OCBC Group Third Quarter 2023 Net Profit Rose 21% from the Previous Year to S$1.81 billion

OCBC Group Third Quarter 2023 Net Profit Rose 21% from the Previous Year to S$1.81 billion

Nine months 2023 net profit up 32% to new high of S$5.40 billion

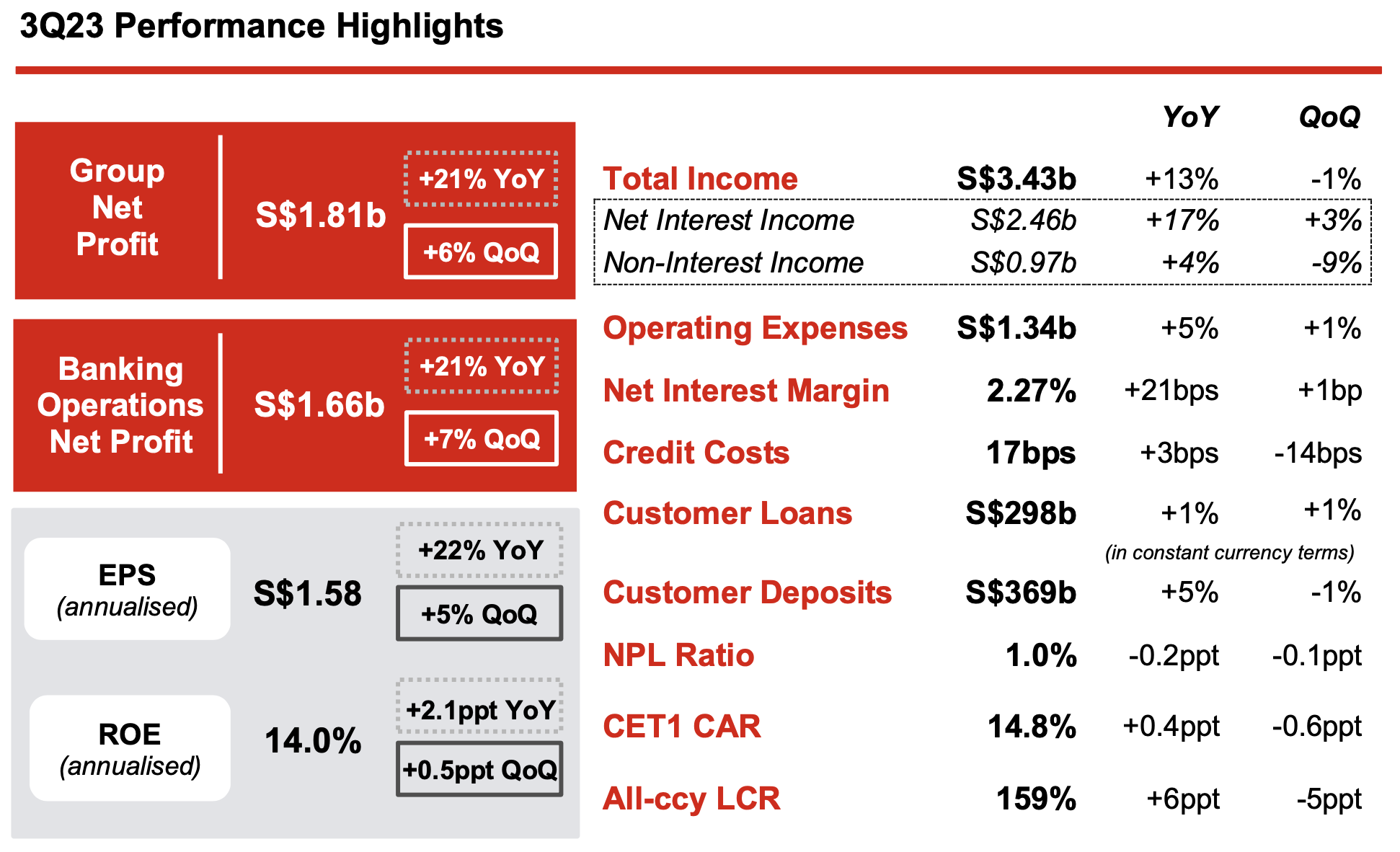

Singapore, 10 November 2023 – Oversea-Chinese Banking Corporation Limited (“OCBC”) reported net profit of S$1.81 billion for the third quarter of 2023 (“3Q23”), 21% higher from S$1.49 billion a year ago (“3Q22”), and 6% above S$1.71 billion in the previous quarter (“2Q23”). Net profit for the nine months of 2023 (“9M23”) was a record S$5.40 billion, a 32% increase from a year ago (“9M22”).

