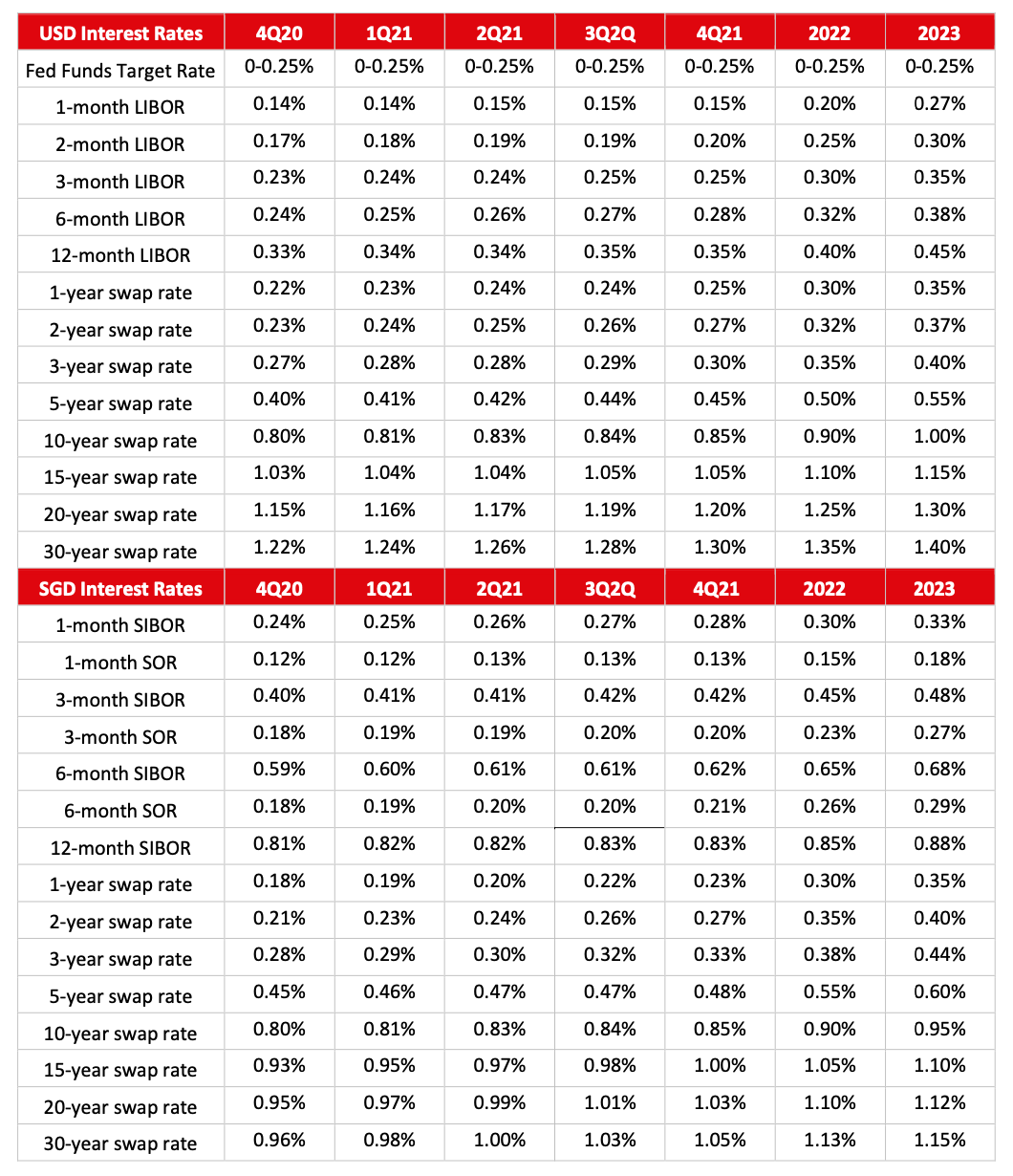

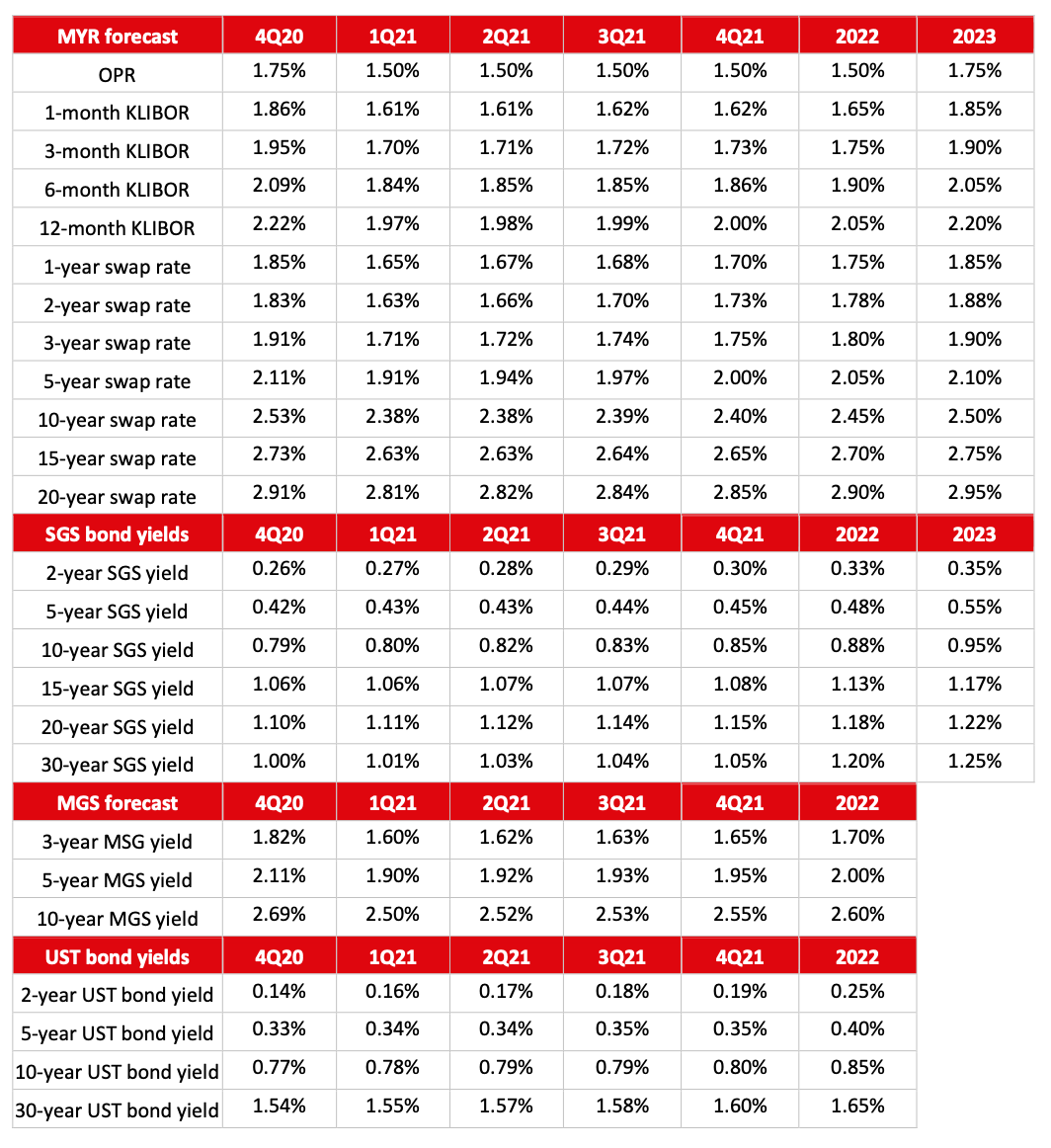

Interest Rate Forecasts (Nov)

- While counting continues for the US elections, signs are emerging that Biden remains primed to become the next President but may be denied a Blue Wave as Republicans retain control of the Senate. Financial market players sustained its “glass half-full” mentality, opting to focus on the likelihood that Biden may be restrained from hiking corporate tax rates and tightening tech regulations. Even the prospect of a smaller fiscal stimulus package was interpreted as less adverse for the UST bond market in terms of funding needs. Market reaction is equities higher, UST unwinding initial sell-off, and USD softer, despite the lingering risk of a contested election and Trump’s threats to mount legal challenges. Near-term, market focus will be dominated by ongoing US election headlines, but the rising global Covid cases and growing lockdowns, especially in Europe may come back to haunt.

- FOMC was a non-event as largely expected, opting to keep the boat on a steady keel even as it explores options to potentially do more to compensate for any fiscal stimulus shortfall to prevent the US economy from sliding. The FOMC statement flagged that employment continued to recover and financial conditions remain accommodative. Fed chair Powell also opined that “we’ll have a stronger recovery if we can just get at least some more fiscal support” even as Fed officials discussed options for modifying their asset purchase program parameters to “deliver more accommodation if it turns out to be appropriate”. The next FOMC meeting is on 15-16 December.

- China’s ruling community party rolled out its guidelines for 14th Five Year Plan as well as 2035 vision. Although it is not clear whether China will set a growth target for its 14th five-year plan, China may still keep a soft growth target for the next 15 years as it plans to boost its GDP per capita to the level on par with moderate developed country by 2035, which is at least US$20000. This hints that China may still need to grow by average 3-4% in real term over the next 15 years. China’s promotion of dual circulation strategy does not mean China will become more inward looking. President Xi announced that China will import about US$22 trillion goods in the next decade. China’s exit of previous administrative intervention including risk reserve for purchasing foreign currency derivative and counter cyclical factor from the daily fixing is a speed bump rather than a game changer. China has limited tool to stop RMB from appreciating due to constraints from its monetary policy. We expect the near term movement of the currency will depend on the outcome of US election.

