The lowdown on property loan regulations

The lowdown on property loan regulations

A summary of all the information about LTV, TDSR, MSR and more.

There are two key regulations governing property loans to ensure a sustainable property market and to safeguard home buyers from overcommitting to a property purchase.

The first one, MAS Notice 632, applies to borrowers purchasing a residential property located in Singapore.

The second one, MAS Notice 645, applies to an individual or an entity set-up for the purchase of properties located in Singapore or Overseas.

| MAS Notice 632 Residential Property Loan |

MAS Notice 645 Guidelines on Total Debt Servicing Ratio (TDSR) |

|---|---|

|

MAS Notice 632 includes regulations relating to the:

Applies to:

|

It provides guidelines on calculating the Total Debt Servicing Ratio (TDSR), and Mortgage Servicing Ratio (MSR) whereby

Applies to:

|

MAS Notice 632 on residential property loan

This applies to any loan secured against a residential property in Singapore, whether for:

- Purchase of a residential property;

- Refinancing of a residential property;

- Other loans secured by a residential property

To secure a loan against a residential property, the applicant must be the property owner, i.e. the borrower must be a mortgagor.

When banks calculate the loan amount they will look at the property’s current market value, and the purchase price. The Loan-To-Value or LTV is the ratio of the loan amount against the lower of the purchase price or the current market value. The purchase price will be adjusted to deduct any discounts, rebates, or benefits included in the purchase of the property or in obtaining a home loan.

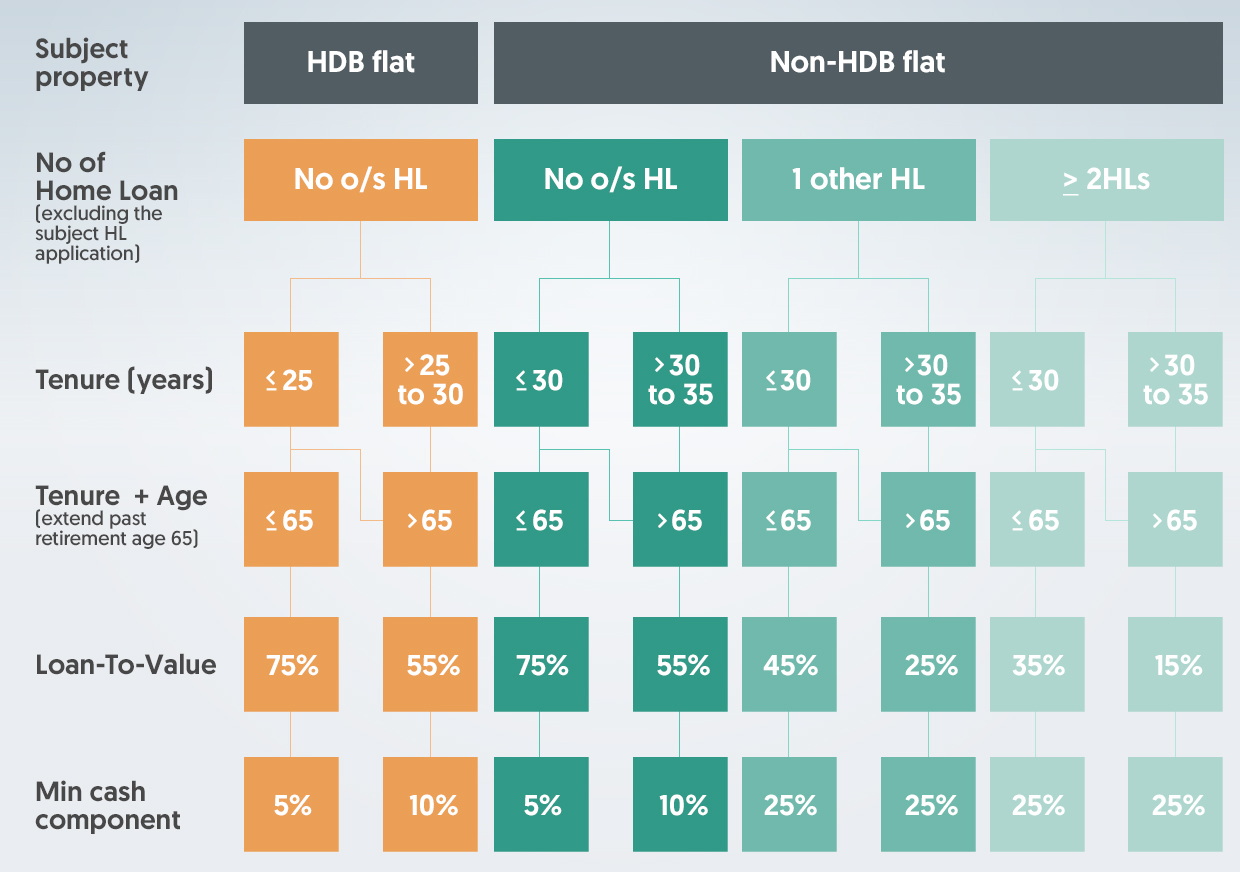

Here’s a diagram showing the maximum LTV, and the minimum cash required (own cash, not from CPF) to purchase a private or HDB property.

