OCBC Group third quarter 2022 net profit up 31% from the previous year to a new high of S$1.60 billion

OCBC Group third quarter 2022 net profit up 31% from the previous year to a new high of S$1.60 billion

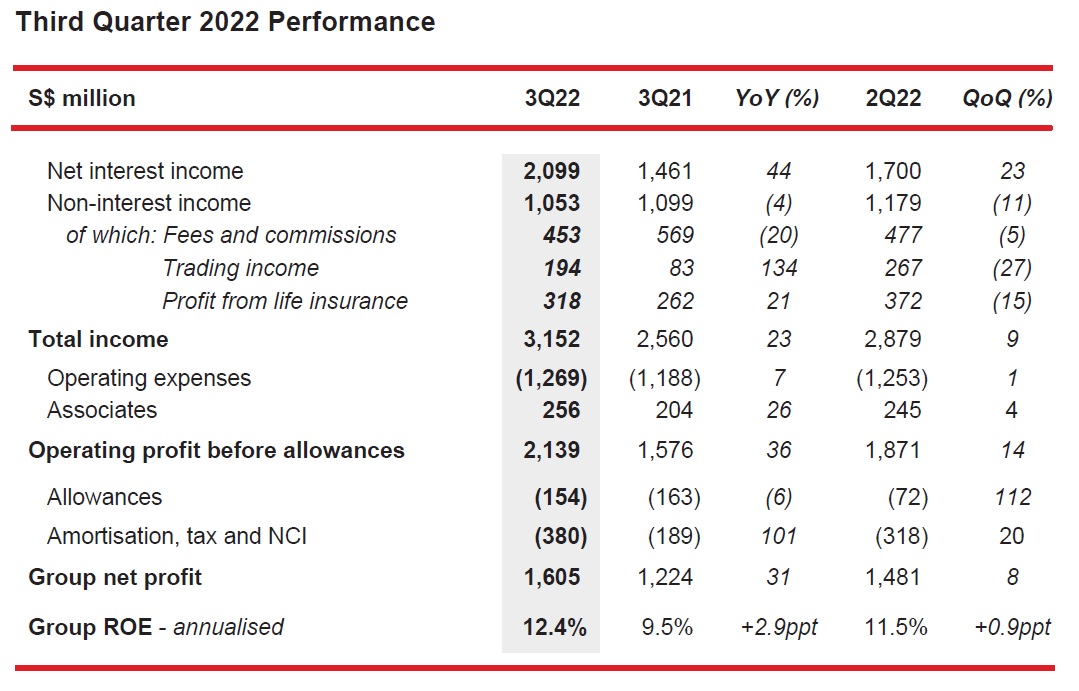

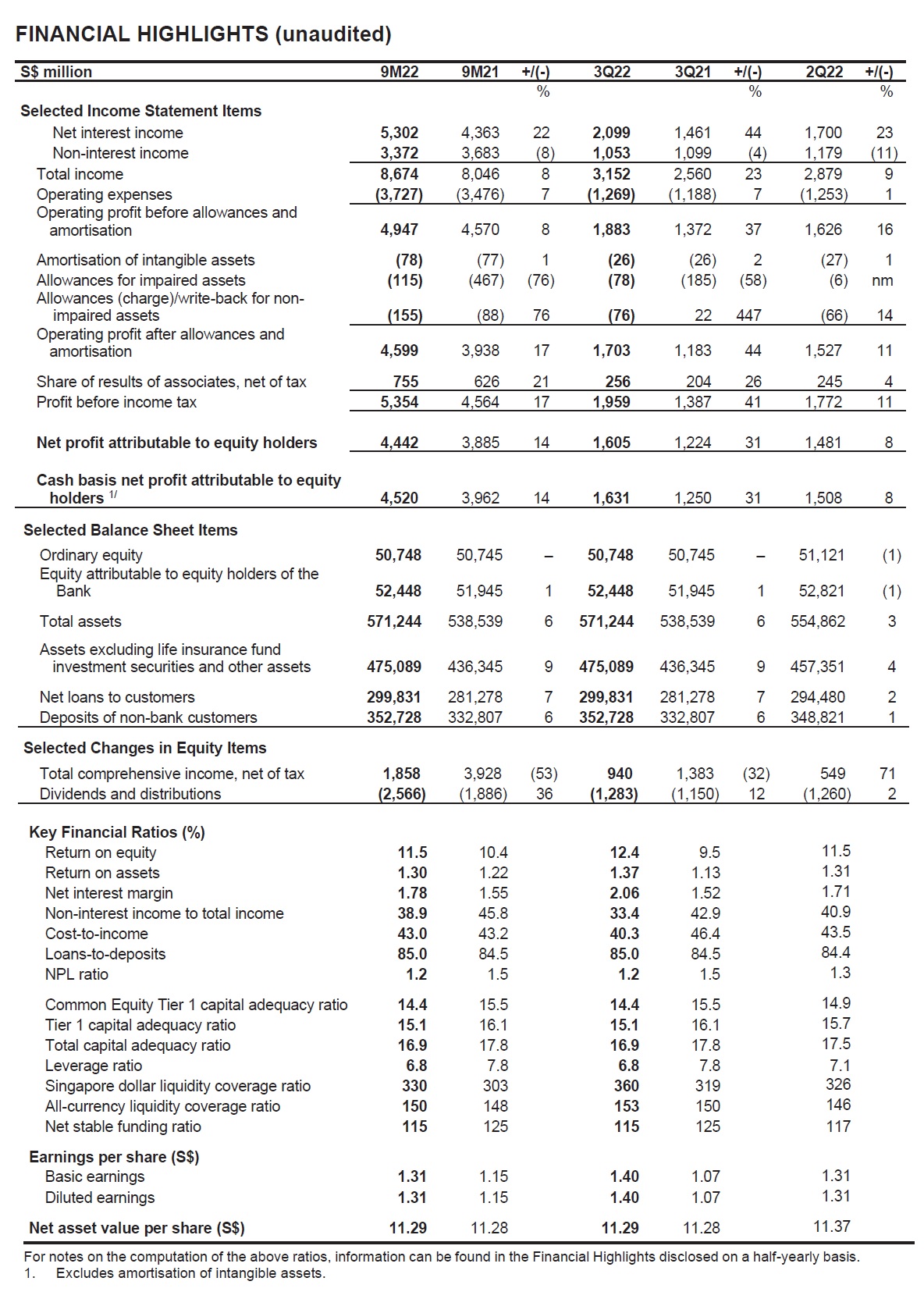

Oversea-Chinese Banking Corporation Limited (“OCBC Bank”) reported its financial results for the third quarter of 2022 (“3Q22”). Group net profit for 3Q22 rose 31% to S$1.60 billion from S$1.22 billion in the previous year (“3Q21”), and was up 8% from S$1.48 billion a quarter ago (“2Q22”).

3Q22 Year-on-Year Performance

- Group net profit of S$1.60 billion was 31% higher as compared to S$1.22 billion a year ago.

- Quarterly net interest income surpassed S$2 billion for the first time, rising 44% to S$2.10 billion on the back of 6% growth in average asset balances and net interest margin (“NIM”) expansion. Amid a rising interest rate environment, NIM rose 54 basis points from 3Q21 to 2.06%, with improved margins across our key markets as the increase in asset yields outpaced the rise in funding costs.

- Non-interest income of S$1.05 billion was 4% below the previous year.

- Net fee income fell 20% to S$453 million, primarily due to a decline in wealth managementfees as customer activities were subdued amid risk-off investment sentiments globally. Thedecline was partly offset by growth in other fee segments including credit card, and loan and trade-related fees.

- Net trading income of S$194 million, largely comprising customer flow treasury income, was higher as compared to S$83 million a year ago.

- Life insurance profit from Great Eastern Holdings of S$318 million was 21% above the previous year, mostly attributable to the net mark-to-market impact of higher interest rates on the valuation of assets and liabilities in its insurance funds.

