Climate Change: Adapt or Perish

- Physical effects of climate change are clearly felt across the world today; 2015 to 2019 are the five hottest years on record

- Businesses are already vulnerable to short term disruption; longer term climate risks could upend business models

- As policymakers strengthen their response to the threat of climate change, we see both risks and opportunities emerging

What is climate change and why does it matter?

At its simplest, climate change refers to a large-scale, long-term shift in the Earth’s weather patterns and temperature. The physical effects of climate change – longer heatwaves and droughts, extreme winters, more frequent and intense storms, flooding, and rising sea levels – are clearly felt across the world today. Climate change disrupts economies and communities, often affecting the poorest and most vulnerable segments of society.

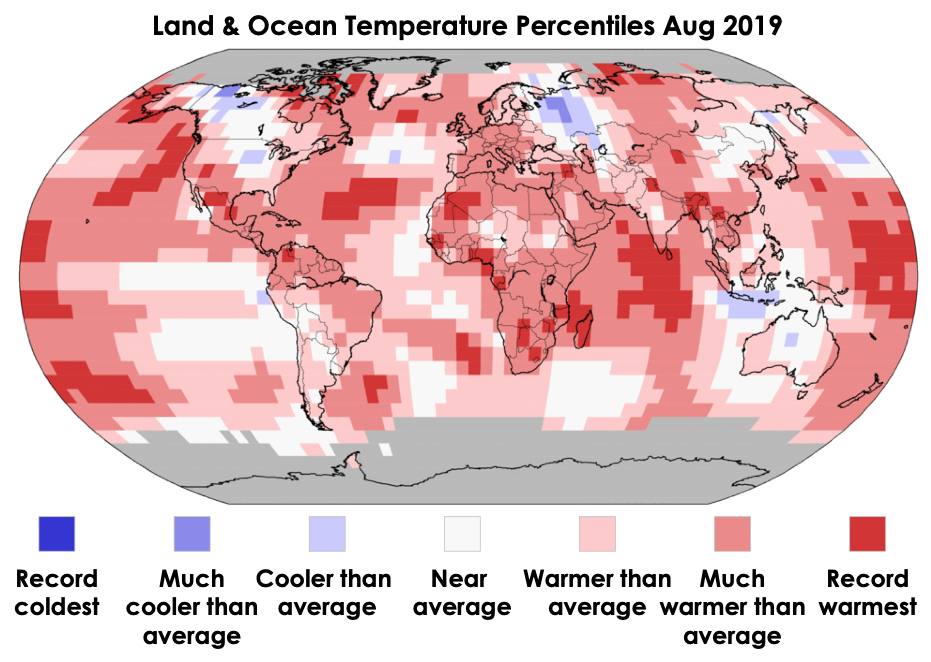

Exhibit 1: Many parts of the world are experiencing record high temperatures

Note: Map shows how a particular location’s average temperature in August 2019 compares with the same month in previous years, with at least 80 years of data for each location.

Source: NOAA National Centers for Environmental Information, Global Climate Report – August 2019.

Recent developments indicate that a greater sense of urgency is taking hold, driven by national commitments made following the landmark 2015 Paris climate agreement, which sets the ultimate goal of capping global warming at 1.5°C (or “well below” 2°C) above pre-industrial levels, as well as the growing international momentum of climate action campaigns such as that led by Swedish environmental activist Greta Thunberg.

Other efforts such as the Science Based Targets initiative and the Task Force on Climate-related Financial Disclosures aim to help businesses contribute to positive climate change outcomes and manage climate risks by supporting them with technical expertise.

This urgency is necessary. Recent climate trends are worrying: 2015 to 2019 are the five hottest years on record, latest World Meteorological Organization data show, and the five-year period 2015-2019 is already 1.1°C warmer, on average, than pre-industrial times. Temperatures over land, where most human activity takes place, have risen by even more than the global average surface temperatures show.

The bulk of this is man-made; human activity has caused about 1.0°C of global warming above pre-industrial levels, according to the Intergovernmental Panel on Climate Change.

