OCBC Group First Half 2025 Net Profit at S$3.70 billion

OCBC Group First Half 2025 Net Profit at S$3.70 billion

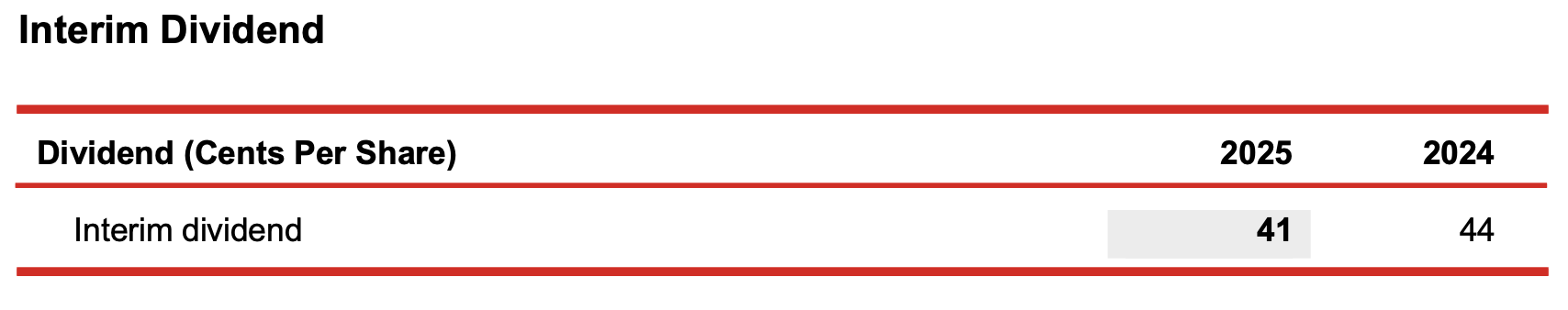

Interim dividend of 41 cents declared.