- The Group’s wealth management income, comprising income from insurance, private banking, premier private client, premier banking, asset management and stockbroking, grew 21% to S$1.12 billion and made up 35% of the Group’s income in 3Q22. The Group’s wealth management business saw positive inflows of net new money which was offset by a decline in market valuations, with wealth management assets under management at S$250 billion as at 30 September 2022, 1% lower from a year ago.

- Operating expenses grew 7% to S$1.27 billion, led by a rise in staff costs associated with headcount growth to support business expansion as well as from annual salary increments. The cost-to-income ratio improved 6.1 percentage points to 40.3% as income growth outpaced the increase in operating expenses.

- The Group’s share of results of associates in 3Q22 increased 26% from the preceding year to S$256 million.

- Total allowances were S$154 million, lower by 6% as compared to the previous year.

- The Group’s annualised ROE was 12.4%, up from 9.5% in 3Q21, while annualised earnings per share increased to S$1.40 from S$1.07 in the previous year.

3Q22 Quarter-on-Quarter Performance

- Group net profit rose 8% from a quarter ago.

- Total income was up 9% to S$3.15 billion.

- Net interest income grew 23% to S$2.10 billion, underpinned by a 35 basis points uplift in NIM.

- Non-interest income declined 11% to S$1.05 billion, mainly attributable to lower fee and trading income, and life insurance profit.

- Operating expenses were up 1% from 2Q22, while the cost-to-income ratio improved from 43.5% to 40.3%.

- Share of results of associates rose 4% from the previous quarter.

