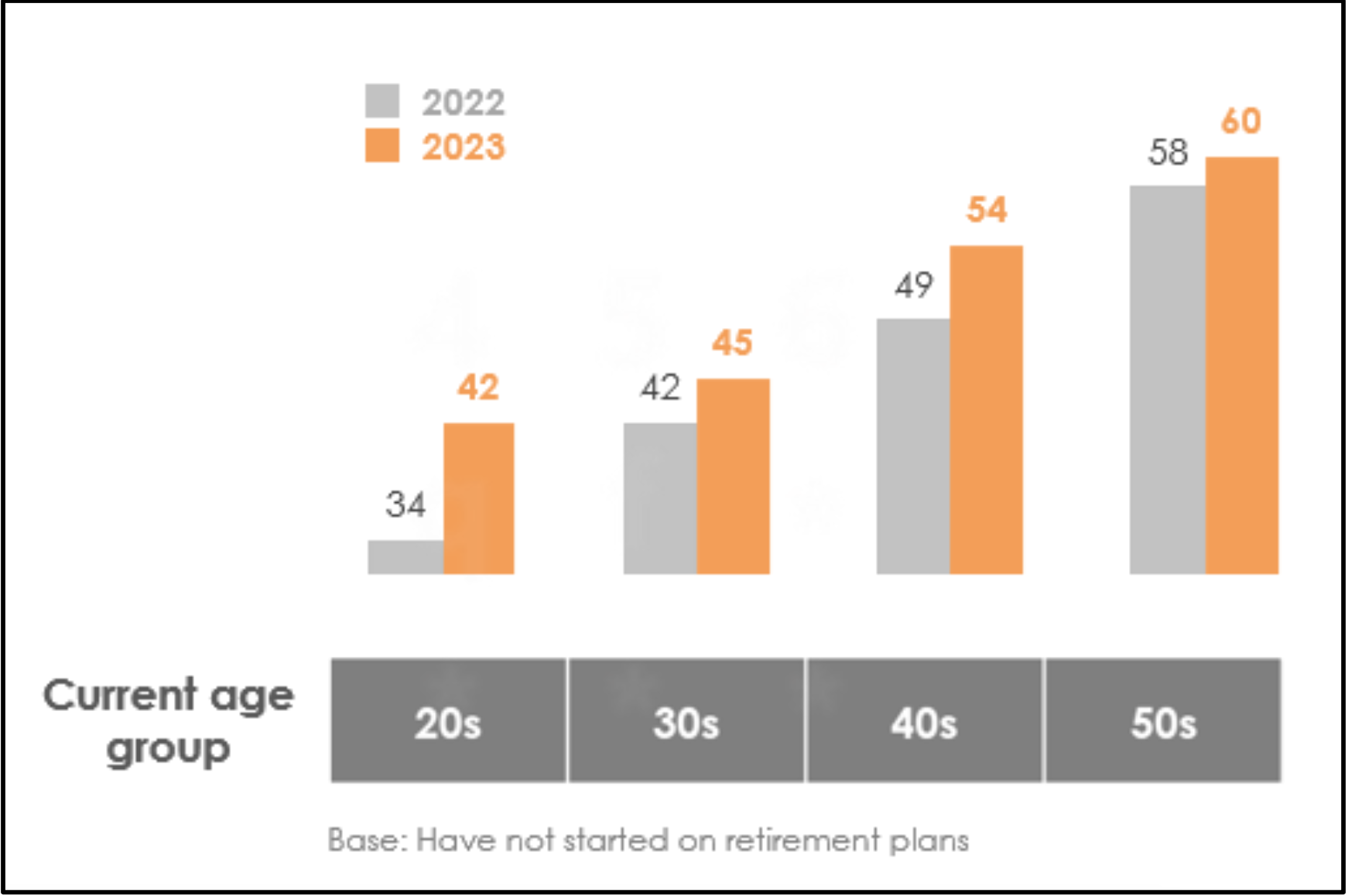

79% of Singaporeans either do not have a retirement plan or are not on track with their retirement plans – an increase from 71% in 2022. While it is not surprising that younger people in their 20s and 30s are further behind in retirement planning, just 1 in 3 (34%) of those in their 50s and 60s are on track – a drop of 8 percentage points from 2022.

