OCBC Bank sets up new FinTech and Innovation unit - The Open Vault at OCBC - to strategically harness open innovation for meaningful financial solutions

OCBC Bank sets up new FinTech and Innovation unit - The Open Vault at OCBC - to strategically harness open innovation for meaningful financial solutions

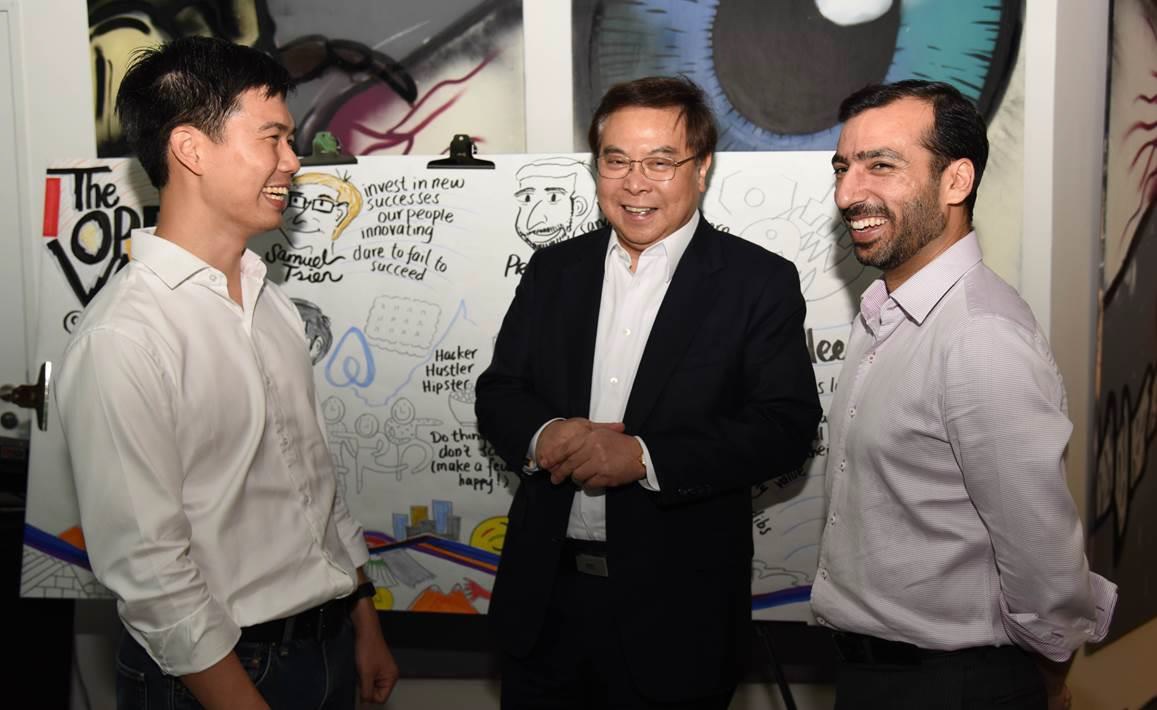

OCBC Bank’s Group Chief Executive Officer, Mr Samuel Tsien (centre), chats with Mr Jia Jih Chai (left), Airbnb’s Managing Director for South East Asia, and Mr Pranav Seth (right), OCBC Bank’s Head of E-Business and Business Transformation, during a networking event at The Open Vault at OCBC.

Singapore, 1 February 2016 – OCBC Bank has set up a new financial technology (Fintech) unit called ‘The Open Vault at OCBC’ to drive the ideation, prototyping and deployment of new technologies, innovative commercial business models and solutions to bring to market relevant financial products and services, and to enhance banking processes.

With the mushrooming of Fintech start-ups around the world, OCBC Bank aims to leverage the creativity and nimbleness of Fintech start-up companies – which are unconstrained by banking regulatory frameworks and bureaucracy, and which operate with a penchant for out-of-the-box thinking – to drive open innovation and help OCBC Bank develop relevant ideas to fuel breakthroughs in banking and insurance.

Five key areas of innovation

Wealth management – Using data to improve the day-to-day money and cash flow management of customers by monitoring actual customer expenditure and bill payments, and offering customers non-traditional banking solutions such as recommendations of grocery item offers to help them manage their expenses.

Credit and financing – Employing different and enhanced credit assessment approaches to extend financing to new retail and corporate customer segments that meet their needs.

Insurance – Leveraging data to monitor customers’ risk profiles and lifestyles, enabling them to live healthier and more active lives through innovative health and insurance solutions such as preventive care mobile applications that provide timely ‘health check’ reminders, minimising hefty medical bills.

