S$54 cash credit

Get S$54 cash credit with every S$5,000 in fresh funds deposited into an OCBC Passbook or Statement Savings Account with no limit. Funds deposited must be maintained for 7 months. Promotion ends 23 August 2019.

Plus S$5 cash credit

Receive an additional S$5 cash credit with every S$500 in fresh funds deposited with OCBC Mighty Savers®. Funds deposited with OCBC Mighty Savers® are not earmarked. Promotion ends 23 August 2019.

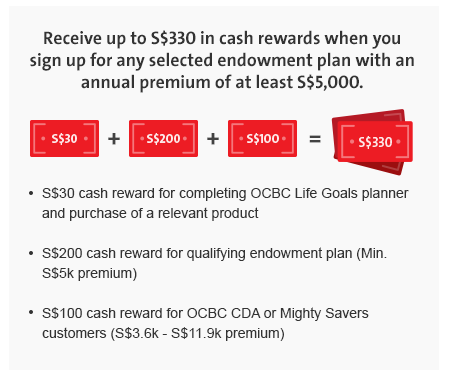

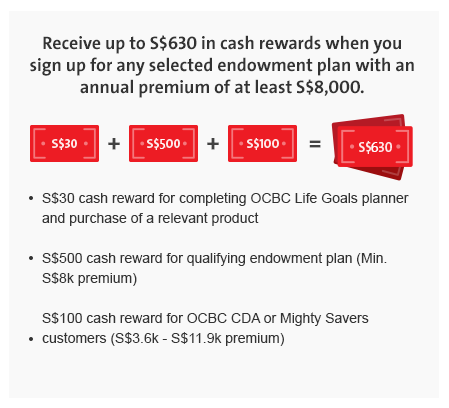

Earn up to 3.01% p.a. in returns with 100% capital guarantee upon maturity. You can also get a 2.5% premium discount if you make a lump sum payment upfront. Apply now to receive up to S$1,600 cash reward!

Enjoy 5% discount on Canon eShop

Capture National Day moments with your kids! Receive 5% off selected items on the Canon eShop when you use the discount code 'OCBCTake5' during checkout.

Longer playtime at Pororo Park

Give your kids extra fun! Get an additional hour of playtime free on weekends at Pororo Park. Simply present your OCBC Baby Bonus card when making payment to enjoy the offer.

The fun never ends at Tayo Station

Enjoy an additional hour of playtime on weekends for free at Tayo Station as well. Simply present your OCBC Baby Bonus Card when making the payment to receive this offer.

Enjoy 10% off your holiday accommodation

Planning for the year-end school holidays? Use the voucher code ‘OCBCSG10’ to get 10% off hotel bookings on Expedia. Payment must be made with an OCBC Credit or Debit card.

Deposits Accounts

Please click here for Terms and Conditions Governing Deposits Accounts.

OCBC National Day Deposits Promotion 2019 (Passbook and Statement Savings Accounts)

Funds deposited must be maintained for 7 months, except for funds deposited with OCBC Mighty Savers®. Withdrawal is permitted before the expiry of the 7 months period, subject to our right to debit fees (including value of gift). Please click here for the full Terms and Conditions.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$75,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$75,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Policy Owners’ Protection Scheme

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Important Notice for GREATAssure Endowment Insurance

Based on an illustrated crediting rate of 4.75% p.a., the yield at maturity will be 3.01% p.a.. Based on an illustrated crediting rate of 3.25% p.a., the yield at maturity will be 1.55% p.a.. The actual benefits payable are dependent on the actual crediting rates and charges, as well as the amounts of any miscellaneous debts and partial withdrawals made. The crediting rate is non-guaranteed and is dependent on the future performance of the non-participating fund. Capital is guaranteed upon maturity, provided no withdrawals are made.

GREATAssure Endowment Insurance is provided by The Great Eastern Life Assurance Company Limited, a wholly owned subsidiary of Great Eastern Holdings Limited and a member of the OCBC Group. The plan provides insurance coverage against death, terminal illness (TI) and total and permanent disability (TPD) throughout the policy term. This plan is not a bank deposit and OCBC Bank does not guarantee or have any obligations in connection with it. The information provided herein is intended for general circulation only. This document does not take into account your particular investment and protection aims, financial situation or needs. You may want to seek advice from a financial adviser before committing to buy the product. If you choose not to seek advice from a financial adviser, you should consider whether the product is suitable for you. As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. Visit ocbc.com/GAEI for the full disclaimers.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

There may be links or hyperlinks which link you to websites of other third parties (the "Third Parties"). OCBC Bank hereby disclaims liability for any information, materials, products or services posted or offered on the website of the Third Parties.