OCBC Bank is first to launch face ID facial recognition for customers to access consumer and business banking apps

OCBC Bank is first to launch face ID facial recognition for customers to access consumer and business banking apps

Singapore, 6 November 2017 – Move over, fingerprints. Your face is your new banking password.

As the world received the launch of the coveted Apple iPhone X with much fanfare, OCBC Bank has rolled out an innovative enhancement to its consumer and business banking apps for Apple iPhone X users. By leveraging Apple’s Face ID facial recognition technology, OCBC Bank customers who have the new phone can now dispense with passwords or even fingerprints when doing their everyday banking on mobile apps like OCBC Mobile Banking, OCBC OneWealth and OCBC Business Mobile Banking, or making payments on OCBC Pay Anyone. These customers just need to look at their iPhone X.

OCBC OneLook makes day-to-day banking and payments via mobile banking apps easy, quick and secure. Once OCBC OneLook has been set up for the OCBC Mobile Banking, OCBC OneWealth, OCBC Business Mobile Banking and OCBC Pay Anyone apps, customers can simply tap on the OCBC

OneLook icon on the apps’ login screens and look at their phone to authenticate access. Once logged in, customers can view their account and card balances, as well as their latest transactions. Customers using the OCBC OneWealth app can also view their investment portfolio. On the OCBC Pay Anyone app, customers can pay friends and make purchases via QR codes using OCBC OneLook.

To get started, customers simply need to perform a one-time activation for OCBC OneLook on the OCBC mobile apps on their iPhone X. Face ID is available on Apple iPhone X, running on the iOS11 operating system.

This is another digital innovation first from OCBC Bank, following OCBC Bank’s OneTouch™ fingerprint authentication, which was developed using Apple’s Touch ID technology. Just like OCBC OneTouch™, OCBC OneLook was developed entirely by OCBC Bank’s in-house mobile developer team. This team is also behind some of the bank’s breakthrough applications like the open Application Programming Interface (API) platform, voice biometrics authentication and OCBC Pay Anyone e-payments that leverage iMessage and Siri.

Mr Aditya Gupta, Head of E-Business Singapore said: "Continuously innovating around new technology to deliver a simple, secure and superior banking experience for our customers is our first priority. With OCBC OneLook, customers are now able to bank and pay on our mobile apps more easily, quickly and safely, just by looking at their phones. There’s a whole generation of customers becoming more comfortable with biometric authentication technology, and we are confident that they will find OCBC OneLook truly impressive and relevant. So, bye-bye fingers, hello faces!"

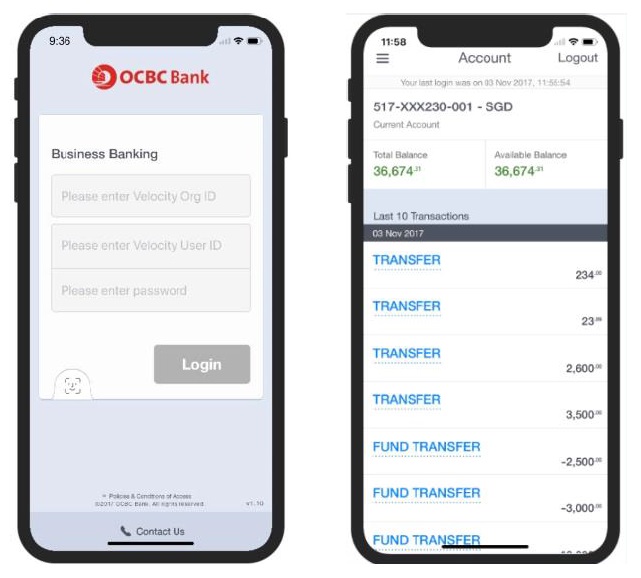

Over 120,000 Singapore-registered users of OCBC Bank’s business internet banking portal, Velocity@ocbc, stand to benefit from this enhancement to the OCBC Business Mobile Banking app.

Said Mr Gregory Trotter, Head of Cash Management, Global Transaction Banking, OCBC Bank: "We have always been pushing the boundaries and coming up with innovative solutions for our business customers. Most recently we had our OCBC Business Mobile Banking app, where we were the first to avail fingerprint authentication, then voice banking using Siri, and now facial recognition technology."

"We understand that business owners want immediate access to banking information wherever they are so that they can effectively manage their day-to-day operations and make decisions on the go. That is why we are

introducing OCBC OneLook for our app, so that business owners who are early adopters of the iPhone X can continue to use biometric authentication to access banking information quickly, conveniently and securely. We have been relentless in our drive to deliver simple, fast and convenient services to our business customers, and will continue to offer innovative digital solutions that meet their needs and add value for them."

