PREMIERLIFE GENERATION V (SGD)

Enjoy lifetime monthly payouts to supplement your lifestyle

A single premium plan that address both your retirement and wealth transfer needs

Receive lifetime monthly payouts starting from the 3rd policy year

Obtain lifetime monthly payouts from the 3rd policy year, consisting of guaranteed survival benefit (i.e. monthly income) and non-guaranteed cash bonuses.

Obtain lifetime monthly payouts from the 3rd policy year, consisting of guaranteed survival benefit (i.e. monthly income) and non-guaranteed cash bonuses.

Benefit from your policy’s growth potential

Your policy’s surrender value is guaranteed at 80% of your single premium from day one, and has the potential to grow over time while you receive the monthly payouts from the 3rd policy year.

Your policy’s surrender value is guaranteed at 80% of your single premium from day one, and has the potential to grow over time while you receive the monthly payouts from the 3rd policy year.

Secure a lump sum inheritance without worry

Receive a lump sum payout in the event of death or terminal illness which consists of 105% of the single premium and non-guaranteed terminal bonus, less any debt.

Receive a lump sum payout in the event of death or terminal illness which consists of 105% of the single premium and non-guaranteed terminal bonus, less any debt.

This is not a fixed or savings deposit. It is a single premium whole of life participating insurance plan.

There is an option to take up a loan to fund part of your insurance premium.

