Our Responsible Financing Framework and Policies

Our Responsible Financing Framework outlines our approach to managing environmental, social and governance (ESG) risks within our lending practices. We firmly adhere to a policy of non-engagement in any financing activities that are on our exclusion and prohibition lists where there is clear evidence of immitigable adverse impact to the environment, people or communities, or where there is a breach of local regulations.

Specifically, the Responsible Financing Position Statement represents OCBC Group’s commitment to sustainable development and securing long-term value for the Bank by ensuring that we take into consideration ESG and climate risks and conduct our business and/or finance our clients in a responsible manner. It underscores our commitment to support our clients in their transition towards a low carbon economy, in line with the Paris Agreement temperature goal. This requires adopting a holistic approach to managing environmental risks, such as climate and nature, and recognising the need for transition planning in the markets and communities we operate in.

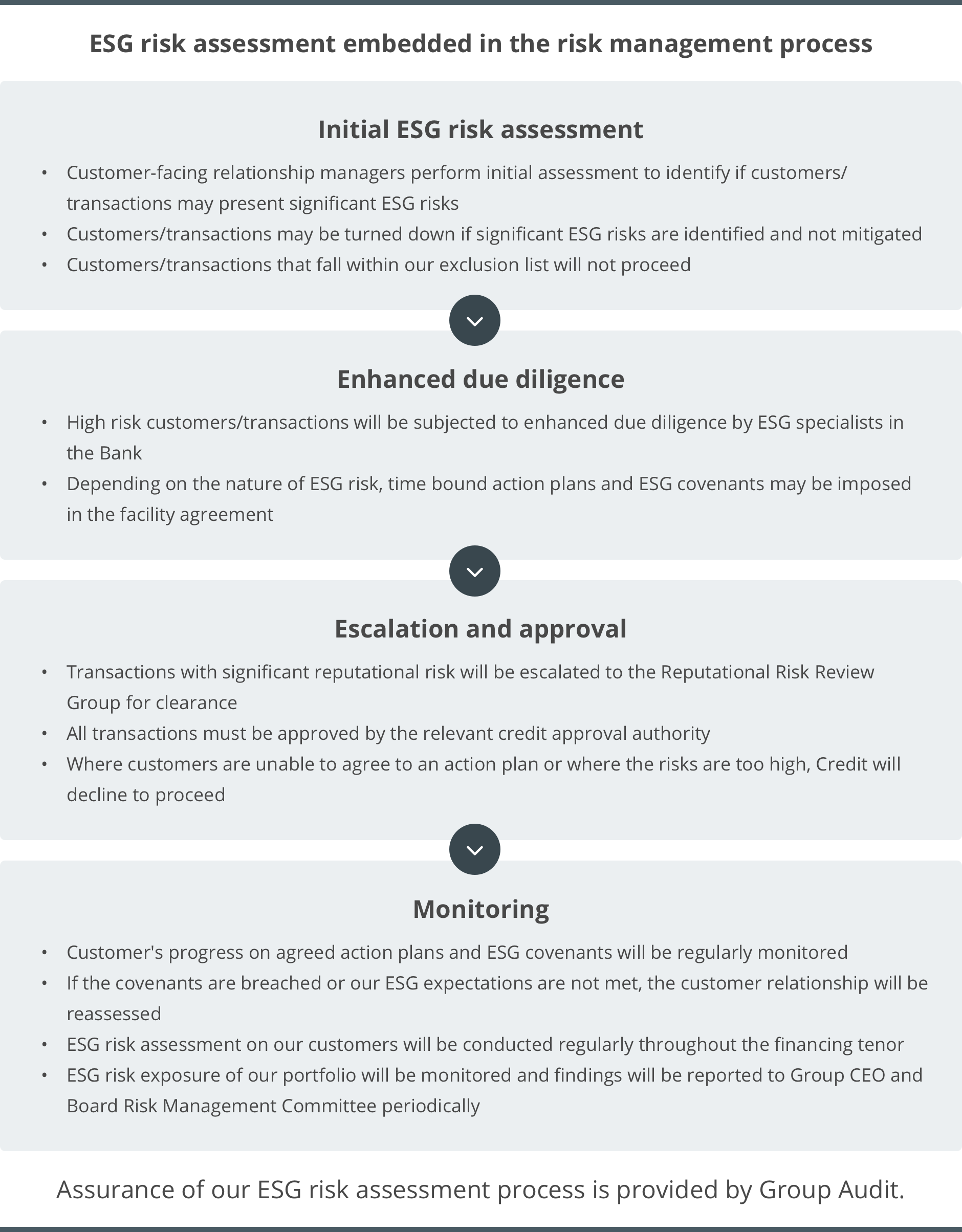

In identifying and assessing clients’ ESG risks, we take a disciplined approach to integrate these considerations in our credit approval process.