The Group’s robust year-on-year performance for 3Q23 was driven by a 13% rise in total income, underpinned by record net interest income and growth in non-interest income. The cost-to-income ratio for the quarter improved year-on-year to 39.1%, while credit costs in 3Q23 were an annualised 17 basis points. Loans grew 1% in constant currency terms and portfolio quality remained resilient, with the non-performing loan (“NPL”) ratio declining to pre-pandemic levels at 1.0%. The Group maintained its sound capital, funding and liquidity positions, to support growth opportunities and ensure adequate buffers for uncertainties.

3Q23 return on equity (“ROE’’) rose to 14.0% and earnings per share (“EPS”) increased to S$1.58 on an annualised basis.

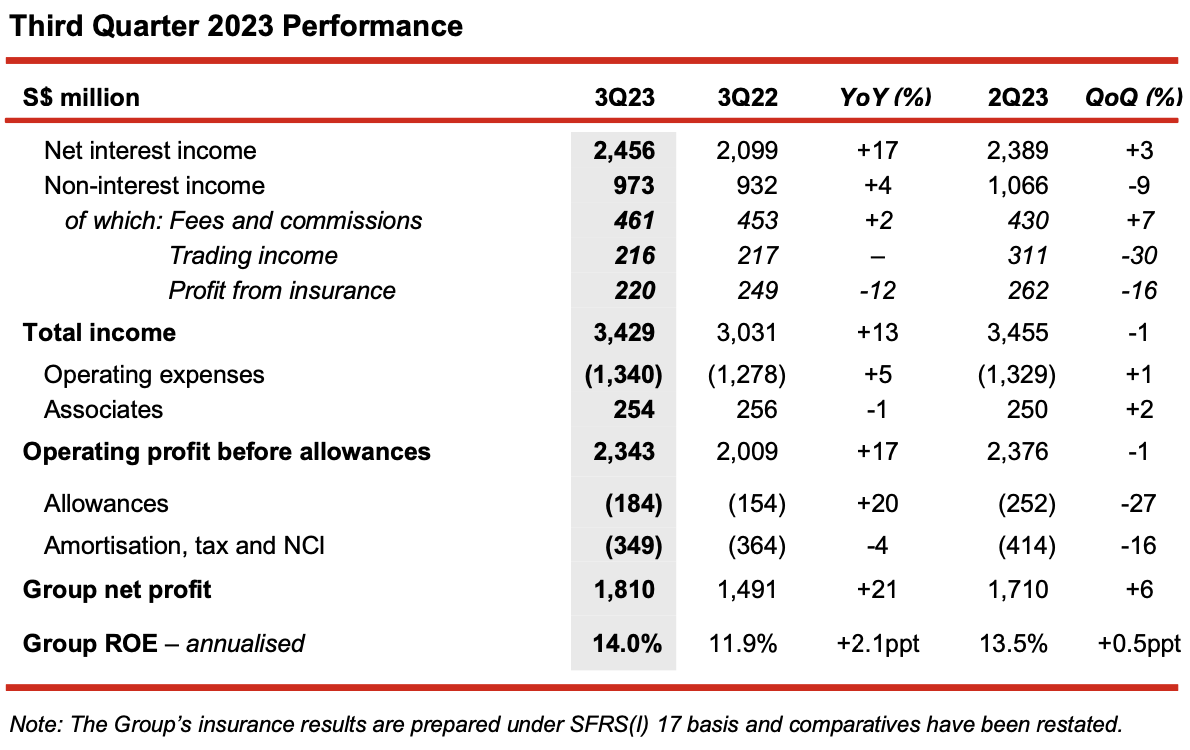

3Q23 Year-on-Year Performance

- Group net profit rose 21% from the previous year to S$1.81 billion, underpinned by income growth.

- Net interest income grew 17% from 3Q22 to a new high of S$2.46 billion. This was supported by 6% asset growth and net interest margin (“NIM”) expansion. NIM rose 21 basis points to 2.27% in 3Q23, driven by higher margins across the Group’s key markets.

- Non-interest income was S$973 million, 4% above the previous year, as higher fee income and improved investment performance offset lower insurance income.

