Managed by professional fund managers, Unit Trusts are investments made in a variety of financial assets. You can start investing for as little as SGD 100 a month or by making a SGD 1,000 lumpsum investment.

Too much savings may limit your wealth gains. Consider investing.

Just keeping money in your savings account will not build much wealth to achieve your desires. Invest.

See how much more you can accumulate if you invest a portion of your savings!

How much of your savings would you like to invest?

Your balance after 40 years with an allocation of:

50% in cash deposits

50% in investments

Investments (Higher Risk)

SGD 00

Investments (Moderate Risk)

SGD 00

Endowment

SGD 00

Cash deposits

SGD 00

All figures and projections shown are for illustration purposes only, and calculated based on projected rates and assumptions which are subject to change at any time.

A recent OCBC study of our customers’ assets and liabilities showed that Singaporeans have a higher level of savings in 2021 compared to 2014 (equivalent of 10 months’ of salary vs 7 months’). This may not be ideal, as they are not maximising the growth potential of their savings.

Why are Singaporeans falling behind?

We save too much

Most Singaporeans are busy accumulating assets in their 20s, preferring to park cash in savings accounts for easy liquidity.

Most Singaporeans are busy accumulating assets in their 20s, preferring to park cash in savings accounts for easy liquidity.

We do not invest enough

Even as we pay off liabilities like home loans over time, we continue to keep most of our money in low-interest deposit accounts.

Even as we pay off liabilities like home loans over time, we continue to keep most of our money in low-interest deposit accounts.

We do not know how to invest

Even though investing may have crossed our minds, we may not have the knowledge or information to do so.

Even though investing may have crossed our minds, we may not have the knowledge or information to do so.

