OCBC Bank to give $3 million Wage Credit Scheme payout to employees

OCBC Bank to give $3 million Wage Credit Scheme payout to employees

Singapore, 16 May 2014 – OCBC Bank will give its first S$3 million Wage Credit Scheme (WCS) payout to 1,500 eligible Singaporean employees of the Bank and its securities subsidiary, OCBC Securities Pte Ltd (OSPL). The employees can choose to have their payouts credited to their CPF accounts or invest in shares via the OCBC Blue Chip Investment Plan.

Under the Scheme, the Government co-funds 40% of the gross monthly wage1 increase given – over the period of 2013 to 2015 – to Singaporean employees earning a gross monthly wage of less than S$4,000. This is to help businesses cope with rising wages in a tight labour market while encouraging them to invest in productivity and share productivity gains with their employees.

OCBC Bank has opted to give the amount co-funded by the Government to its employees. The 1,500 recipients make up about 25 per cent of OCBC Bank’s and OSPL’s total staff strength in Singapore of more than 6,000. They will receive the payouts between June to July 2014.

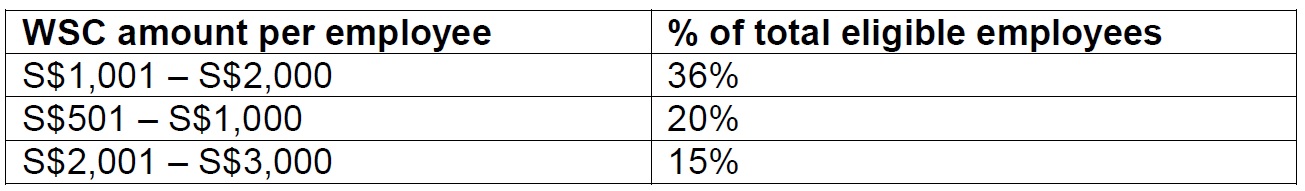

The top three categories of payouts for the 1,500 employees are:

Junior executives and unionised employees2 make up the largest group of recipients of the Wage Credit Scheme payout, with most of them hailing from the Bank’s Consumer Financial Services and Operations and Technology divisions.

For OCBC employees who opt for the CPF top-up scheme, they will have their payouts credited into their CPF accounts in one lump sum. Those who choose to invest the payouts in blue chip stocks via the OCBC Blue Chip Investment Plan can do so by investing monthly over a maximum period of six months or in one lump sum. The investment amount can be as little as S$100 a month. OCBC Blue Chip Investment Plan has a selected basket of 20 blue chip stocks.

The payout due to those employees who have since left the Bank will be channeled back to OCBC Bank’s training budget, as part of the Bank’s continuous effort to invest in the development of its staff.

Said OCBC Bank’s CEO Samuel Tsien: "At OCBC, we have always emphasised a caring and supportive working environment. We invest resources not just to support our employees’ career development, but to tend to their overall welfare and personal growth. Fulfilled employees, after all, will be more productive and serve our customers better. We have introduced several human resource schemes to that end over the years. We have our OCBC Flex Plan, the OCBC Employee Share Purchase Plan, PSLE Leave, Career Break Leave and Flexible Work Arrangements, to name a few. Therefore, deciding on the Wage Credit Scheme payout to our employees came naturally to us.

"The amount, for each of the 1,500 Singaporean employees who will benefit, may not be large. But by empowering each individual to either put that amount in a personal CPF account that earns a decent interest rate, or invest it in the OCBC Blue Chip Investment Plan, we hope to contribute to his or her long-term saving or investment plan – a key component in good financial planning. And good financial planning makes a big difference, given today’s rising cost of living."

Said Jason Tidus Tan, Global Consumer Financial Services, "It is good that the Bank is giving us the Wage Credit Scheme payout. This is definitely a bonus for me. I’m considering the option of having the money placed in my CPF account as it is a form of forced savings for my future use, be it for financing a housing loan or for investment purposes."

Said Quek Siew Ying, Global Commercial Banking Division: "I have always wanted to invest in stocks but wasn’t sure how to go about doing it. With the extra money, I might try my hand at investing in some blue chip stocks by tapping on the OCBC Blue Chip Investment Plan."

For more information on the OCBC Blue Chip Investment Plan, please click on this link: www.ocbc.com/bluechip

1 Gross monthly wage comprises total basic wage, plus bonuses plus other allowances and special payments, divided by number of months employee was at work.

2 Junior executives and unionised employees refer to Assistant Managers, Bank Officers and clerical staff.