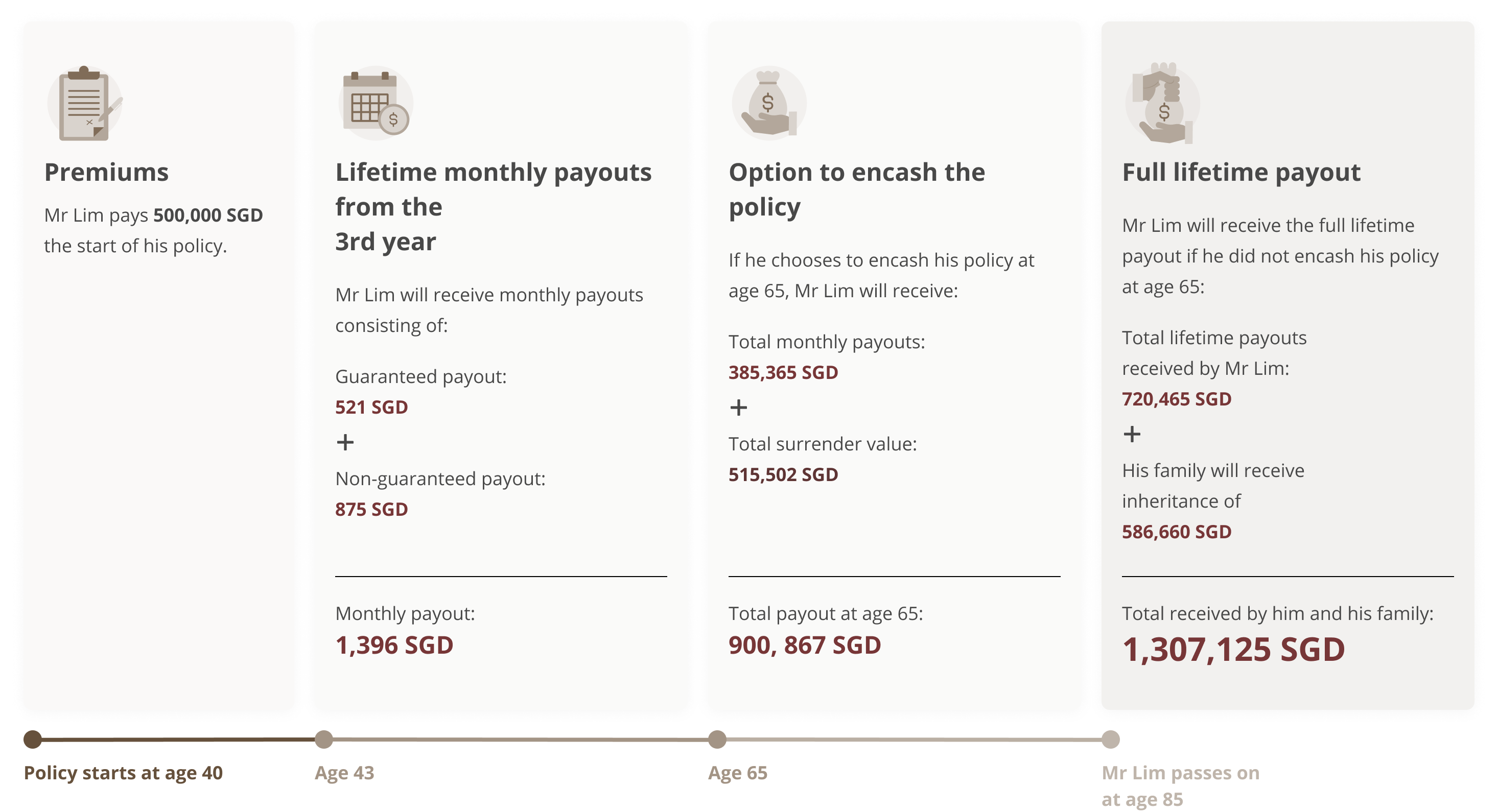

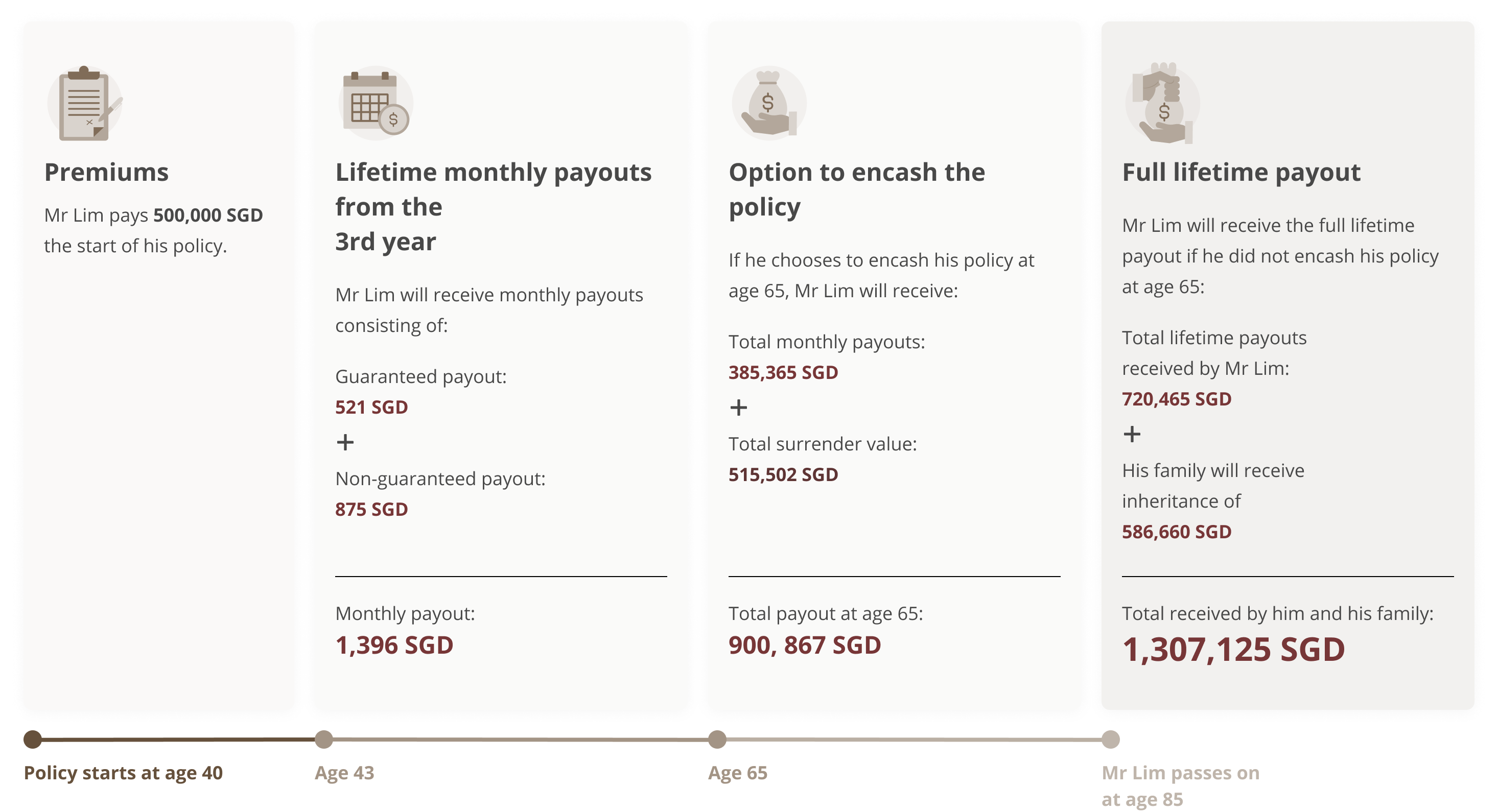

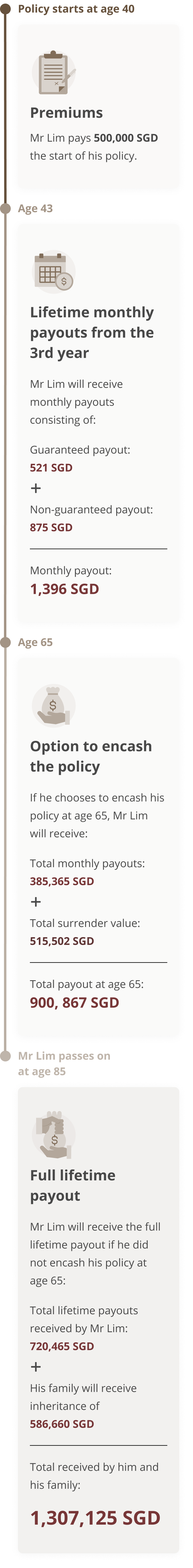

Planning for 2 generations with PremierLife Generation V (SGD)

In the illustration below, the illustrated figures consist of both guaranteed and non-guaranteed bonuses.

The non-guaranteed bonuses are based on an illustrated investment rate of return of the participating fund at 4.25% p.a. and the actual benefits payable will depend on how the participating fund performs in the future.

Mr Lim's profile

40 years old

Married with 2 children

Policy details

Monthly payouts from the 3rd policy year

The figures used are for illustrative purposes and subject to rounding. Please refer to the policy illustration for the exact values. The non-guaranteed bonuses are based on an illustrated investment rate of return of the participating fund at 4.25% a year.

Based on an illustrated investment rate of return at 3.00% a year, Mr Lim will receive monthly payouts of S$976 from age 42. The total monthly payouts till age 85 will be S$503,616 and the inheritance will be S$557,119. The total benefits he and his family would receive is S$1,060,735. If he chooses to encash his policy at age 65, the total monthly payouts received would be S$269,376, the total surrender value would be S$460,537 and the total amount received would be S$729,913. The actual benefits payable are dependent on the future performance of the participating fund.

Find out more about PremierLife Generation V (SGD)

or visit any of our Premier Banking Centres

Customise your plan

Customise your plan

You may take up a loan from OCBC to fund part of your insurance policy. To find out more, please speak to your Relationship Manager.

Financing will be suitable for you if you are able to:

- Make payments towards your loan during your lifetime

The interest rate you are paying is subject to interest rate fluctuations.An increase in interest rate will result in higher interest payment. If there is a default in payment, the bank may be forced to surrender the policy and you will lose the protection from your policy.

- Repay part of your loan if your loan exceeds the value of your policy

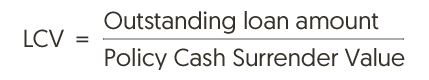

If the Loan-to-Collateral Value (LCV) increases to above 90% (or such percentage as may be determined by OCBC from time to time in its absolute discretion), you will be required to make repayment to reduce your outstanding loan amount. In the event if you are unable to do so, the bank may be forced to surrender the policy and you will lose the protection from your policy.