- Net fee income rose 2% from a year ago to S$461 million, marking the highest level recorded in the past four quarters. This was largely due to the growth in wealth management fees from increased customer activities and from higher credit card fees.

- Net trading income, mainly comprising customer flow treasury income, was stable year-on-year at S$216 million.

- Insurance profit from Great Eastern Holdings (“GEH”) of S$220 million was 12% below 3Q22, largely due to an increase in medical claims which was partly compensated by improved investment performance. Total weighted new sales increased 5% to S$419 million, driven by higher sales in Singapore, while new business embedded value (“NBEV”) for the quarter was S$184 million.

- The Group’s wealth management income, comprising income from insurance, private banking, premier private client, premier banking, asset management and stockbroking, grew 16% to S$1.12 billion and made up 33% of the Group’s income in 3Q23. The Group’s wealth management assets under management expanded 8% from the previous year to S$270 billion as at 30 September 2023, mainly driven by positive inflows of net new money.

- Operating expenses were S$1.34 billion, 5% higher than the prior year, on the back of continued investments in the Group’s franchise across people and technology. As income growth outpaced the increase in expenses, the Group’s cost-to-income ratio (“CIR”) improved to 39.1%, from 42.2% in the preceding year.

- Share of results of associates of S$254 million was slightly below the S$256 million a year ago.

- Total allowances were S$184 million, as compared to S$154 million in 3Q22, largely attributable to higher allowances for impaired assets. Credit costs for the quarter were an annualised 17 basis points.

- Annualised ROE for 3Q23 rose to 14.0%, from 11.9% in the previous year. Annualised earnings per share was S$1.58, an increase of 22% from S$1.30 a year ago.

3Q23 Quarter-on-Quarter Performance

- Group net profit of S$1.81 billion was 6% above 2Q23, mainly driven by higher net interest income and fee income, as well as lower allowances.

- Net interest income grew 3% from the previous quarter and NIM improved 1 basis point to 2.27%, as a rise in asset yields more than outpaced the increase in funding costs.

- Net fee income rose 7% from 2Q23, led by higher wealth management, credit card as well as trade- related fees. Trading and insurance income were both lower quarter-on-quarter.

- Operating expenses were well controlled, up 1% from 2Q23.

- Share of results of associates was up 2% from a quarter ago.

- Total allowances declined 27%, mainly attributable to a S$36 million write-back in allowances for non- impaired assets, as compared to S$200 million set aside in 2Q23.

