OCBC Bank rolls out digital 'soft' tokens to replace all hardware tokens for customers

OCBC Bank rolls out digital 'soft' tokens to replace all hardware tokens for customers

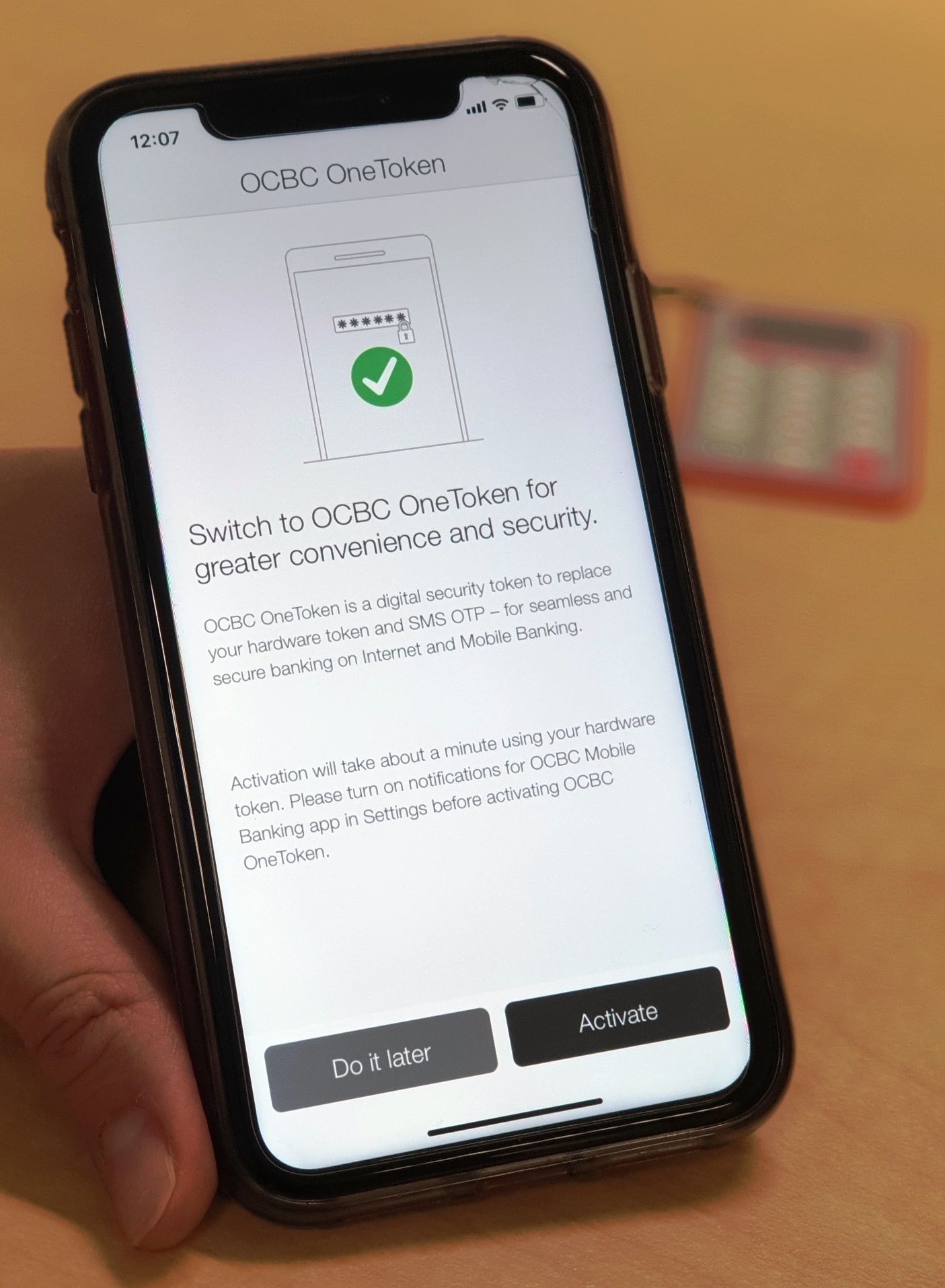

Integrated for use with biometric authentication or access code and PIN, OCBC OneToken offers customers access to all digital banking services on-the-go and on their desktop, eliminating the need for SMS one-time passwords (OTP) or hardware tokens. This service has been available to all OCBC Singapore customers since January 2019. OCBC Malaysia customers will be able to use this service from March 2019.

After a simple one-time set-up, OCBC OneToken is instantly activated on the customer’s mobile phone. Customers can then perform all digital banking services – from basic services such as viewing bank accounts, to making payments and transfers, and even high-risk transactions such as adding payees and updating personal details – more conveniently and securely than ever, without the need for SMS OTPs or their hardware token.

The digital security token automatically authenticates transactions on the OCBC Mobile Banking app, and allows customers to approve transactions on their registered mobile phone when banking on other devices. Even if a customer is travelling or has no data network connectivity, OTPs can be generated offline on their OCBC OneToken-registered mobile phone. Customers can also instantly re-activate OCBC OneToken on another phone if they switch or upgrade devices, which happens once every 2 years on an average in Singapore.

Highlights

- Since its launch in Singapore in January 2019,

- More than 1 in 4 digital customers have activated the digital security token on their mobile device

- More than 2 million transactions have been performed and authenticated with OCBC OneToken

- OCBC Bank expects to save S$25 million in 5 years by reducing SMS OTPs and eliminating the issuance of hardware tokens

Quote

“The move towards digital security tokens will allow our customers to ditch their hardware tokens and bank more seamlessly and securely with us. Everyone has their mobile device with them almost all the time, so having OCBC OneToken on their mobile makes digital banking totally frictionless – no SMS OTPs, no hardware tokens, no passwords needed for authentication. We are excited about the positive initial customer response, and are confident that a majority of our digital consumers will embrace this.” – Mr Aditya Gupta, Head E-Business, Singapore & Malaysia, OCBC Bank

Media Queries

Bernadette Yuen