OCBC Bank Launches First Artificial Intelligence-Powered Home & Renovation Loan Specialist

OCBC Bank Launches First Artificial Intelligence-Powered Home & Renovation Loan Specialist

Singapore, 5 April 2017 – With more than 20,000 enquiries logged since its launch in January, OCBC Bank announced today the success of the first-of-its-kind specialised home and renovation loan chatbot service in Singapore. More than 10% of the chat sessions have been converted into mortgage loan sales prospects.

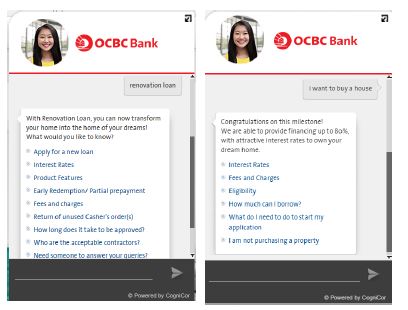

Called ‘Emma’, the home and renovation loan artificial intelligence-powered chatbot provides potential home buyers and current home owners with a convenient, fast and accurate "always-on" digital channel to get their questions addressed. When computing affordability for a home loan or giving a step-by-step guide on applying for a renovation loan, ‘Emma’ can do so within its chat window. This way, ‘Emma’ will not need to direct the consumer to a separate website, where they have to sieve out the information. Neither will the consumers receive vague and non-specific answers, a common

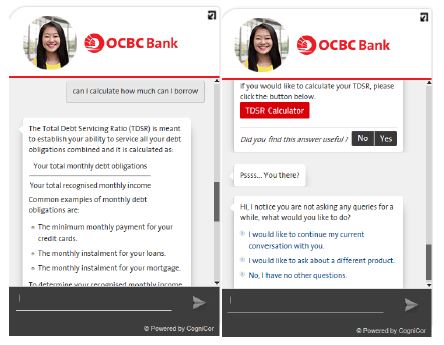

complaint among chatbot users today. One of the top three questions asked by consumers – "How much can I borrow?" – is easily addressed by ‘Emma’ using its built-in Total Debt Servicing Ratio (TDSR) calculator.

With human-like conversational skills, ‘Emma’ interprets any question asked by consumers and answers them in plain English. ‘Emma’ will also ask leading questions to understand the query better, just like how a mortgage specialist would do to help. It took three months for ‘Emma’ to be fully trained to address all possible questions asked by consumers about home loans and renovation loans. As new or revised regulations come up, ‘Emma’ can be updated to respond to new questions. ‘Emma’ is currently available on desktops, laptops and smart mobile devices.

‘Emma’ is jointly developed by OCBC Bank’s home loans team and CogniCor, one of the start-ups from ‘The Open Vault at OCBC’ (OCBC Bank’s FinTech accelerator programme). Cognicor specialises in chatbot solutions and, together with OCBC Bank’s expertise and knowledge in the home and renovation loans business, both teams were able to develop a customised chatbot that is superior to other chatbot solutions in the market. ‘Emma’ was put through a rigorous programming and testing process in a secure yet realistic environment. The resultant solution was a comprehensive and accurate chatbot for OCBC Bank’s home and renovation loans business - one that truly answers consumers’ questions.

Instant answers for home and renovation loan questions

With real time responses delivered through an instant messaging chatbox directly on OCBC Bank’s home loan website (www.ocbc.com/personal-banking/loans/home-loan-hdb-and-private-property.html), consumers can get instant answers to their home loan questions. Three of the most commonly asked questions to ‘Emma’ are:

1. What types of home loan packages are available to me?

2. Am I eligible to take up a home loan?

3. How much can I borrow?

‘Emma’ is trained to identify and associate with the exhaustive terminology used in the process of applying for or refinancing a home loan. Your typical industry abbreviations and terms pose no challenge to ‘Emma’, which is able to accurately highlight the information consumers need. Based on the feedback obtained during each chatbot session, nine out of 10 consumers were satisfied with the assistance rendered by ‘Emma’ – a high standard that has been achieved since ‘Emma’ was introduced.

How ‘Emma’ works

‘Emma’ responds to queries in a way that a person would. When a user types a question in the chat box using natural language, ’Emma’ is able to respond and deploy the relevant answer from its store of knowledge. For example, if the user casually asks ‘Emma’ how much he or she can borrow or what the renovation loan application process is, it can provide the information directly without redirecting the user to a website for answers.

‘Emma’ provides consumers with an alternative to browsing the home loans website for information, and frees Mortgage Specialists to assist consumers with more complex requests and inquiries. In the past, the average waiting time for an email reply to a written query is usually one or two working days. Now, with the use of the chatbot, you can get your answers instantly.

For complex inquiries, suggested topics generated from keywords embedded in the questions will be presented to consumers. If consumers wish to speak directly to OCBC Bank’s Mortgage Specialists, ‘Emma’ will then ask consumers for their contact details. The chat logs of these consumers will be provided to the Mortgage Specialists following up on their requests. This allows the Mortgage Specialists to give consumers tailored consultations without any need for consumers to repeat their questions.

One of OCBC Bank’s home loan customers, Ms Belinda Tan, said, "I was looking for information regarding home loans on OCBC’s home page and chanced upon the Emma chatbot. I am impressed by Emma’s ability to answer my questions almost instantly and such initiatives are suitable for people who are comfortable with technology. This is the way forward for banks."

Built-in Total Debt Servicing Ratio (TDSR) calculator

‘Emma’ is able to help consumers calculate the estimated loan amount by taking into account their income and outstanding debt obligations. This is done with ‘Emma’ providing a step-by-step guide, which makes consumers feel like they are speaking to a Mortgage Specialist.

Ms Phang Lah Hwa, Head, Consumer Secured Lending, OCBC Bank, said: "We want consumers to get real-time information without scrolling through our website or waiting for a reply via the conventional channels. With a higher acceptance of virtual assistants in recent years, service-oriented chatbots are a natural progression to giving consumers better access to basic details about home loans. The response from both our staff and the consumers has been very encouraging and, as Emma continues to ‘learn’, we are confident that chatbots will be an even more integral part of OCBC’s frontline service team in the near future."

Co-innovating with CogniCor

CogniCor went through a rigorous curriculum that included mentorship sessions with OCBC Bank senior management and business leaders, as well as workshops to understand regulatory demands in the banking industry. The co-creation process took three months, where ‘Emma’ was trained to deal with a comprehensive list of scenarios and suggested responses.

Mr Pranav Seth, Head of E-Business and Business Transformation, OCBC Bank, said: "The Open Vault at OCBC is created to harness the potential of FinTech for creating real customer and business value. Emma is one of the pioneer success stories of The Open Vault at OCBC – a story jointly written by both OCBC Bank and CogniCor. We want to build on this momentum to disrupt the status quo for the consumers."