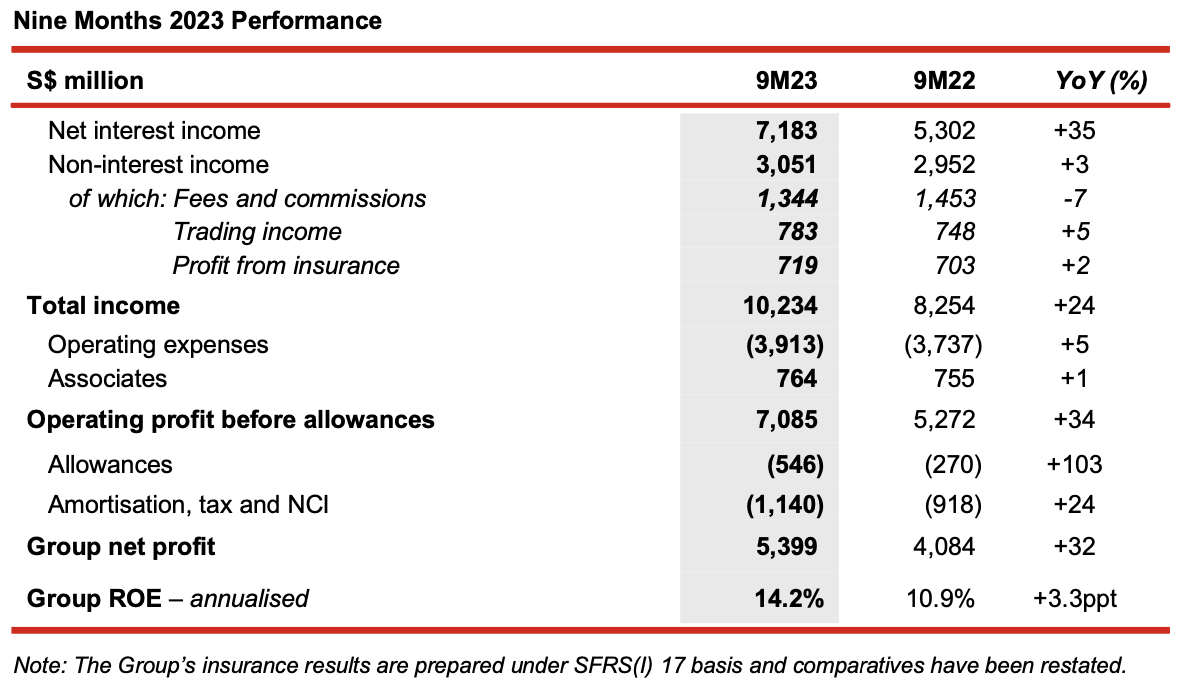

9M23 Year-on-Year Performance

- Group net profit grew 32% to a new high of S$5.40 billion, on the back of record income. This marks the first time that Group net profit has crossed the S$5 billion mark for the nine-month period.

- Net interest income rose 35% to S$7.18 billion. The uplift in net interest income was underpinned by 6% average assets growth and a 50-basis point expansion in NIM to 2.28%, amid a rising interest rates environment.

- Non-interest income of S$3.05 billion was up 3%, as an increase in trading income, net investment gains from sale of investment securities and higher insurance income more than compensated for softer fee income.

- Operating expenses of S$3.91 billion were 5% above 9M22, mainly due to higher staff costs arising from wage increments and rise in headcount, and IT-related expenditure. CIR was 38.2%, lower as compared to 45.3% a year ago, as income growth outpaced the increase in expenses.

- Share of results of associates was S$764 million, up 1% from 9M22.

- Total allowances were S$546 million, higher as compared to S$270 million in the previous year.

- Annualised ROE improved to 14.2% from 10.9% in the preceding year. Annualised earnings per share was S$1.59, 32% higher than S$1.20 in 9M22.

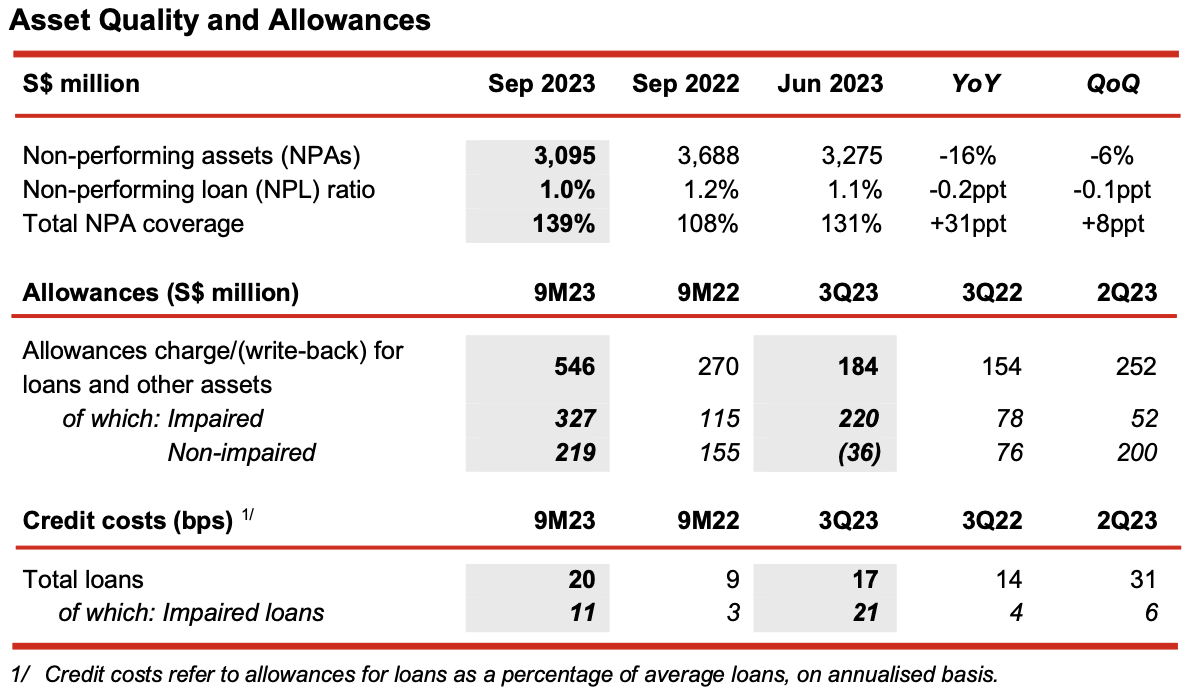

Asset Quality

- Total NPAs as at 30 September 2023 were S$3.1 billion, 16% lower as compared to the previous year and 6% below 30 June 2023, mainly due to higher recoveries and upgrades. Total NPAs declined year- on-year and quarter-on-quarter across all of the Group’s key markets of Singapore, Malaysia, Indonesia and Greater China.

