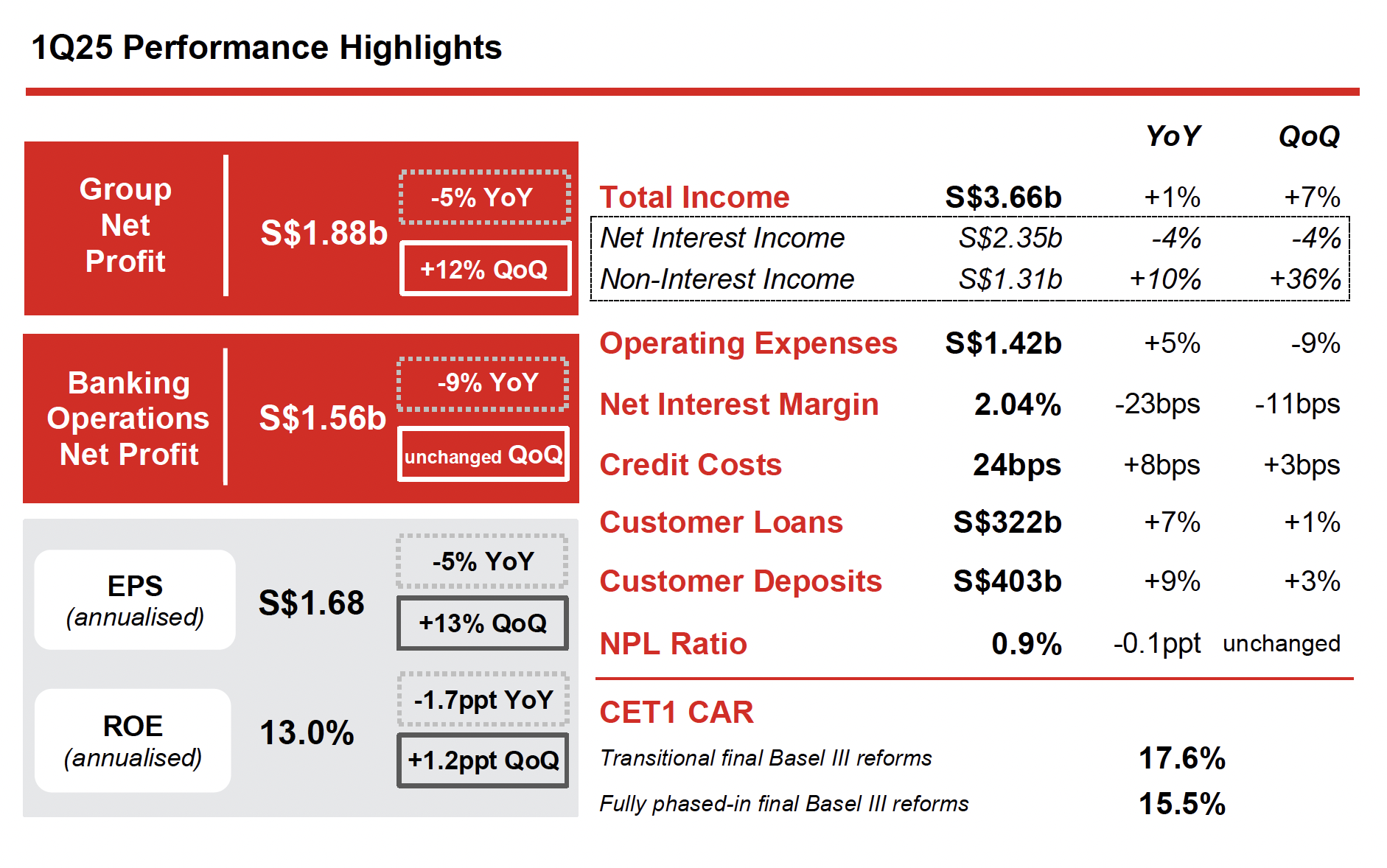

OCBC Group First Quarter 2025 Net Profit Up 12% from the Previous Quarter to S$1.88 billion

OCBC Group First Quarter 2025 Net Profit Up 12% from the Previous Quarter to S$1.88 billion

The Group demonstrated a resilient quarter-on-quarter performance, largely driven by broad-based growth across fee, trading and insurance income.

