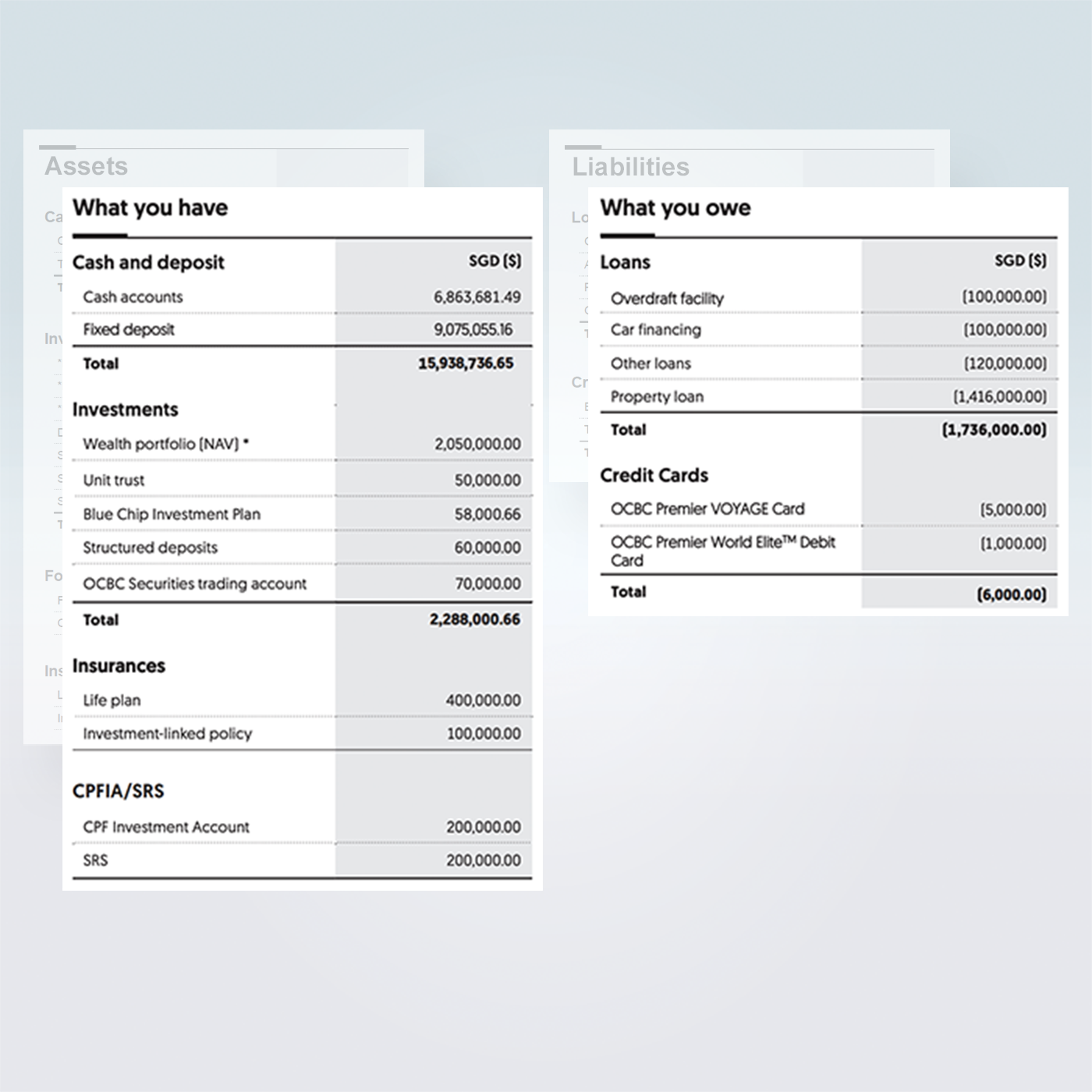

The OCBC Wealth Account is set up based on your banking relationship with OCBC Premier Banking and OCBC Premier Private Client. The Wealth Account will contain Wealth Portfolio(s) that can hold multi-currency cash, term deposits, term loans and marketable securities, such as bonds, equities, dual currency investments, structured products, cash-funded unit trusts/mutual funds. For a full list of assets and liabilities that the Wealth Portfolio can support, please reach out to your Client Advisor / Relationship Manager.

The Wealth Account allows you to hold cash in multiple currencies in the current account such as AUD, CAD, CNH, EUR, GBP, NZD, USD, SGD, HKD, JPY, CHF. View the prevailing interest rates earned on the account.