Run your business with OCBC Velocity, Digital Business Banking

Take your business forward with OCBC Velocity. Maximise our powerful features and advanced tools to grow your business more effectively in this modern economy.

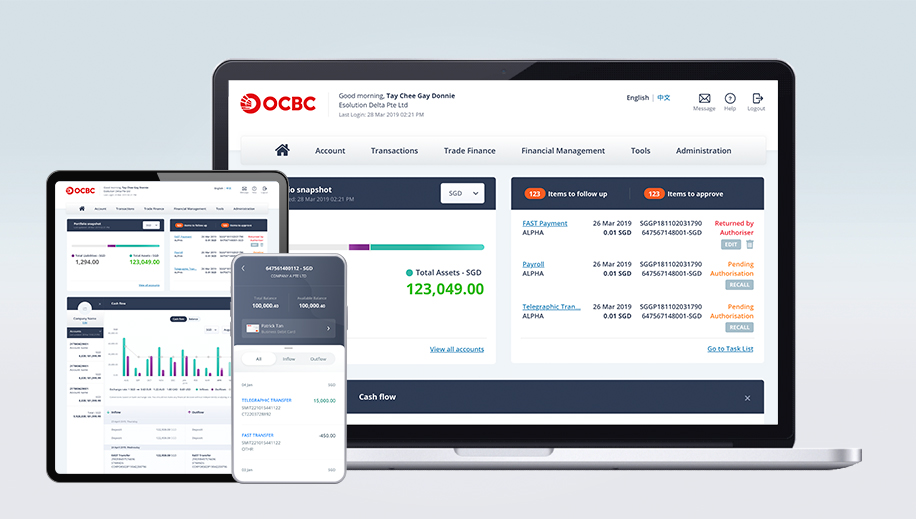

OCBC Velocity. More power. More features. More than just internet banking.

From managing accounts to increasing business efficiency, run your business smoothly with OCBC Velocity by your side. You can even tap into our award-winning trade financing solutions.

Future-proof your business with OCBC Velocity's cash flow forecasting, income and expense management tools.

Explore all our services and discover how OCBC Velocity can help power your business.

Like your very own personal assistant - The multi-useful OCBC Business app

Get the power and flexibility to juggle multiple things - all at the same time. Where multi-use meets useful. Call it ‘multi-useful’: The award-winning mobile business banking app that is like your very own personal assistant to:

- Securely manage accounts and transactional activities with a biometric login.

- Stay on top of your business health with a tap.

- Get alerted instantly on transactions like incoming funds and payment status updates.

- Generate SGQR and PayNow QR codes for payment collection.

- Pay partners via PayNow for Business.

- Update your business address and business details.

OCBC for travel & hospitality

Working with worldwide partners and customers? Learn how Adrian Chia, Co-founder of Tiny Assets – an eco-tourism company with over 350 properties globally – uses the OCBC Business app’s FX alerts to book foreign currency rates that boosts their bottom line.

OCBC for healthcare

Free up time to focus on better quality care and quality growth opportunities? Dr. Zhang Hao Tian, Medical Director of One Medical Group shares how the OCBC Business app helps him to monitor the financial health of his practice and watch out for useful insights that led him to starting up a medical supplies company.

OCBC for F&B

Cook up new ways to increase sales? Nigel Kok, General Manager of Rich Food Catering serves up how he uses the OCBC Business app to spot sales spikes and capitalise on trends for business growth, while also giving him control even when he’s on the move.

OCBC for health & wellness

Looking to streamline approvals? Caleb Leow, Founder of Blood – a feminine care products company with a mission to empower women around the world – uses the OCBC Business app to approve transactions on his mobile, on-the-go.

OCBC for F&B

Faced with fluctuating business costs? Find out how Thomas Ho, 3rd generation owner of Chew Kee Eating House, makes use of cashflow trends on his OCBC Business app to better track and manage monthly flows of money in and money for a clearer overview of his company’s financial position.

OCBC for eCommerce

Always on the move? See how Serene Sim, Founder of E-Essential SG, an online marketplace, makes use of her sales and expenses trend data on her OCBC Business app to run her business better.

Important notices

System requirements

Windows-based PCs:

|

|

Microsoft Edge

|

Google Chrome

|

Mozilla Firefox

|

Windows 7 |

N.A |

√ |

√ |

Windows 8 |

N.A |

√ |

√ |

Windows 10 |

√ |

√ |

√ |

Windows 11 |

√ |

√ |

√ |

Apple Mac:

Safari

|

Google Chrome

|

Mozilla Firefox

|

|

Mac OS X 10.10 or later |

√ |

√ |

√ |

For Tablets:

Android

|

|

Google Android OS Browser (tablet) |

√ |

iOS

|

|

Apple Safari (tablet) |

√ |

Download the OCBC Business app

Log in to OCBC Velocity

or view all service packages if you have not registered.

OCBC Velocity Service Packages

Access to OCBC Velocity is free for all business accounts.

From your daily banking needs to complex control and approval structures, you can choose a setup that caters to your business' unique needs.

Not registered for OCBC Velocity? Apply with this form.