Extended Support Scheme For Reno Loan Customers

Continuous support for homeowners through COVID-19

Applications for Extended Support Scheme for renovation loan have ceased.

Frequently asked questions

| Am I eligible for the Extended Support Scheme (ESS)? |

You are eligible if you have lost employment or if your monthly income has decreased by 25% after 1 February 2020. Before submitting an ESS application, you cannot have missed more than three months of payment. We reserve the right to review each application on a case-by-case basis. |

| For how long can I extend my loan tenor? |

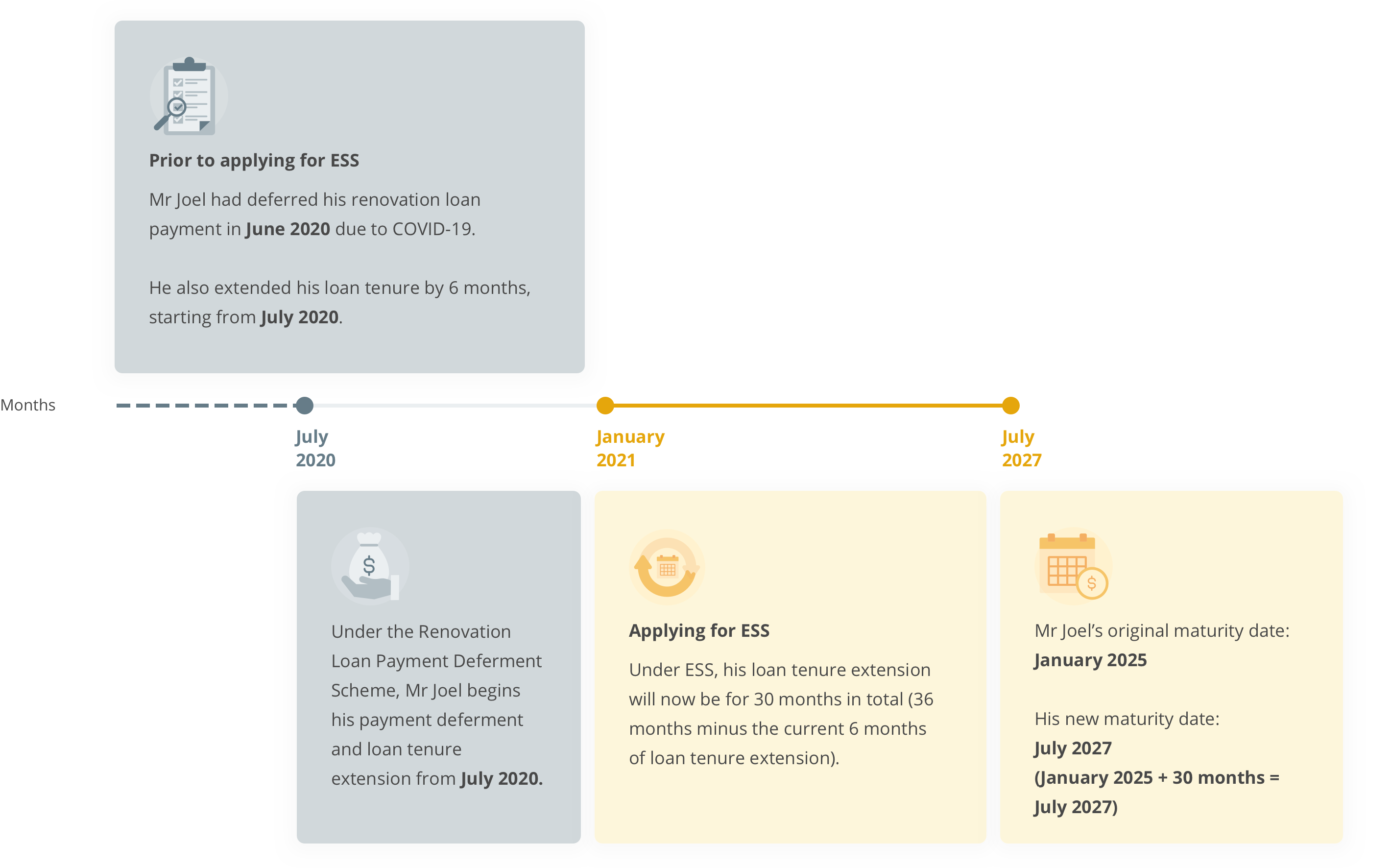

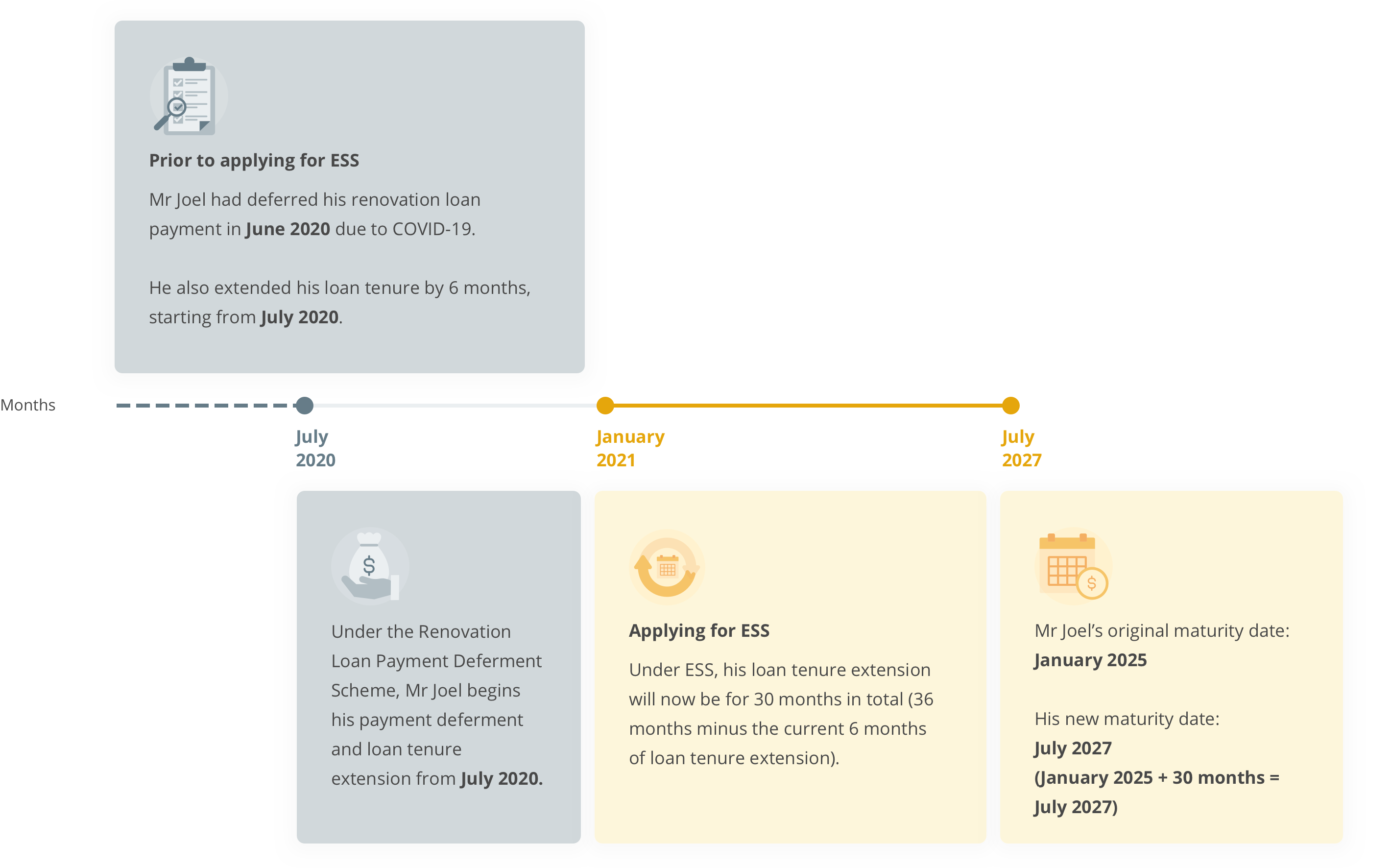

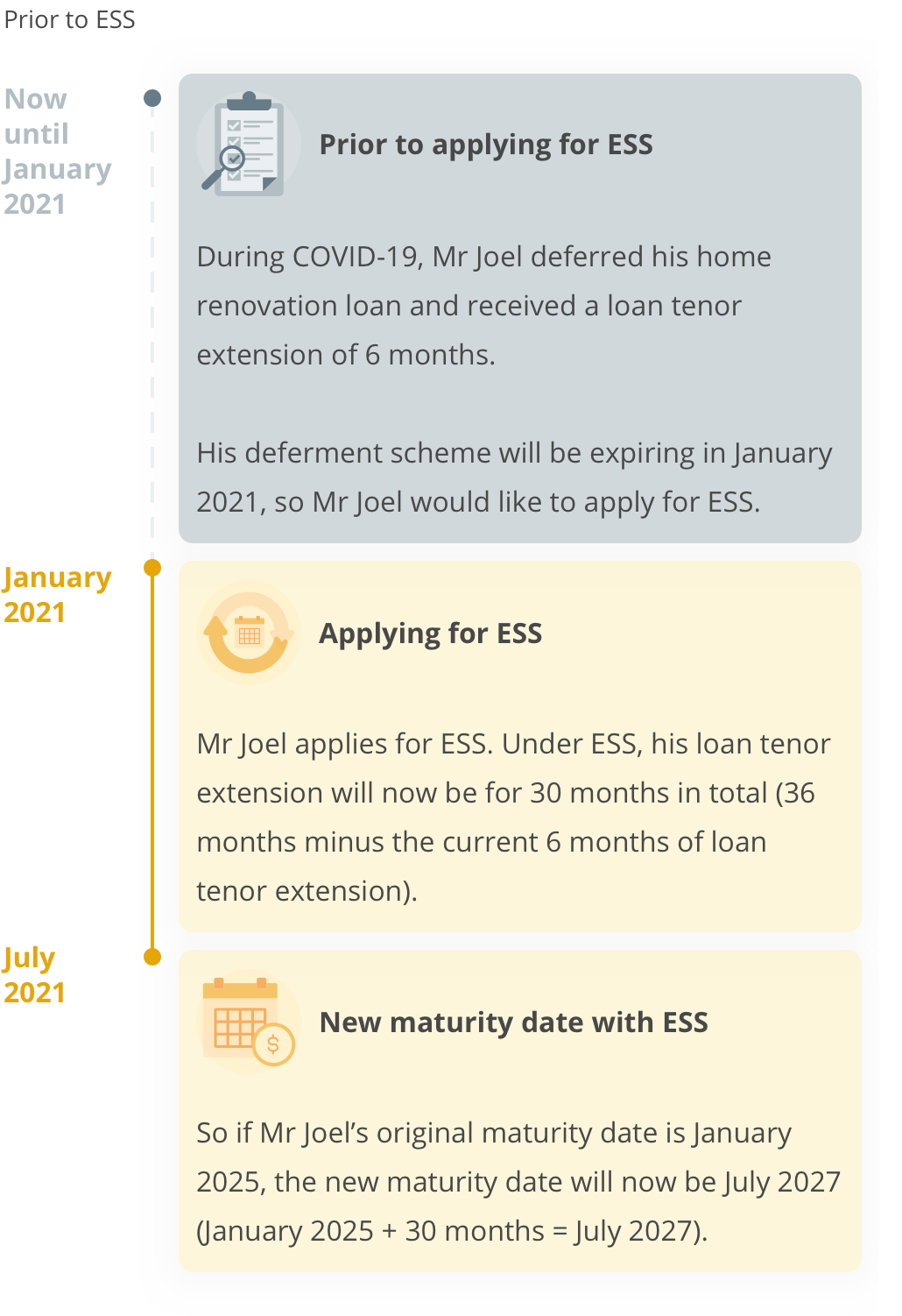

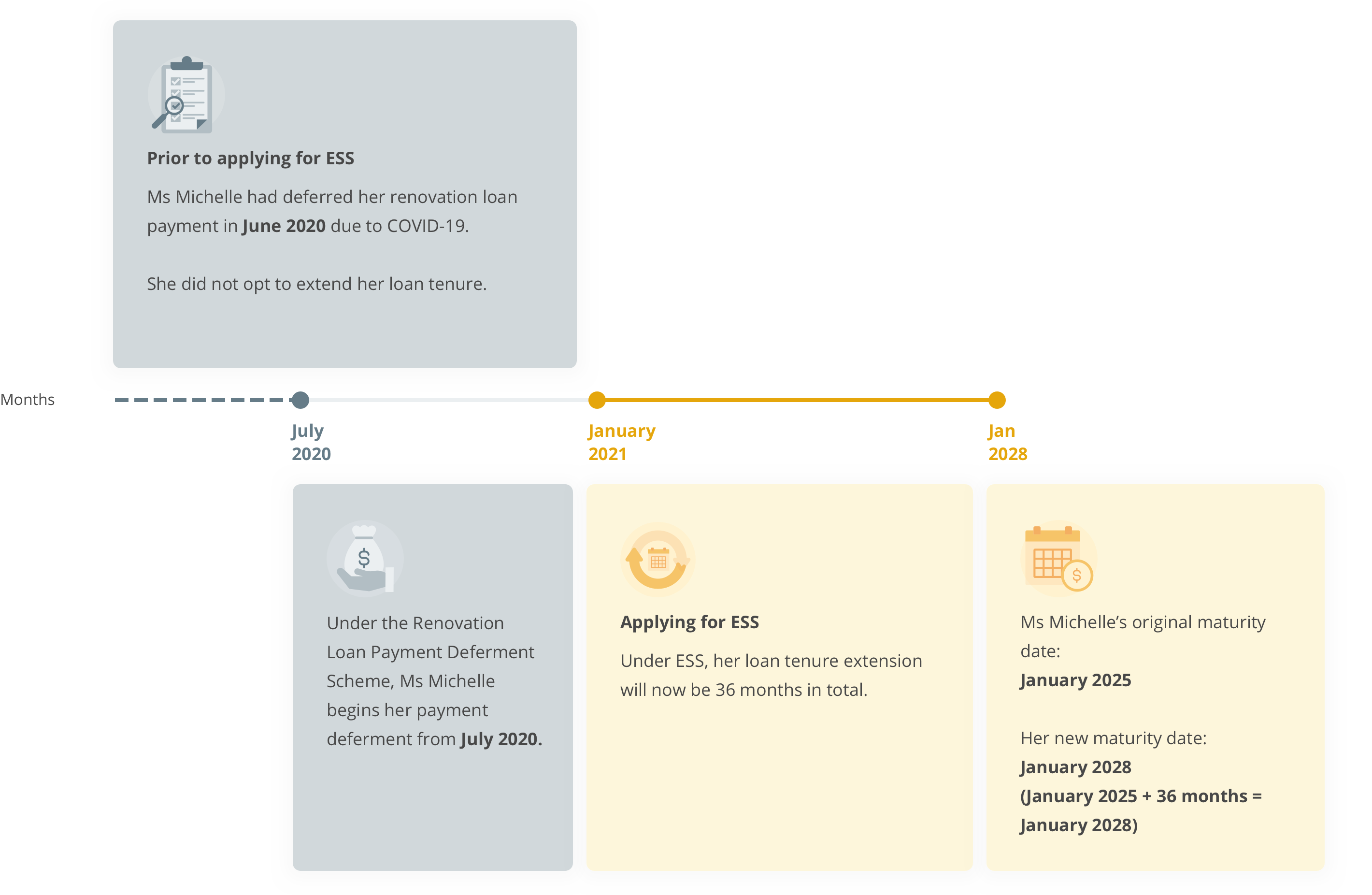

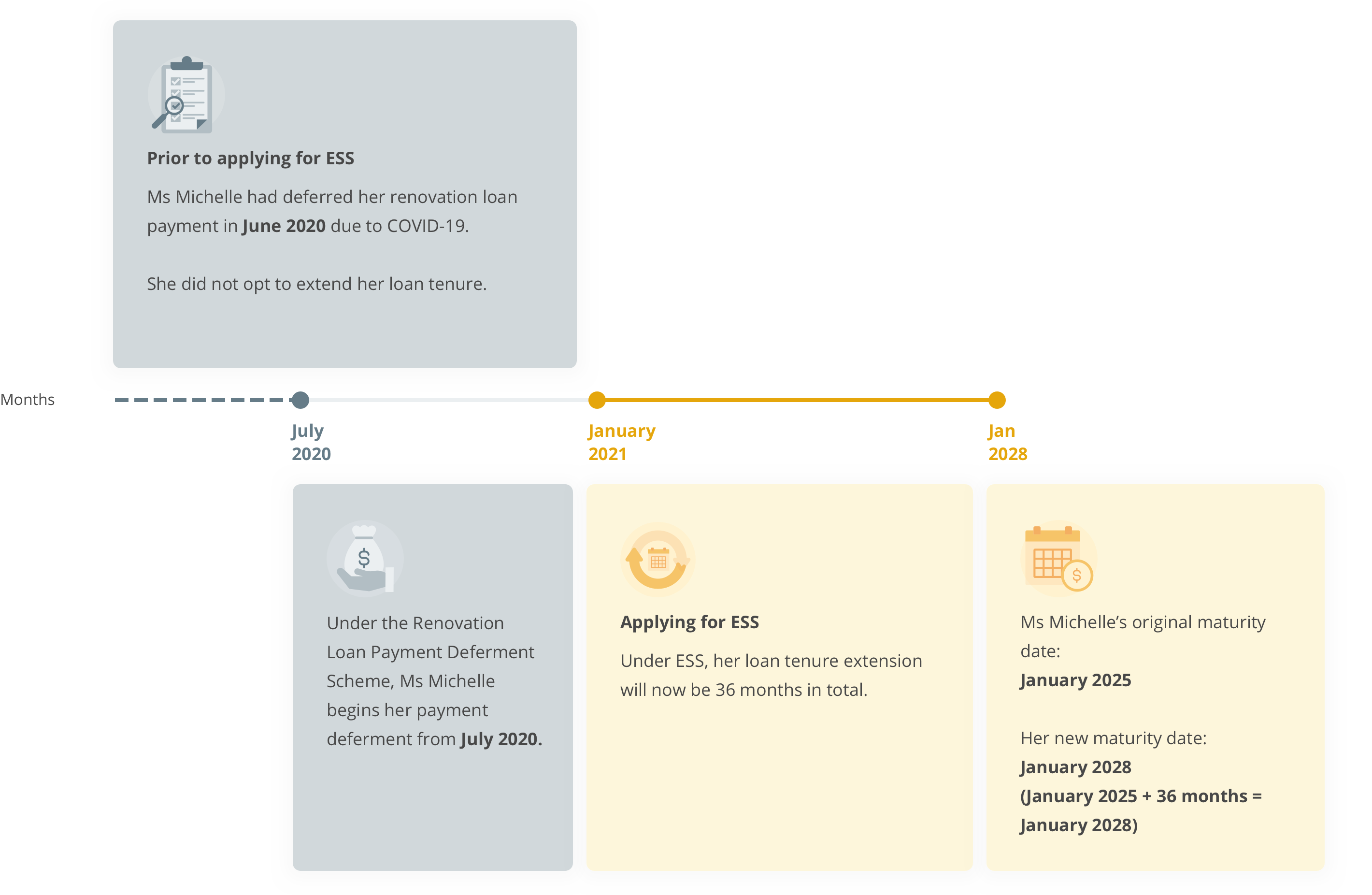

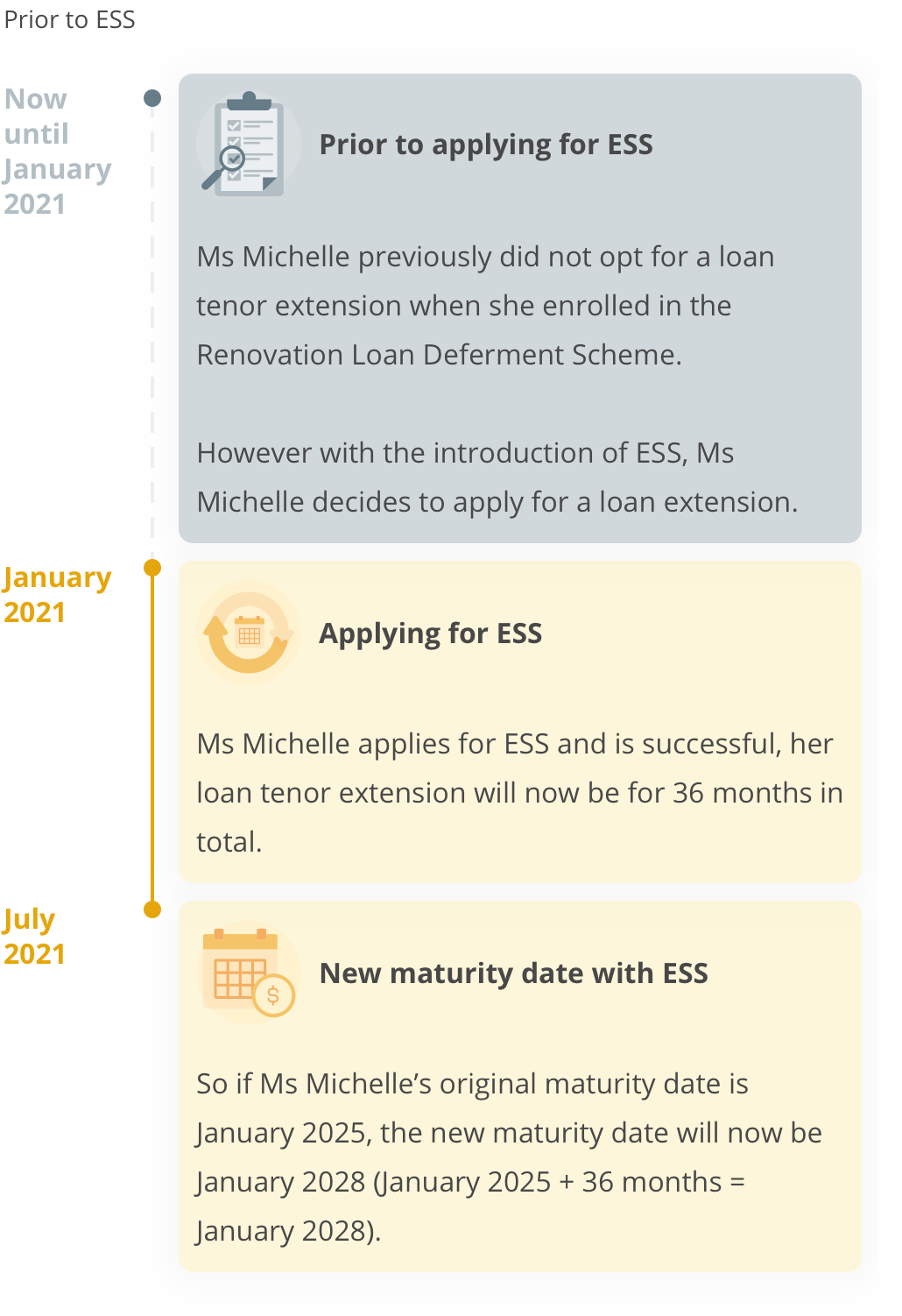

