Fourth OCBC Financial Wellness Index finds young crypto investors still keen on cryptocurrencies despite crash

Fourth OCBC Financial Wellness Index finds young crypto investors still keen on cryptocurrencies despite crash

The fourth edition of the OCBC Financial Wellness Index finds that two in five Gen Z and young millennial Singapore investors in their 20s still plan to invest in cryptocurrencies within the next 12 months despite the crash this year. On average, Gen Z and young millennial crypto investors who made losses lost 40% from their crypto investments.

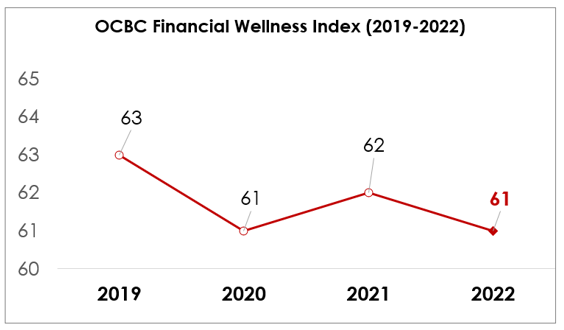

These findings are just two of the many insights into Singaporeans’ financial behaviours, worries and aspirations in an increasingly challenging economic environment in 2022. The uneven post-pandemic recovery, record-high inflation, soaring interest rates and geopolitical and market uncertainty have hit Singaporeans’ financial wellness. This year’s OCBC Financial Wellness Index dipped to 61, returning the score to 2020 levels, when the world was grappling with the Covid-19 outbreak.

The decline comes on the back of poorer investment returns, increased debt stress and derailed retirement plans. Higher rates of gambling, reckless spending and speculative investing were also observed.

The Index is based on an online survey of 2,182 working adults in Singapore between ages 21 and 65 that was carried out in August 2022.

Young Singaporeans keener on crypto to build wealth fast

Close to one in six (14%) Singaporeans in their 20s are invested in high-risk, high-return products, while close to one in five (18%) are invested in cryptocurrencies. Of these young crypto investors, two in five of them said that they would still be willing to invest in crypto within the next year, despite the volatility of the asset class in 2022.

Those in their 30s had a similar risk appetite, with 12% invested in high-risk, high-return products. 14% are invested in cryptocurrencies, compared to just 8% of Gen Xs aged between 40 and 54, and 4% of Baby Boomers aged 55 and above.

This penchant for investing in riskier assets has hit young Singaporeans. About two in five (42%) investors in their 20s made an overall loss on their investments, up 19% from last year, and more than a third (35%) of investors in their 30s made an overall loss, up 10% from last year.