You have an option to pay off the loan during your loan tenure.

- Monthly instalment

Make regular payments towards the principal amount.

- Lump sum payment

Pay off the loan partially or in full.

Important Notice

All ages specified refer to age next birthday. PremierLife Generation V (SGD) is underwritten by The Great Eastern Life Assurance Company Limited, a wholly-owned subsidiary of Great Eastern Holdings Limited and a member of the OCBC Group. This plan is not a bank deposit and OCBC Bank does not guarantee or have any obligations in connection with it. PremierLife Generation V (SGD) is only available in SGD currency. This document does not take into account your particular investment and protection aims, financial situation or needs. You may want to seek advice from a financial adviser before committing to buy the product. If you choose not to seek advice from a financial adviser, you should consider whether the product is suitable for you. As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. Any and all scenario analysis that are set out is provided for demonstrative purposes only. It does not present all possible outcomes or describe all possible factors that may affect the value of the proposed transaction. This document is for general information only. It is not a contract of insurance or an offer to buy an insurance product or service. It is also not meant to provide any insurance or financial advice. The specific terms and conditions of the plan are set out in the policy documents. If you are interested in the insurance policy, you should read the product summary and policy illustration (available from us) before deciding whether to buy this product. The premium financing is provided by OCBC Bank, while the insurance benefits are provided by The Great Eastern Life Assurance Company Limited. We do not guarantee, represent or warrant that any of the information provided in this document is accurate and you should not rely on it as such. We do not undertake to update the information or to correct any inaccuracies. All information may change without notice. We will not be liable for any loss or damage arising directly or indirectly in connection with or as a result of you acting on the information in this document. This document may be translated into the Chinese language. If there are any differences between the English and Chinese versions, the English version will prevail. This advertisement has not been reviewed by the Monetary Authority of Singapore. Information presented as at 1 March 2024.

Policy Owners’ Protection Scheme

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).