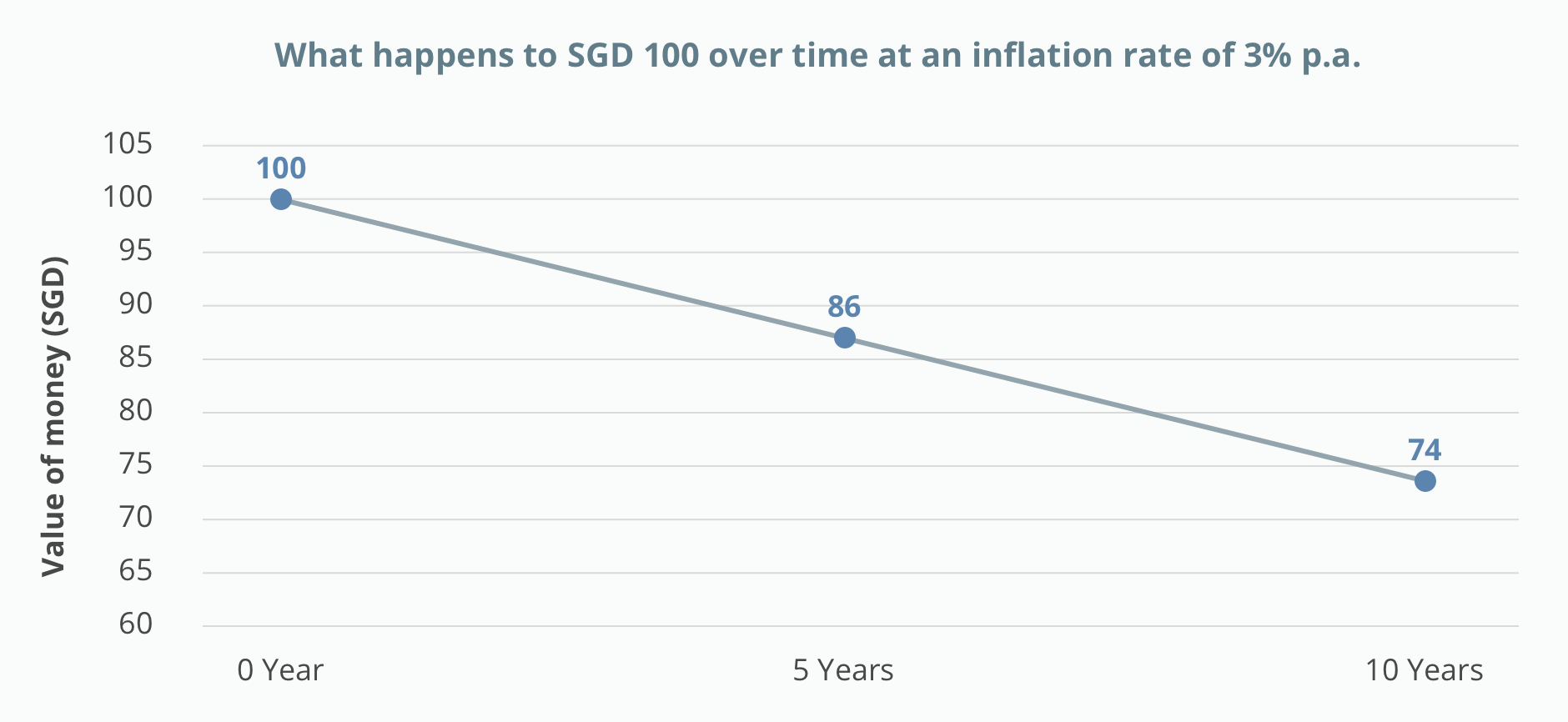

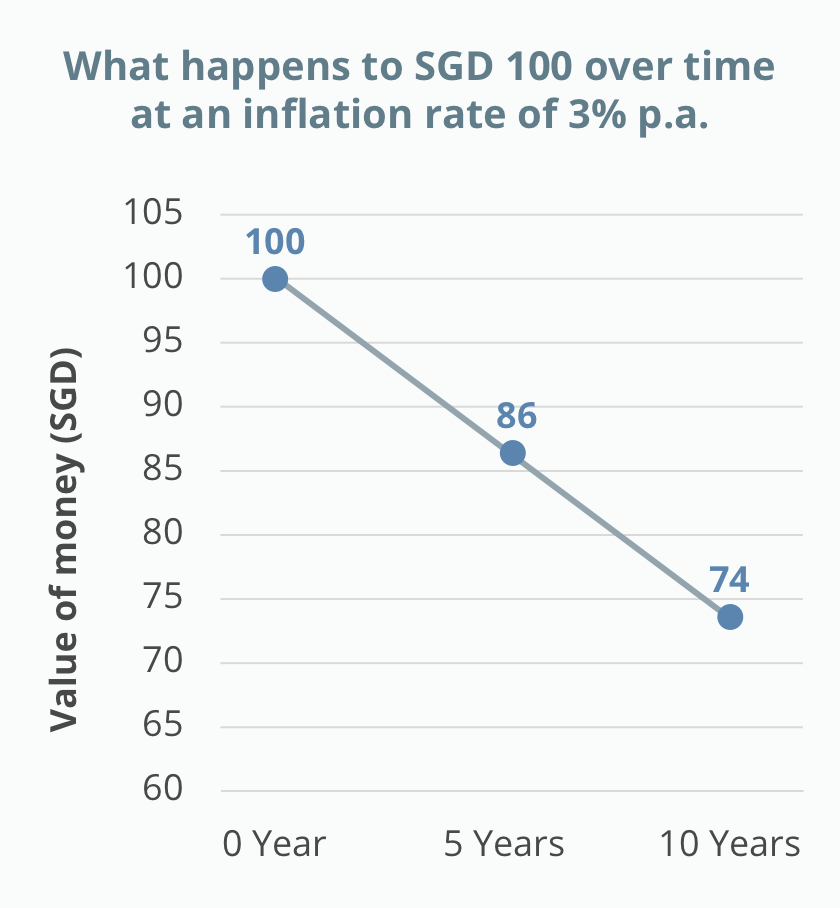

When it comes to your finances, inflation can be a silent wealth killer. For example, SGD 100 today will shrink in value to SGD 74 after 10 years assuming an annual inflation rate of 3%. The interest rates paid by savings accounts are not sufficient to beat inflation. Your best bet is to invest, albeit by taking some risk.

You do not need to be an expert to start investing. A little goes a long way. The earlier you start, the more you can potentially reap over time.

Who is this for?

These funds are ideal for you if you have fewer liabilities and more flexible cash flow, and are looking to earn potentially higher returns.

LionGlobal All Seasons Fund Growth

- To generate capital appreciation over the long term

- Diversified portfolio of active funds and ETFs

LionGlobal Disruptive Innovation Fund

- To generate long-term capital growth

- Potential disruptors with strong growth prospects

Who is this for?

These funds are ideal for you if you have a higher income and increasing liabilities, and prefer the stability that comes with moderate returns.

LionGlobal All Seasons Fund Standard

- To generate capital appreciation over the long term

- Diversified portfolio of active funds and ETFs

Goldman Sachs Global Millennials Equity Portfolio

- To generate capital appreciation with no need for income

- Millennial-themed fund with a concentrated global equity portfolio

Who is this for?