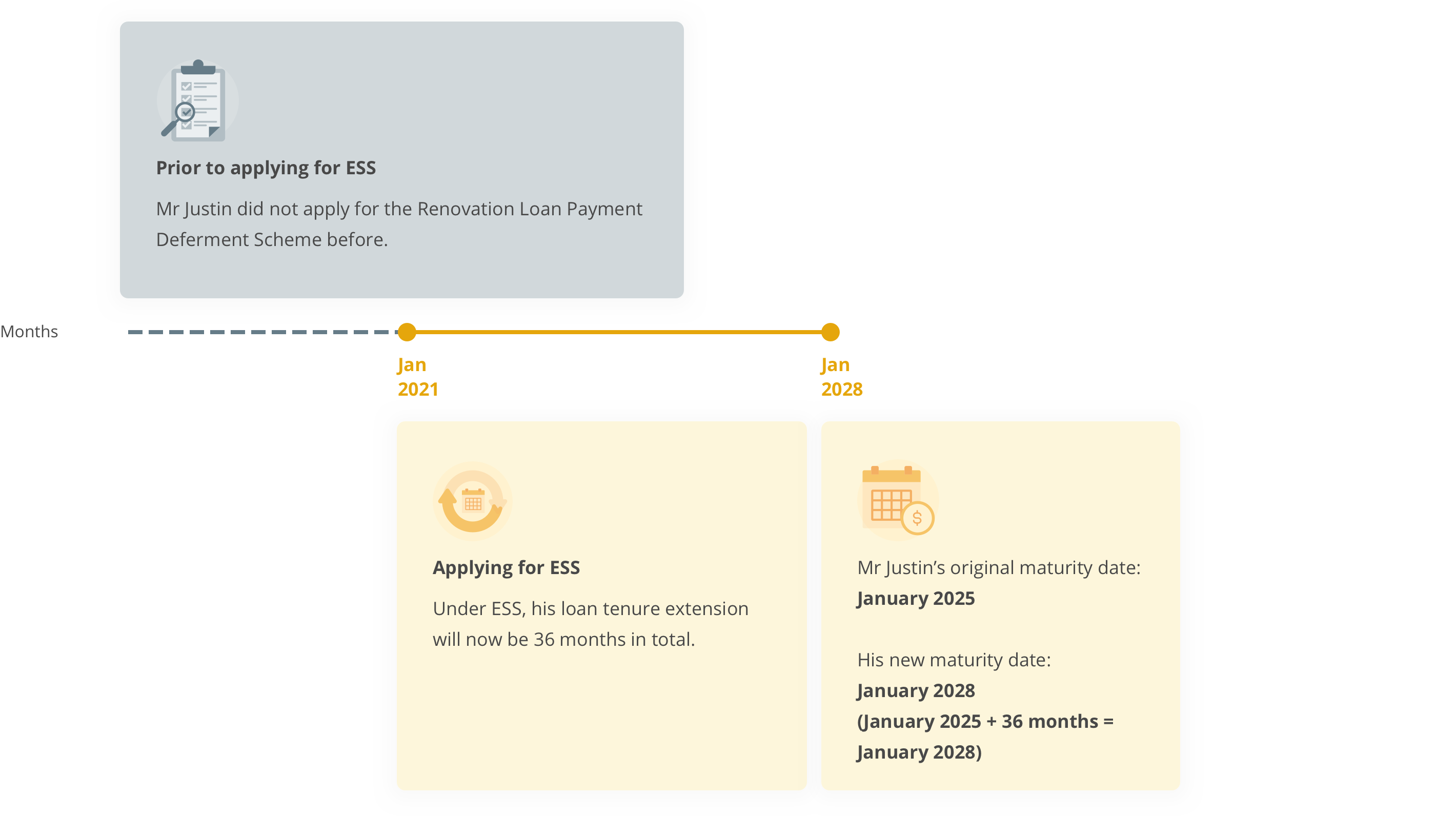

If you have previously enrolled in the Renovation Loan Payment Deferment Scheme and received a loan tenor extension for your deferment period, your loan tenor extension under the ESS will be: Loan tenor extension under ESS = 36 months - the period of loan tenor extension under the Renovation Loan Payment Deferment Scheme If you have not enrolled in the