Will you be able to retire comfortably?

We have been talking to people who are in various stages of planning retirement to understand how they prepare towards their retirement.

Here’s what we hear from conversations:

Common questions:

Our view:

Is my property an asset or a liability?

Your property can be a good asset and a source of passive income.

Read on

Are my savings idling away or fighting inflation?

As inflation remains higher than interest rates, your savings may actually be losing their value.

Read on

Is my CPF enough?

While CPF can be a big help, factors like higher minimum sums and spiraling costs make it unlikely that it will ever be enough.

Read on

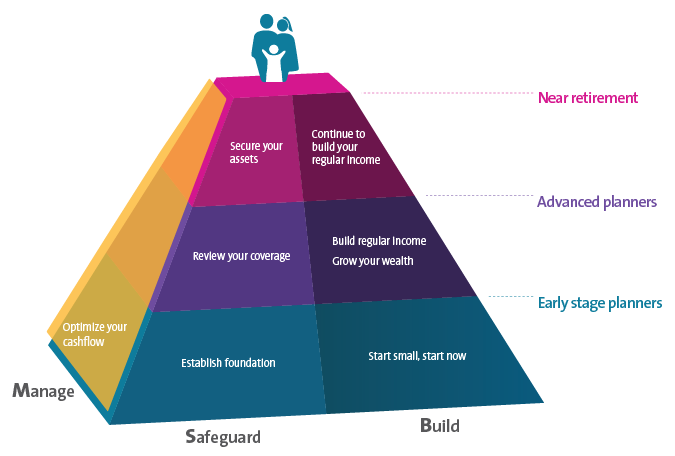

Retirement is an important aspect of life, and it’s not just about having a property, relying on CPF or savings accounts. It is about managing your money, assets and liabilities in a holistic way to retire comfortably.

Whether you are in the early stage of planning or nearing your retirement, you need to ensure that you:

Safeguard yourself, your family, your assets and ability to pay liabilities

Build your retirement fund and grow your assets

Manage your cash flow

While insurance or asset management companies can offer certain types of solutions for your retirement, we, as a bank, can offer a whole suite of financial products that can be tailored to your unique situation.

Let us help you revise your retirement plans holistically.

You would need

You are projected to have:

Your shortfall is

You can consider investing your Cash & Deposits at

to reduce your shortfall

Your now have a surplus of S$

Your estimated retirement funds can potentially fulfil your goals for a comfortable retired life.

You can consider PrimeGold Advantage or MaxRetirement to secure your future.

Present this page at any OCBC Branch for a detailed Financial Analysis and enjoy up to S$80 Cash Rewards when you purchased selected Retirement planning products.

We have defaulted the retirement age at 62 years, according to the minimum retirement age under the Retirement and Re-employment Act.

You may wish to choose a retirement age that is realistic to your situation by replacing the value.

We base the number of years you may live in retirement on the average life expectancy in Singapore, which is

- 80 years for males

- 85 years for females

You may wish to replace this value.

This figure refers to any source of income (eg. allowance from children) that you may receive upon retirement. It should exclude income from CPF Life, Annuities and other Financial Products.

CPF members are required to set aside a Minimum Sum to receive a monthly income for basic standard of living through CPF Life. The Minimum Sum is $155,000 for members turning 55 on or after 1 Jul 2014. Details can be found in CPF website http://mycpf.cpf.gov.sg/Members/home.htm

This figure represents the amount you expect to receive as cash after selling your investment property, eg if you investment property is worth $2,000,000 and your outstanding mortgage is $500,000; then the cash proceeds upon selling it would be $1,500,000 in cash. We assume that the $1,500,000 will be received at the year of your retirement, and the value of the property is based on today's price. http://mycpf.cpf.gov.sg/Members/home.htm

This figure represents the amount you expect to receive as cash after selling your investment property, eg if you investment property is worth $2,000,000 and your outstanding mortgage is $500,000; then the cash proceeds upon selling it would be $1,500,000 in cash. We assume that the $1,500,000 will be received at the year of your retirement, and the value of the property is based on today's price.

FOR CPF MEMBERS WHO TURN 55 IN 2016:

BASIC SUM

With a Basic Retirement Sum of $80,500 set aside for CPF LIFE, a Basic Payout of $650 to $700 per month can be attained for life from age 65. Only applies to members who own a property and have an adequate charge or pledge against it.

FULL SUM

With a Full Retirement Sum of $161,000 set aside for CPF LIFE, a Full Payout of $1,200 to $1,300 per month can be attained for life from age 65. Only applies to members who do not own a property or who own a property but do not wish to pledge it.

ENHANCED SUM

With an Enhanced Retirement Sum of $241,500 set aside, either through their CPF savings or through cash, for CPF LIFE, an Enhanced Payout of $1,750 to $1,900 per month can be attained for life from age 65.

There will be a review of the rate of adjustment in Retirement Sum

periodically to take into account more updated data on long-term inflation and retiree expenditures.

Details can be found in CPF website: mycpf.cpf.gov.sg/Members/Gen-Info/CPFChanges/CPFAdvisoryPanelRecommendations.htm

Lump sum investments refer to the amount of investments you have made for Financial

Products such as Single or Regular Premium, Stocks & Shares Investments or Unit Trust.