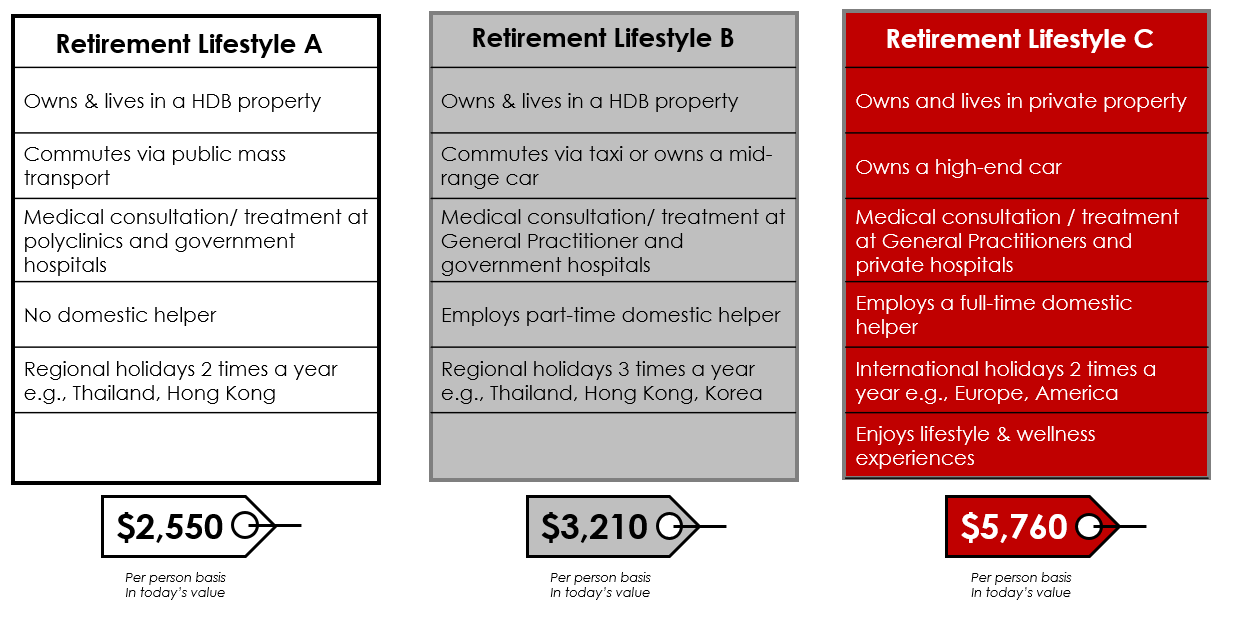

Young Singaporeans’ worries about retirement may be the reason for this risk-taking behaviour. On average, Gen Zs and millennials in their 20s and 30s aspire to retire at 58 – a decade before Singapore’s official re-employment age of 68. In addition, they wish to retire in style. When offered three retirement lifestyles, more in their 20s (34%) and 30s (28%) picked the most luxurious lifestyle, compared to Gen X (21%) and Baby Boomers (22%).

But Gen Zs and millennials are concerned about whether these goals can be reached; despite being relatively far from retirement, 62% of those in their 20s and 56% of those in their 30s worry that they will not have enough retirement funds.

Many have thus begun looking for side income. Besides investments, other popular forms of side income include side hustles like food delivery, running online businesses, giving tuition or being influencers. Almost half (48%) of those in their 20s, and two in five (40%) of those in their 30s, have side hustles.

Despite gloomy outlook, Singaporeans prioritising pleasure over belt tightening

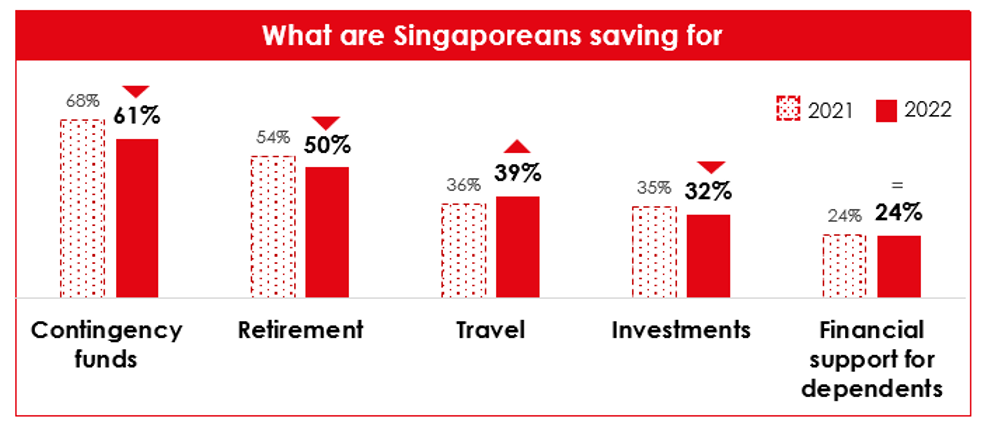

Singaporeans continue to be strong savers, with both the number of Singaporeans who save at least 10% of their salary (91% compared to 88% in 2021), and the average amounts they save (30% compared to 27% in 2021), up from last year. However, with the post-pandemic recovery encouraging “revenge travel and spending”, and despite savings rates going up, more Singaporeans are allocating their savings to pleasures like travel rather than investments, retirement, or emergency funds. Savings for emergencies fell seven-percentage points to 61%.