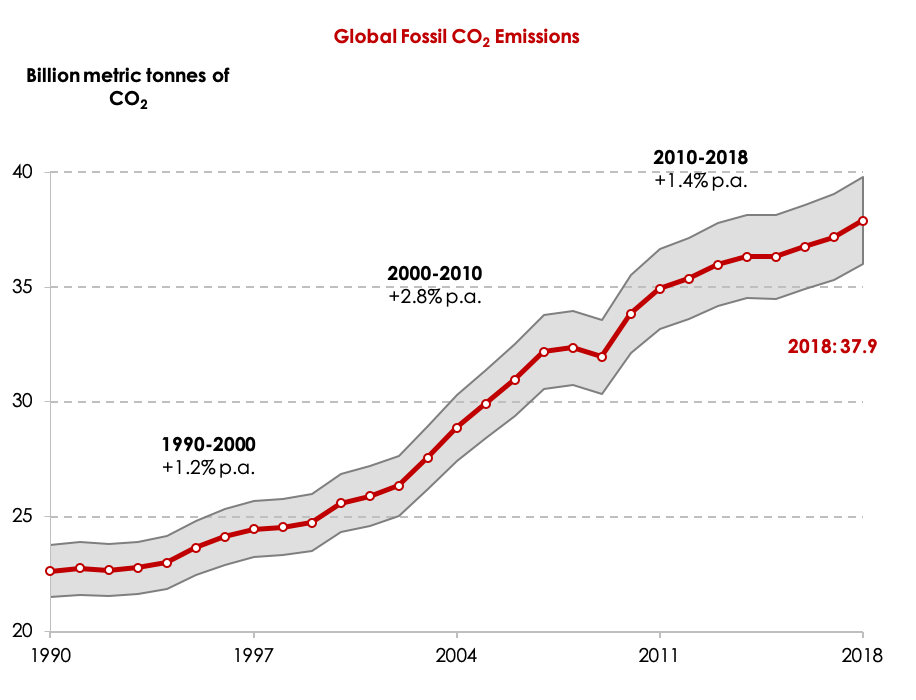

Adding to the worry, emissions of carbon dioxide (CO 2 ) – the primary greenhouse gas that traps heat in the atmosphere and increases global warming – from fossil fuel use and industry are at an all-time high.

Exhibit 2: Global fossil CO 2 emissions are at an all-time high

Notes: Growth rates are compound annual growth rates over the specified period. Grey band shows levels 5% above/below emissions estimates to indicate uncertainty in the emissions estimates.

Source: EU Emissions Database for Global Atmospheric Research (EDGAR), Bank of Singapore.

“Limiting warming to 1.5°C is still possible. But it will require fundamental transformations in all aspects of society – how we grow food, use land, fuel our transport and power our economies,” UN Secretary-General Antonio Guterres said at the UN Climate Action Summit in late September.

In Singapore, Prime Minister Lee Hsien Loong has emphasized the gravity of the threat to the island nation, noting that climate change defenses should be treated as seriously as the country’s military defenses. “These are life and death matters,” he said in his August National Day Rally speech.

Risks to businesses

Today, businesses are already vulnerable to company- and sector-specific climate risks. A simple example would be milder winters or longer summers disrupting order for apparel manufacturers and clothing retailers.

While troublesome, such issues pale in comparison to the potential damage to business assets or entire economies from more frequent flooding, hurricanes, droughts and – over longer term – rising sea levels. Slower-moving, structural changes to the environment due to climate change could fundamentally alter the viability of companies’ operating models Beyond the potential damage to businesses, these changes also threaten to disrupt food production and displace entire populations, with far-reaching implications for social stability.

Policy changes are introducing new regulatory risks for companies, especially those in sectors such as fossil fuel production (oil and gas, thermal coal), mining, power generation, and other emissions-intensive industries such as cement and chemicals manufacturing.

Proposed rules in Europe requiring investors to integrate detailed criteria to screen for economic activities that contribute to positive climate change outcomes are likely to pressure companies worldwide to enhance disclosures on climate risk management and broader environmental-related performance, or risk losing access to investment capital.