LTV, Tenure & Min Cash Down payment for property purchase

^ If more than 1 housing loan, LTV would be reduced, similar to non-HDB flats

^ If more than 1 housing loan, LTV would be reduced, similar to non-HDB flatsNote: LTV for companies is 15%

Note: o/s stands for 'outstanding'

MAS Notice 645 and guidelines on TDSR for property loans

This applies to properties located in Singapore or overseas, and includes residential, commercial or industrial property loans, land and construction loans.

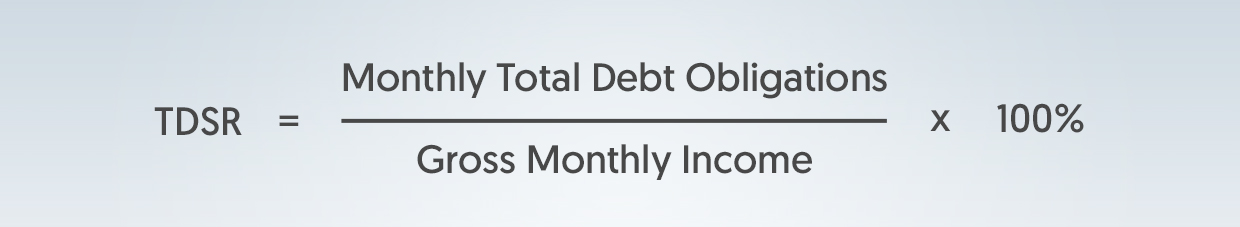

Your total monthly expenditure, including the payment of the loan you’re applying for, must not exceed 55% of your gross monthly income. The figure used for your expenditure must include other property loans, car loans, credit card payments, and part of any other debt you’re a guarantor. The TDSR is calculated using the following equation.

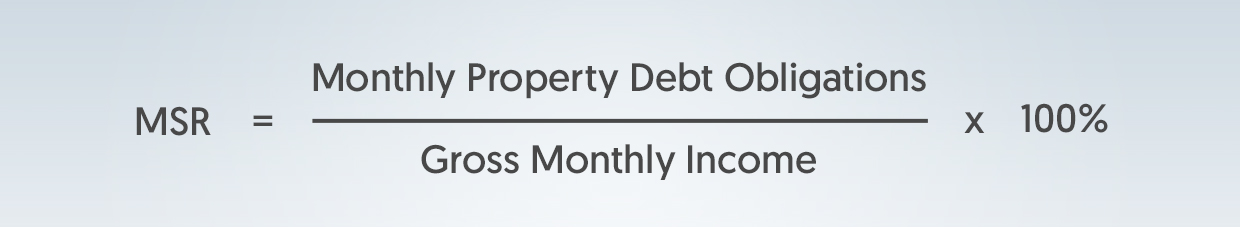

If you’re purchasing a HDB flat (new/resale) or purchasing an EC within the Minimum Occupation Period, your total monthly property-related expenditure, including the payment of the loan you’re applying for, must also not exceed 30% of your total gross monthly income. This is referred to as the Mortgage Servicing Ratio (MSR). The MSR is calculated using the following equation.