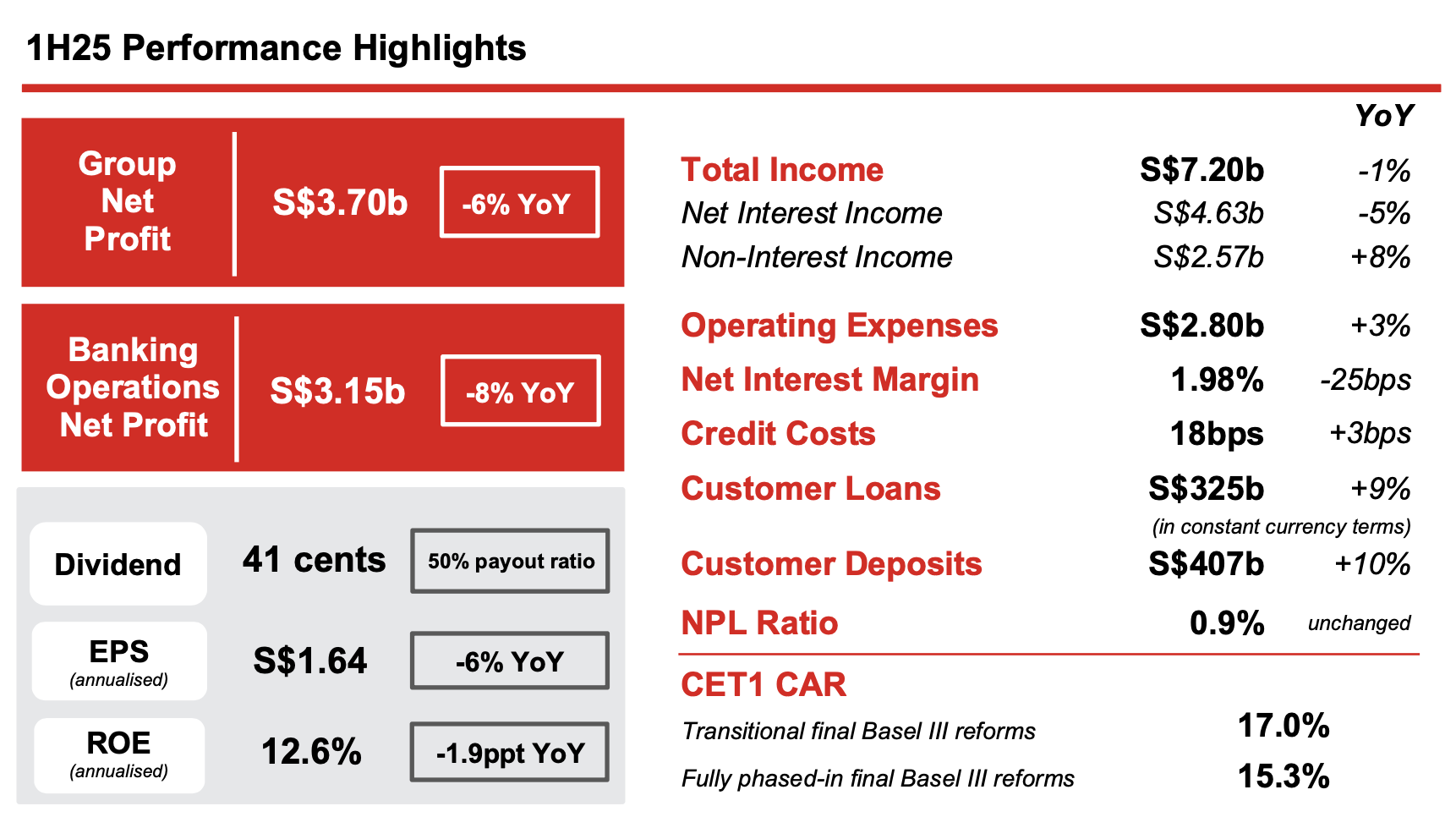

Singapore, 1 August 2025 – Oversea-Chinese Banking Corporation Limited (“OCBC”) reported net profit of S$3.70 billion for the first half of 2025 (“1H25”), 6% below the record S$3.93 billion in the previous year (“1H24”).

OCBC’s total income was little changed, as a decline in net interest income from the peak level a year ago was mostly compensated by robust fee and trading income growth. Cost-to-income ratio was maintained below 40%, and higher credit allowances were set aside in view of the current uncertain operating environment. Asset quality remained benign with non-performing loan ratio at 0.9%, while allowance coverage for total non-performing assets stood at 156%. The Group maintained its solid financial position, and an interim ordinary dividend of 41 cents was declared, representing a payout ratio of 50% of 1H25 Group net profit. The Group remains committed to the previously announced S$2.5 billion capital return which includes a special dividend amounting to 10% of our FY25 Group net profit and share buybacks over two years, to be completed in 2026. Together with OCBC’s target 50% ordinary dividend payout ratio, this represents a total dividend payout ratio of 60% for FY25.

