Programmes

- OCBC Group

- Careers

- Programmes

- Undergraduates

Calling all Penultimate-year undergraduates!

The OCBC FRANKpreneurship is a 4-month bank-wide summer internship programme designed to empower you to make an impact on the banking world of today and tomorrow. We want brave individuals who dare to be game changers navigating the ever-changing demands of the new world economy. We will equip you with a FRANKpreneurship toolkit that would guide and groom you to hone your skills that would drive meaningful change for banking in the future.

This programme will challenge and provide you with:

- Mentorship by industry leaders

- Entrepreneurship tools for agile development

- Cross-collaboration opportunities

- Opportunity to be fast-tracked into our Graduate Talent Programme

6 weeks part-time) we offer you the following -

ENTREPRENEUR STARTER KIT

The FRANKpreneurship toolkit comes packed with lean startup principles and frameworks taught by industry leaders, greatly shortening your learning curve and putting you ahead of the pack. You’ll discover what it means to have a startup mentality and pitch your business ideas.

SUBJECT MATTER EXPERTS

Learn from leading industry mentors

Pick the brains of subject matter experts and understand the ins and outs of the banking world — gain an insider viewpoint to technological trends and in-demand skillsets to succeed in the new world economy.

CROSS-COLLABORATION

Work Across Departments to Tackle Real Challenges

FRANKpreneurship keeps you connected and enables you to collaborate with people in creative ways. You will be working with people across different departments to ideate and create solutions that will impact the youths of the future.

Fast-track your career in Banking & Finance

Get fast-tracked into the OCBC Graduate Talent Programme, which will help you build a strong foundation in banking to achieve your career goals in the finance industry.

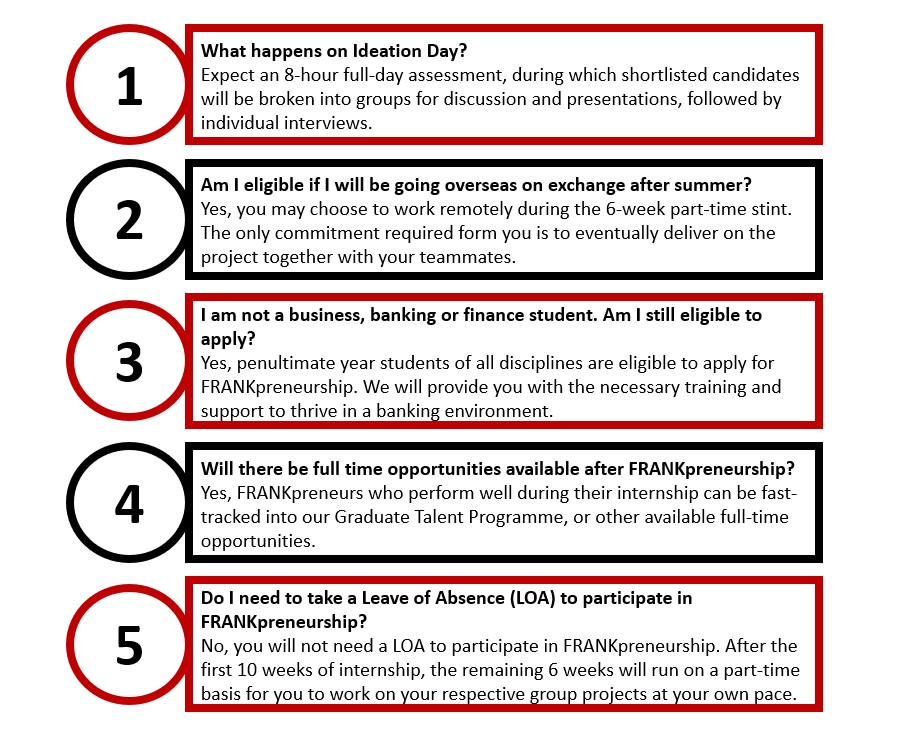

Ideation Day

This is not your average interview. Expect an 8-hour full-day assessment, during which shortlisted candidates will be broken into groups for discussion and presentations, followed by individual interviews.

3-day Bootcamp

Get your notebooks ready as you dive head-first into this intense 3-day bootcamp.

Learn how the bank operates and how the different business units come together to ideate and execute new solutions. Learn from both our business and our partners, Google and Adobe. You’ll be assigned your project teams, your mentors and internship objectives.

Full-time work attachment

Gain a strong foundation that sets you up for future success. During your 10-week business attachment, you will get an insider viewpoint to how various bank departments work together to achieve common goals.

Experience day!

Pitch your project ideas to senior management and industry leaders, gain invaluable feedback, business acumen and insights to refine your startup ideas. Learn what works and what doesn’t from these mentors as they guide you toward refining your ideas.

FRANKpreneurship Projects

The full-time attachment has ended. Get ready to come together as a team once a week to prepare for the Grand Showcase: the final stage to pitch to the judges! These 6 weeks will challenge you to create financial solutions that will help build the bank of the future. It’s all about generating innovative ideas to engage the community and create something meaningful.

Grand Showcase!

D-Day is here: the finale of all FRANKpreneurship Projects. You will pitch your project to an audience of OCBC Bank’s senior management team, participating universities, and other leading industry partners. Put your best foot forward and stand a chance of being selected for the OCBC Graduate Talent Programme.

|

1. Global Consumer Financial Services (GCFS) Global Consumer Financial Services serves almost 3 million customers across Singapore, Malaysia, Indonesia and China. In Singapore, our customer proposition caters to different life-stages and needs ranging from Mighty Savers for children and young families, FRANK by OCBC for the youths and young working adults to OCBC Premier Banking for affluent individuals. Besides being the pioneer in various banking products and services which includes FRANK by OCBC, full-service Sunday Banking and award-wining Online Banking, we are also the market leader for Bancassurance sales. As a FRANKpreneur in GCFS, you will be exposed to technical skills and business knowledge in areas such as customer service, analytics, AML risk management and process improvement while learning to work collaboratively across departments. |

|

2. Global Corporate Bank (GCB) As a FRANKpreneur in Global Corporate Bank, you will be given the opportunity to learn about Corporate Banking products ranging from small and medium-sized enterprises to large conglomerates. You may also be exposed to product specialists in our transaction banking unit, focusing on providing products and services to make banking simpler and more convenient for corporate customers, especially SMEs. |

|

3. Group Human Resources (GHR) At Group Human Resources, we manage compensation, hiring, performance management, organisation development, safety, wellness, benefits, employee motivation, communication, talent management and training. Additional programmes include employee and community outreach, employee engagement activities, which may extend to involve employee families. |

|

4. Group Legal & Regulatory Compliance (GLRC) The Group Anti Money Laundering FRANKpreneur will be part of the team that has responsibilities of managing and maintaining the organisation’s obligations as it relates to the supervision and reporting of money laundering and terrorist financing activities. In addition to the development of appropriate AML/CFT & Sanctions policies, procedures, the team is instrumental in designing and ensuring the AML/CFT & Sanctions framework remains robust to manage the risk associated to money laundering, terrorist financing and sanctions:

5. Fintech and Innovation Group (The Open Vault)

|

|

6. OCBC Securities Private Limited (OSPL) |

|

|