Instant fingerprint access on mobile apps extended to more OCBC Group financial services and customers

Instant fingerprint access on mobile apps extended to more OCBC Group financial services and customers

Singapore, 18 April 2016 – The OCBC Group has shown that FinTech innovations need not be costly.

With less than S$100,000, the OCBC Group developed the OneTouch fingerprint authentication feature – and the technology has since been applied to multiple mobile applications, bringing convenience and value to millions of customers in both banking and stockbroking.

The OCBC Mobile Banking app for iPhones, launched in March 2015, was the first banking app in Singapore to allow customers instant fingerprint access to view their balances and transaction histories across their bank accounts, credit cards and investments.

The OCBC Group’s use of the OneTouch technology has since been broadened to include brokerage services. OCBC Securities, Singapore’s first brokerage to launch a mobile trading app in 2010, marked another industry first today with the launch of its new iOCBC TradeMobile app for iPhones. OCBC Securities customers with an online account are now able to view their stock portfolios, as well as market information on the stocks they hold, with the touch of a finger using Apple’s Touch ID technology.

The app features other enhancements such as sophisticated stock charting, a customisable home page and a dual language function that enables users to view content in Chinese. It was designed to provide a more intuitive user experience, helping customers access market information and perform trades seamlessly.

The OneTouch feature has also been extended to more banking customers. On 8 April 2016, OCBC Bank introduced the OneTouch feature for the Android version of the OCBC Mobile Banking app, becoming the first bank in Singapore to offer a banking app with a fingerprint authentication feature for smartphones running on the Android operating system. Customers who own selected Samsung phone models that are equipped with the recognition

feature and run on the Android 4.4 KitKat operating system or newer now enjoy instant fingerprint access to their balances for all their banking accounts, credit cards and investments, as well as credit card details such as rewards, due dates and credit limits.

The latest innovations further underscore the OCBC Group’s commitment to the digitalisation of financial services, to promote access and convenience for customers as well as optimise the user experience.

Mr Raymond Chee, Managing Director of OCBC Securities, said, "With the new iOCBC TradeMobile app, our customers now have detailed, real-time information about the markets and about their portfolios at their fingertips, which will undoubtedly help them make better investment decisions. In the past three years alone, the number of trades per month that our customers perform through our mobile app has almost doubled. This makes it all the more important for us to keep driving digital innovations to enhance our customers’ mobile experience."

The OneTouch fingerprint recognition feature has been well-received by customers – since its launch a year ago, the OCBC Mobile Banking app for iPhones has been accessed through the OneTouch feature about five million times. The fingerprint authentication technology offers OCBC Bank’s and OCBC Securities’ customers greater convenience in accessing their banking and brokerage information, without compromising the security of their accounts.

Ms Yvonne Cheong, OCBC Bank’s Head of Internet and Mobile Banking, Singapore, said, "Our customers love the ease and speed of accessing their banking accounts on the go, be it to check their incoming salary credits or to track outgoing payments. Usage has grown rapidly by over five times since its launch. We are excited to extend the OCBC OneTouch service to Android phone users for the first time in Singapore, demonstrating our commitment to using smart digital innovation to make banking simpler and more accessible than ever for our customers."

The new iOCBC TradeMobile app is now available for download for free on the Apple App Store. Customers using the iPhone 5s, 6, 6 Plus, 6s and 6s Plus models will be able to enjoy the OneTouch feature. OCBC Securities is working on a version of the new app for iPad and Android models, to be released later this year.

The OCBC Mobile Banking Android app is available for download for free on the Google Play Store. Customers can enjoy the OneTouch function on the following Samsung Galaxy models running on the Android 4.4 KitKat

operating system or newer: S5 series, S6 series, S7 series, A5, A7, A8, Note 4, Note 5, Note Edge and Alpha.

New iOCBC TradeMobile app: Convenient access to stock portfolio, new features, seamless navigation

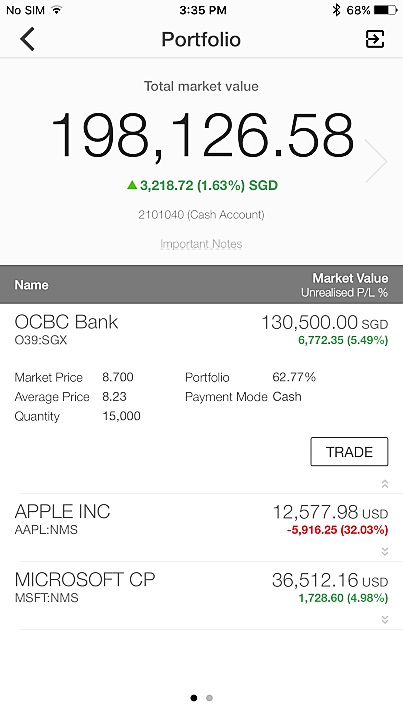

Figure 1: The OneTouch Portfolio page includes "Trade" buttons that make it convenient for customers to log in and immediately perform a trade on stocks in their portfolios.

