New to OCBC Premier Banking?

Enjoy a suite of products and services that is tailored to your unique needs.

Already an OCBC Premier Banking customer?

Browse our latest products and services that cater to your evolving needs.

Be rewarded when you start a Premier Banking relationship with us

Earn up to 9,025 SGD* when you deposit 350,000 SGD in fresh funds.

SGD deposits are insured up to S$100k by SDIC.

OCBC Premier Private Client

To be eligible for OCBC Premier Private Client, deposit or invest 1.5 million SGD in fresh funds and qualify as an Accredited Investor.

Premier Dividend+ Savings Account

From 1 June to 31 July 2025, earn interest of up to 2.50% a year (an additional 0.15% a year) when you deposit at least $8,000 monthly (instead of S$3,000) to your Premier Dividend+ Savings Account and make no withdrawals for the month. Insured up to S$100k by SDIC.

Terms and conditions apply.

Revision to interest rates for OCBC Premier Dividend+ Savings Account on 1 August 2025

In line with prevailing market conditions, we will revise interest rates for the OCBC Premier Dividend+ Savings Account on 1 August 2025. For more information, visit ocbc.com/notices.

Change in the way we display certain fees for securities

On 28 April 2025, we will change the way we display our sale of securities and brokerage fees. They will be shown on our website instead of in our OCBC Premier Banking Fees and Charges guide.

For details, read our revised OCBC Premier Banking Fees and Charges guide which will take effect on 28 April 2025.

Revision to maximum commission fee for certain Outward Remittances

On 1 March 2025, the maximum commission fee that may be charged for over-the-counter Telegraphic Transfers from SGD accounts to non-OCBC accounts will be revised to S$60 (from S$50).

This revision will be reflected under the ‘Remittances’ section of the OCBC Premier Banking Fees and Charges Guide.

You may view the revised guide (which takes effect from 1 March 2025) here.

Revision to certain Terms and Conditions

On 1 February 2025, we will revise the following Terms and Conditions:

- OCBC Premier Banking and OCBC Premier Private Client Terms and Conditions

- Structured Deposits Terms & Conditions

- Terms and Conditions Governing Precious Metals Account

Here is how you can view the details:

Get trusted advice from our experts for every stage of your wealth journey

or visit us at our Premier Banking Centre(s)

Terms and Conditions

Terms and Conditions of OCBC Premier Banking Client Referral Programme

OCBC Premier Banking and OCBC Premier Private Client Terms and Conditions

Terms and Conditions Governing OCBC Premier Banking Welcome Reward Programme

Terms and Conditions Governing OCBC Investment Products and Services

Terms and Conditions Governing OCBC Premier Dividend+ Savings Account Interest Rates

Important notices

Cessation of Teller Services at Parkway Parade Premier Banking Centre

Parkway Parade Premier Banking Centre will cease its teller services at 6pm on 30 September 2025.

Foreign Currency Deposits

- Foreign currency investments or deposits are subject to inherent exchange rate fluctuation that may provide opportunities and risks. Consequently, exchange rate fluctuations may affect the value of your foreign currency investments or deposits.

- Earning on foreign currency investments or deposits may change depending on the exchange rates prevalent at the time of their maturity if you choose to convert.

- Exchange controls may apply to certain foreign currencies from time to time.

- Any pre-termination costs will be taken and deducted from your deposit directly and without notice.

- Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

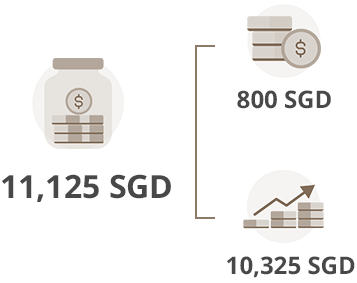

Welcome rewards

Welcome rewards

Cash reward*

Earn a cash reward of 800 SGD when you deposit 350,000 SGD in your Premier Dividend+ Savings Account.

Interest earnings ^

Earn 2.35% interest a year when you deposit S$3,000 in your account a month – for 12 months – and make no withdrawals at all.

* Credited into OCBC Premier VOYAGE Card or OCBC Premier Visa Infinite Card.

^ Based on existing prevailing Premier Dividend+ Savings Account interest rate and account mechanism, which may be subject to change.

Terms and conditions apply