- Total allowances were higher against the previous quarter from an increase in allowances set aside for impaired and non-impaired assets.

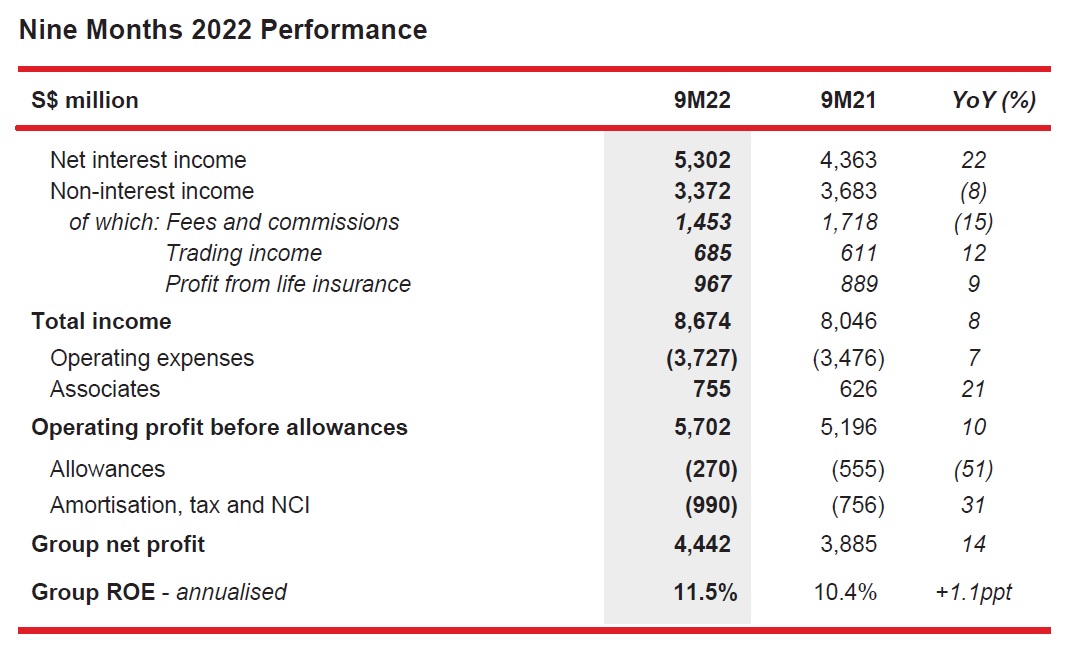

9M22 Year-on-Year Performance

- Group net profit was S$4.44 billion for the first nine months of 2022 (“9M22”), 14% higher as compared to the previous year (“9M21”), largely driven by net interest income growth and a decline in allowances.

- Net interest income rose 22% to S$5.30 billion on the back of asset growth and a 23 basis points improvement in NIM.

- Non-interest income decreased 8% to S$3.37 billion, as the drop in fee and investment income

more than offset higher trading income and life insurance profit. - Operating expenses of S$3.73 billion were 7% above 9M21, as the Group continued to invest for business growth, with the cost-to-income ratio at 43.0%.

- The Group’s share of results of associates was S$755 million, 21% higher against last year.

- Total allowances were 51% lower at S$270 million, mainly attributable to a decline in allowances for impaired assets.

- The Group’s annualised ROE improved to 11.5% from 10.4% in 9M21, while annualised earnings per share grew by 14% to S$1.31.

