OCBC Bank partners CapitaLand on Singapore's first SORA-based loan

OCBC Bank partners CapitaLand on Singapore's first SORA-based loan

The S$150 million three-year corporate loan from OCBC Bank to CapitaLand is a milestone in the industry's transition roadmap towards adopting Singapore Overnight Rate Average (SORA) as the new interest rate benchmark for the Singapore Dollar cash and derivatives markets.

OCBC Bank and CapitaLand have inked Singapore’s first loan facility agreement referencing Singapore Overnight Rate Average (SORA). The S$150 million three-year corporate loan from OCBC Bank to CapitaLand is a milestone in the industry’s transition roadmap towards adopting SORA as the new interest rate benchmark for the Singapore Dollar cash and derivatives markets.

The S$150 million loan is part of a S$300 million sustainability-linked loan extended by OCBC Bank to CapitaLand. Proceeds from the facility will be used for general corporate purposes.

The loan facility’s interest rate, which references SORA, comprises two components: (1) a compounded average of daily SORA rates calculated in arrears and (2) an applicable margin.

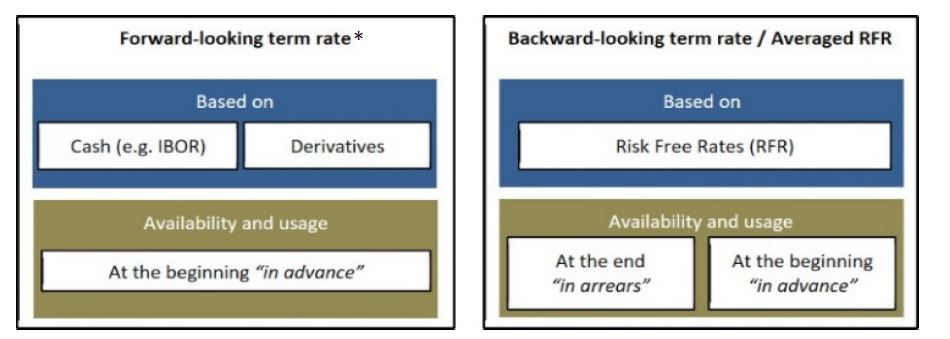

SORA is a backward-looking overnight rate as compared to forward-looking reference rates commonly used for loan facilities in Singapore, such as the SGD Swap Offer Rate (SOR) where the interest rate is determined at the start of the interest period. To determine the interest rate of a SORA-based loan facility, the daily SORA rates are compounded in arrears and the interest rate is determined by the end of the relevant interest period.

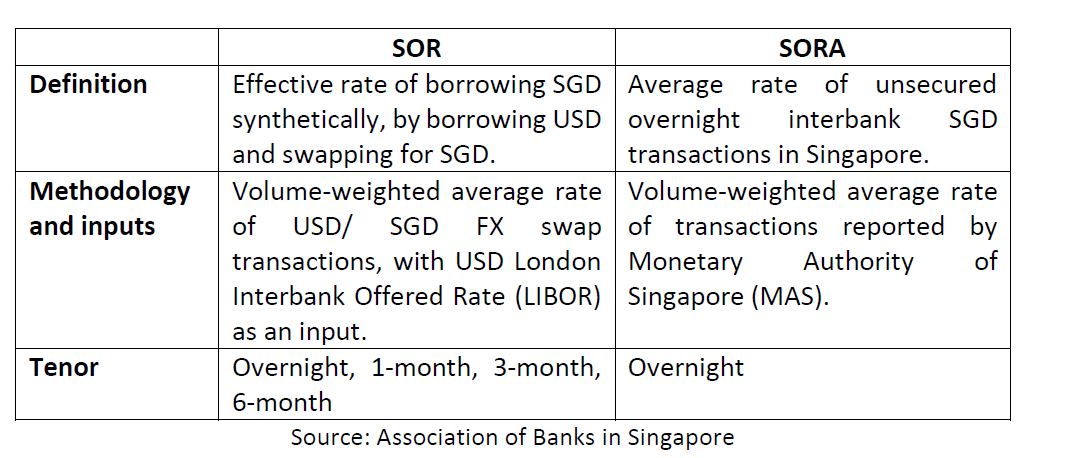

A summary of the key differences between SOR and SORA is set out below:

Globally, several major jurisdictions have identified overnight rates as alternative benchmark rates to LIBOR in their respective currencies, and the industry is trending towards the use of backward-looking, compounded-in-arrears rates.