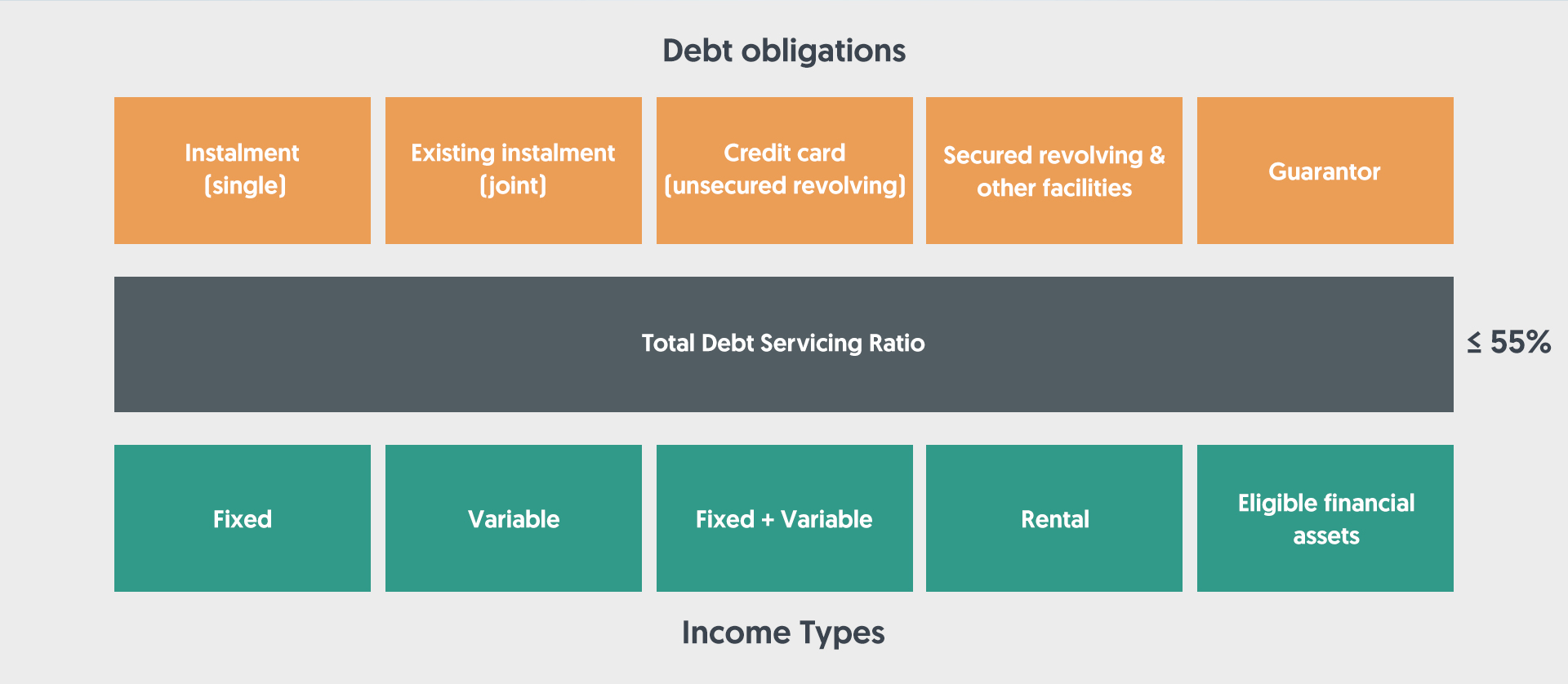

Here is a diagram showing what is taken into account as income and debt for TDSR.

Breakdown of debt components for TDSR:

- Instalment (single): Instalment on loan, at higher of 3.5%^ or current interest rate prevailing (^4.5% for non-residential properties)

- Existing instalment (joint): Instalment apportioned based on income of borrowers (evidence of joint income required)

- Credit card (unsecured revolving): Min payment in latest statement or interest on full credit limit

- Secured revolving & other facilities: Monthly interest on amount drawndown or interest on full credit limit

- Guarantor: Min 20% of instalment on loans guaranteed by borrower

Breakdown of income components for TDSR:

- Fixed: 100% monthly income excluding employer’s CPF contribution

- Variable: 70% of the average monthly variable income earned in the past 12 months excluding employer’s CPF contribution

- Fixed + Variable: 100% Fixed + 70% Variable

- Rental: 70% if borrower is the landlord, stamped tenancy agreement with min 6 months remaining lease

- SGD deposits:

100% value divided by 48 if pledged for ≥ 4 years

30% value divided by 48 if not pledged to the bank orif the pledge period is < 4 years - Other eligible financial assets:

70% value divided by 48 if pledged for ≥ 4 years

30% value divided by 48 if not pledged to the bank or if the pledge period is < 4 years

Monthly instalment of an existing property you are selling can be excluded from TDSR if you provide the required documents:

- Purchasing or re-financing a HDB flat or EC within MOP:

A copy of your signed undertaking to HDB committing to complete the sale of your existing property and provide a written declaration that you will sell your existing property in accordance to the signed undertaking to HDB

- Purchasing or re-financing a private property or EC after MOP:

Selling existing private property or EC after MOP: S&P of the existing property sold, and certificate from IRAS showing that stamp duty has been paid on the signed agreement