Using the OneTouch function, OCBC Securities customers can now view their stock portfolio, in addition to their unrealised profit/loss and the balance in their trust accounts, at the touch of a finger. They will be able to view details such as the number of shares held for any stock in their portfolio, the average transacted price for the day and the latest market price of that stock.

The app has been designed to provide a seamless experience for users. For example, "Trade" buttons have been incorporated within the OneTouch Portfolio page (Figure 1), allowing customers to log in and immediately perform a trade after viewing market information on their stocks. This saves customers the hassle of having to return to the opening page of the app to log in, and then search for the relevant stock counter before placing the trade.

The app introduces a host of other features to cater to the preferences of different users, including sophisticated investors who wish to conduct in-depth market research on the go. These features include comprehensive stock charting, a customisable home page and a dual language function that enables customers to view content in Chinese.

Figure 2: Customers can now perform detailed technical analyses on stocks using common indicators.

The introduction of a sophisticated charting function allows customers to conveniently perform detailed technical analyses on stocks. Customers now have the option of toggling between different graph styles, including candlestick graphs, in viewing historical stock prices. In addition, they will be able to compare historical stock prices with commonly used indicators such as the Simple Moving Average, Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) to glean a more in-depth understanding of the stock price movements (Figure 2).

The new iOCBC TradeMobile app continues OCBC Securities’ long-standing history of digital innovation. OCBC Securities pioneered the mobile trading app in Singapore when it launched the original iOCBC TradeMobile app in 2010, allowing customers to monitor stock prices and execute trades directly on their iPhones. OCBC Securities also has an industry-leading online trading platform, iOCBC, which has been named "Online Securities Platform of the Year in Singapore" by Asian Banking & Finance for the past five years.

OCBC Mobile Banking Android app: Instant fingerprint log-in to view account balances

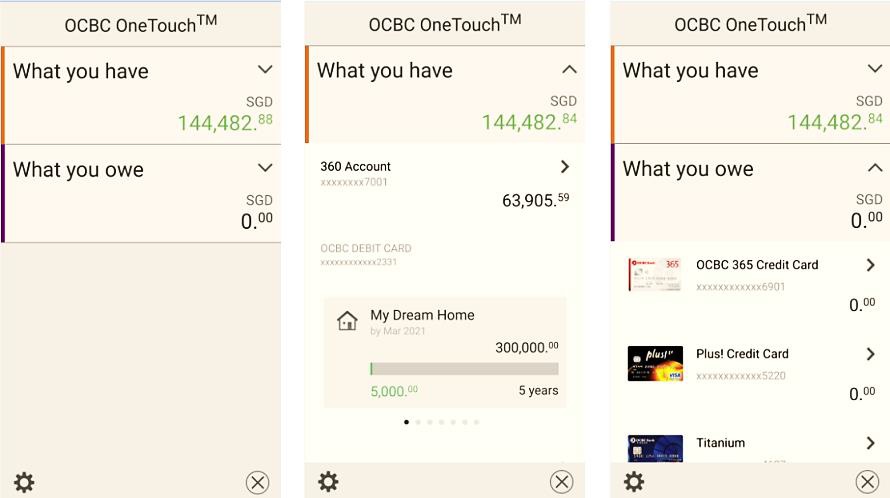

The OCBC Mobile Banking app allows customers to quickly access the full list of their balances – bank accounts, cards and investments – using fingerprint recognition. Customers can also view their transaction histories and credit card details, such as their rewards, credit limits and payment due dates. Categorised under assets and liabilities, the information available through the OneTouch view reflects what is most commonly accessed by OCBC Bank customers via the mobile banking app. Customer research has revealed that checks on account balances make up about 60% of all mobile banking log-ins.

Figure 3: The OCBC Mobile Banking app allows customers to view their balances for all bank accounts, credit cards and investments, as well as savings goals and credit card details.

OCBC Bank has unveiled a series of industry-leading digital banking innovations in the past several years. In the past month alone, OCBC Bank has launched a mobile banking app for the Apple Watch, as well as the OCBC OneWealth app, Singapore’s first integrated wealth management app.

Prior to that, OCBC Bank launched the OCBC Pay Anyone app in 2014, becoming the first bank in Singapore to enable customers to transfer funds through Facebook, mobile phone or e-mail. OCBC Bank was also the first to launch an app allowing customers to open a deposit account on their mobile phones.