Hopes for a new normal

In our view, the long-term risks for markets have eased significantly with a favourable US election outcome, meaningful progress on vaccine development, and with global monetary policy still very supportive of risk asset prices. In the US and Europe, the ongoing surges in Covid-19 cases could inject some near-term market turbulence, though we expect investors to look through this volatility in anticipation of a normalisation in economic activity.

In China, data continues to be encouraging while low inflation could also create room for the People’s Bank of China (PBOC) to allow the recovery to continue without having to increase interest rates.

Still, we recognise a fair degree of volatility in the near-term, given President Donald Trump’s executive order banning US persons from investing in selected Chinese companies deemed to have ties with the Chinese military, as well as the release of draft anti-trust guidelines against monopolistic practices in the Chinese internet industry.

We had recommended clients with significant exposure in growth/momentum stocks to rebalance into value/cyclical ones – this has indeed been playing out thus far. We believe this rotation story still has legs, with our base-case expectation that at least one major drug-maker would receive regulatory approval by 1Q 2021.

United States

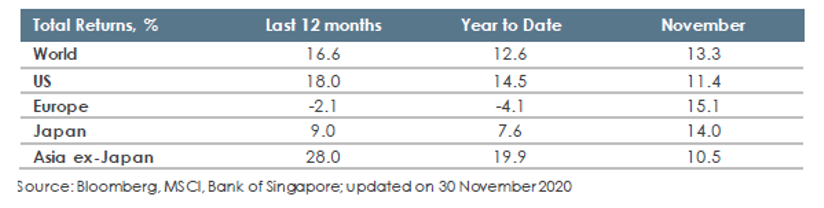

Markets are understandably buoyant for numerous reasons. Uncertainties around the US elections are mostly out of the way, with a Biden presidency widely expected to see the US adopt a diplomatic approach to global trade deals. Positive vaccine-related news has lifted sentiment, while 3Q 2020 corporate earnings have broadly been better-than-expected. The Fed is also likely to remain dovish, in-line with our house view that the Fed funds rate could remain at 0-0.25% until as late as 2025.

Still, we see potential for near-term volatility; valuations are not cheap, control of the Senate remains in play, and events such as Treasury Secretary Mnuchin’s unexpected request to the Fed to return funds would require investors’ attention. While surges in Covid-19 cases could also inject turbulence ahead, we would be buyers on dips, assuming further encouraging developments on the vaccine front.

Europe

Since Pfizer and BioNTech’s vaccine announcement in early November, followed by updates on other vaccines, investors in Europe have shared in the optimism as seen by the appreciation in asset prices. While the market has cheered positive developments on the vaccine front, consumer confidence in key countries such as France and Germany have been impacted by lockdown restrictions, and we would not be surprised by market caution prior to a wider roll-out of vaccines.

We are also keeping an eye on Hungary’s and Poland’s intention to effectively veto the EU budget on the back of objections against more stringent rule-of-law conditionality of EU funds, which could delay execution of the Recovery Fund. While this throws a spanner in the works, it is ultimately in the interest of key stakeholders on both sides to find a solution within the institutional contours of the multi-year EU budget.

Japan

November was a positive month for Japan equities, as the market kept pace with world equities’ rally following faster than expected Covid-19 vaccine development progress. Last month’s rally was driven by fairly equal buying interest in both value and growth stocks as growth expectations improved, which helped MSCI Japan recoup its year-to-date losses. We expect improvement in corporate guidance ahead and a smaller quarterly contraction in profits as economic activities normalise further, which should be supportive of the equity market.

Asia ex-Japan

2020 has been a volatile but fulfilling year for the MSCI Asia ex-Japan Index in terms of investment returns, as it has been the top performer among the major regions.

As we head into 2021, we see scope for this outperformance to continue, given tailwinds which would lend support to a more favourable outlook. We see positives from a breakthrough on the Covid-19 vaccine front, although we are cognisant that the road to recovery is likely to remain bumpy. The MSCI Asia ex-Japan Index is also projected to see a firm double-digit rebound in earnings per share in 2021 even though earnings growth is expected to be only slightly negative in 2020 due to the Covid-19 pandemic. With Joe Biden as US President-elect, we see a more multi-lateral approach towards Sino-US relationships, while de-globalisation concerns may also be alleviated. Expectations of strengthening Asian currencies relative to the USD also leaves more flexibility for the central banks to pursue looser monetary policy. These factors could support capital inflows to Asia.