For OCBC consumer banking customers:

- One-time set-up of OCBC OneLook

- Tap on the OCBC OneLook icon on the OCBC Mobile Banking or OCBC OneWealth app, or open the OCBC Pay Anyone app

- Check the box to agree to the terms and conditions

- Click ‘Activate OCBC OneLook’

- Enter your Online Banking Access Code and PIN

- Key in one-time password when prompted

- Checking balances and transactions with OCBC OneLook

- Tap on the OCBC OneLook icon

- Log in by looking at your phone

- View account balances, latest transactions, credit card and investment account details

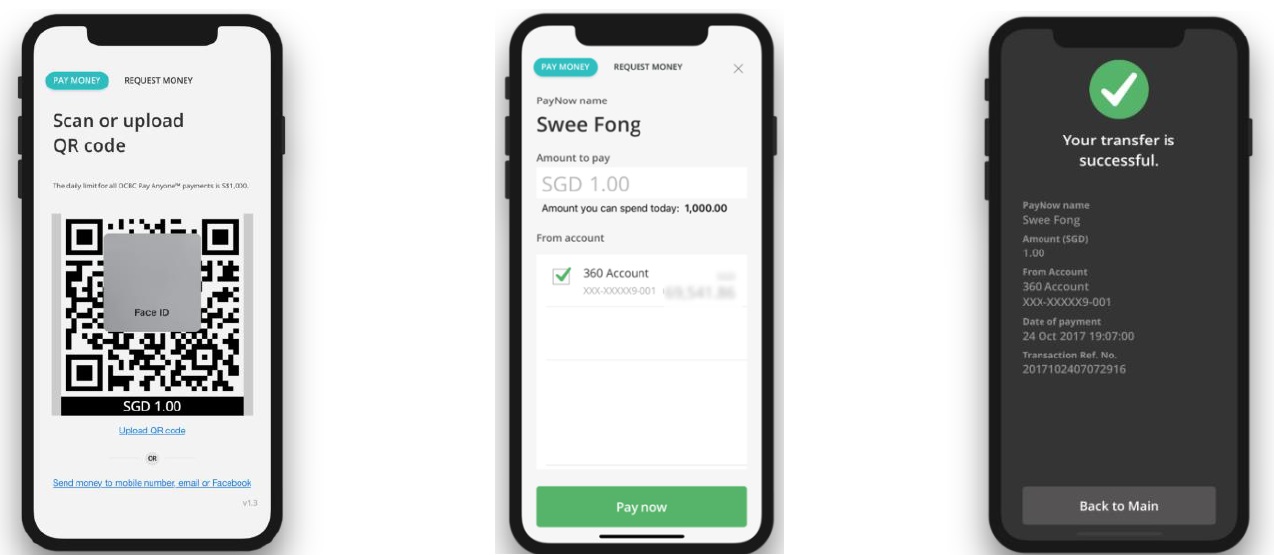

- Make a payment on OCBC Pay Anyone with OCBC OneLook

- Scan or upload a compatible QR code (NETS QR or OCBC Pay Anyone personalised QR code)

- Authenticate payment by looking at your phone

- Select account to pay from

- Tap on ‘Pay now’

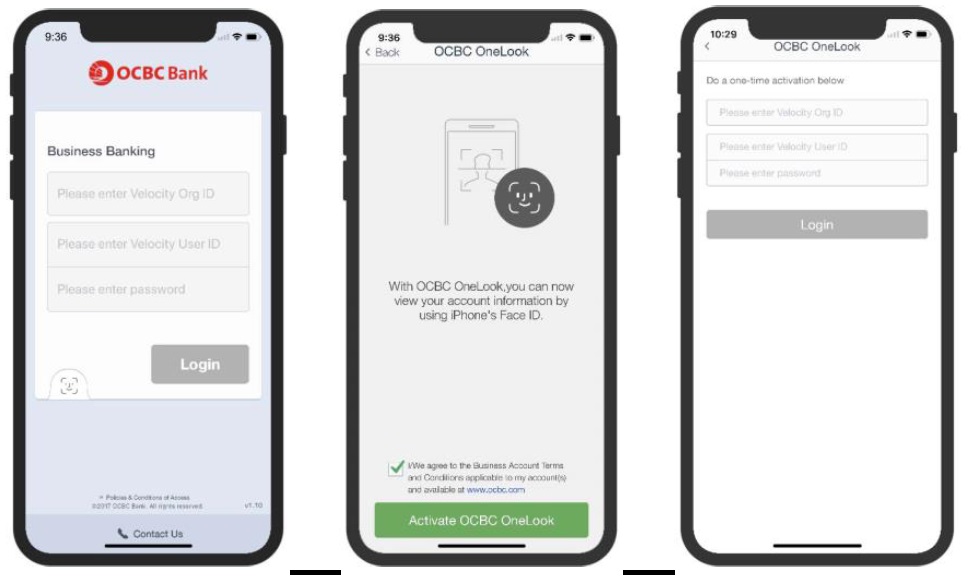

For OCBC business banking customers:

- ï‚· One-time set-up of OCBC OneLook on the OCBC Business Mobile Banking app

- Tap on the OCBC OneLook icon

- Check the box to agree to the terms and conditions

- Click ‘Activate OCBC OneLook’

- Key in Velocity@ocbc Org ID, User ID and Password

- Key in one-time password when prompted

- Checking balances and transactions with OCBC OneLook

- Tap on the OCBC OneLook icon

- Log in by looking at your phone

- View account balances and latest transactions