1H25 Year-on-Year Performance

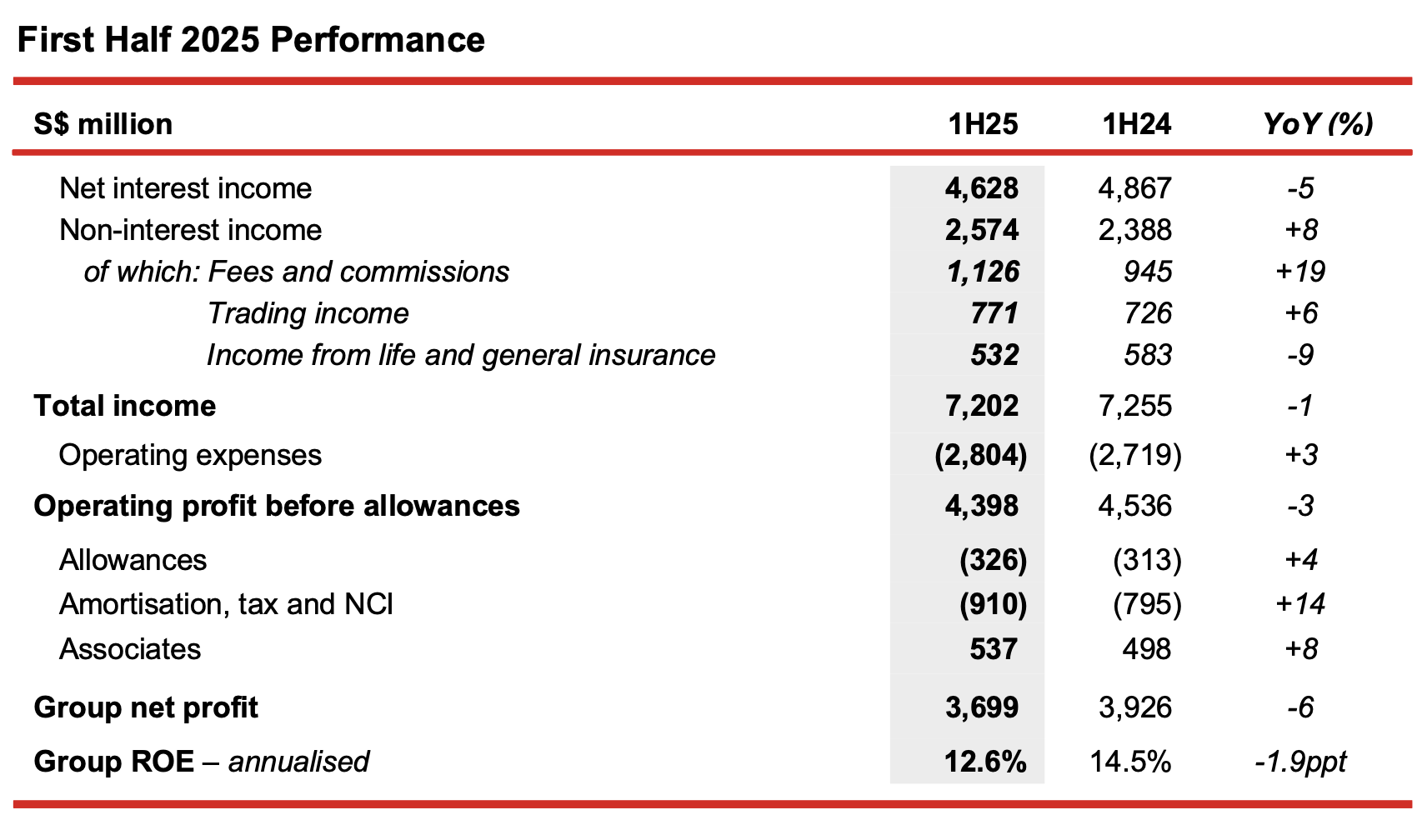

Group net profit was S$3.70 billion, 6% lower than S$3.93 billion a year ago.

- Amid a softening interest rate environment, net interest income fell 5% to S$4.63 billion, as a compression in net interest margin (“NIM”) more than offset an 8% rise in average asset volume. Average asset growth was driven by an increase in loans and other interest-earning high-quality assets which were lower yielding. NIM declined by 25 basis points to 1.98%, as the drop in asset yields outpaced the decrease in funding costs.

- Non-interest income grew 8% to S$2.57 billion, buoyed by a rise in fee and trading income.

- Net fee income of S$1.13 billion was 19% higher from broad-based growth, underpinned by increased customer activities. In particular, wealth management fees which made up nearly half of net fee income, surged by 25%, with growth across all wealth product channels.

- Net trading income was S$771 million, 6% above the previous year. Customer flow treasury income was up 10%, driven by both wealth and corporate segments, with higher treasury sales across the Group’s key markets.

- Insurance income from Great Eastern Holdings (“GEH”) declined by 9% to S$532 million, largely attributable to the mark-to-market impact of decline in interest rates on the valuation of insurance contract liabilities, as well as lower valuation of private equity holdings, from its insurance funds. New business embedded value (“NBEV”) increased by 16% to S$317 million and NBEV margin rose to 44.7% from 28.0% a year ago, driven by improved insurance product mix.

- The Group’s wealth management income, comprising income from private banking, premier private client, premier banking, insurance, asset management and stockbroking, increased 4% to S$2.66 billion. Group wealth management income accounted for 37% of total income, higher than 35% in 1H24. Our Banking wealth management AUM expanded by 11% to an all-time high of S$310 billion, driven by both net new money inflows and positive market valuation.

- Operating expenses were S$2.80 billion, up 3% from the previous year. Staff costs were 4% higher, attributable to annual salary increments and increased variable compensation linked to higher business activities. Technology-related expenses were up as the Group continued to invest in common platforms and upgrade its capabilities across markets. Cost-to-income ratio was 38.9% for 1H25, compared to 37.5% for 1H24.