As we value long-term client relationships, we seek to positively steer the behaviours of our clients by engaging and supporting them on a risk proportionate basis in adopting more sustainable practices. This includes giving our clients reasonable time to work towards meeting applicable expectations/requirements. We will reassess the client relationship (including turning down future transactions or exiting the relationship) if applicable expectations/requirements are not met.

Monitoring of clients is conducted for any adverse activities, or potential non-compliance with the Bank’s policies. At the portfolio level, various tools such as scenario analysis and stress testing, support the monitoring and reporting of exposures to our management and board on a periodic basis. Disclosure on our approach and progress is on an annual basis, through our Sustainability Report.

| Responsible Financing Framework and Policy |

|

| Responsible Financing Sector-Specific Policies |

|

| Responsible Investing Policy |

|

Exclusion List

We will not engage in or knowingly finance any activity where there is clear evidence of immitigable adverse impact to the environment, people or communities. Our exclusion list lays out the activities we will not finance.

- Production or trade in any product or activity deemed illegal under host country laws or regulations (including those ratified by host countries under international conventions and agreements) or subject to international bans

- Production or activities involving harmful or exploitative forms of forced labour or child labour

- Projects located in or have significant impact on United Nations Educational, Scientific and Cultural Organisation (UNESCO) World Heritage Sites and Wetlands of International Importance designated under the Ramsar Convention

- Production or trade in wildlife including products regulated under Convention of International Trade in Endangered Species of Wild Fauna and Flora (CITES) and United for Wildlife Financial Taskforce

- Production or trade in controversial weapons and munitions for offensive warfare (e.g. nuclear, biological and chemical weapons, anti-personnel mines and cluster munitions)

- Coal-fired power plants (CFPPs)

- Project financing:

- Except where financing is towards coal phase-out, as part of a low-carbon transition programme

- Corporate financing:

- Where the power generation capacity or revenue of the new client derived from CFPPs exceeds 25%

- Where the power generation capacity or revenue of an existing client derived from CFPPs exceeds 50%

- Project financing:

- Thermal coal mines

- Project financing

- Corporate financing:

- Where the mines capacity or revenue of the new client derived from thermal coal exceeds 25%

- Where the mines capacity or revenue of an existing client derived from thermal coal exceeds 50%

- Oil and gas upstream projects approved for development after 2021

- Drift net fishing in the marine environment using nets in excess of 2.5km in length

Our ESG Risk Assessment Process

All applicable new and existing corporate, commercial and institutional client transactions are subject to our ESG risk assessment process. We take a risk-based approach towards managing ESG risks where transactions that carry high ESG risks are subject to enhanced evaluation and approval requirements.

Consistent with our overall risk management approach, we manage ESG risks by adopting the Three Lines of Defence model.

OCBC Three Lines of Defence:

- Relationship managers conduct initial ESG risk assessments on their customers.

- Credit approving officers independently review and approve the ESG risk assessments, creating a structure of governance and control.

- Group Audit provides assurance that this process is effective and complies with regulations and our internal standards.

Find out more about our ESG risk assessment process.

Signatory to the Equator Principles

OCBC is a signatory to Equator Principles as an initiative for responsible financing. The Equator Principles is a risk management framework adopted voluntarily by financial institutions to determine, assess, and manage the environmental and social risks associated with financing of large-scale projects such as infrastructure projects to expand transport links and enhance access to basic services such as energy and water.

These include meeting internationally-recognised standards for due diligence and monitoring of projects in accordance with relevant requirements, such as the International Financial Corporation (IFC) Performance Standards and the World Bank Group Environmental, Health and Safety Guidelines.

As a signatory to the Equator Principles, we have integrated requirements from the Equator Principles into our ESG Risk Assessment Process for transactions within the scope of the Equator Principles. In 2021, an Equator Principles Implementation Procedure was established to provide relationship managers with detailed guidance on conducting ESG risk assessment for applicable transactions.

Find out more about the Equator Principles.

Signatory to United for Wildlife Financial Taskforce

OCBC is a member of the United for Wildlife Financial Taskforce, a leading global effort to combat illegal wildlife trade. We recognise that the illegal wildlife trade — among the five most lucrative global crimes — has a devastating impact on the dwindling populations of endangered wildlife left in the world. We are committed to ensuring that the Bank does not facilitate or tolerate financial flows derived from the illegal wildlife trade and the corruption associated with it, such as the sale of illegal wildlife products.