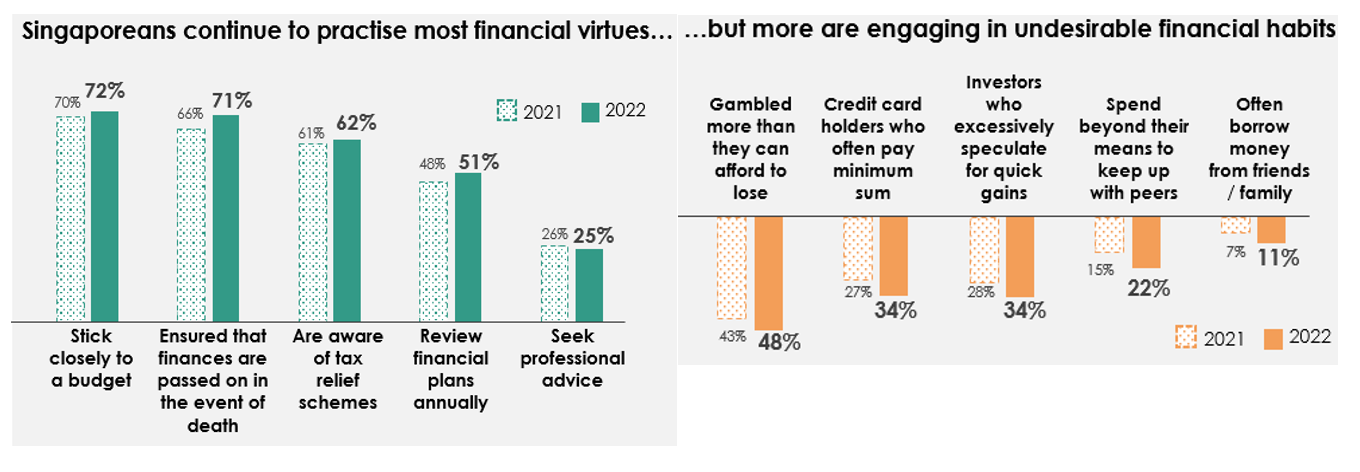

At the same time, while a consistent number of Singaporeans continue to practice financial virtues such as sticking to a budget, reviewing their financial plans and seeking professional advice, more Singaporeans are adopting undesirable habits across all indicators including gambling more than they can afford to lose (48% compared to 43% in 2021), paying only the minimum on their credit cards (34% compared to 27% in 2021) and spending beyond their means to keep up with peers (22% compared to 15% in 2021).

This has resulted in Singaporeans not being ready to face a financial crisis. Less than half of Singaporeans (45%) can meet their families’ needs for the next one year, and a little over half (53%) have accumulated six-months’ of salary enough to overcome a crisis.

Singaporeans running up more unsecured debt; mortgage stress is mounting

Singaporeans’ debt management took a hit this year, off the back of rising interest rates and a gloomy economic outlook. About a third of Singaporeans (31% compared to 24% in 2021) have unsecured debt. Having unsecured debt may not in itself have a significant bearing on financial wellness, but the more troubling finding is how one in five Singaporeans have some difficulty managing their unsecured debt, and around a third of Singaporeans often pay only the minimum sum on their credit cards. More than a third of Singaporeans (35% compared to 32% last year) worry about not being able to pay off their personal loans.

Surprisingly, the more Singaporeans earned, the more unsecured debt they incurred. Of the Singaporeans who earned monthly incomes of $10,000 and above, 38% had unsecured debt, with this group growing 11-percentage points from last year. In contrast, 26% of Singaporeans who earned below $4,000 a month had unsecured debt, increasing just one-percentage point from 2011.

Bad habits may have fuelled the need for unsecured debt. Of the high-income earners who reported having unsecured debt, 68% said they excessively speculated and 64% gambled more than they could afford to lose in the last 12 months. High income earners who did not have unsecured debt were less likely to have these habits – 26% of them said they excessively speculated and 40% gambled more than they could afford to lose.

Mortgage stress is also mounting, with two in five Singaporeans (40% compared to 31% in 2021) facing some difficulties in paying off their mortgage loans. As interest rates continue to climb, stress levels may continue to escalate. More Singaporeans are unable to pay their loans on time (14% vs 9% in 2021), with more indicating they would have to sell or downgrade their homes to pay their loans (8% compared to 6% in 2021).

This has resulted in more Singaporeans worried about home financing – 38% worry about not being able to afford a home, an increase from 36% last year.