- Total allowances rose by 4% to S$326 million, mainly due to an increase in allowances for non-impaired assets.

- Share of results of associates was S$537 million, up 8% from S$498 million a year ago.

- The Group’s annualised return on equity was 12.6%, lower than 14.5% in the preceding year, while annualised earnings per share was S$1.64, 6% below 1H24.

2Q25 Quarter-on-Quarter Performance

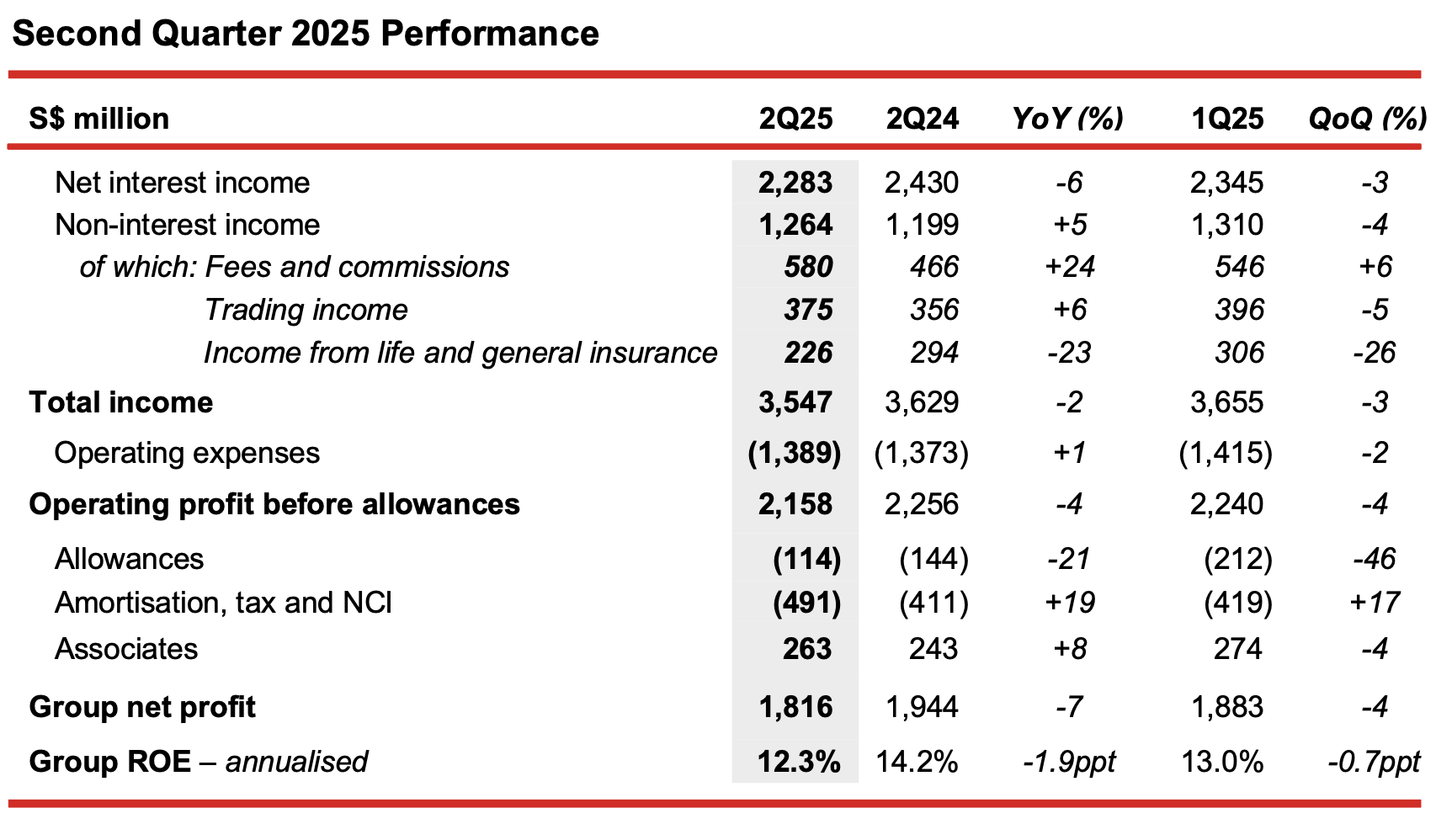

Group net profit was S$1.82 billion, 4% below the prior quarter.

