OCBC Bank is the first bank in Singapore to launch its own artificial intelligence unit

OCBC Bank is the first bank in Singapore to launch its own artificial intelligence unit

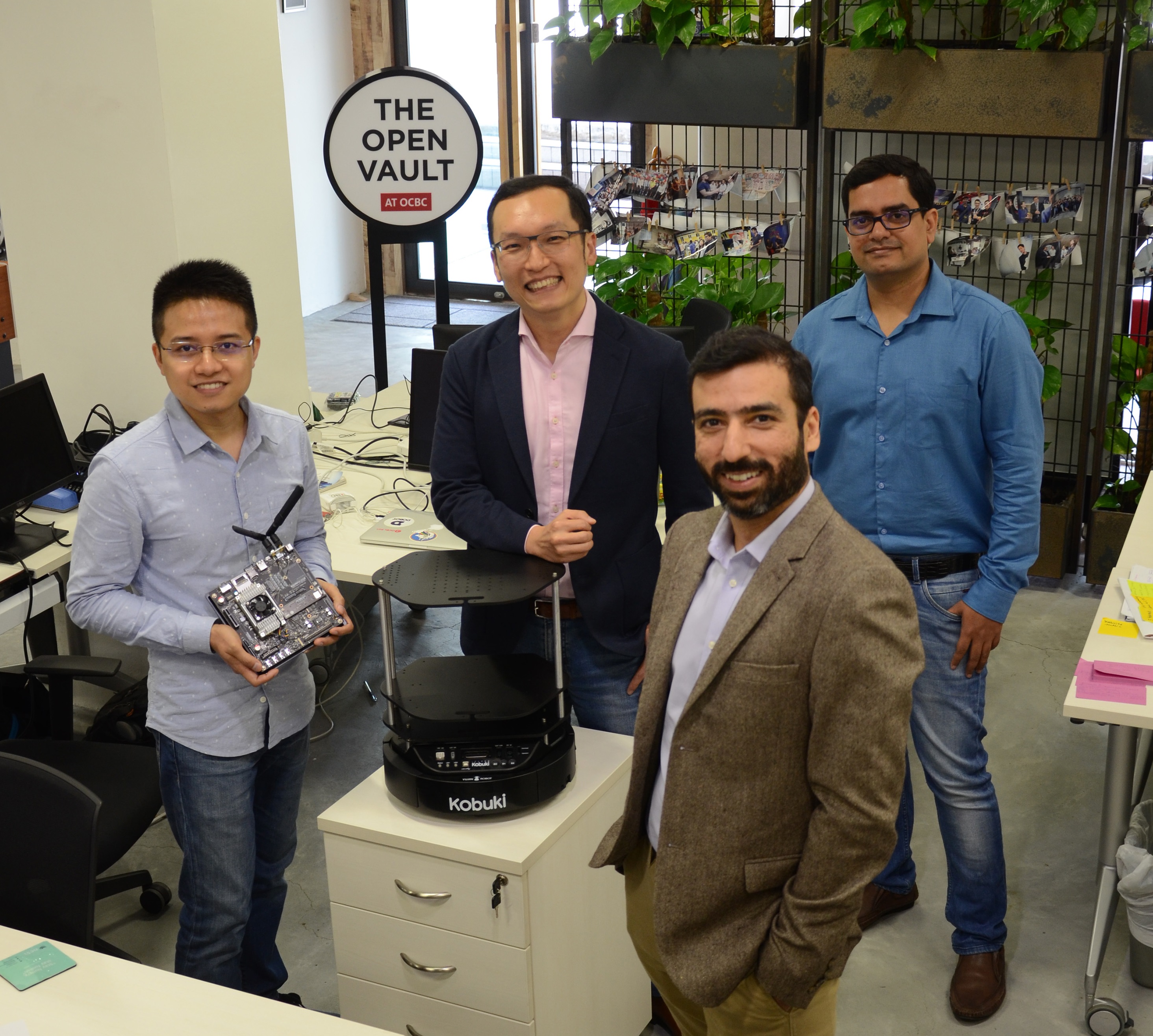

OCBC Bank’s new AI unit, AI Lab@TOV, sits within The Open Vault at OCBC, which is led by Pranav Seth, Head of E-Business, Business Transformation and Fintech and Innovation Group (front). Ken Wong, Head of AI Lab@TOV (centre), Wu Qiong (left) and Vikash Ranjan (right) comprise the pioneering AI Lab@TOV team.

Singapore, 14 March 2018 – Suppose your car is involved in a minor mishap, and you hold a Great Eastern motor insurance policy bought from OCBC Bank. Would it not be convenient if you could simply send an image of your dented vehicle to your insurer via your mobile phone, and get an immediate text message telling you how much you would be eligible to claim?