Some businesses are already exposed to the risk of having their assets lose value more rapidly than expected – known as asset stranding – due to regulatory shifts associated with climate change. Such assets could include fossil fuel and mineral reserves that become uneconomical to extract due to increased carbon and pollution taxes; power generation infrastructure and production facilities that do not meet new energy efficiency and emissions standards; and coastal property and infrastructure rendered unusable by flooding.

Overall, we believe companies will face increasing regulatory, environmental, and consumer pressures associated with climate risk, forcing them to adapt or perish.

Opportunities in adaptation

The gradual transition to a more environmentally friendly, climate-resilient global economy will reshape human activities across the world, introducing new opportunities for investment and growth. Companies that help to design and build climate defenses, improve water and food security, and develop energy-efficient, low-emissions technology and processes are likely to attract increasing interest and investment capital.

Similarly, businesses that deliver products and services closely aligned with the longer term shift towards reducing waste and re-using natural resources – the “circular economy” – are increasingly likely to benefit from evolving consumer preferences and regulations.

As policymakers worldwide strengthen their response to the threat of climate change, we see new risks and opportunities emerging for businesses and investors. Efforts to pursue sustainable, climate- resilient development paths and reduce the threat of climate change through emissions reduction and adaptation are likely to drive wide-ranging, significant changes throughout society.

Companies slow to anticipate and adjust to these changes risk being gradually sidelined by investors or, in the extreme, having their operating models upended; those that adapt successfully will benefit from the reshaped economic landscape and enjoy more sustainable business prospects.

The information provided herein is intended for general circulation and/or discussion purposes only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The information in this document is not intended to constitute research analysis or recommendation and should not be treated as such.

Without prejudice to the generality of the foregoing, please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase the investment product. In the event that you choose not to seek advice from a financial adviser, you should consider whether the product in question is suitable for you. This does not constitute an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into a transaction or to participate in any particular trading or investment strategy.

The information provided herein may contain projections or other forward looking statement regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures are not necessarily indicative of future or likely performance. Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same. Investments are subject to investment risks, including the possible loss of the principal amount invested.

The Bank, its related companies, their respective directors and/or employees (collectively “Related Persons”) may or might have in the future interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. The Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.

No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (including without limitation any statement, figures, opinion, view or estimate) provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

The contents hereof may not be reproduced or disseminated in whole or in part without OCBC Bank's written consent. The contents are a summary of the investment ideas and recommendations set out in Bank of Singapore and OCBC Bank reports. Please refer to the respective research report for the interest that the entity might have in the investment products and/or issuers of the securities.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Cross Border Market Disclaimers

- Brunei: This document has not been delivered to, licensed or permitted by the Autoriti Monetari Brunei Darussalam, the authority as designated under the Brunei Darussalam Securities Markets Order, 2013 and the Banking Order, 2006; nor has it been registered with the Registrar of Companies, Registrar of International Business Companies or the Brunei Darussalam Ministry of Finance. The [products] are not registered, licensed or permitted by the Autoriti Monetari Brunei Darussalam or by any other government agency or under any law in Brunei Darussalam. Any offers, acceptances, sales and allotment of the [products] shall be made outside Brunei Darussalam.

- Hong Kong SAR: Oversea-Chinese Banking Corporation Limited is an Authorised Institution as defined in the Banking Ordinance of Hong Kong (Cap 155), regulated by the Hong Kong Monetary Authority in Hong Kong and a Registered Institution as defined in the Securities and Futures Ordinance of Hong Kong (Cap. 571), regulated by the Securities and Futures Commission in Hong Kong. This document is for information only and is not intended for anyone other than the recipient. It has not been reviewed by any regulatory authority in Hong Kong. It is not by itself an offer or a solicitation to deal in any of the financial products referred to herein or to enter into any legal relations, nor an advice or a recommendation with respect to such financial products. It does not have regard to the specific investment objectives, financial situation, investment experience and the particular needs of any recipient or Investor. This document may not be published, circulated, reproduced or distributed in whole or in part to any other person without the Bank’s prior written consent. This document is not intended for distribution to, publication or use by any person in any jurisdiction outside Hong Kong, or such other jurisdiction as the Bank may determine in its absolute discretion, where such distribution, publication or use would be contrary to applicable law or would subject the Bank and its related corporations, connected persons, associated persons and/or affiliates to any registration, licensing or other requirements within such jurisdiction.