Selling existing HDB flat: letter from HDB approving the sale of the flat

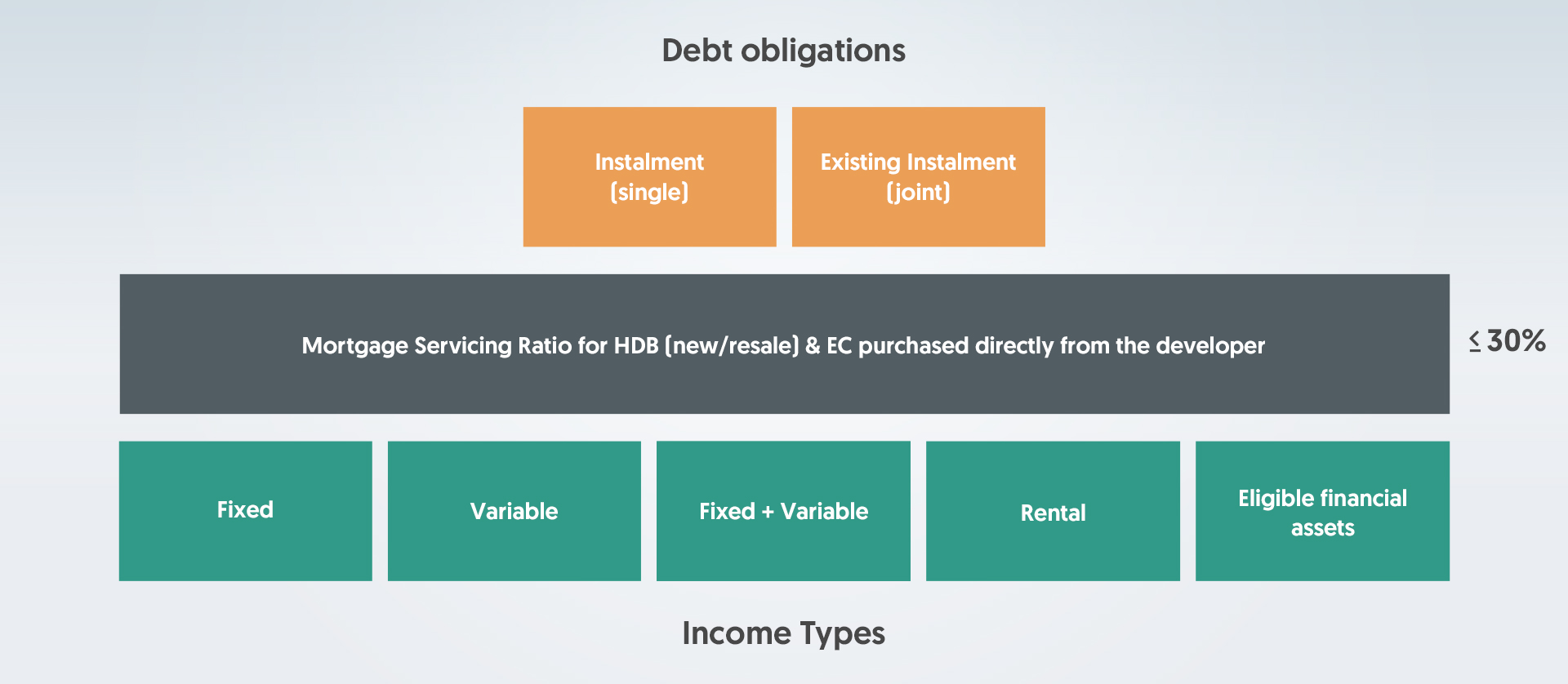

Here is a diagram showing what is taken into account as income and debt for MSR.

Breakdown of debt components for MSR:

- Instalment (single): Instalment on housing loan, at higher of 3.5% or current interest rate prevailing

- Existing instalment (joint): Instalment apportioned based on income of borrowers (evidence of joint income required)

Breakdown of income components for MSR:

- Fixed: 100% monthly income excluding employer’s CPF contribution

- Variable: 70% of the average monthly variable income earned in the past 12 months excluding employer’s CPF contribution

- Fixed + Variable: 100% Fixed + 70% Variable

- Rental: 70% if borrower is the landlord, stamped tenancy agreement with min 6 months remaining lease

- SGD deposits:

100% value divided by 48 if pledged for ≥ 4 years

70% value divided by 48 if not pledged to the bank or if the pledge period is < 4 years - Other eligible financial assets:

70% value divided by 48 if pledged for ≥ 4 years

30% value divided by 48 if not pledged to the bank or if the pledge period is < 4 years

Monthly instalment of an existing HDB or EC within MOP can be excluded from MSR if you provide a copy of your signed undertaking to HDB committing to complete the sale of your existing property and provide a written declaration that you will sell your existing property in accordance to the signed undertaking to HDB.

This guide is for general information only. This summarises the key requirements and regulations applicable to property loans. The requirements and regulations are subject to changes from time to time.

Article was originally published on 14 December 2017.

Disclaimer

The information provided herein is for general information only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person, and does not constitute an offer or solicitation by OCBC Bank to provide loan or financing to any particular person or to enter into a transaction.

No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein. Any reference to any specific entity, authority, area, figures, property or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same.

The contents of this article are considered proprietary information and may not be reproduced or disseminated in whole or in part without OCBC Bank’s written consent.