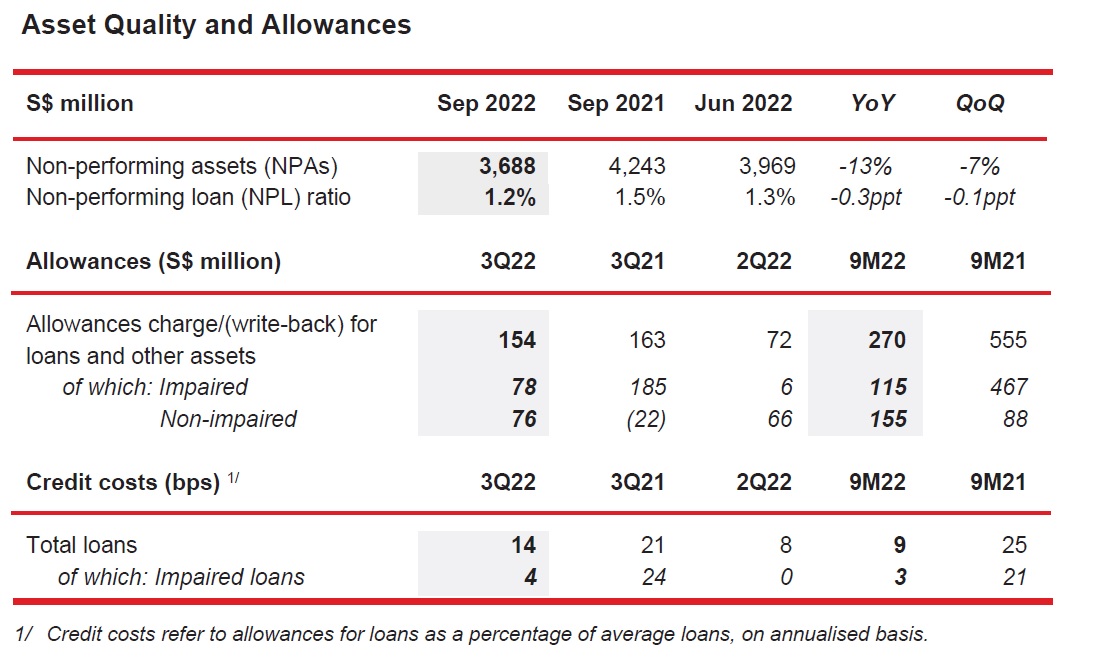

- As at 30 September 2022, total NPAs were S$3.69 billion, down 13% from a year ago and 7% from the previous quarter.

- NPAs were lower as compared to the last quarter, mainly attributable to higher recoveries and upgrades from both corporate and consumer segments in Malaysia and Indonesia, which more than offset new NPA formation during the quarter.

- NPL ratio was lower at 1.2%, while the NPA coverage ratio increased to 108%.

- Total allowances for 3Q22 were S$154 million, comprising S$78 million in allowances for impaired assets and S$76 million in allowances for non-impaired assets, while total credit costs amounted to 14 basis points on an annualised basis.

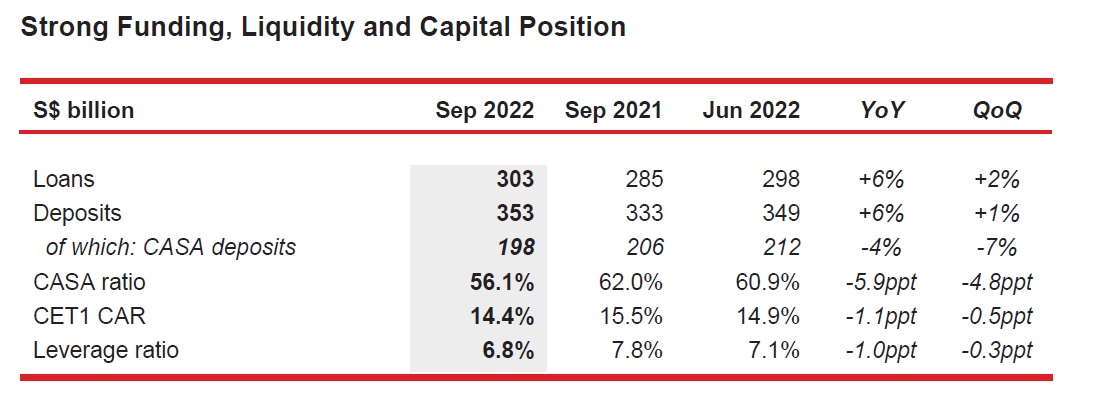

- Customer loans grew 6% from the previous year to S$303 billion as at 30 September 2022. By geography, the main contributors to loan growth were Singapore, Indonesia, Greater China, USA, Australia and UK. By industry, the increase in loans was mostly driven by higher lending to the building and construction sector, financial institutions, investment and holding companies, and consumer segment. Against the last quarter, customer loans rose 2%.

- Green and sustainable financing to customers was S$28 billion as at 30 September 2022, up 45% from a year ago and 8% from the previous quarter. These made up 9% of the Group’s loans.

- Customer deposits were S$353 billion as at 30 September 2022, increasing 6% from last year and up 1% from the prior quarter mainly due to growth in fixed deposits. The Group’s funding composition remained stable with customer deposits comprising around 80% of total funding.

- Loans-to-deposits ratio was 85.0%, higher as compared to the 84.5% in the previous year and 84.4% last quarter.

- The Group’s CET1 CAR was 14.4%, while the leverage ratio was 6.8% as at 30 September 2022.

Message from Group CEO, Helen Wong

“We are pleased to have delivered a strong set of quarterly results. Net interest income grew on higher net interest margin and loan growth was sustained. While subdued customer investment activity impacted wealth fees, we continued to attract net new money inflows into our wealth management franchise. Our portfolio quality remained resilient; and our investments to drive franchise growth, raise productivity and deliver operational efficiencies continue to yield positive results.

Looking ahead, the global economic outlook is expected to be increasingly challenging. Backed by our strong balance sheet, we are well-positioned to support our customers and capture opportunities as they arise.”

For more information, please visit www.ocbc.com