In addition, the age at which people intend to start planning for retirement has been pushed back, even among older Singaporeans. Even those in their 50s who have not started planning for their retirement stated that they intend to start preparing for retirement at age 60, which is 2 years later than what this group said in 2022. Those in their 20s said they plan to start at 42 on average, a whopping 8 years later what was said in 2022.

Figure 4. Average age at which age group intends to start preparing for retirement

With fewer people on track with their retirement plans, more are considering alternative retirement strategies to make up for time. 37% of those who have not started on a retirement plan said they would work beyond retirement age, while 28% said they would retire overseas where the cost of living is lower. 9% said they would rely on their children to support them in their later years.

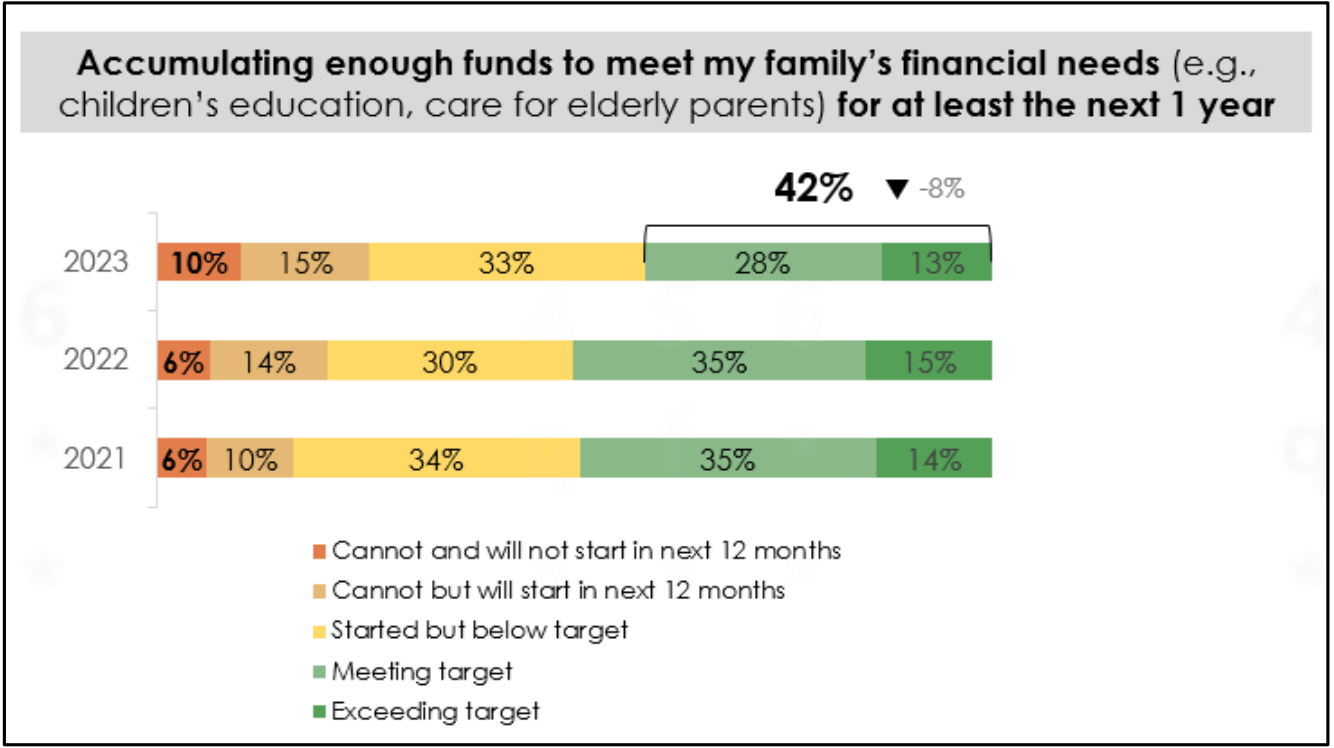

Singaporeans also fell behind on their ‘rainy day’ plans such as being able to defray major medical expenses or being able to meet their family’s financial needs for the next year. For example, only 42% of Singaporeans with dependents have accumulated enough funds to meet their family’s financial needs for at least the next one year – a drop from 50% in 2022. More Singaporeans in their 50s (48%) and 60s (43%) with dependents had saved enough for this purpose. But these two groups also took a much bigger hit compared to younger Singaporeans, with a 14- and 24- percentage point drop respectively from 2022. This is most likely because they are sandwiched between tertiary institution-going children and aging parents. In contrast, this year, 31% (vs 41% in 2022) of those in their 20s and 46% (no change from 2022) of those in 30s with dependents had saved enough.

