Investing is not just about deciding what to invest in. To make your money work to suit your needs, it is important to first be aware of your risk appetite and financial goals so you have clarity in your investing journey. Be rewarded for taking your first step when you complete the Financial Needs Analysis (FNA) and learn more about yourself as an investor in 30 minutes.

79% of women have harnessed the power to change their future.

So can you, with as little as S$100.

Ladies, let us celebrate women empowerment and financial inclusiveness this International Women's Day!

Take control of your wealth with the Schroder Asian Income W Share Class, exclusive to OCBC and designed with your financial needs and challenges in mind. Start investing with as little as S$100 and earn a projected monthly payout of 4.5% to 6% p.a.

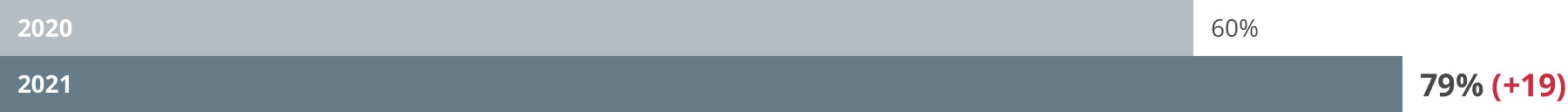

Based on the OCBC Financial Wellness Index 2021, Singaporean women are increasingly active in growing their wealth, with up to 79% reporting that they have started investing – a 19% jump from 2020!