Singapore, 9 May 2025 – Oversea-Chinese Banking Corporation Limited (“OCBC”) reported net profit of S$1.88 billion for the first quarter of 2025 (“1Q25”), 12% higher than S$1.69 billion in the previous quarter (“4Q24”), and 5% lower than the S$1.98 billion a year ago (“1Q24”).

The Group demonstrated a resilient quarter-on-quarter performance, largely driven by broad-based growth across fee, trading and insurance income. Expenses were lower, with cost-to-income ratio (“CIR”) improving to 38.7%. Loan and deposit growth momentum was sustained, while portfolio quality continued to be sound with non-performing loan (“NPL”) ratio at 0.9%. In view of the uncertain operating environment ahead, the Group adopted a prudent approach to set aside allowances for non-impaired assets. Capital, funding and liquidity positions remained strong, providing flexibility to support business growth and buffer for uncertainties. Return on equity rose from a quarter ago to 13.0% and earnings per share was higher at S$1.68, on an annualised basis.

1Q25 Quarter-on-Quarter Performance

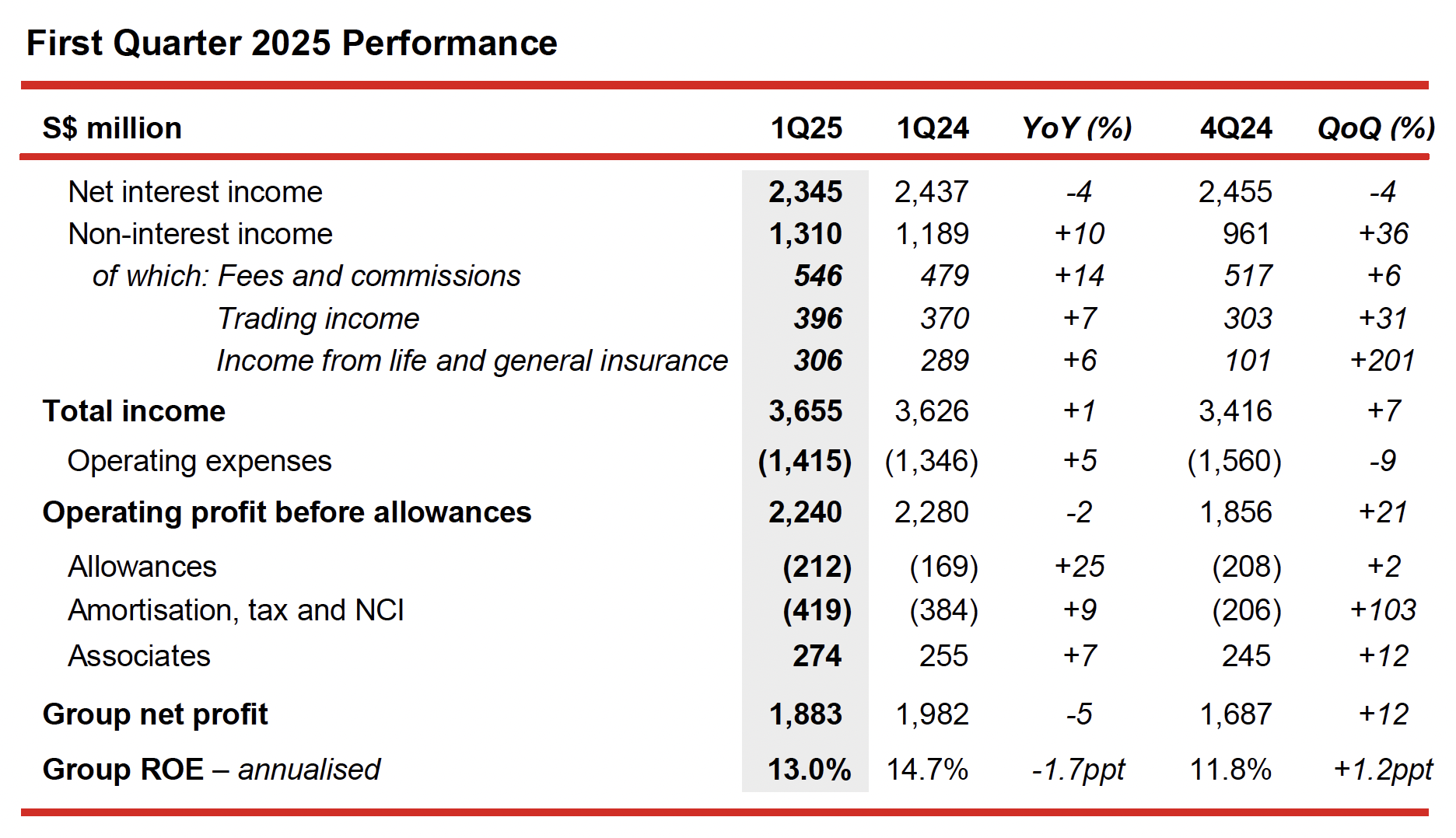

Group net profit rose 12% to S$1.88 billion, underpinned by stronger income and lower operating expenses.

