OCBC Group first quarter 2023 net profit up 39% from the previous year to a record S$1.88 billion

OCBC Group first quarter 2023 net profit up 39% from the previous year to a record S$1.88 billion

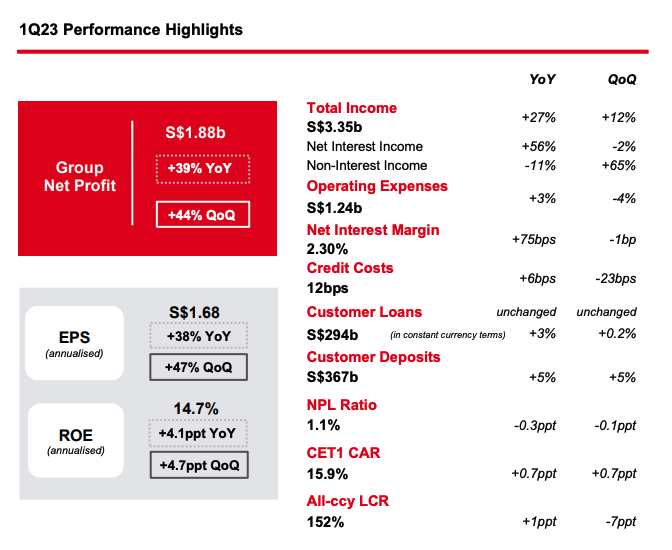

Singapore, 10 May 2023 – Oversea-Chinese Banking Corporation Limited (“OCBC”) reported record net profit of S$1.88 billion for the first quarter of 2023 (“1Q23”), 39% higher as compared to S$1.36 billion a year ago (“1Q22”), and 44% above S$1.31 billion in the previous quarter (“4Q22”).

The Group’s performance was supported by its diversified income streams across banking, wealth management and insurance. Credit costs in 1Q23 were an annualised 12 basis points and portfolio quality remained resilient, with non-performing loan (“NPL”) ratio improving to 1.1%. The Group’s liquidity and capital positions remained strong, supporting business growth while providing buffer for uncertainties. Return on equity (“ROE’’) rose to 14.7% and earnings per share (“EPS”) improved to S$1.68 on an annualised basis.

1Q23 Quarter-on-Quarter Performance

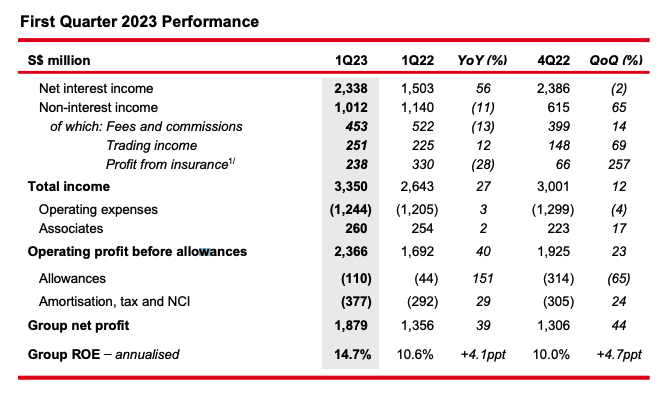

- Group net profit increased 44% to S$1.88 billion to a new quarterly high, largely driven by rise in non-interest income and lower allowances.

- Net interest income of S$2.34 billion was 2% lower against a record 4Q22, mainly due to a shorter quarter. Adjusted for the shorter-days effect, net interest income was largely unchanged. Net interest margin (“NIM”) of 2.30% was 1 basis point below 2.31% a quarter ago, as a rise in asset yields was offset by higher funding costs, as well as lower loans-to-deposits ratio as the increase in deposits outpaced that of loans.

- Non-interest income was S$1.01 billion, up 65% from a quarter ago.

- Net fee income rose 14% to S$453 million, mainly driven by higher wealth management fees.

- Net trading income was S$251 million, a 69% increase from the last quarter. Net realised gains from the sale of investment securities were S$24 million, as compared to a S$67 million loss in the previous quarter.

- Profit from insurance from subsidiary Great Eastern Holdings (“GEH”) was S$238 million. The Group’s insurance results for this quarter were reported based on Singapore Financial Reporting Standard (International) (“SFRS(I)”) 17 Insurance Contracts, which GEH adopted on 1 January 2023. Total weighted new sales were S$391 million and new business embedded value (“NBEV”) was S$170 million, with NBEV margin at 43.4%.

1Q23 Year-on-Year Performance

- Group net profit of S$1.88 billion was 39% higher than the same period last year, on the back of strong net interest income growth.