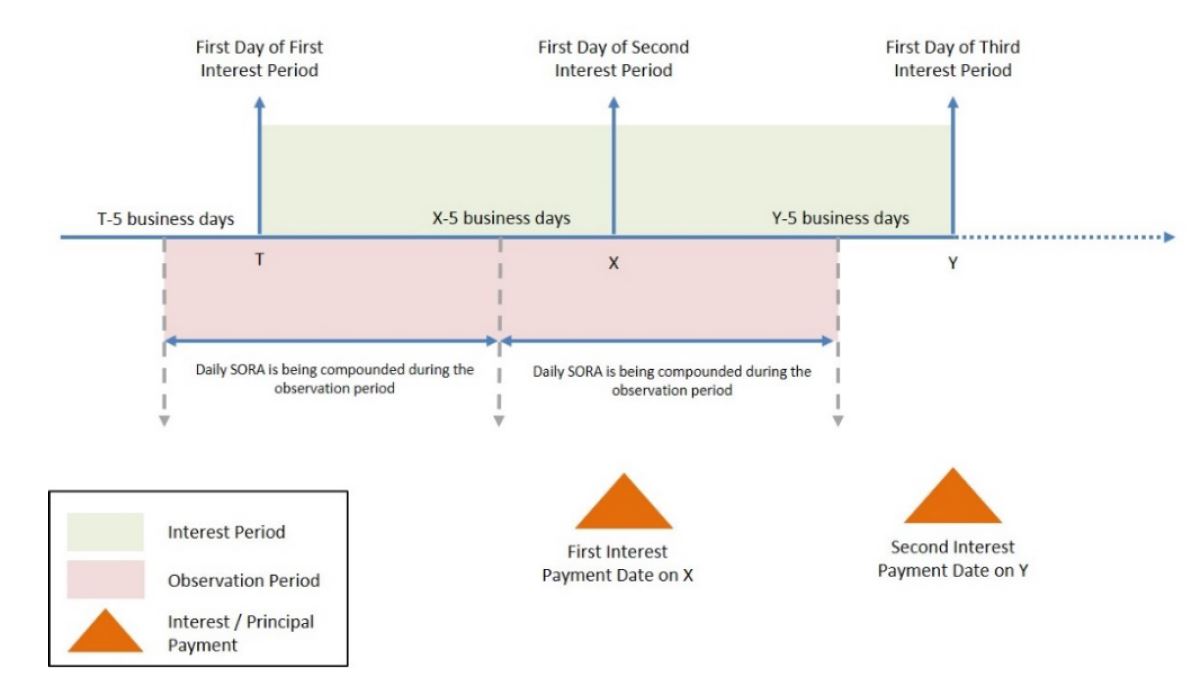

For Singapore’s inaugural SORA-based loan facility, the compounded average SORA will be calculated in arrears, using the ‘Five-business day backward-shifted observation period’ methodology.

Refer to Annex A for an illustration on how this methodology works.

The use of a compounded average SORA calculated in arrears has several benefits:

- SORA is accessible and has been published on the MAS website daily since 1 July 2005.

- SORA is a robust benchmark underpinned by a deep and liquid overnight interbank funding market and not susceptible to manipulation.

- The averaging effect of compounded SORA rates will result in more stable rates, compared to forward-looking term rates, such as SOR, which are exposed to idiosyncratic market factors on a single day’s fixing, such as quarterly and year-end volatility.

- SORA has been identified as the alternative benchmark rate for Singapore Dollar derivatives. Hence, pegging cash products to the same benchmark allows for effective hedging as the basis risk between cash and derivatives markets is minimised.

OCBC Bank had previously executed Singapore’s first overnight indexed swap derivatives transaction using SORA as the reference rate in November 2019. It was also a party to the first Singapore dollar interest rate swap referencing SORA, cleared by LCH, a leading global clearing house, in May 2020.