- Indonesia: The offering of the investment product in reliance of this document is not registered under the Indonesian Capital Market Law and its implementing regulations, and is not intended to constitute a public offering of securities under the Indonesian Capital Market Law and its implementing regulations. According, this investment product may not be offered or sold, directly or indirectly, within Indonesia or to citizens (wherever they are domiciled or located), entities or residents, in any manner which constitutes a public offering of securities under the Indonesian Capital Market Law and its implementing regulations.

- Japan: The information contained in this document is for general reference purposes only. It does not have regard to your specific investment objectives, financial situation, risk tolerance and particular needs. Nothing in this document constitutes an offer to buy or sell or an invitation to offer to buy or sell or a recommendation or a solicitation to buy or sell any securities or investment. Oversea-Chinese Banking Corporation Limited, Singapore does not have any intention of conducting regulated business in Japan. You acknowledge that nothing in this document constitutes investment or financial advice or any advice of any nature.

- Malaysia: Oversea-Chinese Banking Corporation Limited, Singapore does not hold any licence, registration or approval to carry on any regulated business in Malaysia (including but not limited to any businesses regulated under the Capital Markets & Services Act 2007 of Malaysia), nor does it hold itself out as carrying on or purport to carry on any such business in Malaysia. Any services provided by Oversea-Chinese Banking Corporation Limited, Singapore to residents of Malaysia are provided solely on an offshore basis from outside Malaysia, either as a result of "reverse enquiry" on the part of the Malaysian residents or where Oversea-Chinese Banking Corporation Limited, Singapore has been retained outside Malaysia to provide such services. As an integral part of the provision of such services from outside Malaysia, Oversea-Chinese Banking Corporation Limited, Singapore may from time to time make available to such residents documents and information making reference to capital markets products (for example, in connection with the provision of fund management or investment advisory services outside of Malaysia). Nothing in such documents or information is intended to be construed as or constitute the making available of, or an offer or invitation to subscribe for or purchase any such capital markets product.

- Myanmar: This document and information herein is made available by Oversea-Chinese Banking Corporation Limited, Singapore, which is licensed and regulated by the Monetary Authority of Singapore. Oversea-Chinese Banking Corporation Limited, Singapore is not licensed or registered under the Financial Institutions Law (Law No. 20/2016) or other Myanmar legislation to carry on, nor do they purport to carry on, any regulated activity in Myanmar. The provision of any products and services by Oversea-Chinese Banking Corporation Limited, Singapore shall be solely on an offshore basis. You shall ensure that you have and will continue to be fully compliant with all applicable laws in Myanmar when entering into discussion or contracts with Oversea-Chinese Banking Corporation Limited, Singapore.

- Oman: This document does not constitute a public offer of investment, securities or financial services in the Sultanate of Oman, as contemplated by the Commercial Companies Law of Oman (Royal Decree No. 4/1974), Banking Law of Oman (Royal Decree No. 114/2000) or the Capital Market Law of Oman (Royal Decree No. 80/1998) and the Executive Regulations of the Capital Market Law (Ministerial Decision No. 1/2009) or an offer to sell or the solicitation of any offer to buy non-Omani investment products, securities or financial services and products in the Sultanate of Oman. This document is strictly private and confidential. It is being provided to a limited number of sophisticated investors solely to enable them to decide whether or not to make an offer to invest in financial products mentioned in this document, outside of the Sultanate of Oman, upon the terms and subject to the restrictions set out herein and may not be reproduced or used for any other purpose or provided to any person other than the original recipient. Additionally, this document is not intended to lead to the making of any contract within the territory or under the laws of the Sultanate of Oman. The Capital Market Authority of Oman and the Central Bank of Oman take no responsibility for the accuracy of the statements and information contained in this document or for the performance of the financial products mentioned in this document nor shall they have any liability to any person for damage or loss resulting from reliance on any statement or information contained herein.

