OCBC Group Full Year 2022 net profit rose 18% to a record S$5.75 billion

OCBC Group Full Year 2022 net profit rose 18% to a record S$5.75 billion

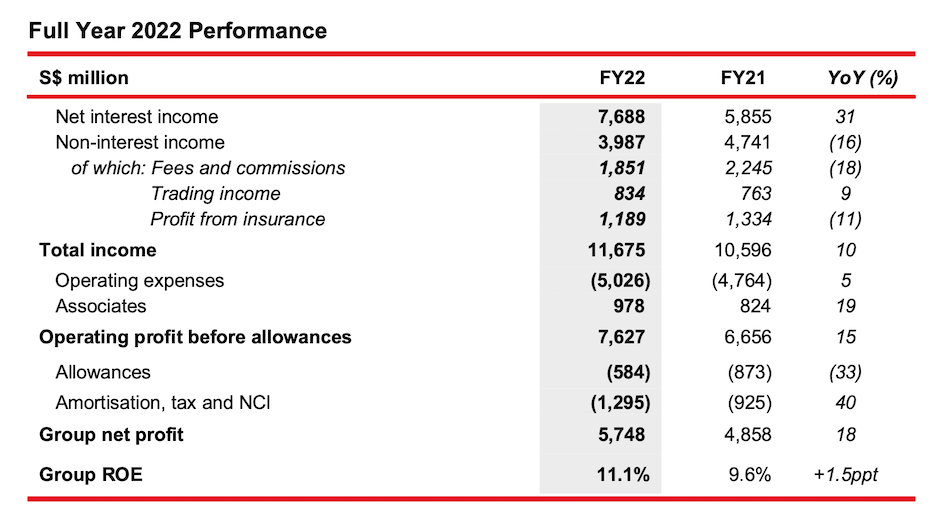

Oversea-Chinese Banking Corporation Limited (“OCBC Bank”) reported its financial results for the full year of 2022 (“FY22”). Group net profit for FY22 increased 18% to S$5.75 billion, from S$4.86 billion a year ago (“FY21”).

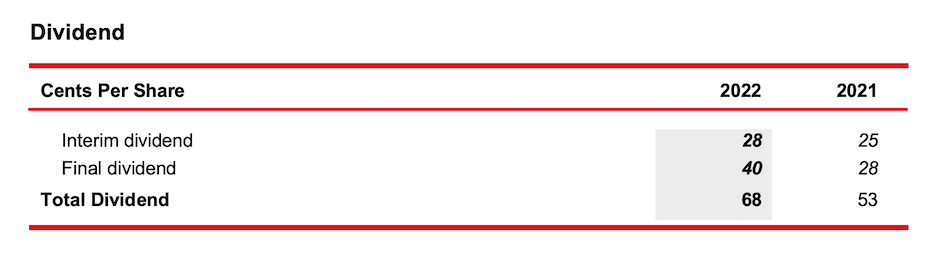

The strong performance reflected the strength and agility of OCBC’s well-diversified business franchise that was well-positioned to capture opportunities in a rapidly changing operating environment. The Group’s record earnings were supported by strong growth in net interest income which more than offset weaker non- interest income. Disciplined cost management drove cost-to-income ratio lower, while allowances declined from improving credit conditions and robust portfolio quality. Wealth management fee income was softer as macro headwinds and market volatilities lowered client investment activity, although net new money inflows were higher year-on-year. Great Eastern Holdings’ (“GEH”) underlying insurance business remained strong. However, profit from insurance declined as a result of unrealised valuation losses arising from unfavourable movement in the discount rates used to value longer-end duration insurance contract liabilities in the fourth quarter. We continue to maintain sound capital, funding and liquidity positions to capture growth opportunities while ensuring sufficient buffers for uncertainties. We are pleased to raise FY22 dividend to 68 cents, supported by our resilient earnings and strong capital position.

FY22 Year-on-Year Performance

- Group net profit rose 18% to a new high of S$5.75 billion, driven by strong growth in net interest income and lower allowances.

- Net interest income grew 31% to a record S$7.69 billion, underpinned by a 37-basis point expansion in net interest margin (“NIM”) and 6% growth in average assets.

