Are Money Market Rate Spikes Warning Signs?

One question we hear from clients is whether the recent surges in money market rates in the US and Hong Kong, namely, the US repo rate (repurchase agreement rate) and the HIBOR (Hong Kong Interbank Overnight Offered Rate) – serve as warning signs of a market dislocation ahead.

We agree that these events need to be assessed carefully, as the end of bull markets is often accompanied by discordant warning signs. For instance, one would recall that months before the failure of Lehman Brothers in September 2008, the Federal Reserve had to set up a term auction facility in August 2007 to supply short term credit to banks holding sub-prime mortgages.

One difficulty in assessing these events, however, is that they often take on the appearance of prescience only with the benefit of hindsight. In addition, many are false alarms, or some warn of potential dangers that would likely be averted once we also consider the larger picture and other forces at play.

Investors had faced similar fears in late 1998 due to the Russian debt default and the failure of Long-Term Capital Management, a large US hedge fund which posed systemic risks to the financial system. And yet the risk of a global recession was successfully offset by the Federal Reserve cutting rates by 75 basis points. From 4Q1998, global equities subsequently rose about 60% over the next 18 months.

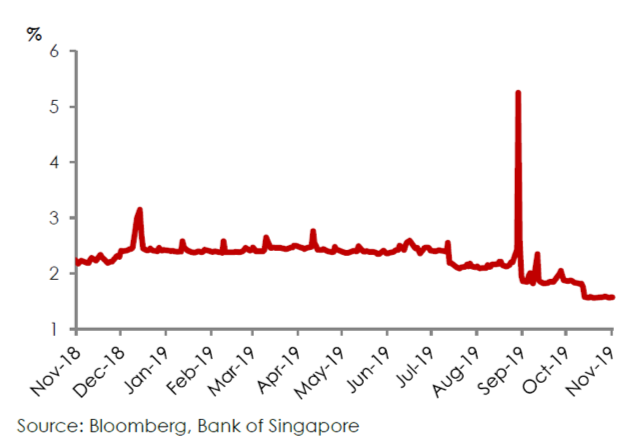

The US repo rate spike in September 2019

The widely reported spike in US repo rates in mid-September was due to a confluence of factors.

During these episodes, we saw large supplies of new Treasuries issuances absorbed by the market, which coincided with seasonal demand for cash from corporate treasuries due to quarterly tax payments.

Demand for liquidity was also driven by tighter financial requirements in recent years which imposed constraints on the use of liquidity at banks. For instance, coverage requirements related to resolution planning have increased the amount of liquidity that some large US banks must maintain daily.

From a broader perspective, this also suggests that the Federal Reserve’s balance sheet had shrunk too much between 2018 and September 2019. But the Federal Reserve had already attempted to address this gap in October this year by significantly increasing the size of its temporary overnight repo operations, from US$75b to US$120b daily, and also growing its balance sheet by buying a sizeable US$60b of T-bills per month.

The Secured Overnight Financing Rate (SOFR)

We see the Federal Reserve’s actions as supportive of overall financial conditions and would reduce (albeit not eliminate) the likelihood of more repo rate volatility ahead.

Additionally, we see the Federal Reserve to be averse to the headlines and distractions posed by these repo spikes and would be prepared to decisively expand the size of its repo operations if required.

Recent surge of the HIBOR in Hong Kong

Temporary surges in the HIBOR are not uncommon and the most recent one was driven by both temporary and structural factors.

One temporary factor was the sizeable Alibaba Hong Kong listing, where strong margin demand led to brokerages borrowing HKD from the interbank markets. The lift in 1-month HIBOR was evident and it is now showing some signs of easing as this temporary factor unwinds.

In terms of structural factors, HKD deposit growth in Hong Kong banks has been subdued since mid-2018, which has led to increased deposit competition. Looking ahead, the launch of virtual banks in Hong Kong would likely intensify competition for deposits, and overall, banks could need to keep rates elevated to stabilize their HKD deposit bases. This would translate to some sustained upward pressure on the HIBOR going forward.

No cause for panic

While canaries in the coalmine should be watched carefully, we see no cause for panic at this juncture.

The global manufacturing slump is in part being offset by the support provided by monetary policy easing over the year to date. The uncertainty from the US-China trade war remains a wildcard, but we see better-than-even odds that a Phase 1 trade deal would eventually be ratified and believe that the upcoming tariffs on 15 December could potentially be postponed or suspended.

Our assessment of the bigger picture and incoming data further corroborates our base case scenario of global growth finding stabilization in mid-2020, which underpins our constructive stance on markets.

>

The information provided herein is intended for general circulation and/or discussion purposes only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The information in this document is not intended to constitute research analysis or recommendation and should not be treated as such.

Without prejudice to the generality of the foregoing, please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase the investment product. In the event that you choose not to seek advice from a financial adviser, you should consider whether the product in question is suitable for you. This does not constitute an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into a transaction or to participate in any particular trading or investment strategy.

The information provided herein may contain projections or other forward looking statement regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures are not necessarily indicative of future or likely performance. Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same. Investments are subject to investment risks, including the possible loss of the principal amount invested.

The Bank, its related companies, their respective directors and/or employees (collectively “Related Persons”) may or might have in the future interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. The Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.

No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (including without limitation any statement, figures, opinion, view or estimate) provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

The contents hereof may not be reproduced or disseminated in whole or in part without OCBC Bank's written consent. The contents are a summary of the investment ideas and recommendations set out in Bank of Singapore and OCBC Bank reports. Please refer to the respective research report for the interest that the entity might have in the investment products and/or issuers of the securities.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Cross-Border Marketing Disclaimers

Please click here for OCBC Bank's cross border marketing disclaimers relevant for your country of residence.