OCBC 360 Account a hit with young professionals

OCBC 360 Account a hit with young professionals

Singapore, 2 June 2014 – The total number of OCBC 360 Accounts doubled within the first month of the launch of the enhanced version on 2 April 2014. The strong demand for the product was attributable to the account’s simplicity in enabling customers to enjoy up to 3.05% p.a. on their money.

Key Highlights:

- Over 18,000 new accounts were opened within the first month.

- 70% of customers are PMETs.

- 30% were young professionals aged 23 to 29 years old.

- The number of OCBC 360 account holders who have at least one OCBC credit card grew by eight times.

OCBC 360 Account was first launched in July 2013, rewarding customers with a higher interest rate for doing more online banking with OCBC Bank - Customers who performed any two online banking transactions would earn 1.28% p.a. on their account balances. Within seven months, more than 16,000 accounts were opened.

Customer insights have shown that the ease and convenience of operating an account was one of the key reasons before starting a new primary bank relationship. OCBC Bank’s extensive network of 52 branches, shared network1 of 1,200 ATMs island-wide, and award-winning online banking platforms have contributed to the overwhelming response to the product launch.

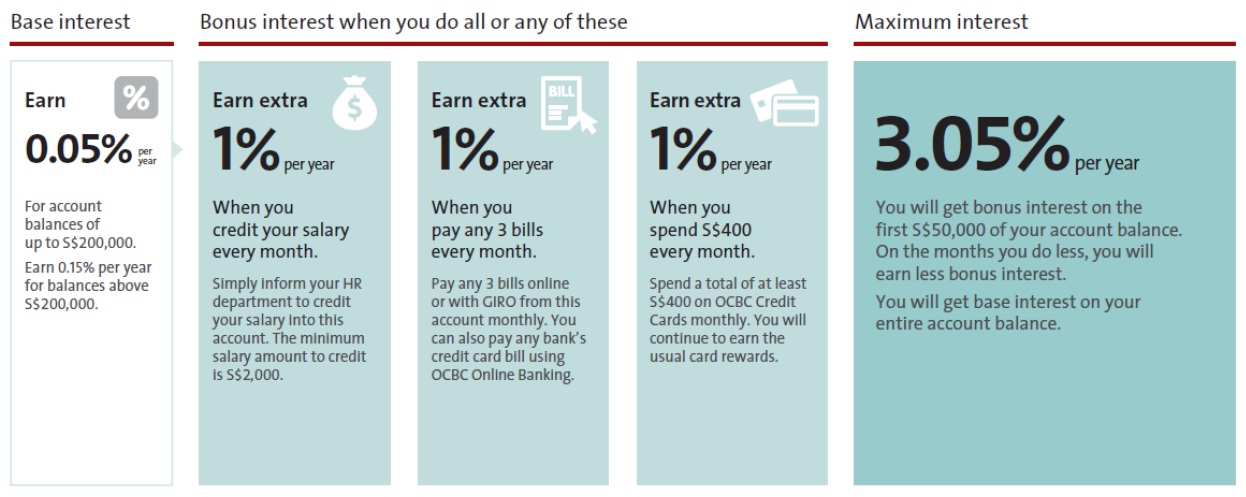

Given the good response to the initial launch of the OCBC 360 Account, the product was enhanced to reward customers beyond doing online banking transactions with the Bank. The enhanced OCBC 360 Account enables eligible customers to earn interest rates of up to 3.05% p.a. when they perform everyday banking transactions.

Here’s how the OCBC 360 Account works:

On top of a base interest rate paid on the account balance, there are three separate ways to earn Salary Bonus Interest, Payment Bonus Interest and Credit Card Spend Bonus Interest. These apply to the first S$50,000 of the account balance. (See Table 1)

Table 1 – Transaction type and rates

On his reasons for opening an OCBC 360 Account, Hu Jiaming, a 28-year old IT Management Associate, said: "The high interest rate was obviously an attractive proposition. However, the ease in qualifying for the bonus interest was what turned my head. I like the OCBC 360 Account’s mechanics of rewarding me for what I’m already doing on a daily basis with the bank, without having to go out of the way to meet the criteria."

Mr Ling Seng Chuan, Head of Deposits, OCBC Bank, said: "The reason for the popularity of the OCBC 360 Account, especially with young professionals is by no means a coincidence. All we did was to listen to them and create a bank account they wanted – a simple and rewarding one."

He added: "OCBC Bank continues to be a trailblazer in banking innovation and the OCBC 360 Account was launched as the first of its kind in Singapore as a direct response to customers’ needs. We are passionate about not only supporting but also enhancing our customers’ banking relationships with us, and will continue to create innovative products and services to make banking easy and accessible."

1 Includes UOB ATMs under the Shared ATM network.