- Non-interest income was S$3.99 billion, down 16% from the previous year.

- Net fee income was S$1.85 billion, 18% lower than a year ago. The decline was largely from softer wealth management fees attributable to prevailing risk-off investment sentiments. This was partly offset by an increase in fees from loan and trade-related activities.

- Net trading income improved 9% to S$834 million, compared to S$763 million a year ago, from higher non-customer flow treasury income partly driven by gains from hedging activities.

- Net loss from the sale of investment securities of S$206 million, compared to net gain of S$92 million last year, was mainly attributable to bond portfolio rebalancing and positioning amid changing market conditions.

- GEH’s underlying insurance business remained resilient with a 7% growth in operating profit. GEH’s embedded value, a measure of the long-term economic value of the existing business of a life insurance company was S$17.9 billion as at 31 Dec 2022. Total weighted new sales were S$1.91 billion with new business embedded value (“NBEV”) 9% higher at S$875 million and the NBEV margin increased to 45.8%. However, profit from insurance fell 11% to S$1.19 billion from S$1.33 billion in the previous year, largely from unrealised valuation losses in the fourth quarter due to unfavourable movement in the discount rates used to value its longer-end duration insurance contract liabilities.

- The Group’s wealth management income, comprising consolidated income from insurance, private banking, premier private client, premier banking, asset management and stockbroking was S$3.89 billion, as compared to S$4.01 billion last year, and contributed 33% to the Group’s total income. As at 31 December 2022, Group wealth management AUM was higher at S$258 billion compared to S$257 billion a year ago, driven by continued growth in net new money inflows which offset negative market valuation.

- Operating expenses grew 5% to S$5.03 billion, led by higher staff and IT-related costs. The increases were largely attributable to annual salary adjustments and headcount growth to strengthen the talent pool, coupled with the Group’s continued investments to enhance technology capabilities in support of the strategic priorities to drive growth. Cost-to-income ratio (“CIR”) improved to 43.0% from 45.0% in FY21.

- Share of results of associates rose 19% to S$978 million from S$824 million in the previous year.

- Net allowances declined 33% to S$584 million. A drop in allowances for impaired assets was partly offset by increased allowances for non-impaired assets arising from macro-economic variables (“MEV”) updates and additional overlays to buffer for uncertainties.

- Full year ROE improved to 11.1% from 9.6% in the previous year. Earnings per share rose 18% to S$1.27 from S$1.07 in the prior year.

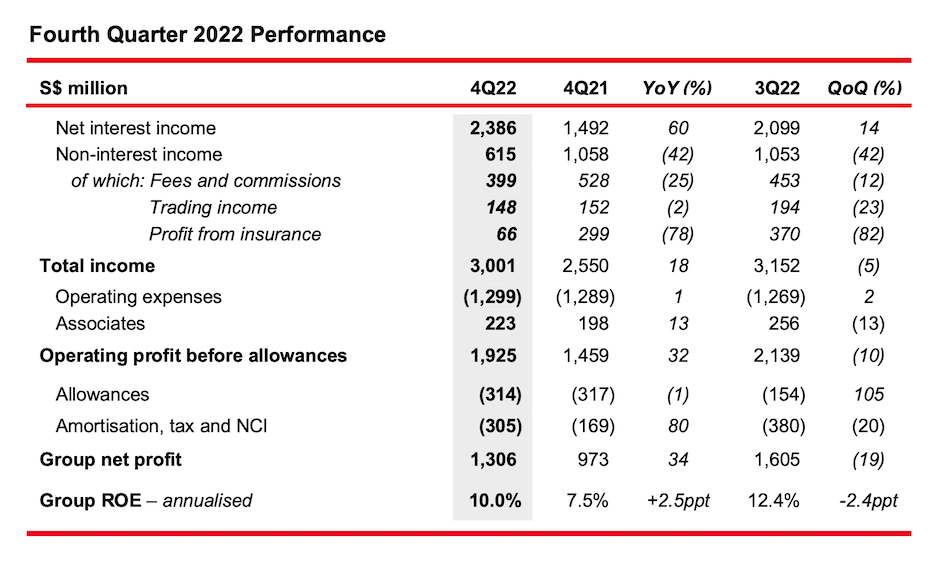

4Q22 Year-on-Year Performance

- Group net profit rose 34% to S$1.31 billion, driven by record quarterly net interest income.