- Net interest income rose 56% to S$2.34 billion, underpinned by 5% growth in average asset balances and NIM expansion of 75 basis points from the rapid increase of interest rates during 2022.

- Non-interest income of S$1.01 billion was 11% below a year ago, led by a decrease in wealth management fees, which was partly compensated by a rise in trading income and net realised gains from the sale of investment securities. Operating expenses were up 3% to S$1.24 billion. This was largely due to the rise in staff costs from salary increments and headcount growth to drive business expansion, and partly offset by a deduction in insurance-related expenses as noted above. Cost-to-income ratio was 37.1%, as compared to 45.6% a year ago.

- Share of results of associates of S$260 million was 2% higher year-on-year.

- Total allowances of S$110 million were higher as compared to S$44 million for 1Q22, mainly due to higher allowances set aside for non-impaired assets.

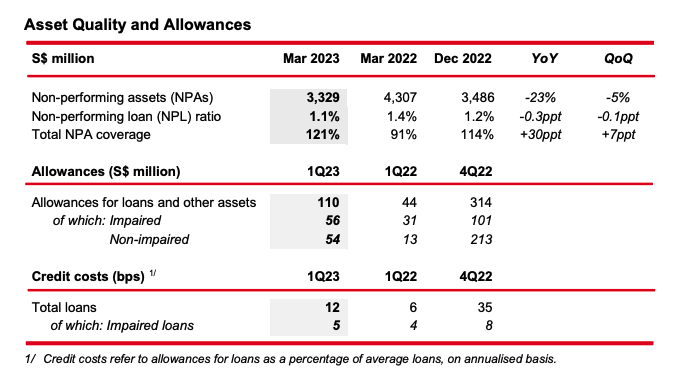

Asset Quality

- Total NPAs as at 31 March 2023 were 5% lower as compared to the previous quarter, as higher recoveries and upgrades more than compensated for new NPA formation. Total NPAs declined across the Group’s key markets of Singapore, Malaysia, Indonesia and Greater China.

- New NPA formation for the quarter was S$174 million, lower as compared to a quarter ago and the previous year, reflecting declines in both the corporate and consumer segments.

- NPL ratio was lower at 1.1% and the allowance coverage for total NPAs for the quarter further improved to 121%.

Allowances

- Total allowances for 1Q23 were S$110 million, comprising S$56 million in allowances for impaired assets and S$54 million in allowances for non-impaired assets. This was substantially lower than the S$314 million in total allowances in 4Q22, mainly due to comparatively higher allowances for non-impaired assets set aside last quarter. Total credit costs of 12 basis points were lower as compared to a quarter ago.

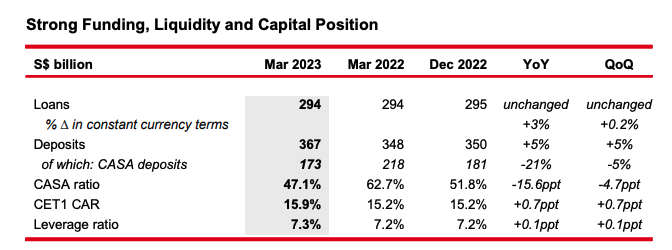

- Customer loans were S$294 billion as at 31 March 2023. On constant currency basis, loans rose 0.2% from the previous quarter and 3% from a year ago.

- Sustainable financing commitments were up 34% from a year ago and 7% from the previous quarter to S$47 billion, reflecting strong progress towards achieving the Group’s target of S$50 billion by 2025.

- Customer deposits grew by 5% from both the previous quarter and a year ago to S$367 billion, underpinned by strong growth in fixed deposits. As at 31 March 2023, the Group’s diversified customer deposit base made up more than 80% of funding composition.

- As deposit growth was higher than that of loans, loans-to-deposits ratio decreased to 79.2% from 83.3% a quarter ago.

- The Group continues to maintain strong funding, liquidity and capital positions, with all regulatory ratios well above requirements.

Message from Group CEO, Helen Wong

“We are pleased to achieve a record quarter on the back of a strong operating performance. Total income reached a new high and expenses were well controlled, while we maintained prudent levels of allowances. Our loan portfolio was resilient and our wealth management business continued to attract net new money inflows. These reflected the strength of our diversified franchise and contributed to a strong uplift in our return on equity.

Looking ahead, we are watchful of tighter financial conditions which may slow global economic growth and elevate overall risks. We remain confident of the long-term prospects of our key markets in Asia. Our capital position is strong and our liquidity positions are healthy. These provide ample buffer for uncertainties and allows us to pursue growth opportunities as they arise.”