We have defaulted the rate of return at 3% for Lump Sum investments.

It is a voluntary scheme to encourage individuals to save for retirement. Contributions to the scheme are eligible for income tax relief. Details can be found in IRAS website http://www.iras.gov.sg/irasHome/page04_ektid138.aspx

Regular investments refer to the monthly amount you are setting aside for Financial Products such as Regular Premium or Monthly Investment Plan, from now up to your retirement age. We have defaulted the rate of return at 3% for Regular investments.

Please include Investments using CPF & SRS funds, if any.

Retirement Planner Assumptions

The following assumptions are used in the calculation of the Retirement Planner:

Inflation rate

Inflation rate is based on a 10-year geometric average of the Singapore CPI.

Source: Statistics Singapore - Time Series on CPI (2009=100) & Inflation Rate (Year 1980 to 2012)

Investment growth rate

Based on individual risk profile, an average range of 2% - 7% is being used.

Cash rate of return

Based on the average 12-months Fixed Deposit Rate from Jan 2003 to Dec 2012 (both dates inclusive). Source: MAS

Growth rate for regular and lump sum contributions

Where applicable, a long term growth rate of 3% is assumed for regular and lump sum contributions in retirement.

General Disclaimers

The OCBC Retirement Planner is designed to assist in financial planning and is for general reference only. Amount shown includes projected rates of return for variables such as inflation, investment growth and cash. Actual numbers may vary depending on economic conditions. The information and analysis provided by these tools are based on various assumptions, which are subject to change at any time without notice.

The information provided herein is intended for general circulation and/or discussion purposes only. It does not take into account the specific investment objectives, financial situation or needs of any particular person. Before you make any investment decision, you should speak to a financial adviser who will assess whether the products are suitable for you based on your investment objectives, financial situation or particular needs. If you choose not to do so, you should consider if the investment product is suitable for you.

We are not making an offer, solicit to buy or sell or subscribe for any security or financial instrument, enter into any transaction or participate in any trading or investment strategy with you through this document.

OCBC Bank, its related companies, their respective directors and/or employees (collectively “Related Persons”) may have positions in, and may effect transactions in the products mentioned herein. OCBC Bank may have alliances with the product providers, for which OCBC Bank may receive a fee. Product providers may also be Related Persons, who may be receiving fees from investors. OCBC Bank and the Related Persons may also perform or seek to perform broking and other financial services for the product providers.

No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (including without limitation any statement, figures, opinion, vie woe estimate) provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

FUNDS

Bonds Templeton Global Total Return

LGI Short Duration Bond Fund (CPF)

Templeton Global Bond Fund

Multi-Asset

Schroder Global Multi Asset Income BGF Global Allocation

First State Bridge (CPF)

Equities Aberdeen Global Opportunities (CPF) BGF Global Equity

Income Schroder Asian Equity Yield (CPF) Aberdeen Pacific

Equity (CPF) First State Dividend Advantage (CPF)

BANCA

MaxGrowth Enhanced

MaxGrowth Enhanced (Prepaid)

MaxRetirement Flex

MaxRetirement

PrimeGold Advantage

FUNDS

Bonds Templeton Global Total Return

LGI Short Duration Bond Fund (CPF)

Templeton Global Bond Fund

Multi-Asset

Schroder Global Multi Asset Income BGF Global Allocation

First State Bridge (CPF)

Equities Aberdeen Global Opportunities (CPF) BGF Global Equity

Income Schroder Asian Equity Yield (CPF) Aberdeen Pacific

Equity (CPF) First State Dividend Advantage (CPF)

BANCA

MaxGrowth Enhanced

MaxGrowth Enhanced (Prepaid)

MaxRetirement Flex

MaxRetirement

PrimeGold Advantage

FUNDS

Bonds Templeton Global Total Return

LGI Short Duration Bond Fund (CPF)

Templeton Global Bond Fund

Multi-Asset

Schroder Global Multi Asset Income BGF Global Allocation

First State Bridge (CPF)

Equities Aberdeen Global Opportunities (CPF) BGF Global Equity

Income Schroder Asian Equity Yield (CPF) Aberdeen Pacific

Equity (CPF) First State Dividend Advantage (CPF)

BANCA

MaxGrowth Enhanced

MaxGrowth Enhanced (Prepaid)

MaxRetirement Flex

MaxRetirement

PrimeGold Advantage

FUNDS

Bonds Templeton Global Total Return

LGI Short Duration Bond Fund (CPF)

Templeton Global Bond Fund

Multi-Asset

Schroder Global Multi Asset Income BGF Global Allocation

First State Bridge (CPF)

Equities Aberdeen Global Opportunities (CPF) BGF Global Equity

Income Schroder Asian Equity Yield (CPF) Aberdeen Pacific

Equity (CPF) First State Dividend Advantage (CPF)

BANCA

MaxGrowth Enhanced

MaxGrowth Enhanced (Prepaid)

MaxRetirement Flex

MaxRetirement

PrimeGold Advantage