Singaporeans’ average return on investments slashed by half

Singaporeans across all age groups saw their average rate of return on investments fall by more than half from 1.5% last year to 0.7% this year, with more suffering overall investment losses (36% compared to 26% in 2021). Those in their 20s had the lowest average rate of investment returns (0.3%) compared to investors in their 30s (0.9%), Gen X (0.7%) and Baby Boomers (1.1%).

This dip in investment returns meant fewer Singaporeans could meet their investment targets. Less than half of Singaporean investors (41%) were on track with their investment goals, an 11-percentage point fall from last year’s 52%.

Singaporeans want to retire better but still underestimate the amount needed for their ideal retirement

While Singaporeans have considered the high inflation of the past 12 months and have factored in rising expenses in their retirement planning estimations, many are still underestimating the costs of their desired retirement lifestyles.

Last year, the Covid-19 pandemic may have dampened Singaporeans’ desires for excesses, so more were prudent about their dream retirement lifestyles – 40% of Singaporeans picked the most basic lifestyle for their desired retirement, but they underestimated the amount needed for that retirement lifestyle by 31%.

This year, the group that desired the most basic retirement lifestyle fell six-percentage points to 34%, while the number of Singaporeans who picked Lifestyle B – a more lavish lifestyle that includes car ownership, employing a domestic helper and more regional holidays – increased to a majority at 41% (six-percentage points up from last year). Still, Singaporeans underestimated the amount required for their desired lifestyle. On average, Singaporeans indicated they would need $2,372 for Lifestyle B, but the actual cost of that lifestyle in today’s value is 35% higher than their estimations ($3,210).

When it comes to making retirement plans, Singaporeans performed better than last year, with 68% (compared to 66% in 2021) having started on retirement planning. However, Singaporeans are not on track to their ideal retirement, with less than half able to achieve their retirement goals (42% compared to 49% in 2021).

Amidst a volatile year rife with market volatility, older Singaporeans resorted to taking on more risk to meet their retirement goals. More Baby Boomers began investing (86% compared to 79% in 2021) but there was also an increase in the number who indicated that they excessively speculated to build up their retirement funds more quickly. This group of speculators (34% of Baby Boomers) saw the largest increase from last year – 17-percentage points over 2021 – compared to other age groups.

Silver lining for Singaporeans who save and invest prudently

OCBC Bank’s Head of Wealth Management, Ms Tan Siew Lee, commented: “2022 has been a tough year for Singaporeans – probably one of the toughest in decades with inflation at an all-time high. Add to this economic uncertainty, rising interest rates and a market downturn, and we truly are experiencing a year with ‘no place to hide’.

"Due to these ongoing challenges, it's no surprise that Singaporeans' financial wellness took a beating this year. Young Singaporeans, many of whom may not have experienced such an economic storm before, are especially concerned about their finances – but I do not think that the future is bleak. Many young Singaporeans are excellent savers, are already planning for retirement and starting to invest. The drive that they have shown in hustling on the side also shows determination and the willingness to work hard, which stands them in good stead.

“In their hurry to grow their retirement funds, however, some may be tempted to speculate for quick gains. Young Singaporeans need to look longer term, seek professional advice, and always do their research before investing. Three important things all Singaporeans can keep in mind are these: Save diligently, invest prudently, and have adequate insurance. If they do this, and if they persist with good financial habits, they can emerge stronger in time to come.”

About the OCBC Financial Wellness Index

The OCBC Financial Wellness Index (“the Index”), launched in 2019, is a measurement of the state of Singaporeans’ financial wellness. Every year, around 2,000 working adults in Singapore between the ages of 21 and 65 are surveyed online.

The Index is based on 10 pillars of financial wellness as defined by the Bank’s wealth management experts. These 10 pillars are – Saving Habits, Protection from Financial Emergencies, Regular Investing, Retirement Planning, Regular Reviews, Gambling Habits, Excessive Speculation, Borrowing Money, Spending Beyond Means and Manageable Debt. To assess how respondents fare on these 10 pillars, 24 indicators – standards and guidelines that are widely-accepted best practices in financial planning – are used.

Based on their responses against these indicators, a score is calculated for each respondent ranging from 0-100. The individual scores from all respondents are then averaged to come up with the overall Index score.