First pure maternity protection plan for expectant mothers strengthens OCBC Bank's position as the leading baby bonus bank

First pure maternity protection plan for expectant mothers strengthens OCBC Bank's position as the leading baby bonus bank

Singapore, 16 September 2014 - Following last week’s announcement of OCBC Bank being re-appointed as the Baby Bonus Bank, OCBC Bank continues to innovate with the first pure maternity protection plan, MaxMaternity Care that is not bundled with an investment-linked plan (ILP). This makes the protection plan more affordable and more targeted at addressing the needs of new parents. MaxMaternity Care is a three-year policy that aims to protect the expectant mother against maternity complications from as early as the 13th week of pregnancy, and to continue protecting the newborn against congenital illnesses until the policy matures.

The market currently offers only investment-linked plans which allow for a maternity complication rider to be attached to them. In comparison to a pure maternity protection plan, ILPs are investment products that require medium-to long-term commitment and monitoring of its investment value. Moreover, these riders only provide the expectant mothers with coverage from the 18th week of pregnancy.

As the leading Baby Bonus Bank since 2008, OCBC Bank had the opportunity to obtain consumer insights about the needs of many mothers and mothers-to-be. Several research studies conducted by OCBC Bank have revealed that the top concerns of expectant mothers include pregnancy complications and their newborn’s medical expenses.

Based on these insights, the MaxMaternity Care is specially designed to:

- Provide financial protection to the expectant mother during her pregnancy. With MaxMaternity Care, her coverage starts from as early as the 13th week of her pregnancy until 30 days after delivery. This plan covers pregnancy complications, total and permanent disability, terminal illness and death.

- Provide coverage for the child until the third policy year for 18 congenital illnesses including Congenital Cataract, Congenital Deafness, Down’s Syndrome, Cleft Palate/Cleft Lip and Cerebral Palsy.

- Pay cash allowance up to 30 days (hospital care benefit) if hospital stay is required by the mother or child due to any of the covered complications.

- Provide the newborn with a discount up to S$108 for his/her first integrated shield plan, SupremeHealth, which primarily covers hospitalisation and surgical expenses. This $108 premium-offset is valid for the first premium payment and is exclusive to MaxMaternity Care customers only.

As SupremeHealth is a Medisave-approved integrated shield plan, parents can pay for the annual premiums from the child’s CDA (Child Development Account) or from their own CPF account, giving parents one less worry about their cash flow.

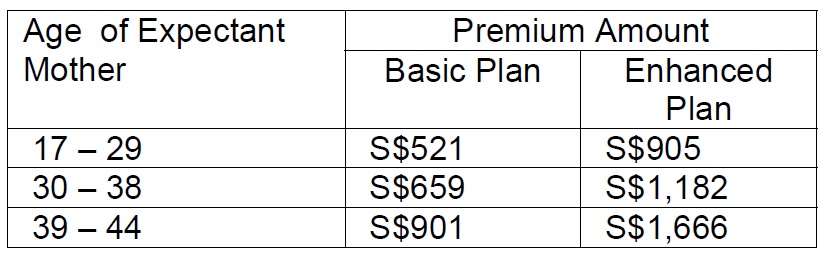

The premium of MaxMaternity Care is kept affordable and customers only need to pay once. OCBC customers interested to purchase MaxMaternity Care only need to pay the following premium amount:

All OCBC customers who are Singapore citizens, permanent residents and foreigners holding a valid Singapore/ Dependent pass are eligible to apply for this plan.

Mr Dennis Tan, OCBC Bank’s Head of Consumer Financial Services Singapore, said: “OCBC became the Baby Bonus Bank in 2008 on the strength of our comprehensive family banking solutions. Since then, some 90% of Singaporean parents with newborn babies have opened their children’s CDAs with us. With our re-appointment last Friday, we are pleased to be able to continue meeting the needs of new parents with our latest product innovation. As the leading Baby Bonus Bank as well as the leading bancassurance provider, we will meet the needs of mothers-to-be with a product that strikes a chord with them. An innovative product must be relevant in order to succeed. We believe that MaxMaternity Care will be well-received. With this simple plan, expectant mothers can have the ease of mind and not be burdened with extra medical costs from pregnancy complications or their newborn’s congenital illness.”

He added: “MaxMaternity Care completes our suite of holistic offerings for the family segment starting from the period when mothers are pregnant. After the child is born, he can continue to grow with our OCBC Mighty Savers Programme which teaches him how to save in a fun way. We are committed to providing value and convenience to families in Singapore.”

MaxMaternity Care is underwritten by The Great Eastern Life Assurance Company Limited, a wholly-owned subsidiary of Great Eastern Holdings Limited and a member of the OCBC Group.