- Net interest income moderated by 3% from the previous quarter to S$2.28 billion, as a 2% increase in average assets was more than offset by a 12 basis-point contraction in NIM to 1.92%. The NIM decline was largely associated with the downward repricing of SGD and HKD denominated loans, as a result of the significant drop in the benchmark rates this year, which outpaced the reduction in deposit costs. The strategic deployment of liquidity into income-accretive high-quality assets in 1Q25 also weighed on NIM.

- Non-interest income decreased 4% to S$1.26 billion, largely driven by lower insurance and trading income, which were partly compensated by higher fee income and net realised gains from the sale of investment securities.

- The Group continued to maintain cost discipline, and operating expenses declined 2% to S$1.39 billion.

- Total allowances were S$114 million, down 46% quarter-on-quarter from a decline in allowances for both impaired and non-impaired assets. Credit costs were an annualised 12 basis points, lower as compared to 24 basis points in 1Q25.

- Share of results of associates was 4% lower at S$263 million.

2Q25 Year-on-Year Performance

Group net profit decreased 7% from a year ago to S$1.82 billion.

- Net interest income was 6% lower from the previous year, as NIM narrowed by 28 basis points in a declining interest rate environment, partly cushioned by a 7% growth in average assets.

- Non-interest income was up 5% from the prior year, lifted by a 24% rise in fee income and 6% increase in trading income, which more than offset lower insurance income.

- Operating expenses were 1% above 2Q24, and cost-to-income ratio was 39.1%, compared to 37.8% for 2Q24.

- Total allowances of S$114 million was lower as compared to S$144 million a year ago, from a decrease in allowances for impaired assets.

- Share of results of associates increased by 8% to S$263 million.

Non-performing assets (“NPAs”)

