Managing your cash flow in your Silver Years

Budgeting was important in your younger years. As you approach your Silver years, it becomes even more crucial. When you stop working, you will no longer have the benefit of a monthly salary, so managing your cash flow well will be crucial to enjoying a comfortable retirement.

Cash flow management sounds complicated, but when broken down into a few easy steps, does not require much effort.

Here are some tips and tools that can have you managing your cash flow like a professional.

1. Know where your money is going

The first step to managing your money is to know what you are spending on every month.

Tracking every single thing you spend on manually can be extremely laborious, but thanks to technology, there are more efficient ways to know where your money is going now.

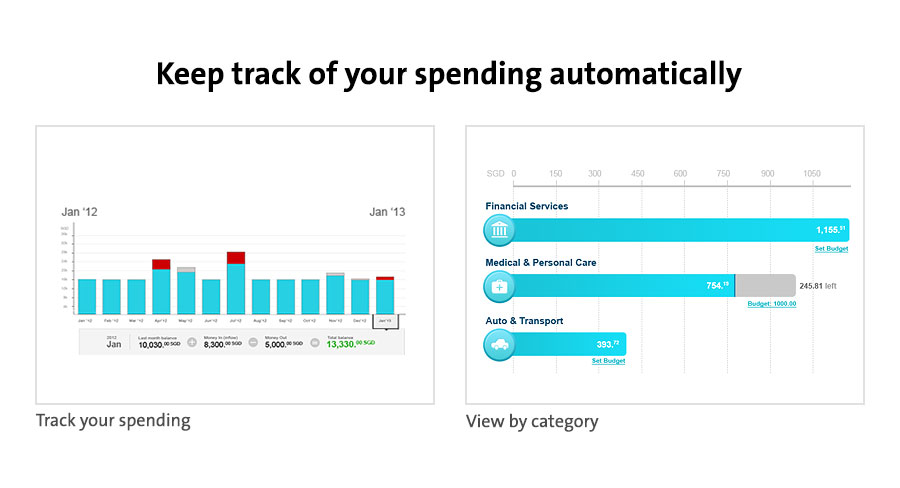

The simplest way to do so is to use a mobile tool like OCBC’s Money In$ights , which can be synced with your bank and credit card accounts, and it enables you to organise and categorise your spending.

When you pay by NETS, debit card or credit card, one advantage is that your spending amounts and the merchants you used will be logged and displayed in your account statements.

Using OCBC’s Pay Anyone app , you can make NETS or other purchases using your mobile phone. This includes taxi rides and meals at participating food centres and merchants. This is preferable to using cash as it will enable your spending to be automatically recorded.

The tool enables you to visualise your spending with the help of graphs and charts that are generated based on your spending history. The application’s cash flow graph helps you see at a glance where your money is going.

You can then access a summary of your spending by logging into your OCBC online banking account and check your e-statements, which provide you with a detailed account transaction history any time of the month.

2. Set budgets

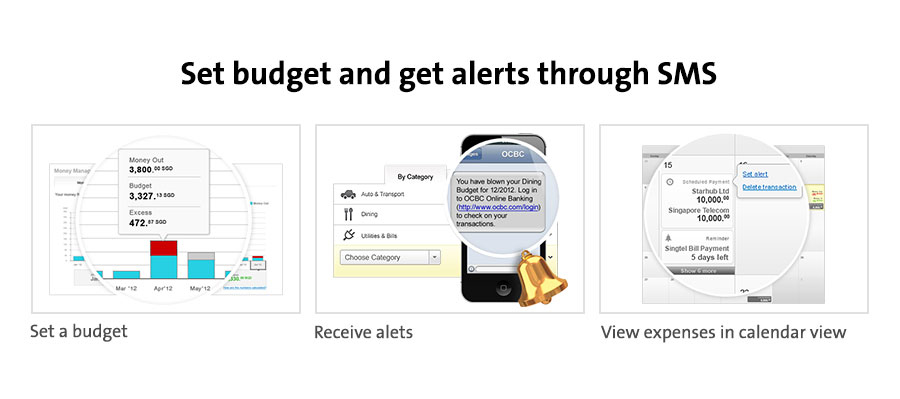

Knowing your spending habits is half the battle won. The second half is to set budgets, so you can limit your spending according to your financial goals. As you are approaching retirement, you will have a great incentive to save and invest more in the lead-up to your Silver Years.

When setting budgets, it’s a good idea to be as detailed as possible. Instead of pledging to spend under a certain amount every month, break it down into different categories such as groceries, dining out, travel, transport, shopping and so on.

The easiest way to set budgets is to use a tool like OCBC Money In$ights. Expenditure from your OCBC accounts is automatically categorised into popular spending categories, requiring minimal effort on your part.

At any time during the month, you will be able to see at a glance how much you have spent on food, travel, transport and so on, thanks to the graphs and statistics displayed by the tool. Knowing your spending allocation will allow you to figure out what you are overspending or underspending on.

Once you know where your money is going, you will be able to set reasonable budgets that are aligned with your financial goals. You can set budgets according to category or a lump sum.

3. Stick to your budget

Obviously, a budget isn’t very helpful if you do not stick to it. Luckily, there are many tools that can prevent you from overspending.

OCBC Money In$ights also offers you the option of receiving alerts via SMS or email when you are about to go over one of the budgets you have set.