Or would you fancy a mobile phone voice assistant that could suggest gift ideas for your Mum’s birthday, once triggered by a question like: ‘How much can I afford for Mum’s gift based on my bank balance?’

With artificial intelligence (AI), these OCBC Bank services could become a reality sooner than imagined.

Making OCBC ‘AI-first’

OCBC Bank is the first bank in Singapore to establish an AI unit to strategically develop in-house AI capabilities. With an initial investment of $10M over three years, the pioneering team of three data scientists, led by Singaporean Ken Wong, will drive the adoption of AI across banking services such as wealth advisory and loans financing. The goal is to deliver greater value to customers by giving them access to banking services through natural user interfaces that are seamless and convenient, as well as targeted and tailored products and services that are contextually relevant, driven by machine learning.

Since 2016, OCBC Bank has been among the first financial institutions to be successful in leveraging AI to increase operational efficiency and derive new revenue streams. The AI-powered chatbot, ‘Emma’, launched in 2016, was developed with Fintech startup Cognicor to respond to customers’ queries on home and renovation loans, and has since raked in more than S$100 million in home loans. In the following year, OCBC Bank partnered with Fintech firm, Thetaray, to use its AI solution to identify potential suspicious transactions. The solution has reduced the volume of transactions reviewed by anti-money laundering compliance analysts by 35 per cent, and increased the accuracy rate of identifying suspicious transactions by more than four times.

The AI unit sits within OCBC Bank’s Fintech and Innovation Group, The Open Vault at OCBC (TOV), and is named AI Lab@TOV. The AI unit will serve as a ‘test bed’ for all new AI technologies and will demonstrate the feasibility of new technology before it is integrated into the bank’s existing systems. Leveraging OCBC Bank’s data sandbox and application programme interfaces (APIs) to experiment with real-life anonymous customer data in a secure environment, the unit will generate proofs-of-concept that can be rapidly tested. AI Lab@TOV aims to double its headcount within a year to manage the surge in AI technologies that the bank plans to implement.

Mr Ken Wong, Head of AI Lab@TOV, said: “With the set-up of our very own AI lab, we are able to experiment for the first time with deep learning neural networks and graphics processing units, which are heavily used in the gaming industry and hardly used in banking. This is an exciting new space to be in, especially for banking, and we welcome talent who have the passion to develop something new and fresh for the industry.”

Mr Pranav Seth, Head of E-Business, Business Transformation and Fintech and Innovation Group, said: “AI is going to redefine all aspects of banking – from the way we interact with our customers digitally, to the way we help them make faster and better financial decisions. The impact cannot be ignored. The time to act on AI is now! It is integral to digital banking, or what we call ‘the new digital’. We have already enjoyed tremendous success with AI in the past two years – working with Fintechs to commercialise AI solutions for transaction monitoring and chatbots – and I believe there is a massive competitive advantage to be gained from being a first mover in this space. AI is going to break the Internet and be bigger than the mobile revolution. We want to be at the forefront of this new age of banking.”

Leveraging new AI technologies

AI Lab@TOV is experimenting with natural language and speech processing technologies. Leveraging on research and technology from the Agency for Science, Technology and Research (A*STAR), AI Lab@TOV is developing AI technology that can recognise and understand local accents accurately, such as the Singaporean accent. If successful, the technology could be used to create chatbot services that can respond to customers using voice messaging. This solution could also enable customers to fill in banking forms digitally simply by having a phone conversation with their relationship manager.

AI Lab@TOV will also work with Amazon Web Services (AWS) DeepLens, the world’s first deep learning video camera for developers. Deep learning is a machine learning technique that uses neural networks to learn and make predictions. Supported by AWS Professional Services consulting and training, this AI technology will provide a more personalised experience to OCBC customers by leveraging facial recognition technology, and could be deployed at OCBC Bank branches or ATMs.

Developing AI talent

In addition to hiring data science talents with AI expertise, the AI Lab@TOV will serve as a specialised training centre to further develop the data science skills of data analysts and technologists within the bank. Through specialised workshops run by AI Lab@TOV, OCBC Bank data analysts and technologists will learn AI modelling and predictive machine learning, which are core skills in employing AI.

Internal hackathons will also be organised to extract new ideas from OCBC Bank employees across different banking divisions on the use of AI for various aspects of banking. This will propagate the use of AI in even more banking products and services outside this AI unit, and create a community of passionate ‘data junkies’ who can champion the use of AI.

Media Queries

Bernadette Yuen