OCBC Bank launches first-of-its-kind digital business dashboard for SME customers as spending on apps almost doubles to $9 million

OCBC Bank launches first-of-its-kind digital business dashboard for SME customers as spending on apps almost doubles to $9 million

The “go digital” movement for small and medium enterprises (“SMEs”) continued to pick up steam in 2018 as the popularity of digital applications (“apps”) that help business owners and managers run their businesses soared.

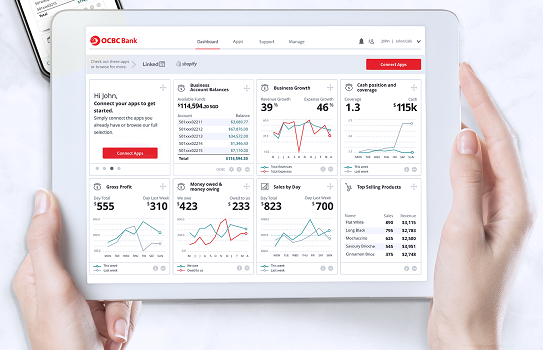

Catering to this trend, OCBC Bank, which serves more than 1 in 2 SMEs in Singapore, has launched a one-stop digital business dashboard that displays apps which provide a holistic view of the business.

Based on OCBC Business Debit Card spending data, SME expenditure in 2018 on some of the most popular business apps such as Facebook, Xero, MailChimp, Shopify and Quickbooks, hit $9 million, almost double the amount spent in 2017.

This is consistent with findings from the 2018 SME Development Survey conducted by DP Information Group, where a third of the 2,557 respondents stated that they had already adopted at least one digital solution.

OCBC Bank has integrated more than 40 of these business apps, including the bank’s digital banking platform Velocity@ocbc, with the web-browser based dashboard.

It is the first dashboard available to SMEs in Singapore that integrates with such an extensive network of apps supporting business functions like accounting and expense management, sales and inventory, marketing and human resources.

SMEs can seamlessly connect these apps if they have already been using them in their operations, or purchase them directly through the dashboard. Once the apps have been connected to the dashboard, user-friendly graphs and charts displayed via widgets are generated from the apps’ data. Gross Profit, Weekly Sales and Website Traffic are just three of the more than 60 widgets that business owners can choose to add to the fully customisable dashboard.

Having the dashboard enables business owners to see key information on all aspects of the business in one place – with just one log in. This breaks down information silos within the organisation and empowers business owners to make more informed decisions. For example, a business owner could more easily monitor his email marketing campaign using Mailchimp, analyse the same campaign’s effectiveness in driving website traffic by looking at Google Analytics, and check on subsequent sales, top selling products and inventory levels using Shopify and Tradegecko.

The dashboard is free for all OCBC SME customers, with the apps ranging from those that are free to those that cost approximately US$200 per month. Moreover, in support of the Start Digital initiative by Infocomm Media Development Authority (IMDA) and Enterprise Singapore (ESG) announced on 9 Jan 2019, OCBC SME customers can sign up for the Start Digital pack in order to get any two of the following four apps – Xero, MailChimp, Shopify or Quickbooks – free for the first 12 months through the dashboard. These four apps have strong customer endorsement and are well-suited to accelerating the digital transformation journey of SMEs.

Said Mr. Melvyn Low, Head of Global Transaction Banking, OCBC Bank, “Running a business requires owners and managers to keep track of many aspects – sales, inventory, human resources, and banking. Knowing this, we developed the dashboard so that SMEs can get a holistic view of the business. We anticipate that this will become a command centre for them – something that they will keep accessing every day – as it provides real, actionable insights in one place.

“This dashboard is part of OCBC’s effort to go beyond banking in order to build an ecosystem that SMEs can tap on to fulfill their growth ambitions. It is something that we have been doing and will continue to do more of.”

A soft launch for the dashboard was carried out with a select group of customers in December 2018. Among them was Mr. Jackson Aw, founder of toy design and manufacturing company Mighty Jaxx.

Said Mr. Aw, “I currently use many digital solutions including Mailchimp, Shopify, Xero and Google Analytics in the running of my business but they are mostly managed by different departments. Because I just need to log in to the dashboard once in order to get an entire view of my business, it is very convenient and will save me a lot of time in the future.”

This digital business dashboard is the result of a collaboration between OCBC Bank and fintech 9 Spokes which began in 2017 under the second Fintech Accelerator Programme run by OCBC Bank’s fintech unit, The Open Vault at OCBC.