Step-by-step guide to financing your new home

Step-by-step guide to financing your new home

Getting a private property? Between loan application and key collection, here's what to expect and what's needed from you.

Getting your private property purchase financed

Step 1Receive the Option to Purchase An Option to Purchase (OTP) document gives you exclusive rights to a property for a short agreed amount of time (usually 2 to 5 weeks). You have an option fee, which is 1% of the property's purchase price. This makes the seller contractually obliged to make the property available to you should you proceed with the purchase. To exercise your option to purchase, you must pay a full deposit, which is usually 5%. If you do not proceed with the purchase, the seller will keep the 1% deposit. |

|

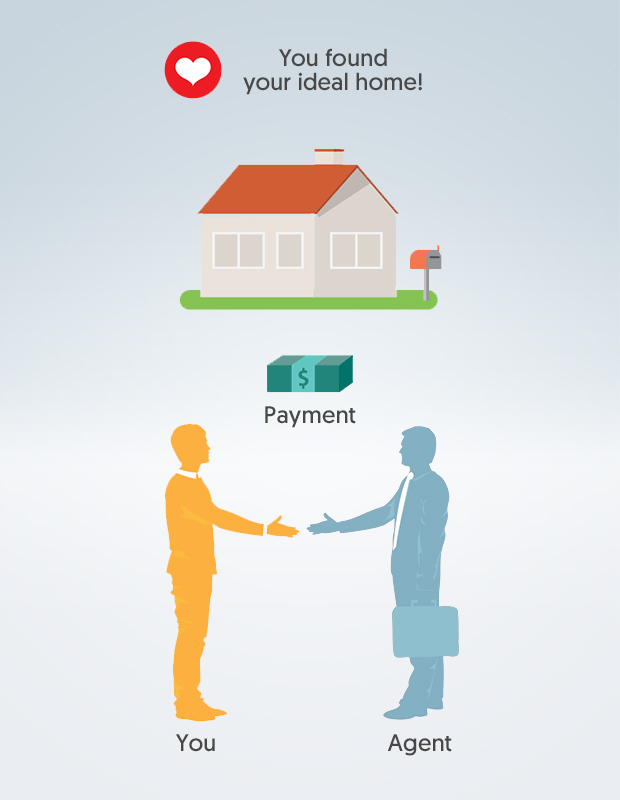

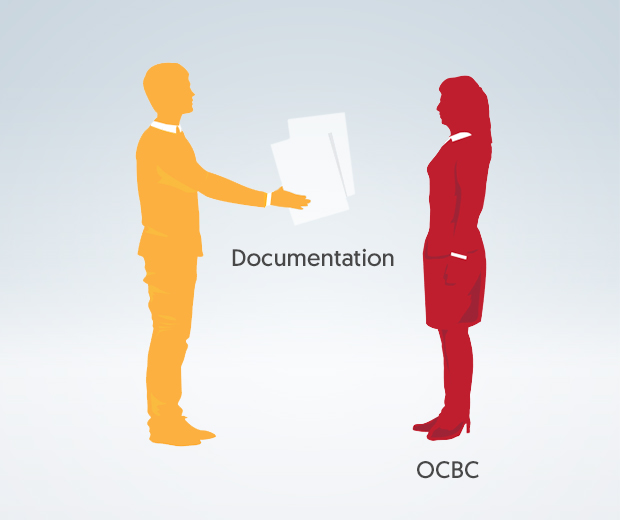

Step 2Apply for your home loan Now that you've found and reserved your dream property, you need to secure a home loan to help pay for it. A mortgage specialist will discuss your financing needs, assess your affordability, and advise you on the next steps. You will need to provide:

|

|

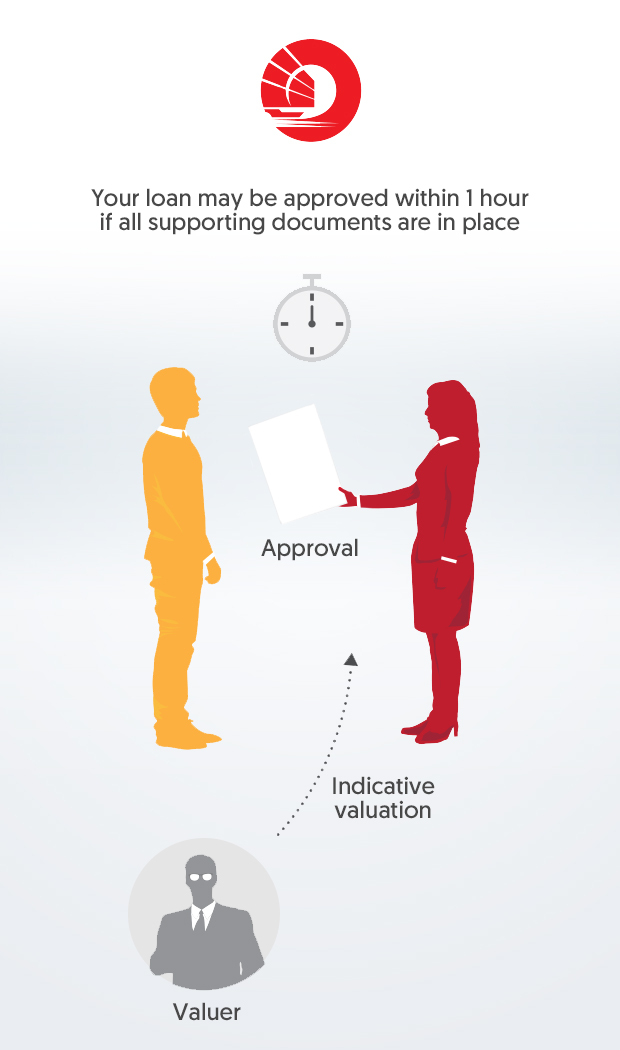

Step 3Accept your loan offer When your application is approved, the bank will issue you with a Letter of Offer containing all the details of your selected home loan package. If you have all the required documents, approval can take as little time as 1 hour. The documents you need to sign include:

|

|

Step 4Sign the Option to Purchase You'll need to fulfil the requirements of exercising your option to purchase, including paying the remaining 4% of the booking fee. Stamp duty is payable 14 days from this step. |

|

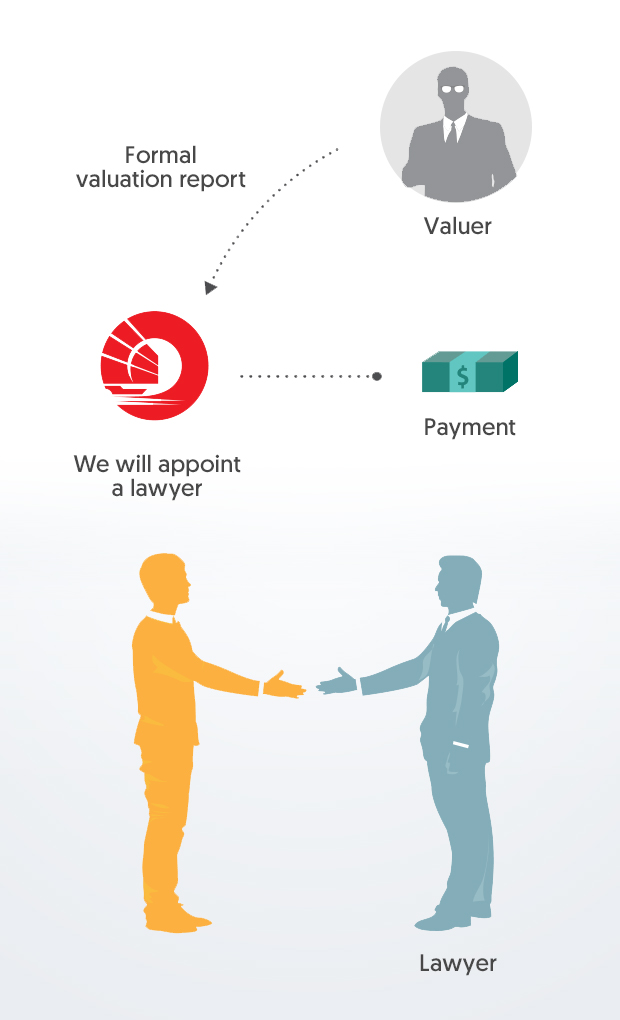

Step 5Await legal checks Your lawyer will exercise the option to purchase on your behalf and take care of all the necessary legal checks. He or she can also offer advice on the unfinanced portion of your purchase. |

|

Step 6Make the final payment Once all the legal checks are completed, you will need to sign your mortgage document. At this point, the unfinanced part of your purchase will need to be paid using your own cash. And of course, you'll need to pay your lawyer. For properties still under construction, the mortgage will remain in escrow. The unfinanced portion can be paid in stage payments, leading up to the completion of the building. |

|

Step 7Collect your keys You collect your keys on the day of completion. Your bank will disburse the loan and you will receive the loan disbursement letter. Within a month of completion, your lawyer will lodge your property's title deed with the Singapore Land Authority (SLA). The original title deed will be sent to your bank for safekeeping, and you'll receive a copy. |

|

Step 8Start repaying your home loan Your first instalment will be due on the first day of the following month, and every month thereafter. You can pay with funds from your bank. You can view your loan through OCBC online banking. You will also receive an annual loan statement. |

|

Summary

A little preparation can help you to speed up both of these processes. Just having the correct documents available when required can save time, allowing your mortgage specialist to provide the most accurate advice, and keep the process moving.

Disclaimer

The information provided herein is for general information only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person, and does not constitute an offer or solicitation by OCBC Bank to provide loan or financing to any particular person or to enter into a transaction.

No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein. Any reference to any specific entity, authority, area, figures, property or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same.

The contents of this article are considered proprietary information and may not be reproduced or disseminated in whole or in part without OCBC Bank's written consent.