- Russia: The investment products mentioned in this document have not been registered with or approved by the local regulator of any country and are not publicly distributed in Singapore or elsewhere. This document does not constitute or form part of an offer or invitation in any country to subscribe for the products referred to herein.

- Korea: The document does not constitute an offer, solicitation or investment advertisement to trade in the investment product referred to in the document.

- Taiwan: The provision of the information and the offer of the service concerned herewith have not been and will not be registered with the Financial Supervisory Commission of Taiwan pursuant to relevant laws and regulations of Taiwan and may not be provided or offered in Taiwan or in circumstances which requires a prior registration or approval of the Financial Supervisory Commission of Taiwan. No person or entity in Taiwan has been authorised to provide the information and to offer the service in Taiwan.

- Thailand: Please note that none of the material and information contained, or the relevant securities or products specified herein is approved or registered in Thailand. Interests in the relevant securities or products may not be offered or sold within Thailand. The attached information has been provided at your request for informational purposes only and shall not be copied or redistributed to any other person without the prior consent of Oversea-Chinese Banking Corporation Limited, Singapore or its relevant entities and in no way constitutes an offer, solicitation, advertisement or advice of, or in relation to, the relevant securities or products by Oversea-Chinese Banking Corporation Limited, Singapore or any other entities in Oversea-Chinese Banking Corporation Limited, Singapore’s group in Thailand.

- The Philippines: The information contained in this document is not intended to constitute a public offering of securities under the Securities Regulation Code of the Philippines.

- Dubai International Financial Centre (DIFC): Oversea-Chinese Banking Corporation Limited is not a financial institution licensed in the Dubai International Financial Centre ("DIFC") or the United Arab Emirates outside of the DIFC and does not undertake banking or financial activities in the DIFC or the United Arab Emirates nor is it licensed to do so. This material is provided for information purposes only and it is general information not specific in any way to any particular investor, investor type, strategy, investment need or other financial circumstance. As such this information is not financial advice or a financial promotion, nor is it intended to influence an investor's decision to invest. It is not to be construed as an offer to buy or sell or solicitation of an offer to buy or sell any financial instruments or to participate in any particular trading strategy in any jurisdiction. The material is only intended for persons who fulfil the criteria to be classified as “Professional Clients” as defined under the DFSA rules and should not be reviewed, received, provided to or relied upon by any other person.

- United Kingdom: In the United Kingdom, this document is being made available only to the person or the entity to whom it is directed being persons to whom it may lawfully be directed under applicable laws and regulations of the United Kingdom (such persons are hereinafter referred to as ‘relevant persons’). Accordingly, this document is communicated only to relevant persons. Persons who are not relevant persons must not act on or rely on this document or any of its contents. Any investment or investment activity to which this document relates is available only to relevant persons and will be engaged in only with relevant persons. Relevant persons in receipt of this document must not distribute, publish, reproduce, or disclose this document (in whole or in part) to any person who is not a relevant person.

- United Arab Emirates (UAE): The information contained herein is exclusively addressed to the recipient. The offering of certain products in this document has not been and will not be registered with the Central Bank of United Arab Emirates or Securities & Commodities Authority in the United Arab Emirates. Any products in this document that are being offered or sold do not constitute a public offering or distribution of securities under the applicable laws and regulations of the United Arab Emirates. This document is not intended for circulation or distribution in or into the UAE, other than to persons in the UAE to whom such circulation or distribution is permitted by, or is exempt from the requirements of, the applicable laws and regulations of the United Arab Emirates. The distribution of the information contained herein by the recipient is prohibited. Where applicable, this document relates to securities which are listed outside of the Abu Dhabi Securities Exchange and the Dubai Financial Market. Oversea-Chinese Banking Corporation Limited is not authorized to provide investment research regarding securities listed on the exchanges of the United Arab Emirates.

- United States of America: This product may not be sold or offered within the United States or to US persons.

© Copyright 2019 - OCBC Bank | All Rights Reserved. Co. Reg. No.: 193200032W