In August 2019, the Association of Banks in Singapore (ABS) and the Singapore Foreign Exchange Market Committee identified SORA as the most suitable interest rate benchmark to replace the SOR. This change is necessary as the long-term viability of SOR, which utilises the USD LIBOR in its computation, would be impacted by the expected discontinuation of the USD LIBOR after 31 December 2021.

An industry-led Steering Committee for the transition (SC-STS), comprising senior representatives from key banks, relevant industry associations, and MAS was established in August 2019. Chaired by Mr Samuel Tsien, OCBC Group CEO and ABS Chairman, the SC-STS is responsible for providing strategic direction on industry proposals to develop new products and markets based on SORA, and to engage with stakeholders to seek feedback and raise awareness on issues related to the transition from SOR to SORA.

Said Ms Elaine Lam, Head, Global Corporate Banking, OCBC Bank, “We are pleased to be working with CapitaLand on Singapore’s first SORA-pegged loan, which is an important first step for the industry transition from SOR to SORA. This deal will provide guidance for the development of SORA-pegged loans, pave the way for greater market acceptance and help such loans gain traction in the market. This landmark SORA-pegged loan, being a sustainability-linked loan, deeply resonates with OCBC’s and CapitaLand’s shared commitment to advancing green finance in Singapore.”

Said Mr Andrew Lim, Group Chief Financial Officer, CapitaLand Group, “CapitaLand’s pioneer adoption of the SORA-based loan enables us to contribute to how SORA will be understood, structured and priced, in the process preparing the groundwork for mainstream adoption in the future. It also positions CapitaLand well as we embark on our own gradual transition. With the support of a like-minded partner in OCBC, we are able to dovetail this important innovation in Singapore’s financial ecosystem with our commitment to our environmental, social and governance efforts. We will continue to advocate and pursue responsible growth and sustainability as a Group.”

In total, CapitaLand and its real estate investment trusts have raised over S$2.72 billion in less than two years through sustainable financing.

Refer to Annex B for details on this sustainability-linked loan and CapitaLand’s sustainable financing efforts.

ANNEX A

Illustration: Determining the backward-looking compounded-in-arrears SORA using a ‘Five-business day backward-shifted observation period’ methodology.

- SORA is a backward-looking overnight rate. Observation period is the period from, and including, the date five business days preceding the first day of the interest period to, but excluding, the date five business days preceding the last day of the interest period.

Source: Financial Stability Board

*IBOR refers to Interbank Offered Rate

- The daily SORA rates are compounded in arrears over the observation period.

- Interest amount will be a product of (i) outstanding principal (ii) compounded-in-arrears SORA and an applicable margin (iii) number of days in the interest period divided by 365.

- The interest amount in respect of an interest period will be determined after the end of the observation period and prior to the end of such interest period and is payable on an agreed date. (For illustration purposes, the interest payment date is assumed to be the last day of the interest period.)

ANNEX B

Details on the sustainability-linked loan and CapitaLand’s sustainable financing efforts

- With the S$300 million sustainability-linked loan from OCBC Bank, CapitaLand and its real estate investment trusts have raised over S$2.72 billion in under two years through sustainable financing, reinforcing the Group’s commitment towards responsible growth. This is CapitaLand’s sixth sustainability-linked loan, the highest number of sustainability-linked loans obtained by a real estate company in Singapore.

- CapitaLand Group has partnered with seven financial institutions to secure a total of 13 sustainable financing instruments comprising sustainability-linked loans, green loans and a green bond since 2018.

- The sustainability-linked loan is explicitly tied to CapitaLand’s environment, social and governance (ESG) performance and achievements in the Global Real Estate Sustainability Benchmark (GRESB), a leading ESG benchmark for real estate and infrastructure investments across the world. CapitaLand will obtain interest savings as it maintains or improves its rating on the benchmark. This is CapitaLand’s second sustainability-linked loan to be tied to GRESB.

- In 2019, CapitaLand had achieved interest savings on its previous S$600 million sustainability-linked loans. These sustainability-linked loans are explicitly linked to CapitaLand’s ESG efforts to maintain its listing on the Dow Jones Sustainability World Index.

Media Queries

Liew Aiqing