US economy remains resilient

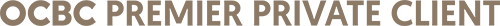

January 2026 reminded financial markets that the global macro regime is still fragile. However, resilient US economic data releases have contributed to delayed market expectations of Fed rate cuts this year. Meanwhile equities swung between AI-led optimism and valuation anxiety. The return of US tariff threats and geopolitical concerns in Venezuela, Iran and Greenland also rekindled fears of policy-driven volatility, especially for globally exposed sectors. The silver lining is that ASEAN economies saw a turbo charge in the second half of 2025 due to the AI-related boom, instead of the expected payback from earlier front-loading efforts ahead of US tariffs. For as long as the AI overdrive is sustained, the growth momentum in the first half of 2026 should be positive. For Asia, the spillovers were felt through three channels: capital flows, trade sentiment and currency gyrations.

Looking ahead to February 2026, markets will focus on whether disinflation resumes decisively in the US, which would reopen the door to the next Fed easing, or whether rates stay on pause mode. There is currently no clarity on the US Supreme Court ruling on Trump’s IEEPA tariffs. Geopolitically, we are watching for concrete trade actions rather than rhetoric from Washington, and for any escalation risks in the Middle East or elsewhere that could reprice energy, shipping and insurance costs. For ASEAN, the key test is resilience – whether domestic demand, tourism and investments can offset external uncertainty in a world that remains more fragmented, politicised and volatile than markets would like.

United States

The US entered January 2026 with a resilient economic backdrop but elevated policy uncertainty. Nevertheless, we believe Trump’s TACO (“Trump Always Chickens Out”) trade is still alive. The US government shutdown could delay key publications and distort incoming indicators, adding complexity to the Fed’s deliberations on the trajectory of policy. Equity markets have so far extended gains amid these crosscurrents, with sentiment supported by the TACO trade. However, the US dollar has weakened marginally so far this year on rising concerns about fiscal credibility, while Treasury yields have increased, influenced by both the spillover from rising Japanese government bond yields and domestic fiscal stress.

The Atlanta Fed’s GDPNow forecasting model estimates that real US GDP growth (seasonally adjusted annual rate) in 4Q2025 is still strong at 4.2% as of 29 January 2026, although this is down from 5.4% on 26 January. Fiscal policy dynamics, however, have emerged as a key risk. Political tensions over the Department of Homeland Security’s (DHS) funding package have intensified significantly after the fatal shootings by federal immigration agents in Minneapolis. The heightened risk of a partial government shutdown introduces uncertainty around the release and quality of critical economic data – empirical inputs that the Fed typically relies upon for policy decisions.