- Net interest income for 1Q25 was 4% lower at S$2.35 billion. While average assets grew by 3%, this was more than offset by narrower net interest margin (“NIM”) and the effect of a shorter quarter. NIM contracted 11 basis points to 2.04%, as loan yields tightened at a faster pace than deposit costs, in a declining interest rate environment. The Group also continued to deploy liquidity into high-quality assets which were income accretive but lower yielding.

- Non-interest income was up 36% to S$1.31 billion.

- Net fee income was S$546 million, up 6% from a quarter ago. This was largely driven by increased customer activities which boosted wealth management, brokerage and fund management, as well as loan-related and investment banking fees.

- Net trading income improved 31% to S$396 million, from higher customer flow and non- customer flow treasury income.

- Insurance income was S$306 million, significantly higher as compared to S$101 million a quarter ago. This was largely attributed to better underlying insurance performance in 1Q25 and the negative impact from changes in the medical insurance environment in GEH’s key markets recognised in 4Q24.

- The Group’s wealth management income, comprising income from private banking, premier private client, premier banking, insurance, asset management and stockbroking, was S$1.37 billion, 29% higher than the previous quarter, and contributed 38% to the Group’s total income. Our banking wealth management AUM was S$306 billion, up 2% from S$299 billion at the end of 2024.

- Operating expenses declined 9% quarter-on-quarter to S$1.42 billion, largely due to higher investments incurred in 4Q24 to support strategic initiatives and business growth. CIR improved to 38.7%, from 45.7% a quarter ago.

- Total allowances rose 2% from the prior quarter to S$212 million, primarily from allowances for non- impaired assets.

- Share of results of associates was S$274 million, 12% higher compared to 4Q24.

1Q25 Year-on-Year Performance

Group net profit was 5% lower compared to the record quarter a year ago.

- Net interest income was 4% lower than 1Q24, mainly due to a 23 basis-point decline in NIM in a falling interest rate environment, which more than offset the 8% growth in average assets.

- Non-interest income was S$1.31 billion, up 10%, underpinned by stronger fees, trading and insurance income.

- Operating expenses increased 5% from 1Q24 to S$1.42 billion, mainly driven by higher staff costs attributable to annual salary adjustments and volume-related compensation, and continued investments in technology.

- Total allowances were S$212 million, 25% higher as compared to S$169 million a year ago.

- Share of results of associates was S$274 million, up 7% from the previous year.