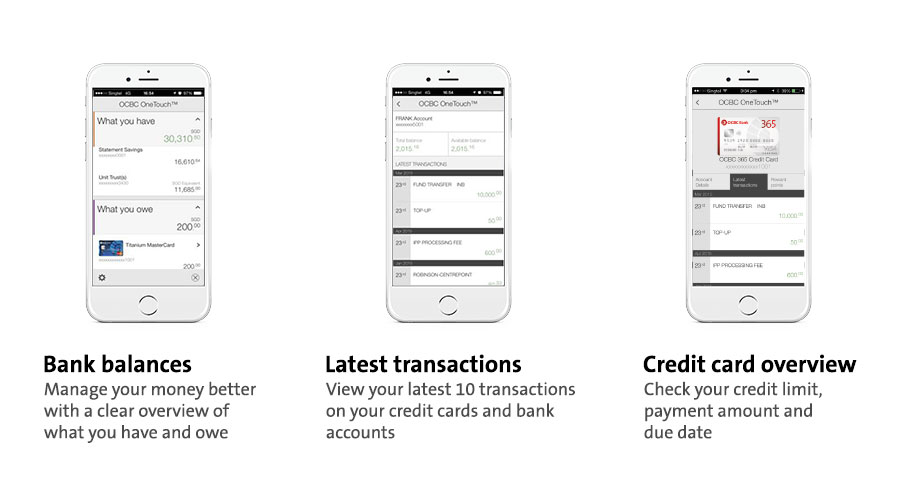

Another useful application is OCBC’s One Touch , available for Touch ID-enabled iPhones running on iOS8 or newer operating systems, and selected Samsung smartphones with the fingerprint recognition feature running on Android 4.4 or newer operating systems.

The application lets you check your bank balances, latest transactions and credit card overview on your smartphone at the touch of a finger, so you can receive a little reminder of your remaining account balance. This can be helpful if you maintain a separate account into which you transfer your spending money, as you will be able to see how much remains until the end of the month.

4. Achieve your savings goals

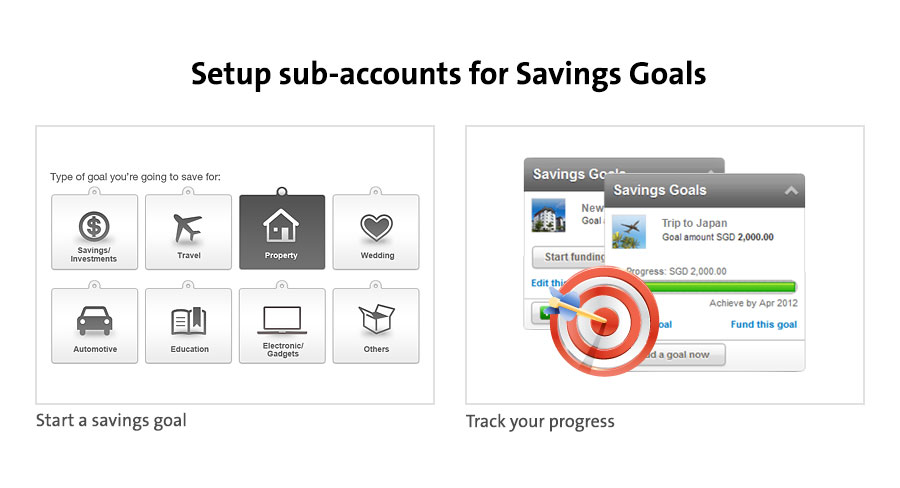

Putting aside a portion of your income towards retirement is essential. Some of this should be kept in cash as an emergency fund if you do not already have an adequate one or recently dipped into yours, while the rest can be invested with the goal of providing you with a retirement income.

We recommend that you set aside this money at the beginning of each month or whenever you receive the bulk of your salary or other income.

What’s more, whenever you receive a lump sum of money, whether it is from the maturity of insurance policies, CPF withdrawals, pension plans or so on, it is important to manage it well and to resist the urge to spend it all. You can opt to invest the bulk of the money in vehicles that can offer you a regular income such as annuities products.

Transferring your retirement savings into the account you have set aside for investments is a breeze with OCBC’s Mobile Banking app , which lets you log into your internet banking account and make fund transfers using your smartphone. The money in this account should be kept separate from your daily spending money and to be used only for investments. Keeping the cash in a separate account makes it easier for you to see at a glance how much you have earmarked for investment purposes.

As you can see, successfully managing your cash flow can be done in just four easy steps. Before you know it, you will be on the road to a speedy and happy retirement.

Click here to find out more about OCBC Bank’s approach to your Silver Years

The information provided herein is intended for general circulation and/or discussion purposes only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The information in this document is not intended to constitute research analysis or recommendation and should not be treated as such.

Without prejudice to the generality of the foregoing, please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase the investment product. In the event that you choose not to seek advice from a financial adviser, you should consider whether the product in question is suitable for you. This does not constitute an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into a transaction or to participate in any particular trading or investment strategy.

The information provided herein may contain projections or other forward looking statement regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures are not necessarily indicative of future or likely performance. Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same. Investments are subject to investment risks, including the possible loss of the principal amount invested.

The Bank, its related companies, their respective directors and/or employees (collectively “Related Persons”) may or might have in the future interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. The Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.

No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (including without limitation any statement, figures, opinion, view or estimate) provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

The contents hereof may not be reproduced or disseminated in whole or in part without OCBC Bank's written consent. The contents are a summary of the investment ideas and recommendations set out in Bank of Singapore and OCBC Bank reports. Please refer to the respective research report for the interest that the entity might have in the investment products and/or issuers of the securities.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Cross-Border Marketing Disclaimers

Please click here for OCBC Bank's cross border marketing disclaimers relevant for your country of residence.