Women who have investments

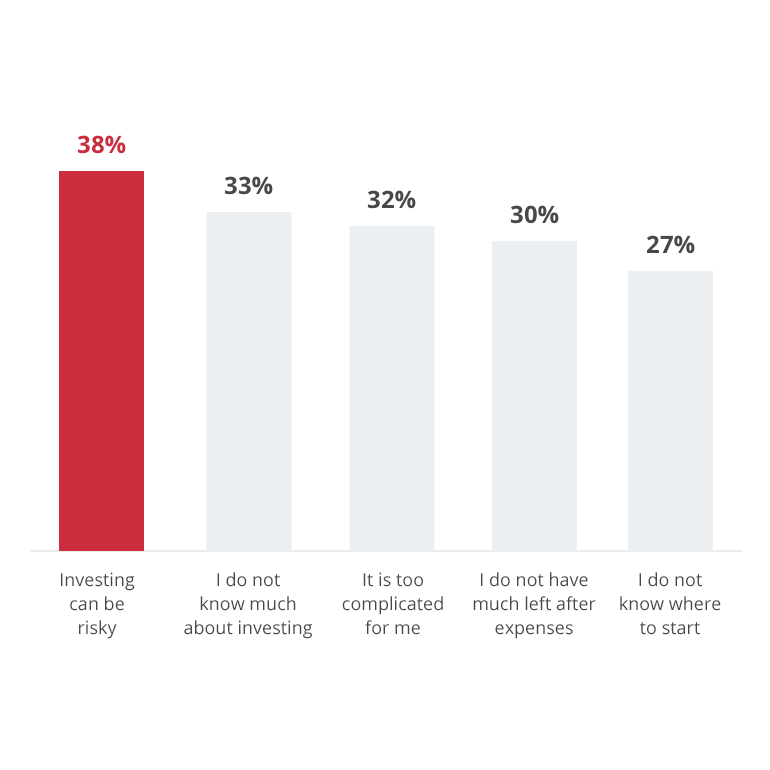

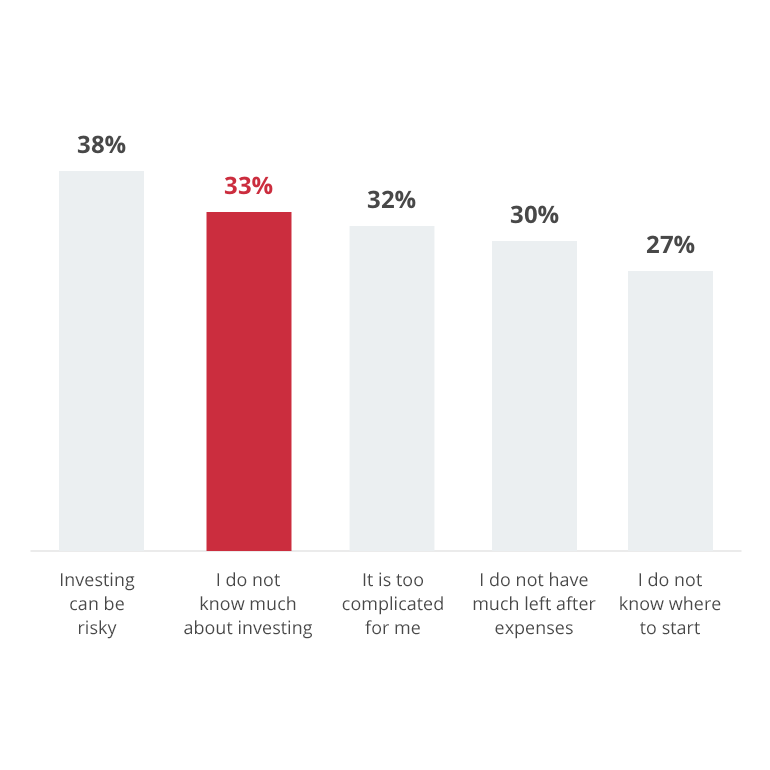

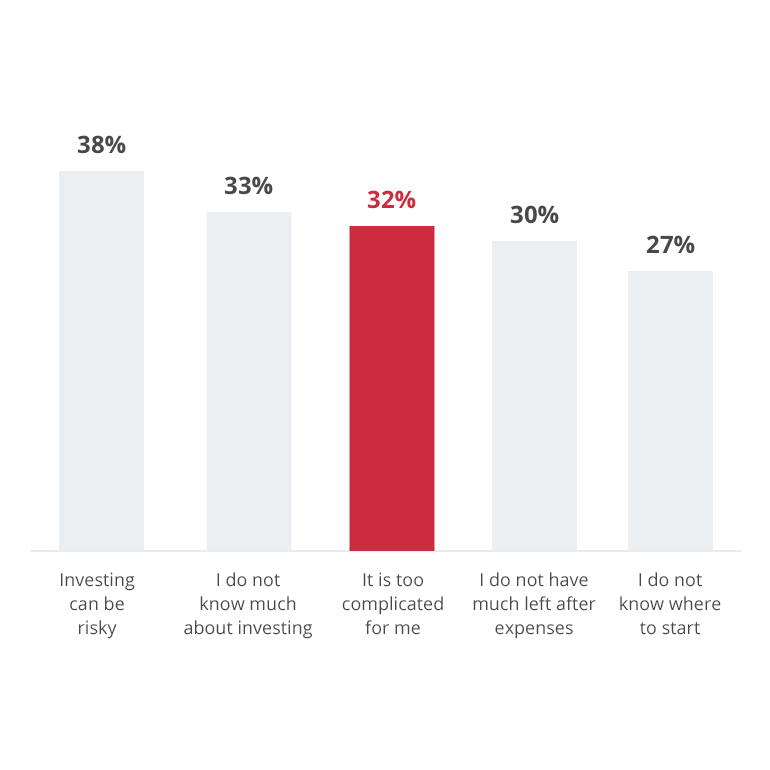

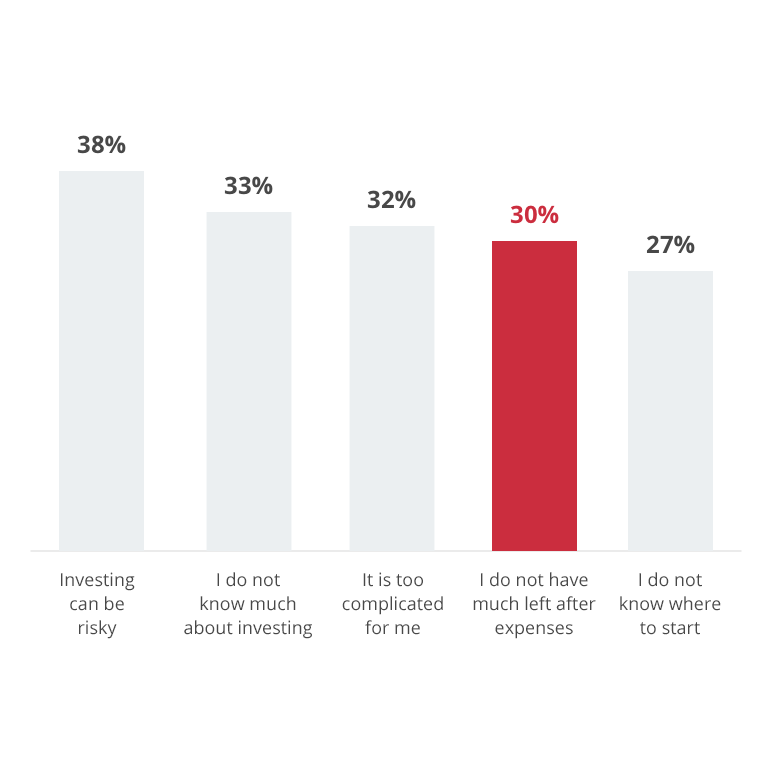

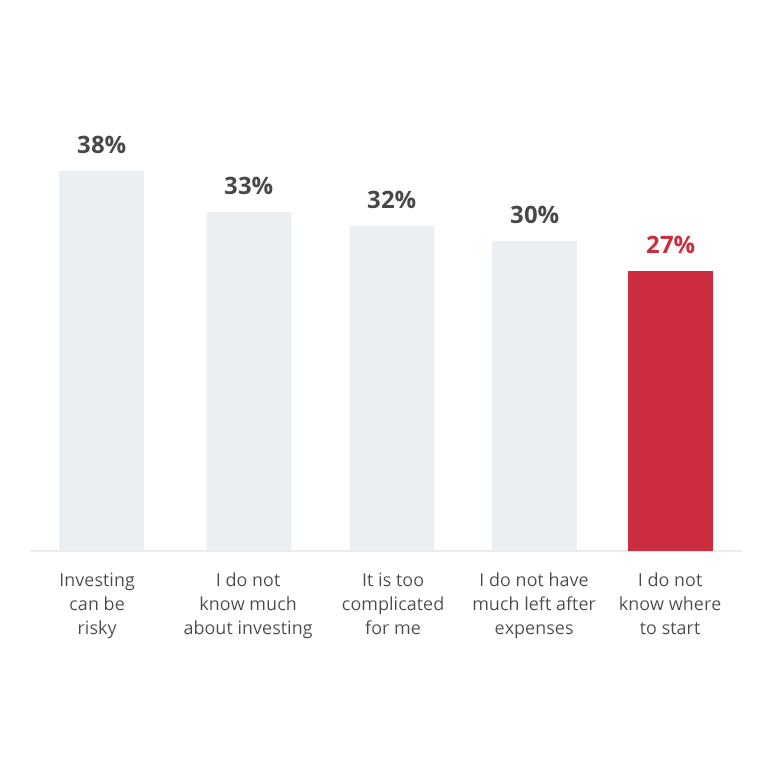

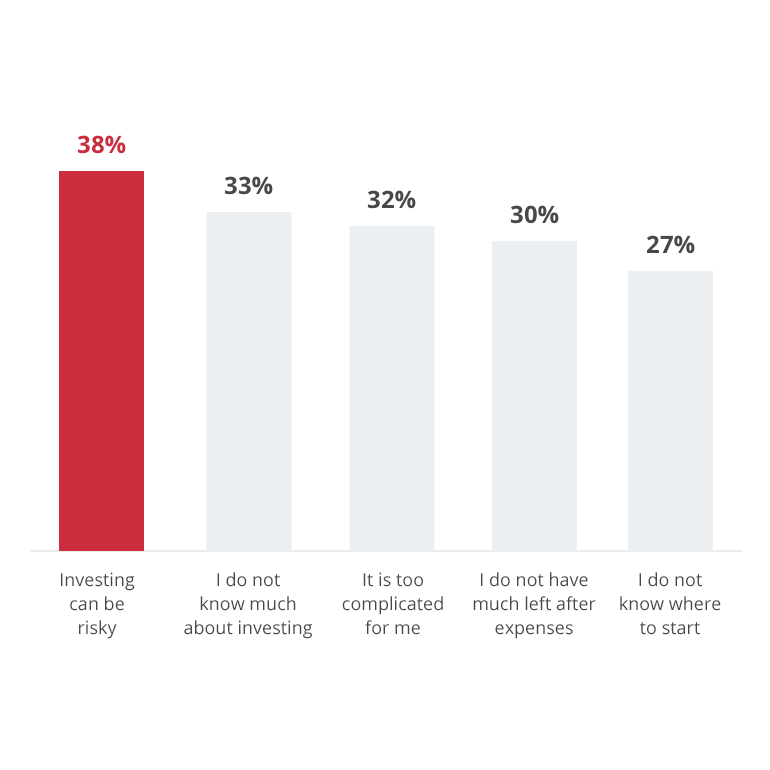

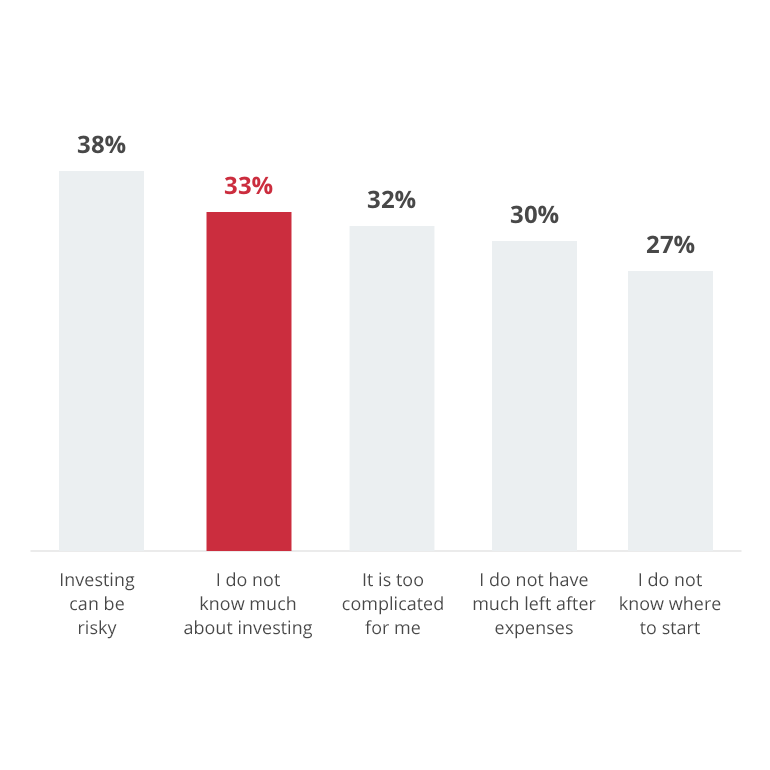

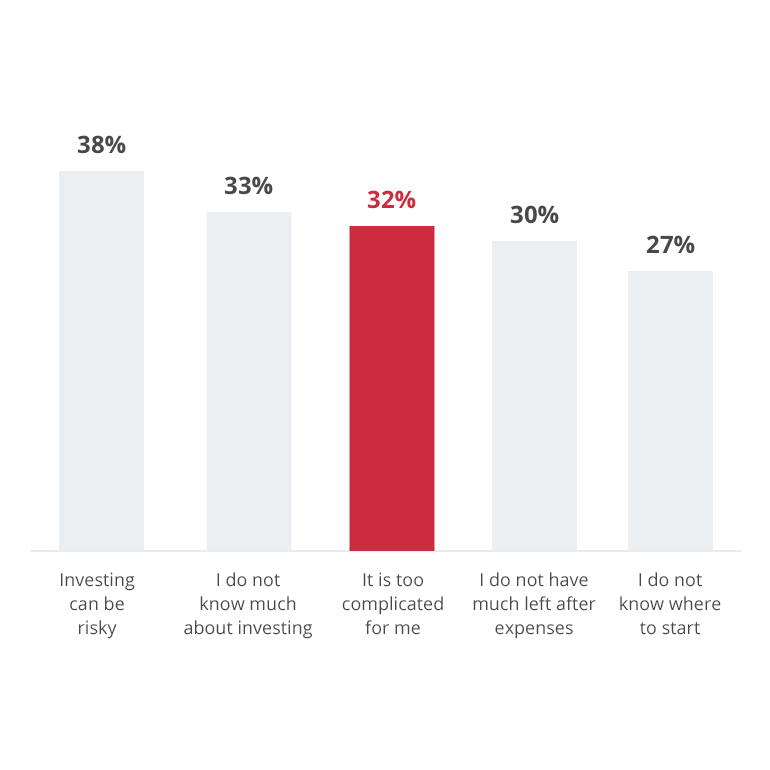

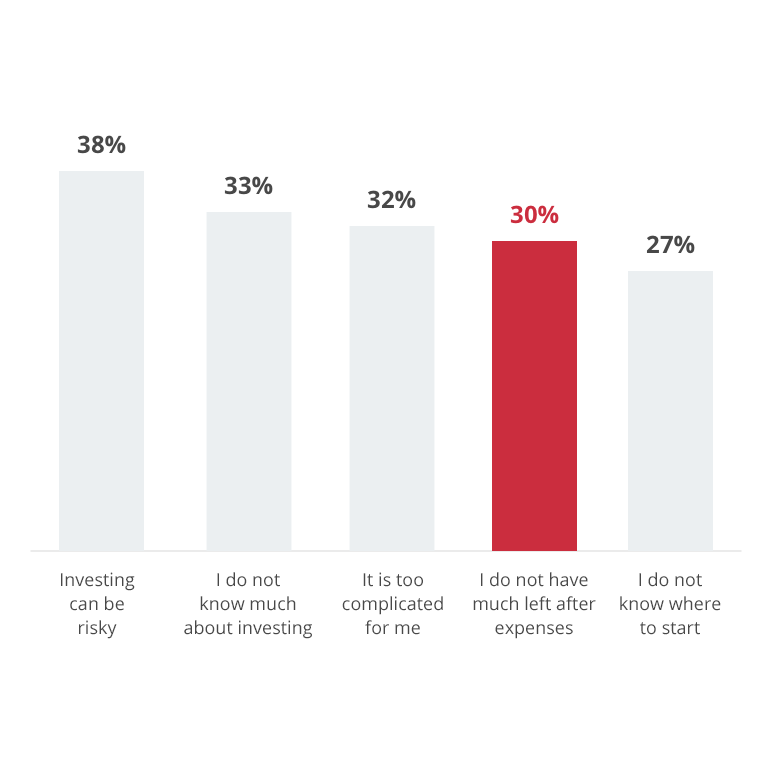

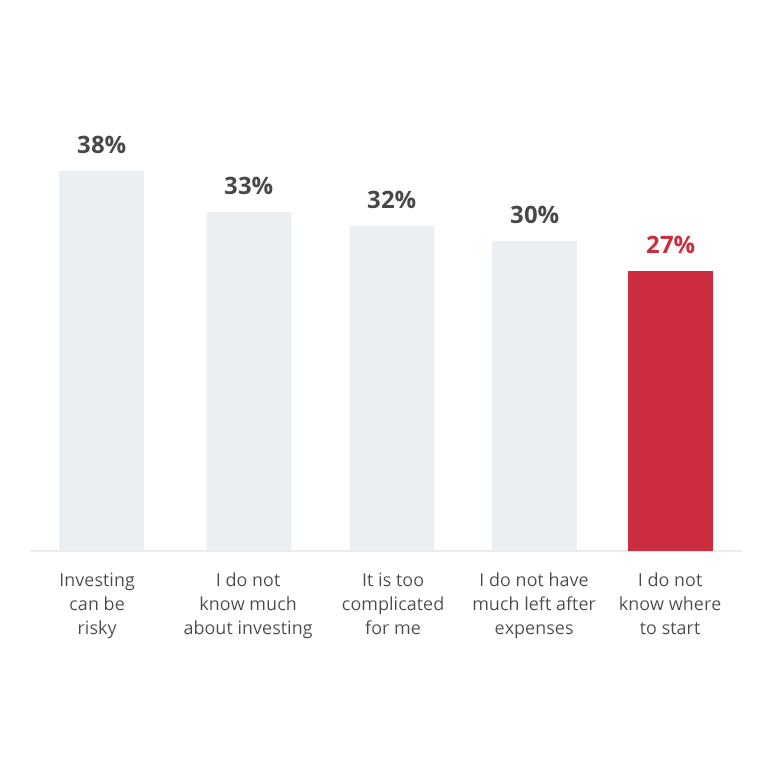

But what is holding back the 21% who have yet to start?

Top 5 reasons why women have not started investing

Investing can seem risky

With a lower minimum investment amount, we want to make your first steps as comfortable as possible.

Do not know much about investing

Our advisors will guide you every step of the way, starting with assessing your risk profile and understanding your goals.