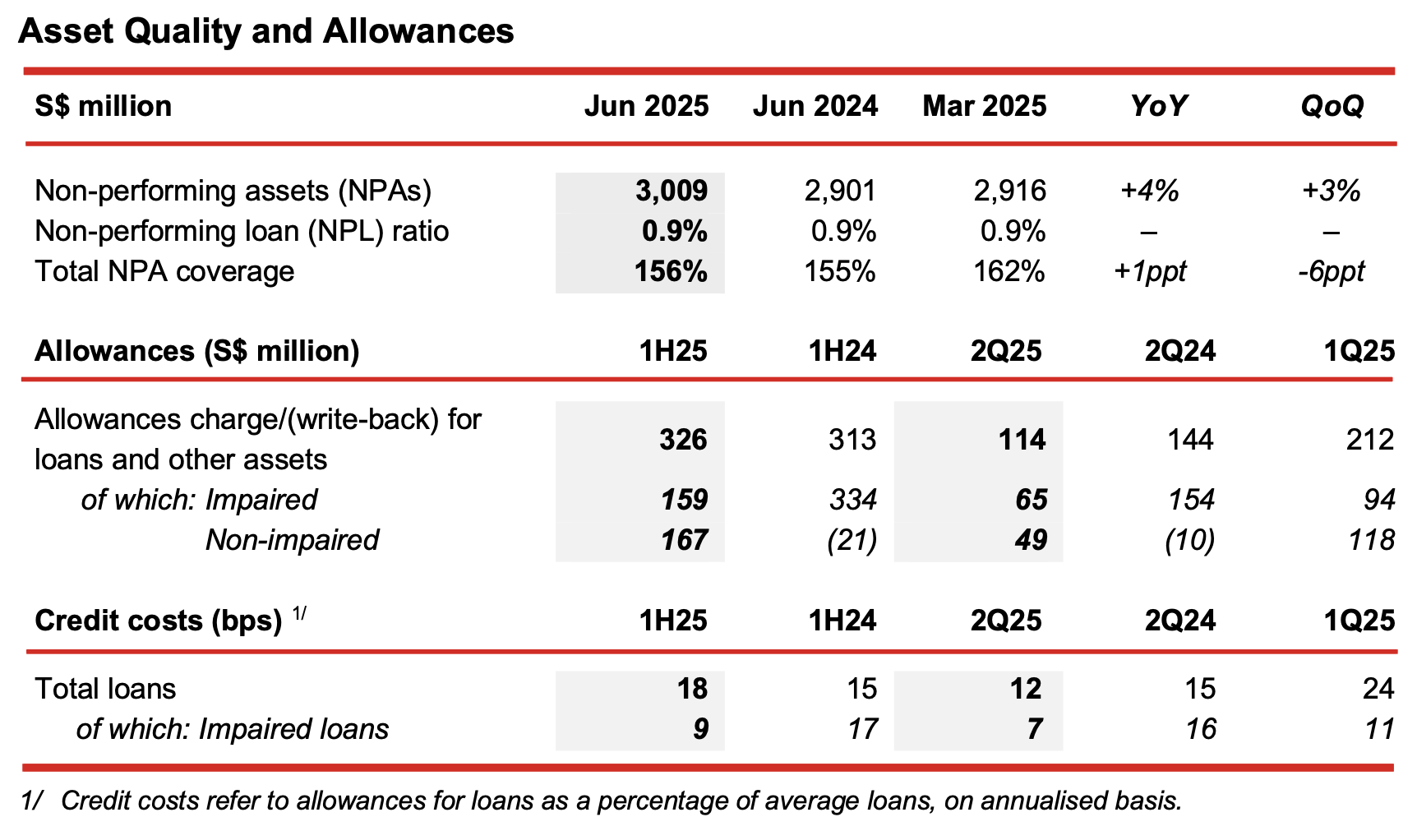

- Total NPAs as at 30 June 2025 were S$3.01 billion, up 4% from a year ago. Against the previous quarter, NPAs were 3% higher, mainly due to new NPA formation which was partly compensated by net recoveries and upgrades, write-offs and the effect of foreign currency translation.

- NPL ratio was stable at 0.9%, and total NPA coverage was 156%.

Allowances

- For 1H25, total allowances were 4% higher at S$326 million, comprising:

- Allowances for non-impaired assets of S$167 million, which included additional allowances set aside to cater for increased macroeconomic uncertainties; and

- Allowances for impaired assets of S$159 million, which were lower than the S$334 million a year ago.

- 2Q25 total allowances were S$114 million, below the previous quarter and the prior year.

- Total 1H25 credit costs were an annualised 18 basis points.