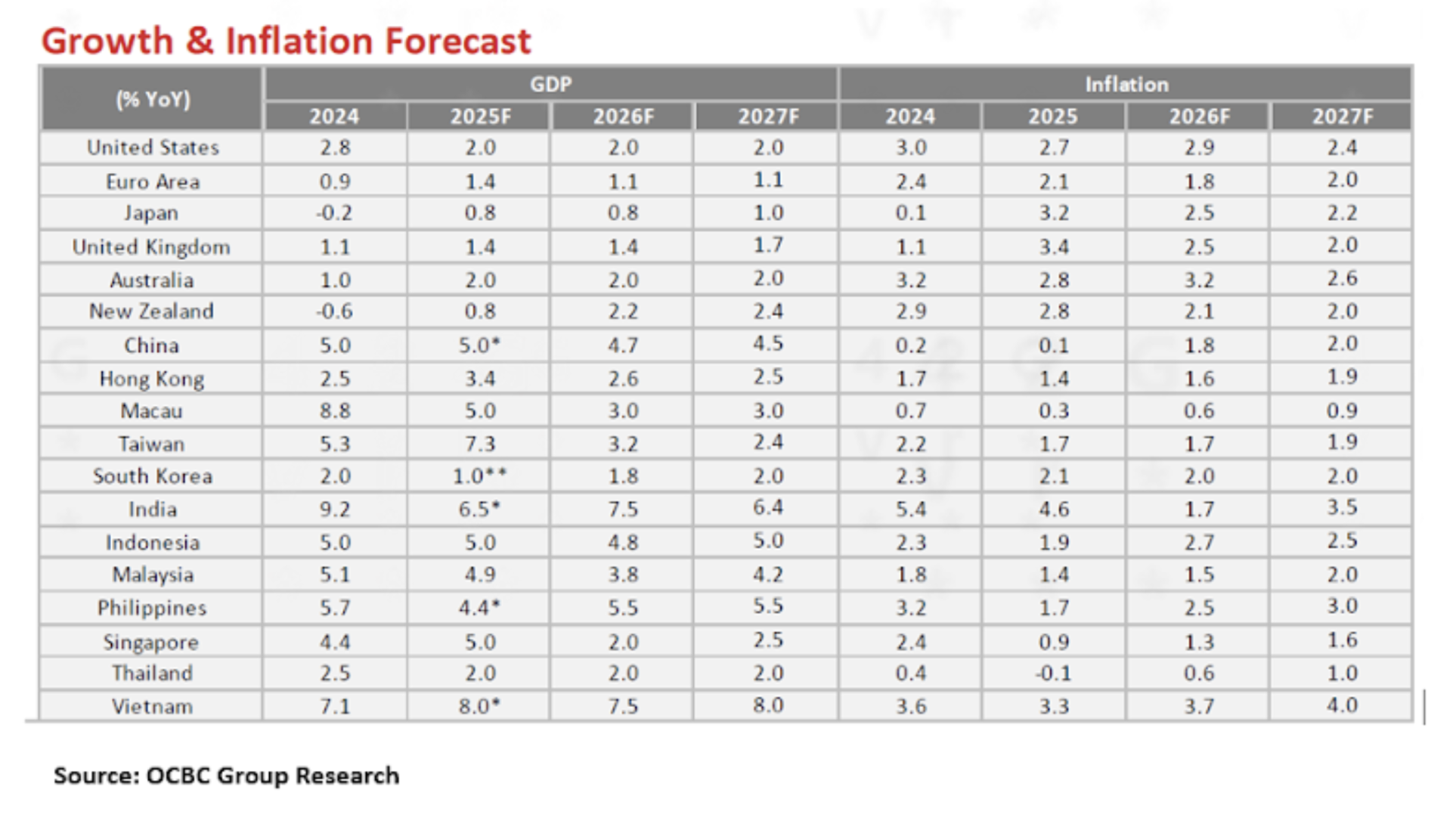

The January FOMC statement sounded more upbeat on economic activity and the labour market, but Powell’s speech was more balanced. We maintain our expectation for one 25bp Fed funds rate cut this year. We have pencilled in this cut for March, while some of Powell’s comments were interpreted as pointing to an extended pause. There are still two rounds of inflation and labour market data before the March FOMC meeting. We will review the expected timing of the next Fed funds rate cut based on the incoming data.

Euro-Area

We continue to see a slower, albeit still resilient, growth trajectory for the region in 2026 at a 1.1% expansion, down from the expected 1.4% in 2025. Meanwhile, on the inflation front, headline inflation eased to 2.0% YoY in December from 2.1% in November, broadly in line with the ECB’s price stability target of 2% over the medium term. Similarly, core CPI eased to 2.3% YoY in December, versus expectations for a steady reading of 2.4%. In terms of monetary policy, our base case is that no additional rate cuts are required based on the economic outlook. Tariff-related uncertainty has faded slightly while domestically, the labour market remains resilient.

Economic growth showed signs of stabilisation in January 2026, supported by firmer confidence and resilient business activity. Surveys from S&P Global showed that eurozone activity remained in expansionary territory, with the HCOB Flash Eurozone Composite PMI Output Index unchanged at 51.5 in January, supported by an increase in new orders. Business optimism reached a 20‑month high, pointing to improving near‑term sentiment despite still‑mixed external demand. Tensions between the EU and the US were heightened as President Trump threatened tariffs on several EU members regarding concerns about Greenland. Tensions were tempered following talks with Mark Rutte, Secretary General of NATO. Elsewhere, the EU and India officially concluded negotiations on free trade agreements on 27 January 2026, which are expected to eliminate tariffs on over 90% of bilateral trade.