Within ASEAN, we prefer Singapore and Indonesia

Within ASEAN, our preference is for Singapore and Indonesia. We see Singapore as a key beneficiary of improved business and consumer confidence which would support its Financials, Real Estate and Industrial sectors. The stable political climate and control of the pandemic would also support the recovery of its tourism industry and continue to draw fund flows, especially from family offices. For Indonesia, we see potential tailwinds from i) an increase in foreign fund inflows post the US elections with a rotation to emerging markets, ii) Omnibus Law to drive reforms and attract foreign direct investments, iii) strengthening IDR and room for more monetary easing, and iv) valuations relatively less expensive than regional peers.

One key theme which remains intact in 2021 would be the continued hunt for yield as investors seek opportunities amid a low interest rate environment. We are Overweight on the S-REITs sector to play this theme, given undemanding valuations and we also see a robust recovery in distributions given a low base effect and improvement in macro conditions.

China

We remain constructive on Chinese equities on the back of solid recovery and robust activities. However, there could be overhang in the near-term in light of the executive order that was signed by President Donald Trump in banning US persons from investing in 31 Chinese companies that are deemed to have ties to the Chinese military by the US Department of Defence. There are uncertainties regarding the scope and implementation rules, and there is also the risk of whether the Trump administration will expand the list by adding more companies.

Recent high frequency data, such as industrial profits and PMI indicators suggest a broader economic recovery.

The solid recovery and strong rebound in industrial profits support the performance of “old economy sectors”, especially the upstream sectors, such as materials. At the same time, the 14th Five Year Plan focuses on quality growth, innovation and market reform, and also emphasises the “dual-circulation” strategy. This should support emerging pillar industries for future growth and development. While detailed sector guidelines and policies have yet to be announced, and the full version will be released only after approval by the National People’s Congress in March 2021, we believe it will benefit sectors like clean and renewable energy, domestic consumption, high-end industrials, internet and “new infrastructure”.

Financial sector upgraded

With a steeper yield curve expected over time and improved confidence on the strength of the global economic recovery going into 2021, we have raised our Financials sector rating to Neutral on the view that tail risks are more diminished and the sector should benefit from cyclical tailwinds, as a more conducive operating.

Remain cautious on tech sector

On the Technology front, we have been cautioning clients on the rich valuations and potential for a near-term pullback and this was seen in the recent rotation from growth to value. In addition, China decided to throw a spanner in the works by releasing a draft soliciting public feedback on anti-trust guidelines relating to monopolistic practices in the internet industry. While regulations relating to anti-trust have been rolled out over the years, this is the first time detailed guidelines specifically designed for anti-trust activities in the internet space have been mapped out.

The information provided herein is intended for general circulation and/or discussion purposes only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The information in this document is not intended to constitute research analysis or recommendation and should not be treated as such.

Without prejudice to the generality of the foregoing, please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase the investment product. In the event that you choose not to seek advice from a financial adviser, you should consider whether the product in question is suitable for you. This does not constitute an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into a transaction or to participate in any particular trading or investment strategy.

The information provided herein may contain projections or other forward looking statement regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures are not necessarily indicative of future or likely performance. Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same. Investments are subject to investment risks, including the possible loss of the principal amount invested.

The Bank, its related companies, their respective directors and/or employees (collectively “Related Persons”) may or might have in the future interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. The Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.

No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (including without limitation any statement, figures, opinion, view or estimate) provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

The contents hereof may not be reproduced or disseminated in whole or in part without OCBC Bank's written consent. The contents are a summary of the investment ideas and recommendations set out in Bank of Singapore and OCBC Bank reports. Please refer to the respective research report for the interest that the entity might have in the investment products and/or issuers of the securities.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Cross-Border Marketing Disclaimers

Please click here for OCBC Bank's cross border marketing disclaimers relevant for your country of residence.