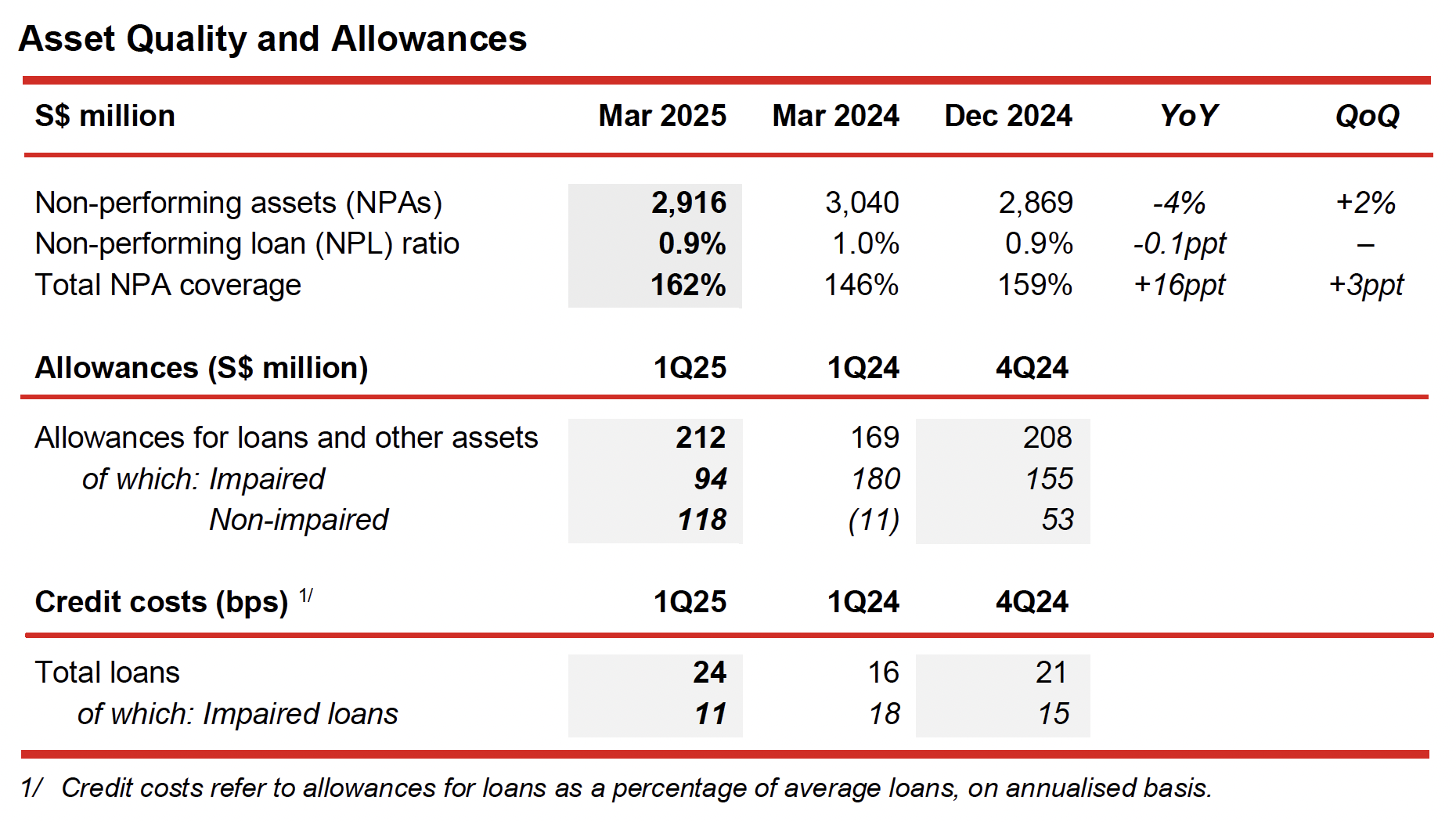

- As at 31 March 2025, total NPAs were S$2.92 billion, down 4% from a year ago. NPAs were 2% higher compared to the previous quarter, largely due to new corporate NPA formation which were partially offset by net recoveries and upgrades, and the impact of foreign currency translation.

- NPL ratio was 0.9%, stable against the previous quarter and lower than 1.0% in the prior year. Allowance coverage for total NPAs was higher at 162%.

- Total allowances for loans and other assets were S$212 million in 1Q25. This comprised:

- Allowances for impaired assets of S$94 million, which were lower against the previous quarter and a year ago; and

- Allowances for non-impaired assets of S$118 million arising from changes in credit risk profiles and management overlays set aside for heightened uncertainties in the macroeconomic environment.

- Total credit costs for 1Q25 were 24 basis points on an annualised basis.