Japan

We expect GDP growth of 0.8% in 2026 as business fixed investment plans have become more proactive, with uncertainty regarding tariff policy reduced to some extent. Private consumption is likely to stay resilient. The BOJ kept its policy rate unchanged at 0.75% at its January meeting, as expected. There is room for further, gradual policy normalisation. To that end, we have pencilled in two 25bp rate hikes, bringing the BOJ target rate to 1.25% by end-2026, with the first hike expected at the upcoming March meeting and the second one in 4Q2026.

Tokyo CPI eased more-than-expected to 1.5% YoY in January from 2.0% in December 2025 while core inflation also eased in tandem. The labour market indicators pointed to continued tightness, with the December jobless rate unchanged at 2.6% and the job-to-applicant ratio broadly stable at 1.19.

China

China’s GDP growth moderated to 4.5% YoY in 4Q2025, easing from 4.8% YoY in 3Q2025, broadly in line with market expectations. For full-year 2025, the economy expanded by 5.0% YoY, meeting the government’s target of “around 5%” growth. We expect China to set its growth target at “around 5%” again in 2026. Overall, the three surprises in 2025 – resilient external demand, but weaker investments and entrenched disinflation – are likely to extend into 2026. Supported by still-robust exports, we expect growth to reaccelerate modestly to around 4.7% YoY in 1Q2026. However, on a full-year basis, China’s GDP growth is likely to slow from 5.0% in 2025 to around 4.7-4.8% in 2026, constrained by sluggish investments and lingering balance-sheet adjustment.

While the headline growth numbers were largely unsurprising, a closer look at the composition of growth reveals three notable surprises in 2025 – one positive and two negatives. On the upside, net exports contributed around 1.6 percentage points to overall GDP growth in 2025, accounting for roughly one-third of total expansion, and once again emerged as a key stabilising force for the economy. On the downside, growth deceleration was primarily driven by weaker investment activity. This reflects the ongoing correction in property investments, alongside a simultaneous softening in infrastructure and manufacturing investments. A second negative surprise lies in persistent disinflationary pressures. The GDP deflator has remained in negative territory for 11 consecutive quarters, with no clear signs of bottoming out – marking the longest disinflationary streak in China’s modern history.

The information provided herein is intended for general circulation and/or discussion purposes only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The information in this document is not intended to constitute research analysis or recommendation and should not be treated as such.

Without prejudice to the generality of the foregoing, please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase the investment product. In the event that you choose not to seek advice from a financial adviser, you should consider whether the product in question is suitable for you. This does not constitute an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into a transaction or to participate in any particular trading or investment strategy.

The information provided herein may contain projections or other forward looking statement regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures are not necessarily indicative of future or likely performance. Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same. Investments are subject to investment risks, including the possible loss of the principal amount invested.

The Bank, its related companies, their respective directors and/or employees (collectively “Related Persons”) may or might have in the future interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. The Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.

No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (including without limitation any statement, figures, opinion, view or estimate) provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

The contents hereof may not be reproduced or disseminated in whole or in part without OCBC Bank's written consent. The contents are a summary of the investment ideas and recommendations set out in Bank of Singapore and OCBC Bank reports. Please refer to the respective research report for the interest that the entity might have in the investment products and/or issuers of the securities.

Investments are subject to investment risks, including the possible loss of the principal amount invested. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures, predictions or projections are not necessarily indicative of future or likely performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

This document may be translated into the Chinese language. If there is any difference between the English and Chinese versions, the English version will apply.

Cross-Border Marketing Disclaimers

OCBC Bank's cross border marketing disclaimers relevant for your country of residence.

Any opinions or views of third parties expressed in this document are those of the third parties identified, and do not represent views of Oversea-Chinese Banking Corporation Limited (“OCBC Bank”, “us”, “we” or “our”).