- Volatility returned to the crude oil market after trading in tight ranges in the past three months. The 3-month implied volatility in Brent rose to as high as 52% in early November after being stuck at 40% since mid-September, after the benchmark crude fell more than 10% in a week. We expect further weakness in the crude complex as we enter the last stretch of 2020.

The information provided herein is intended for general circulation and/or discussion purposes only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person.

Please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase any investment product.

The information in this document is not intended to constitute research analysis or recommendation and should not be treated as such. This does not constitute an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into a transaction or to participate in any particular trading or investment strategy.

Some of the contents in this report are summaries of investment ideas and recommendations set out in research reports disseminated by OCBC Bank and its respective associated and connected corporations (“OCBC Group”). For any interest that OCBC Group might have in the securities and/or issuers of the securities, you may request for a copy of the relevant report from your relationship manager.

Any opinions or views of third parties expressed in this material are those of the third parties identified, and not those of OCBC Group.

No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (including without limitation any statement, figures, opinion, view or estimate) provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

OCBC Bank, its related companies, their respective directors and/or employees (collectively “Related Persons”) may or might have in the future interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.

The information provided herein may contain projections or other forward-looking statement regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures are not necessarily indicative of future or likely performance. Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same.

Investors should note that there are necessarily limitations and difficulties in using any graph, chart, formula or other device to determine whether or not, or if so, when to, make an investment.

The contents hereof are considered proprietary information and may not be reproduced or disseminated in whole or in part without OCBC Bank’s written consent.

Cross-Border Marketing Disclaimers

Please click here for OCBC Bank's cross border marketing disclaimers relevant for your country of residence.