OCBC Bank 1st issuer here to sweeten rights issue with product-specific incentives

OCBC Bank 1st issuer here to sweeten rights issue with product-specific incentives

Singapore, 28 August 2014 – Oversea-Chinese Banking Corporation Limited (OCBC Bank) today unveiled new incentives for shareholders to participate in the rights issue it announced on 18 August 2014:

- Enjoy waiver of standard ATM fee

OCBC Bank shareholders who subscribe for their rights shares at OCBC ATMs will not have to pay the usual S$2 ATM fee. They must have an OCBC ATM card to do so.

The popular OCBC 360 Account can be the vehicle to enjoy this benefit. Any shareholder has until 15 September 2014, the closing date of the rights issue, to open an OCBC 360 Account at any OCBC Bank branch. A new OCBC ATM card can be issued and activated on the spot. If the shareholder already has an OCBC ATM card, it can be linked to his new OCBC 360 Account. He can then immediately use that card – so long as there is enough cash in the account – to subscribe for his rights shares at an OCBC ATM at the branch.

- Earn Payment Bonus interest of 1% p.a. on your OCBC 360 Account balance by paying another two bills online or via GIRO, on top of using your OCBC 360 Account to pay for the rights at an OCBC ATM.

There is a further incentive, on top of the S$2 ATM fee waiver, for shareholders to subscribe for their rights shares at OCBC ATMs using their OCBC 360 Accounts. Shareholders need only pay two other bills online or through GIRO in the same month to enjoy the Payment Bonus Interest of 1%. The interest will apply to the first S$50,000 in an OCBC 360 Account for the month of September.

To enjoy this higher interest rate, OCBC 360 Account holders usually have to pay three bills online or through GIRO in a month. And the subscription for the rights shares will not usually count as one such payment.

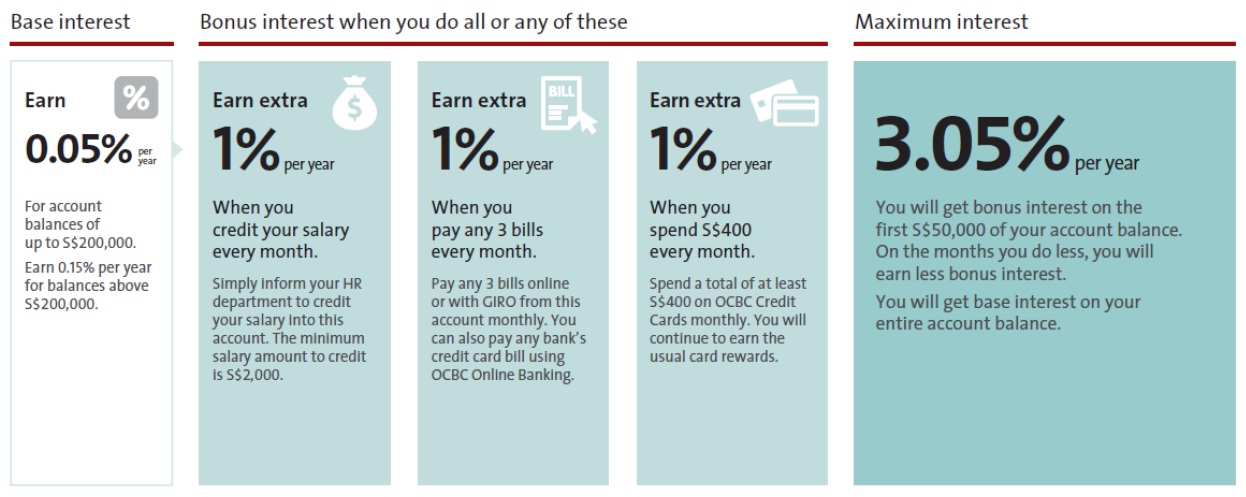

Please refer to the diagram below for a summary of how to earn more interest using the OCBC 360 Account under normal circumstances.

About OCBC Bank’s rights issue

On 18 August 2014, OCBC Bank announced a renounceable underwritten rights issue of up to 440,047,710 new shares to raise net proceeds of about S$3.32 billion, following the successful completion of its takeover offer for Wing Hang Bank, Limited on 29 July 2014. The rights issue is offered on the basis of one rights share for every eight existing shares held by entitled shareholders as at 5.00 pm on 27 August 2014. Fractional entitlements will be disregarded. At S$7.65 for each rights share, the issue price represents a discount of 25% to the closing price of $10.20 per share on 15 August 2014.

The Offer Information Statement will be despatched to shareholders on 1 September 2014. The rights issue will close on 15 September 2014 and the cut-off for ATM subscriptions will be 9:30 pm on 15 September 2014.