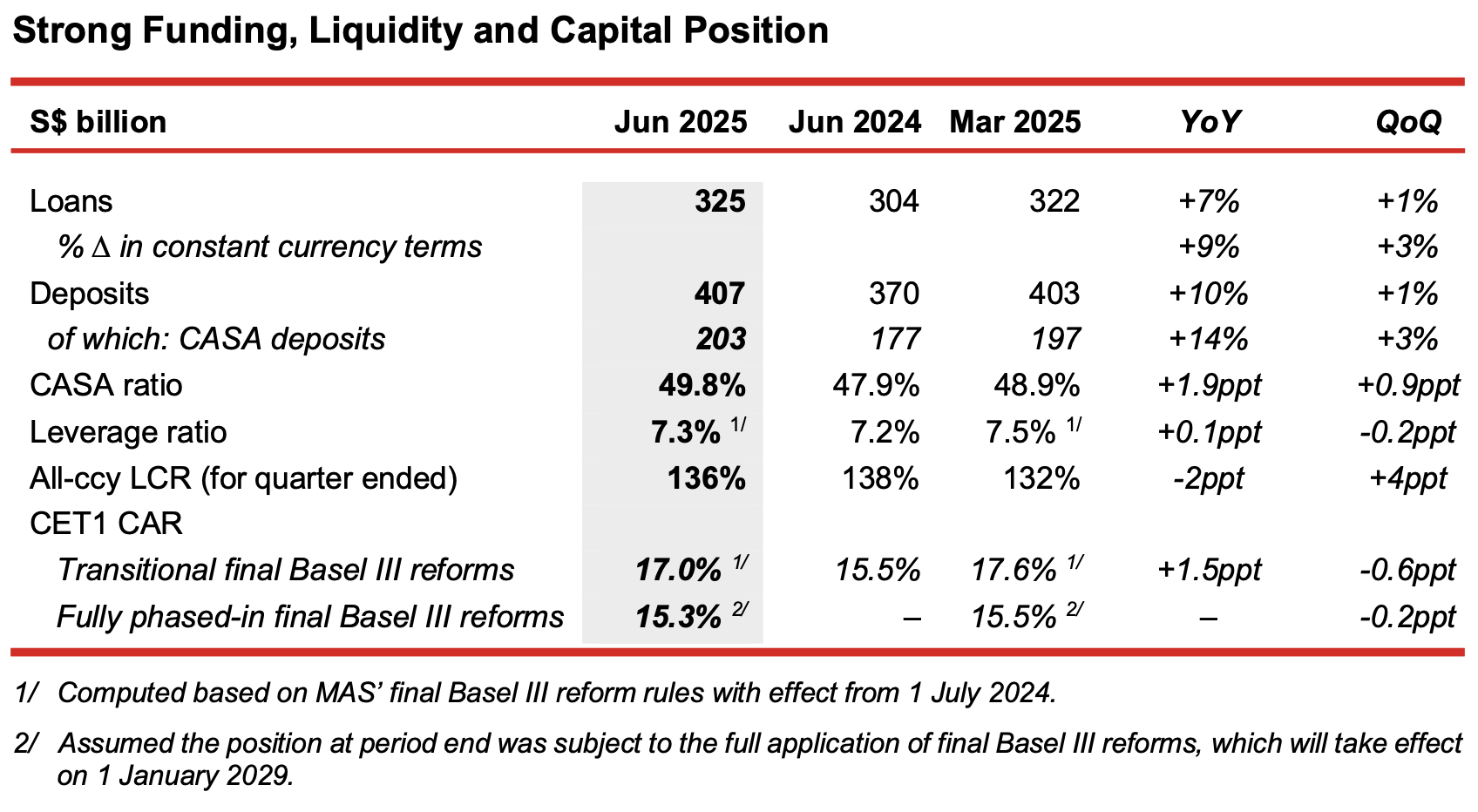

- As at 30 June 2025, customer loans were S$325 billion, up 9% from a year ago and 3% from the previous quarter on a constant currency basis.

- The year-on-year expansion in loans was driven by housing loan growth in Singapore and higher non-trade corporate lending, as the Group continued to support customers in the infrastructure, data centres and transportation sectors.

- Sustainable financing loans grew 19% year-on-year to S$53.1 billion and made up 16% of Group loans, while total commitments stood at S$74.3 billion.

- Customer deposits increased 10% year-on-year to S$407 billion, primarily driven by CASA deposit growth across both corporate and consumer segments.

- Loans-to-deposits ratio was 78.7%, broadly unchanged as compared to 78.9% in the prior quarter.

- The Group’s CET1 CAR is subject to MAS’ final Basel III reforms requirements which came into effect on 1 July 2024 and are being progressively phased in between 1 July 2024 and 1 January 2029. Group CET1 CAR as at 30 June 2025 was 17.0%, and on a fully phased-in basis, it was 15.3%.

- An interim dividend of 41 cents per share has been declared.

- The interim dividend payout will amount to S$1.84 billion, representing a payout ratio of 50%.

- The Scrip Dividend Scheme will not be applicable to the interim dividend.

Message from Group CEO, Helen Wong

“Our first half 2025 results reflected resilient performance across our diversified business franchise. We expanded our loan book and maintained sound asset quality, and delivered broad-based fee income growth. Underpinned by our strong balance sheet and capital position, we are firmly committed to our comprehensive capital return plan.

Over the past year, we have met our objectives of increasing our economic interests in GEH and have also assisted GEH in managing the trading suspension of its shares. As we move forward, we will continue to derive more synergies within the Group, and are confident that this will further our drive to be a leading wealth management player in the region.

The outlook ahead remains challenging. Evolving trade and monetary policies, and persistent geopolitical tensions are expected to weigh on growth prospects. Despite the uncertainties, OCBC has a strong and resilient franchise. As I prepare to hand over the reins of Group CEO to Teck Long’s capable hands on 1 January 2026, I do so with full confidence. OCBC is well placed for the future with a clear ambition, and we are focused on supporting our customers and capturing growth opportunities across the region to drive long-term value for our stakeholders.”