Cyber security – Exploring new technologies and innovations in banking security like voice recognition, fingerprint and retina scanning, and heart-rate frequency recognition, to provide customers with a convenient and secure way to make transactions with their mobile devices.

Artificial intelligence – Enhancing knowledge of customers through data analysis and back-end banking services to provide superior robot advisory to customers.

Space to co-innovate

The Open Vault at OCBC is housed in a specially-created 2,400 square foot space on New Bridge Road. Here, Fintech start-ups can work with in-house OCBC Bank experts – programmers, application developers, credit risk management specialists, data analytics experts, wealth management advisors and legal advisors, who have a deep understanding of banking rules and regulations, processes, practices and customer behaviours – to employ OCBC Bank’s data sandbox and application programme interfaces (APIs) to bring innovative solutions quickly to the market. ‘Sandboxing’ will enable OCBC Bank and the Fintech start-ups to experiment with real-life anonymous customer data in a secure environment to generate proof of concepts that can be rapidly commercialised.

Led by Mr Pranav Seth, OCBC Bank’s Head of E-Business and Business Transformation, The Open Vault at OCBC is focused on opening OCBC Bank’s doors to external innovation and ideas, and connecting with the Fintech eco-system to spot potential solutions to create innovative solutions for customers and employees.

Mr Samuel Tsien, OCBC Bank’s Group Chief Executive Officer, said: "I am excited about the launch of The Open Vault at OCBC, a stand-alone Fintech unit that will harness ideas from the fast-evolving global arena of financial technology for the convenience of our customers and employees. Digital innovation is not new to us. OCBC One Touch is just one recent example of how we simplify a very common customer request – checking bank balances. It makes use of the advances in digital technology – in this case, the advent of fingerprint sensors in smart devices.

Our key focus is to deliver tangible outcomes and value; without this, we would not want to play in the Fintech arena. While digital innovation is very much part of our entrenched culture, and while OCBC One Touch was an idea developed by our own employees, we know the world of Fintech is wide and deep. More good ideas can be developed by working with external partners such as Fintech accelerators, technology scouts, universities and other key stakeholders in the Fintech ecosystem. The Open Vault at OCBC has great potential. I see it helping us to come up with digital solutions that will make banking with OCBC even simpler, faster and more secure, our internal banking processes more efficient, and our banking systems even more robust."

OCBC Bank has always been at the forefront of customer and technology innovations, with many first-to-market products. From being the first to introduce mobile phone banking across all telecommunications companies in 2005, to launching Singapore’s first personal financial management tool for online and mobile banking, bio-metrics based authentication (OCBC OneTouch), and peer-to-peer payments leveraging social media (OCBC Pay Anyone), OCBC Bank has consistently invested in value-added applications and services to benefit customers. Collaborating with the Fintech ecosystem is an extension of OCBC Bank’s already-entrenched focus on digital strategy and innovation culture.

Mr Seth said: "We are investing heavily in the areas of mobile, data and analytics, bio-metrics and security to provide superior customer-centric solutions. We actively scan for technologies and innovations globally that can help us achieve our vision of providing innovative, useful and efficient financial services to our customers. At The Open Vault at OCBC, we seek to experiment with a larger set of new technologies, business models and applications in a controlled environment to find tangible, value-added services that our customers can benefit from."

Building a smart financial centre

The setup of OCBC Bank’s Fintech unit and The Open Vault at OCBC innovation lab is a step towards realising the Singapore government’s Smart Nation Programme and Monetary Authority of Singapore’s (MAS) vision to create a Smart Financial Centre in Singapore. Working together with MAS, OCBC Bank aims to magnify its culture of innovation in the financial industry through its accelerator and education programmes.

The Open Vault at OCBC has partnered exclusively with NEST, a leading global investment and start-up incubation firm, to attract innovators from around the globe who are passionate about developing new technologies, as well as local innovators, to participate in OCBC Bank’s inaugural accelerator programme. Bringing together global and local start-ups will enable OCBC Bank to build Singapore’s start-up community and culture further. The accelerator programme kicks off in April 2016 and will provide the selected start-up firms with access to business mentorship, technical expertise from OCBC Bank and dedicated guidance from NEST experts and partners.

Innovators and Fintech start-ups can apply for OCBC Bank’s accelerator programme at www.theopenvaultatocbc.com. Applications will close on 17 March 2016 and the programme will begin in April 2016. The summit of the programme is Demo Day in July 2016, when the selected start-ups will pitch their innovations to compete for investment interest.

Media Queries

Group Corporate Communications