Renovation Loan Payment Deferment Scheme, or you have but did not apply for a loan tenor extension, your loan tenor extension under the ESS will be three years. |

| What will happen to my instalment after I enrol in the ESS? |

As your outstanding loan amount is paid over the remaining extended loan tenor, the monthly instalment after enrolment in the ESS will be lower than your current monthly instalment. However, the total interest paid over the extended loan tenor will be more than if the loan tenor had not been extended. |

| How will I know what the revised monthly instalment is? |

We will advise you on the revised amount. |

| How will interest be calculated? |

Interest will be calculated based on the interest rate applied when the renovation loan was first granted. Based on the loan tenor extension period, interest will be calculated accordingly based on a monthly rest rate computation. The total interest paid over the extended loan tenor will be more than if the loan tenor had not been extended. |

| When do I need to submit my application? |

Applications from now until 20 September 2021 will come into effect the following month. |

Here are a few renovation loan scenarios that you can refer to.

Mr Joel's Profile

He is currently enrolled in the Renovation Loan Payment Deferment Scheme.

The maturity date of his renovation loan is currently January 2025.

His renovation loan deferment ends on January 2021.

Ms Michelle's Profile

She is currently enrolled in the Renovation Loan Payment Deferment Scheme but she previously opted not to extend her loan tenure.

The maturity date of her renovation loan is currently January 2025.