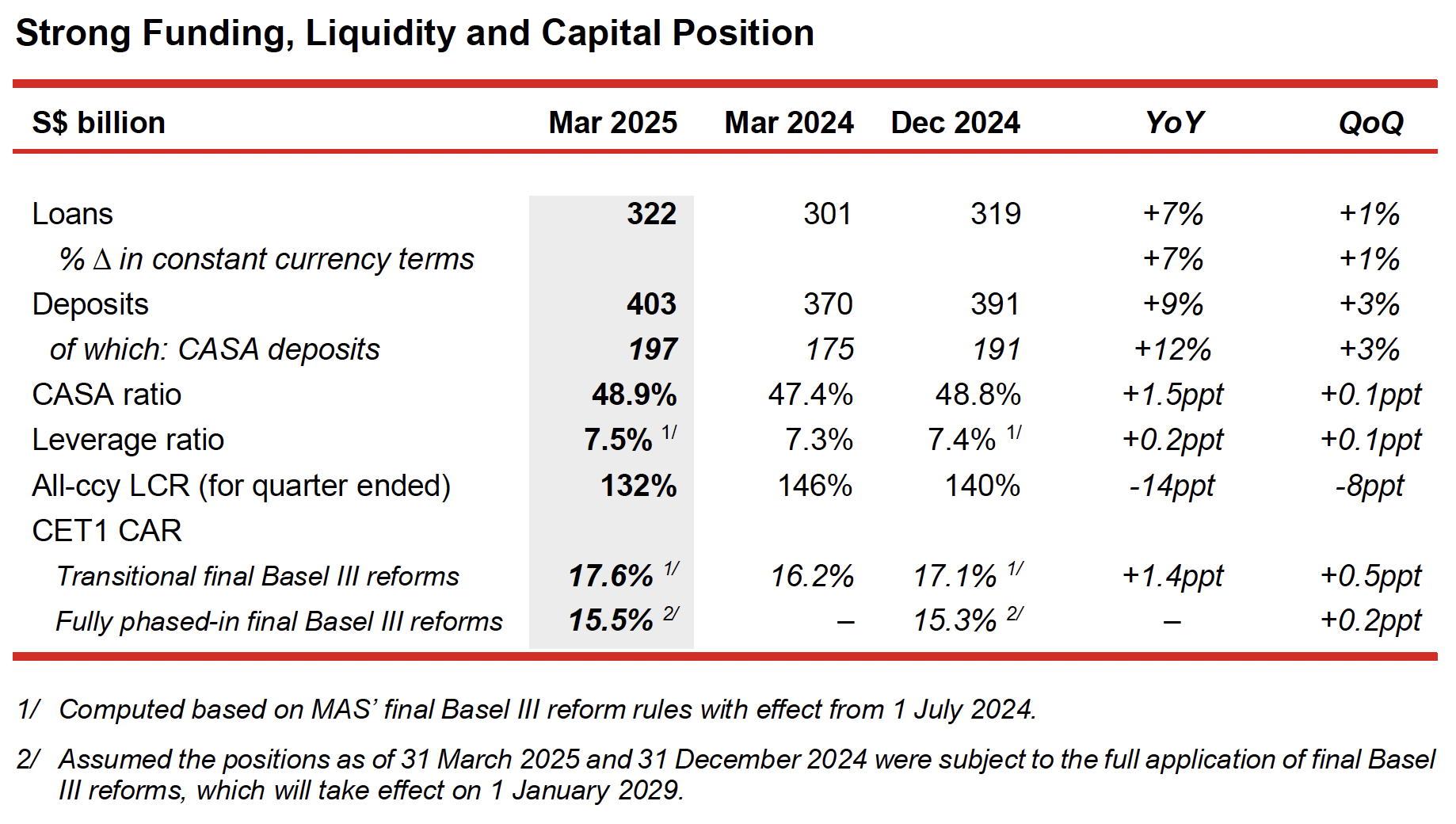

- Customer loans were S$322 billion as at 31 March 2025, up 7% from the previous year and 1% from a quarter ago.

- Loans growth year-on-year was largely driven by the increase in residential mortgages and corporate loans, with lending to the transport, storage and communication sector growing the most.

- Sustainable financing loans rose 19% from a year ago to S$51.1 billion, against a total loan commitment of S$71.1 billion, and comprised 16% of total customer loans.

- Customer deposits increased 9% year-on-year and 3% quarter-on-quarter to S$403 billion, from growth in both CASA and fixed deposits. CASA ratio rose to 48.9%.

- Loans-to-deposits ratio was 78.9%, compared to 80.7% in the previous quarter.

- The Group is subject to MAS’ final Basel III reforms requirements which came into effect on 1 July 2024, and are being progressively phased in between 1 July 2024 and 1 January 2029. Group CET 1 CAR as at 31 March 2025 was 17.6%, and was 15.5% on a fully phased-in basis.

Message from Group CEO, Helen Wong

“Our first quarter results reflected the strength and diversity of our banking, wealth management and insurance franchise. We continued to see deposit inflows and loan growth, while portfolio quality remained sound. We have prudently set aside credit allowances to buffer our portfolio on a forward-looking basis, in view of the challenging economic outlook.

Looking ahead, the heightened uncertainties brought about by the shifts in trade policies and geopolitical risks are expected to have a dampening effect on overall economic growth in the region. As the situation continues to unfold, we remain watchful and vigilant in managing risks. With our strong balance sheet and capital position, we have the ability to navigate complexities while supporting our customers throughout our network.”