Think that investing is complicated

No unnecessary and complex jargon. Our advisors will ensure everything is simple and easy to understand.

Do not have much to invest after expenses

Our low minimum investment amount keeps investing accessible to all.

Do not know how to start

Enjoy a diversified portfolio with Unit Trusts. Our team of professionals will manage your investments.

In an exclusive collaboration with Schroders, we are excited to introduce the Schroder Asian Income W Share Class, specially selected to suit both new and seasoned investors.

Launched in 2011, this Schroder flagship fund has been designed to adapt to various economic cycles to capture income and growth opportunities wherever they are in Asia. It also has a strong track record of effective risk management during challenging times.

For new investors

With a low commitment entry point (minimum investment starts at S$100) and a steady stream of monthly dividend payouts of 4.5% to 6% p.a., this fits women who are new to investing and looking to kickstart their investment journey.

For seasoned investors

This fund can serve as a core or complementary holding in your portfolio. Given its strong track record of capturing income and growth opportunities while managing volatility, this fund is ideal for supporting long-term investment goals.

Comfortable starting commitment

You only need a minimum lump sum investment of S$100.

You only need a minimum lump sum investment of S$100.

Stable monthly income stream

Enjoy targeted payouts of 4.5% to 6% p.a.

Enjoy targeted payouts of 4.5% to 6% p.a.

Access to a wealth of opportunities across Asia

Get exposure to a diverse range of Asian companies that benefit from the region’s long-term growth potential.

Get exposure to a diverse range of Asian companies that benefit from the region’s long-term growth potential.

Flexibility and agility for a smoother investment journey

This fund has a dynamic asset allocation with a focus on risk management to minimise losses during challenging times.

This fund has a dynamic asset allocation with a focus on risk management to minimise losses during challenging times.

The fund is designed to draw on the asset allocation, stock selection and risk management expertise of 3 specialist investment teams at Schroders. This collaborative approach can generate the most efficient access to opportunities across all asset classes.

As at 30 June 2021, Schroders has over £700 billion in assets under management.

Asset allocation

Schroder Asian Income invests in high-quality companies with proven track records of generating sustainable cash flows, providing a reliable income stream for the fund.

Asian Equities

60%

Asian Fixed Income

27%

Cash

4%

Global (Excl. Asia) Assets

9%

Source: Schroders as at 31 January 2022. Asset classes shown above are for illustration purposes only and should not be considered a recommendation to buy or sell.

Terms and conditions apply. Only applicable to FNAs completed at an OCBC Bank branch or through a Relationship Manager/Client Advisor.

Existing investors will get the voucher if they purchase more units.

