Your guide to home loan speak

Your guide to home loan speak

Understand the key home financing terms, abbreviations, and technical terms.

Here’s a list of simplified explanations for key terms relating to residential property ownership, purchases, and home loans.

Approval-In-Principle (AIP)

This is an approved loan amount given by the bank typically based on a borrower’s declaration of income and debts. It may or may not be based on the borrower’s credit report and assessment of actual affordability. Hence, it is not a binding document and may be subject to other checks in the actual application process. It is typically valid for 30 days.

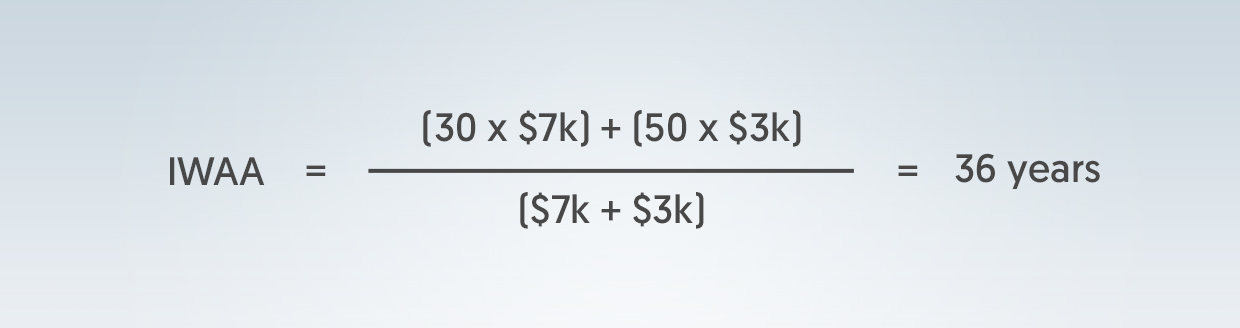

Income-weighted average age (IWAA)

When there is more than one borrower for the loan, the bank will compute the IWAA of all the borrowers.

For example:

Borrower A (age 30) earns $7,000 per month

Borrower B (age 50) earns $3,000 per month

Late charge or late fee

This is a fee payable when the monthly repayment instalment is not received by the due date.

Loan tenure or repayment period

This is determined by the bank’s credit guidelines and rules of the the Monetary Authority of Singapore.

Loan-to-Value (LTV)

This is the home loan amount you can borrow quoted as a percentage of the current market value of the property.

If the loan is to finance the purchase of residential property, the current market value or the property purchase price (excluding discounts, rebates or other benefits that you receive from the seller or any other party that has the effect of reducing the purchase price of a property), whichever is lower, will be applied.

Lock-in period

During this period, fees and charges may apply if you do a partial or full repayment of your home loan or if you refinance with your existing bank or a different bank.

MAS Notice 632 on Residential Property Loans

MAS Notice 632 issued by the Monetary Authority of Singapore contains rules governing credit facilities secured by residential properties in Singapore. These include rules on Loan-to-Value, loan tenure, income-weighted average age, prohibition of interest-only loans, treatment of discounts, rebates or other benefits, and the borrower-mortgagor rule, and the guarantor-mortgagor rule.

MAS Notice 645 on Computation of Total Debt Servicing Ratio for Property Loans

MAS Notice 645 issued by the Monetary Authority of Singapore contains rules governing computation of affordability for credit facilities secured by residential properties in Singapore and overseas. The rules prescribe the computation of the Total Debt Servicing Ratio and Mortgage Servicing Ratio.

Mortgage or charge

The terms “mortgage” and “charge” are often used interchangeably.

A charge is a security whereby the owner of a property (or mortgagor) gives the bank the right to resort to the property for payment of the loan if the loan goes into default.

A mortgage is defined as including any charge on any property for securing money or money’s worth.

Mortgagee vs mortgagor

The lending bank is typically the mortgagee, while the owner of the property is typically the mortgagor.

All borrowers of a home loan are required to be mortgagors of the residential property for the following scenarios:

- Home loan for the purchase of a residential property where the Option to Purchase was granted on or after 29 June 2013;

- Refinancing of a home loan for a residential property where the Option to Purchase was granted on or after 29 June 2013.

Mortgage equity withdrawal loan

This refers to loans secured on the borrower’s equity in a residential property (otherwise known as term loan).

The loan may be secured by:

- An unencumbered property whereby the bank grants a term loan on the property; or

- A property with an existing facility whereby the bank grant an additional term loan facility on the difference between the maximum Loan-to-Value based on current market value less the existing facility with the bank.

Mortgagee Interest Policy (MIP)

The MIP protects a bank’s financial interest. Some banks may require you to take up a MIP if your private apartment or condominium is mortgaged to them.

The MIP covers the outstanding property loan amount and allows the bank to claim for repayment of the outstanding amount, in the event the property is damaged due to an insured event (such as a fire) and the bank has concerns over your repayment ability.

You remain liable for the outstanding amount. When there is a claim by the bank for full repayment of the outstanding amount, you will need to repay this amount to the insurer. When the bank claims for partial repayment of the outstanding amount, you will need to repay the insurer for the amount claimed by the bank as well as the bank for the remaining outstanding loan amount that was not claimed. You should approach your bank for further information.

Refinancing vs repricing

Refinancing is when you switch to a new home loan package either with your existing bank or another lender. There are rules to be observed for refinancing.

Repricing is when you switch to a new interest rate package with your existing bank. It is considered a type of refinancing and hence, subject to rules on refinancing.

Residential Property Loan Fact Sheet

The Residential Property Loan Fact Sheet contains key features of the home loan and highlights the implication of possible future increases in interest rates on your monthly repayment instalments. When you discuss taking up a home loan with a bank, the bank must provide you with a Residential Property Loan Fact Sheet.

Singapore Interbank Offered Rate (SIBOR)

This is the rate at which banks borrow from one another. The Association of Banks in Singapore publishes the SIBOR at 11 a.m. on each working day. There is a SIBOR for each fixed period, for example, the 3-month SIBOR is fixed once every 3 months.

Swap Offer Rate (SOR)

SOR is the Singapore Interbank Offered Rate (SIBOR) plus lending costs incurred by banks according to a formula.

For more information, read the guide to home loans published by the Association of Banks in Singapore and MoneySENSE, “What You Should Know about Housing Loans – Key Questions to Ask the Bank Before Taking a Housing Loan” (PDF, 1.6mb).

Disclaimer

The information provided herein has been provided by third party source(s) and is for general information only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person, and does not constitute an offer or solicitation by OCBC Bank to provide loan or financing to any particular person or to enter into a transaction. You rely on the content herein at your own risk.

No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein. Any reference to any specific entity, authority, area, figures, property or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same.