OCBC expands cross-border payment options with UnionPay QR feature

OCBC expands cross-border payment options with UnionPay QR feature

OCBC customers will be able to pay UnionPay QR-enabled merchants in 47 markets by using the OCBC Digital app

Singapore, 1 August 2023 – OCBC customers can soon use their OCBC Digital app to easily make retail payments to UnionPay QR-enabled merchants in 47 markets from their OCBC Singapore bank accounts. This eliminates the need to download, set up and fund third-party payment apps or to queue for currency exchange. The launch is timely given the expected surge in Mainland China-bound travel following the recent resumption of the 15-day visa-free entry for Singaporeans, but the feature can also be used at other popular destinations including Malaysia, Thailand and Hong Kong SAR.

The feature, which will be launched on 4 August, is especially useful in markets where merchants rarely accept payment cards or cash. Payments are made directly from customers’ OCBC Singapore accounts up to the daily transaction limit of S$1,000 – sufficient for the everyday traveller’s expenses. The exchange rate will be shown to customers on the OCBC Digital app before they confirm their transactions. There are no additional fees and charges.

This feature was introduced given the rising popularity of QR code payments globally. The global QR code payment market size is predicted to reach S$15.5 billion this year and expected to surpass S$74 billion by 2033 – a compound annual growth rate (CAGR) of 16.9% – according to a 2023 report by market research consultancy Future Market Insights.

This scan-and-pay feature is the result of an agreement signed between OCBC and UnionPay International (UPI) in April 2023, and is the latest cross-border payment collaboration for OCBC. In the last year alone, OCBC has established cross-border payment linkages to enable peer-to-merchant transactions with Malaysia’s DuitNow QR and Thailand’s PromptPay QR.

Mr Sunny Quek, OCBC’s Head of Global Consumer Financial Services (郭斯强, 环球个人银行总裁, 华侨银行), said: “Digital payments are the way forward. We use it for everyday transactions, but now, even when we go overseas, we expect to enjoy that same convenience. Thanks to UnionPay’s extensive network, our customers can now pay in many markets with the same OCBC Digital app that they are accustomed to – bypassing the need for multiple apps or e-wallets and empowering them to pay merchants overseas as easily as they already do in Singapore.”

“This tie-up will be especially beneficial to our customers who are travelling to Mainland China for work or pleasure. We expect QR payments to be the primary mode of payment for retail purchases of smaller value. With travellers between the two areas expected to increase with the restoration of the visa-free facility and major upcoming events like the Hangzhou Asian Games, we believe customers will appreciate this seamless payment method.”

Ms. Carine Low, Singapore Country Manager, UnionPay International (刘可薇,新加坡国家经理,银联国际), said: “With more residents in Singapore embracing mobile payment as a, fast, secure and seamless way to pay, we are pleased to embark on this digital partnership with OCBC. This partnership enables customers using their OCBC Digital App to pay in Singapore and 46 other markets, saving them the hassle of using clunky foreign currencies. This collaboration with OCBC will significantly improve our service and product offerings for residents and businesses in Singapore.”

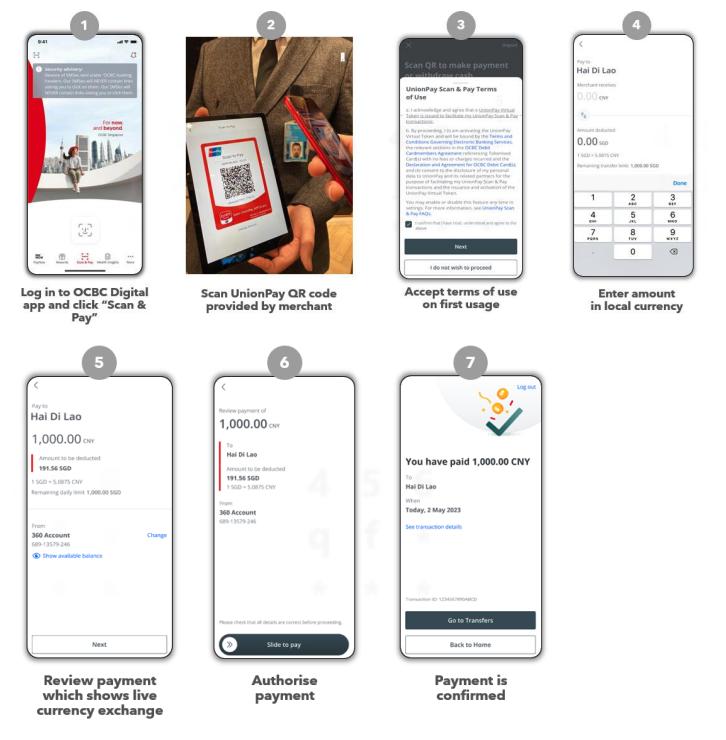

How it works

Come September, the OCBC Digital app will also be enhanced to enable OCBC customers to generate a QR Code which merchants across UnionPay’s QR code payment can scan to effect the payment. This practice, also known as the “customer present mode”, is common in several markets, including Mainland China. It would be in addition to what is available from 4 August – the “merchant present mode”, as shown above – where the merchant presents the QR code to the customer to scan with the OCBC Digital app.

UnionPay QR acceptance enabled on OCBC merchant collections app

OCBC has also collaborated with UnionPay to enable its business banking customers to accept UnionPay QR payments via OCBC’s OneCollect digital merchant collections solution. OCBC OneCollect helps businesses collect payments digitally from customers via QR codes and sends automated notifications with each successful transaction, providing peace of mind for businesses. Currently, over 100 mobile wallets outside Mainland China are UnionPay QR-enabled. Users of these mobile wallets can pay businesses that use OneCollect simply by scanning the UnionPay QR code.