Figure 5. Proportion of Singaporeans with dependents who have saved enough to meet their family’s financial needs for at least the next 12 months

In a similar vein, 84% of Singaporeans are putting aside at least 10% of their salary, a drop from 2022’s 91%. The average savings rate – the average percentage of monthly income saved – fell 5 percentage points, to 25% of one’s monthly income. A larger proportion of Singaporeans also do not have at least 6 months’ salary as funds to overcome a crisis (53% this year compared to last year’s 46%). Fewer are investing, with rate of returns plummeting; Gen Zs and young Millennials’ investments performed the worst. Amid the gloomy climate, fewer are investing this year, with only 79% of Singaporeans having investments versus 85% a year ago. The average rate of returns for Singaporean investors was slashed by half for another year running, to 0.4%.

Figure 6. Average rate of return from investments

Gen Zs and young Millennials again had the highest proportion of investors who had losses – 40% of those in their 20s had negative investment returns. Taken in totality, the proportion of Gen Zs and young Millennials on track with their investment goals has plummeted from 75% in 2019 to 32% this year. This could be attributed a lack of rigorous research. 1 in 5 investors in their 20s (22%) seek investment-related advice and news only from social media channels and chat groups like TikTok and WhatsApp – the highest among all age groups. Many young investors in their 20s who lost money may not realise they have a blind spot either, with more than a third (35%) of them actively managing investments on their own, trading daily to profit from short-term price fluctuations.

Figure 7. Percentage of investors who suffered losses on their overall portfolio

At the same time, Gen Z and young Millennial investors were likely to have been impacted by their international stocks, which have taken a pounding this year. 30% of investors in their 20s invested in such stocks, the highest among all the age groups.

Non-traditional investments such as cryptocurrency and NFTs – once popular among young investors – have declined in popularity this year. In 2022, close to 1 in 5 (18%) investors in their 20s invested in cryptocurrency. Of these young crypto investors, 2 in 5 of them had said that they would still be willing to invest in crypto within the next year, despite the volatility of the asset class in 2022. Yet just 6% of investors in their 20s invested in cryptocurrency in 2023, likely due to adverse news including the collapse of a notable cryptocurrency exchange.

Qualified financial advice and the use of digital tools can uplift financial wellness

Despite the poorer performance across most indicators, the Index found that getting proper help, whether in terms of advice or tools, had a positive impact on improving scores. For instance, almost half (46%) of investors who seek qualified financial advice from financial institutions are on track with their investments. This is in contrast with those who do not seek advice from financial institutions, of whom only 35% are on track.

On average, investors who had sought qualified financial advice had a 3.3 times higher rate of return on overall investments compared to the national average. Those who did not seek advice, on average, reported a loss.

Even for those dominant in the ‘Emotional’ trait, many of whom scored poorly on various indicators of the Index, the use of financial tools helped to uplift their score significantly. For example, the average score for a person who is dominant in the 'Emotional’ trait and who used a digital tool that provides an overview of their finances across financial institutions they used, was 57. A similar person who did not use such a tool had an average Index score of 51.

OCBC’s Head of Group Wealth Management Ms Tan Siew Lee said, “2023 has been yet another tough year, with the continuation of high interest rates, inflation and turmoil in the financial markets. All of these are reflected in this year’s results, with the Index at its lowest since we started in 2019. The silver lining is that Singaporeans are managing their debt better this year and are still saving well. These are virtues that Singaporeans must continue to practise, especially given the challenging outlook.

“Another simple step that Singaporeans can take is to understand themselves better. Our survey this year found that personality traits have a bearing on financial wellness. Taking the time to understand what traits they have, and the strengths and weaknesses associated with these traits, is therefore important. Only then can they find the right digital tools and solutions to bridge their shortcomings.”

Please refer to the OCBC Financial Wellness Index 2023 Report or visit our website for more information.