- Net interest income grew 60% to S$2.39 billion, propelled by a 79-basis points increase in NIM on the back of rapid rise in interest rates during the year.

- Non-interest income declined 42% to S$615 million, largely from lower wealth management fees as a result of subdued customer investment activities amid market headwinds and valuation losses on GEH’s insurance contract liabilities.

- Operating expenses of S$1.30 billion were 1% above 4Q21 with the CIR lower at 43.3% compared to 50.5% a year ago.

- Share of results of associates was 13% higher at S$223 million for the quarter.

- Total allowances of S$314 million were 1% below the previous year.

4Q22 Quarter-on-Quarter Performance

- Group net profit declined as net interest income growth was more than offset by a drop in profit from insurance as a result of unrealised valuation losses arising from unfavourable movement in the discount rates used to value longer-end duration insurance contract liabilities.

- Net interest income grew 14%, driven mainly by NIM uplift of 25-basis points as loan yields rose faster than the increase in funding costs.

- Expenses increased 2% from a quarter ago, led by higher IT-related costs and business promotion expenses.

- Share of results of associates was 13% lower than the previous quarter.

- Total allowances were higher largely due to increased allowances for non-impaired assets.

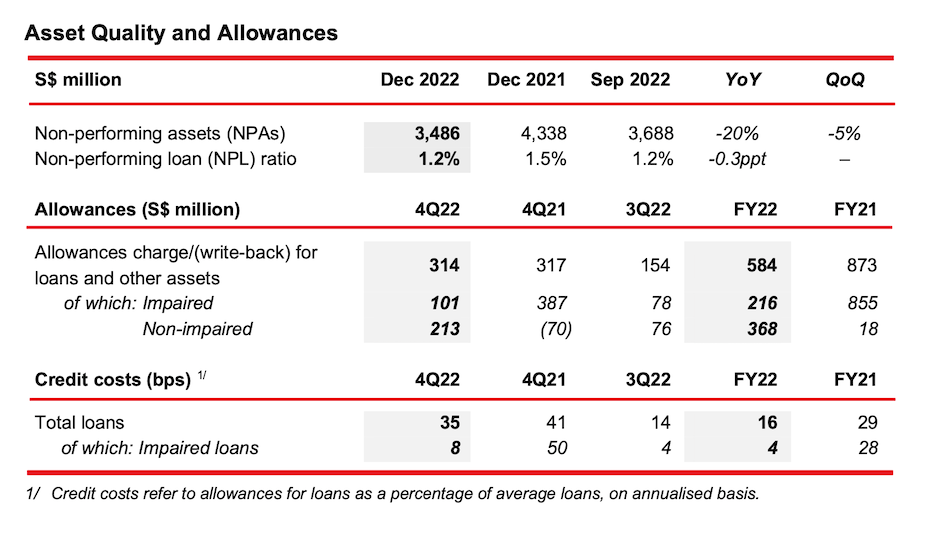

Asset Quality

- As at 31 December 2022, total NPAs were S$3.49 billion, 20% lower than a year ago and down 5% from the previous quarter.

- NPAs declined from the previous year as higher recoveries and upgrades largely from Malaysia and Indonesia following exits from relief programmes more than offset new NPA formation during the year.

- New NPA formation more than halved from a year ago, driven by overall improvement in the credit environment and asset quality.

- The NPL ratio was stable at 1.2%, while the allowance coverage against total NPAs was raised to 114%.

Allowances

- For FY22, total allowances were lower at S$584 million and represented 16-basis points of loans, as compared to S$873 million and 29-basis points in the preceding year.

- Total allowances for 4Q22 were S$314 million, slightly lower than a year ago. These comprised:

- Allowances for impaired assets of S$101 million, lower than S$387 million a year ago.