Terms and conditions apply. Only applicable to investments made at an OCBC bank branch or through a Relationship Manager/Client Advisor.

Investing for the first time

Stepping into the world of investing may seem intimidating, but you can overcome that by taking one step at a time.

In this video, Tan Siew Lee, our Head of Wealth Management, provides tips on how you can approach investing as a first timer.

To celebrate the launch of our new W Share Class, tune in to Schroders’ curated podcast playlist, ‘Together As Women’, featuring a mix of local and global perspectives on inspirational stories, tackling common misconceptions and practical advice for women who want to achieve financial independence.

Tune in by scanning the Spotify barcode below.

Spotify

Spotify

To celebrate the launch of our new W Share Class, tune in to Schroders’ curated podcast playlist, ‘Together As Women’, featuring a mix of Singaporean and Global perspective episodes on inspirational stories, tackling common misconceptions, and practical advice for women who want to achieve financial independence.

Listen to the Spotify playlist now.

According to our research, Singaporeans require an average of about S$2,300 per month when they retire. Yet, as many as 81% underestimate how much we need. Find out how you can achieve your retirement goals with us.

Important notices

This advertisement has not been reviewed by the Monetary Authority of Singapore.

- Any opinions or views of third parties expressed in this document are those of the third parties identified, and do not represent views of Oversea-Chinese Banking Corporation Limited (“OCBC Bank”, “us”, “we” or “our”).

- This information is intended for general circulation and / or discussion purposes only. It does not consider the specific investment objectives, financial situation or needs of any particular person.

- Before you make an investment, please seek advice from your Relationship Manager regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs.

- If you choose not to do so, you should consider if the investment product is suitable for you, and conduct your own assessments and due diligence on the investment product.

- We are not making an offer, solicit to buy or sell or subscribe for any security or financial instrument, enter into any transaction or participate in any trading or investment strategy with you through this document. Nothing in this document shall be deemed as an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into any transaction or to participate in any particular trading or investment strategy.

- No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice.

- OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

- Investments are subject to investment risks, including the possible loss of the principal amount invested. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures, predictions or projections are not necessarily indicative of future or likely performance.

- Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way.

- The information in and contents of this document may not be reproduced or disseminated in whole or in part without the Bank’s written consent.

- OCBC Bank, its related companies, and their respective directors and/or employees (collectively “Related Persons”) may, or might have in the future, interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.

- You must read the Offer Document/Indicative Term Sheet/Product Highlight Sheet before deciding whether or not to purchase the investment product, copies of which may be obtained from your relationship manager.

- Any hyperlink to any third party article, or other website or webpage (including any websites or webpages owned, operated and maintained by third parties) is for informational purposes only and for your convenience only and is not an endorsement or verification of any such article, website or webpage by OCBC Bank and should only be accessed at your own risk. OCBC Bank does not review the contents of any such articles, website or webpage, and shall not be liable to any person for the same.

- There are links or hyperlinks which link you to websites of other third parties (the “Third Parties”). OCBC Bank hereby disclaims liability for any information, materials, products or services posted or offered on the website of the Third Parties.

Collective Investment Schemes

- A copy of the prospectus of each fund is available and may be obtained from the fund manager or any of its approved distributors. Potential investors should read the prospectus for details on the relevant fund before deciding whether to subscribe for, or purchase units in the fund.

- The value of the units in the funds and the income accruing to the units, if any, may fall or rise. Please refer to the prospectus of the relevant fund for the name of the fund manager and the investment objectives of the fund.

- Investment involves risks. Past performance figures do not reflect future performance.

- Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way.

For funds that are listed on an approved exchange, investors cannot redeem their units of those funds with the manager, or may only redeem units with the manager under certain specified conditions. The listing of the units of those funds on any approved exchange does not guarantee a liquid market for the units.

Graphs, charts, formulae and other devices

Investors should note that there are necessarily limitations and difficulties in using any graph, chart, formula or other device to determine whether or not, or if so, when to, make an investment.

Secure your financial future with this exclusive share class.

or locate a branch to find out more.