Mr Justin's Profile

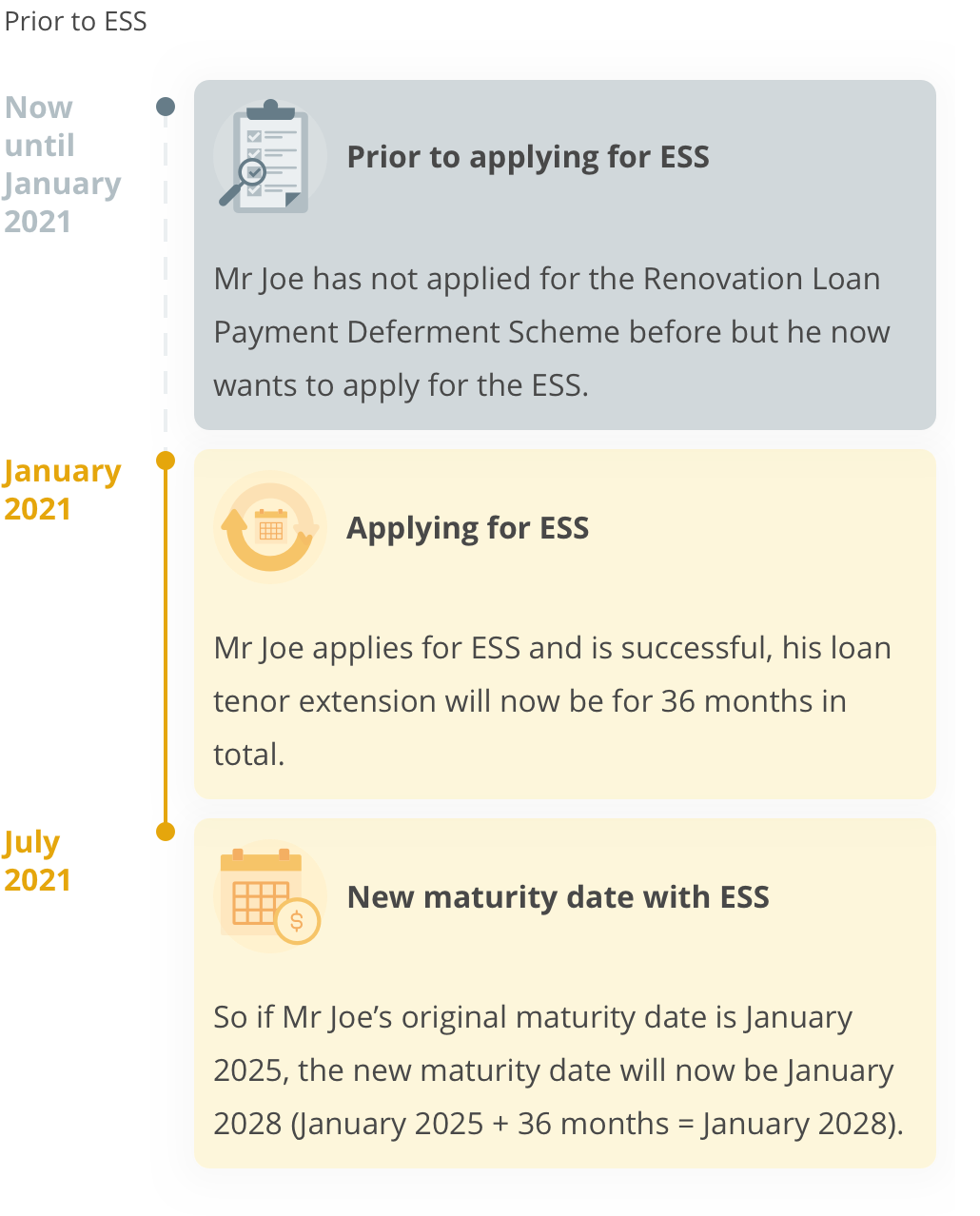

He is currently serving his home renovation loan. He did not apply for the Renovation Loan Payment Deferment Scheme before but he now wants to enrol in the ESS.

The maturity date of his renovation loan is currently January 2025.

“Original Maturity Date” refers to the loan maturity date indicated in your loan approval letter. If you had previously received a loan tenure extension under the Renovation Loan Payment Deferment Scheme, the loan maturity date would not be the Original Loan Maturity Date, but the new loan maturity date notified to you via email.

Opting into the scheme will result in higher interest charged. Interest is charged on the principal loan amount, based on the interest rate applied when the renovation loan was approved.