- Higher allowances for non-impaired assets of S$213 million which included additional allowances from MEV adjustments to reflect a prudent view of the current and forecasted economic conditions, as well as management overlays set aside over and above the Expected Credit Loss model to buffer for uncertainties.

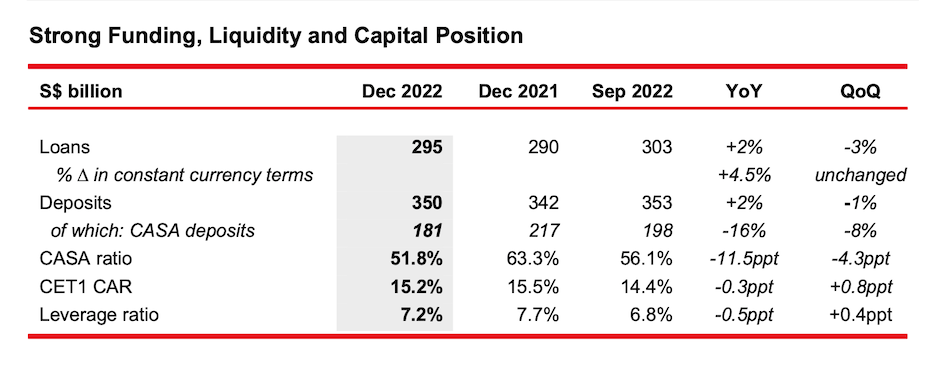

- As at 31 December 2022, customer loans were S$295 billion. On a constant currency basis, loans grew 4.5% from a year ago and were unchanged from the previous quarter.

- In FY22, loan growth was largely driven by lending in Singapore, Australia, the United States and United Kingdom.

- Sustainable financing commitments rose 30% from a year ago to S$44 billion, well on track to achieve the Group’s target of S$50 billion by 2025.

- Customer deposits rose 2% year-on-year to S$350 billion, led by a rise in fixed deposits.

- Loans-to-deposits ratio was 83.3% as compared to 83.6% in the previous year.

- As at 31 December 2022, Group CET1 CAR was 15.2%, while the leverage ratio was 7.2%.

- The Board has proposed a final dividend of 40 cents per share, an increase of 43% or 12 cents from a year ago. This brings FY22 total dividend to 68 cents, up 28% or 15 cents from the previous year. This represents a payout ratio of 53% against net profit, which exceeds 49% a year ago.

- The increase is supported by our resilient earnings growth and strong capital position.

- The Scrip Dividend Scheme will not be applicable to the final dividend.

- Target 50% dividend payout ratio going forward.

Message from Group CEO, Helen Wong

“OCBC has emerged stronger from the pandemic and achieved another consecutive year of robust performance despite challenging conditions. I am delighted that the steady execution of our strategic priorities has yielded positive results and we have delivered record earnings, which crossed the S$5 billion mark for the first time. Supported by our sustained earnings growth and strong capital position, we are pleased to raise the 2022 dividend by 28% or 15 cents from a year ago to 68 cents per share, representing a payout ratio of 53%.

We are constantly redefining our business through accelerating digitalisation. We continue to enhance our digital platforms and introduce market-first initiatives to enrich the customer experience. For example, almost all customer transactions in Singapore are now conducted digitally and we have seen strong growth in digital wealth sales. We have also deepened partnerships and integration in the wider digital ecosystem. The focus to boost artificial intelligence and analytics capabilities has helped to better position us to identify business opportunities, improve operational efficiencies and reinforce our cybersecurity infrastructure.

Equally important, we made significant progress in our sustainability agenda in 2022. We joined the Net Zero Banking Alliance which demonstrated our firm commitment to achieving net zero by 2050. We also attained carbon neutrality in our banking operational emissions, and firmly embedded ESG considerations into our lending and investment practices. Our sustainable financing commitments exceeded S$44 billion and is on track to meet our target of S$50 billion by 2025 or earlier.

Looking ahead, our key markets in Asia are expected to remain resilient, and growth is forecasted to outpace the global average in 2023. We are optimistic that the reopening of China and Hong Kong SAR could further spur regional economic growth. We enter the new year with confidence as we drive for sustainable growth and deliver long-term value to our shareholders.”