- NPL ratio further improved to 1.0% and the allowance coverage for total NPAs rose to 139%.

Allowances

- Total allowances were S$184 million in 3Q23, which comprised:

- Allowances for impaired assets of S$220 million, made up of S$176 million for impaired loans and S$44 million for impaired other assets; and

- A write-back of allowances for non-impaired assets of S$36 million.

- Total allowances for 3Q23 were 27% lower quarter-on-quarter. The decline was largely due to the above write-back in allowances for non-impaired assets this quarter, as compared to the S$200 million charge set aside in 2Q23. The write-back included migration of allowances for non-impaired assets prudently set aside in previous quarters, to allowances for impaired loans.

- Total credit costs for 9M23 were an annualised 20 basis points.

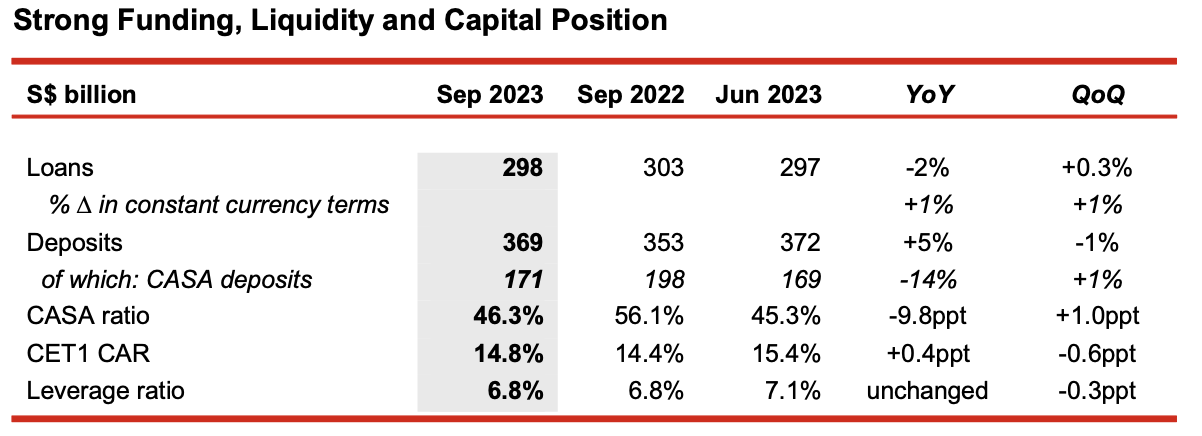

- Customer loans as at 30 September 2023 were S$298 billion, an increase of 1% from a year ago and the previous quarter on a constant currency basis.

- Sustainable financing loans grew 28% year-on-year and comprised 12% of customer loans. Total loan commitments were S$52.1 billion as at 30 September 2023, ahead of the Group’s target of S$50 billion by 2025.

- Customer deposits of S$369 billion were 1% lower from a quarter ago. CASA deposits rose 1% quarter- on-quarter while fixed deposits and certificates of deposit were reduced.

- Loans-to-deposits ratio was 79.7%, higher compared to 78.8% in the previous quarter.

- All regulatory ratios continued to be well above requirements, reflecting the Group’s strong funding, liquidity and capital positions.

Message from Group CEO, Helen Wong

“We are pleased to achieve a solid set of results for the nine months of 2023, backed by strong operating performance across the Group’s diversified franchise. Our total income for the nine-month period surpassed the S$10 billion mark for the first time, lifting net profit to a record high. We continued to sustain loan growth while maintaining sound asset quality, and actively managed our balance sheet which helped to drive improvements in net interest margin. Our expenses were well controlled while we stayed focused on investing in our franchise.

Looking ahead, macroeconomic conditions are expected to be clouded by growing uncertainties from inflationary risks, tightening monetary policies and heightened geopolitical risks. Nonetheless, with our robust funding, liquidity and capital positions, we are confident of the Group’s ability to deliver sustainable value to our stakeholders.”