These funds are ideal for you if you have decreasing liabilities and are approaching retirement as they offer steady returns and income payouts.

Fidelity Enhanced Reserve Fund

- To provide investors with liquidity, stability and yield

- Portfolio of high-quality, global debt securities

FSSA Dividend Advantage

- To provide investors with regular distributions and long term capital appreciation

- Asia Pacific (excluding Japan) focused equity portfolio

Beating inflation is the first step towards taking control over your financial health. There are other areas to consider, such as ensuring you are adequately insured, saving up for your children’s future education and planning for your retirement.

For a more personalised, comprehensive financial plan, head on to OCBC Life Goals.

Start investing in Unit Trusts today

through OCBC Digital or

You can also download the OCBC Digital app via the Apple App Store, Google Play and Huawei App Gallery.

Percentage to be invested

Percentage to be invested

Key in the percentage of your total cash savings that you would like to invest. E.g. If you have SGD 100,000 in cash savings and would like to invest half, key in 50%.

How we calculate these values

How we calculate these values

We use these projected rates to calculate your returns over 40 years:

- Cash deposits: 0.05% p.a.

- Endowment: 2.50% p.a.

- Investments (Moderate Risk): 4.00% p.a.

- Investments (Higher Risk): 5.00% p.a.

Important note: Investments are subject to investment risks, including the possible loss of the principal amount invested. Past performance figures, predictions or projections are not necessarily indicative of future or likely performance. Actual performance may differ from the projections in this document.

General disclaimer

- The opinions or views expressed in this document are expressed by the third parties identified, and do not represent our view.

- This information is intended for general circulation only. It does not consider the specific investment objectives, financial situation or needs of anyone.

- Before you make an investment, you should speak to your OCBC Relationship Manager who will assess whether the products are suitable to you based on your investment objectives, financial situation or needs.

- If you choose not to do so, you should consider if the investment product is suitable for you.

- We are not making an offer, solicit to buy or sell or subscribe for any security or financial instrument, enter into any transaction or participate in any trading or investment strategy with you through this document.

- No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice.

- OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

- Investments are subject to investment risks, including the possible loss of the principal amount invested. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures, predictions or projections are not necessarily indicative of future or likely performance.

- Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way.

- The information in this document must not be reproduced or shared without our written agreement.

- The Bank, its related companies, their respective directors and/or employees (collectively “Related Persons”) may or might have in the future interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. The Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.

- Investors should note that there are necessarily limitations and difficulties in using any graph, chart, formula or other device to determine whether or not, or if so, when to, make an investment.

- Where the contents have not been identified as summaries of the investment ideas and recommendations set out in research reports disseminated by the OCBC Group, the information is not intended to constitute research analysis or recommendation and should not be treated as such.

- This advertisement has not been reviewed by the Monetary Authority of Singapore.

Unit trusts disclaimer

The information contained herein has been prepared by OCBC Bank, the issuer and manager of the fund. It is for general information only. It does not take account of your specific investment aims, financial situation or needs.

This is not a formal offer for this product. We are not recommending that you buy this product as you must first assess whether it is suitable for your investment needs. You should speak to a financial adviser before you buy an investment product. The financial adviser will look at your specific investment aims, financial situation and particular needs before advising you on whether the product is suitable for you. Of course, if you decide not to get advice from a financial adviser, you should consider carefully whether this product is suitable for you.

The investment objective of the fund is more particularly described in the fund prospectus. You can get a copy of the prospectus of the fund from the manager of the fund, or any of its approved distributors. You should read the prospectus for details of the fund before deciding whether to subscribe for, or buy, units in the fund. The value of the units in the fund and the income building up from the units, if any, may fall or rise.

The information in this document may contain projections or other predictions regarding future events or the future performance of countries, assets, markets or companies. These may be different from actual events or results. Past performance figures are not necessarily an indication of future or likely performance. Any reference to any specific company, financial product or asset class is used as an example only. We (OCBC Bank), and any of our related and connected companies, and their directors and employees (known as 'related people'), may have interests in, and may make transactions in, the products mentioned in this document. We may have connections with, and may receive a fee from, the product providers. Product providers may also be related people, who may receive fees from investors. We and our related people may also carry out or try to carry out broking and other financial services for the product providers.

We have done all we can to make sure that this document is accurate at the time of printing, but we are not responsible if there are any errors or missing information. If the document becomes out of date, we do not have to replace it. We are not responsible for any direct or indirect loss or damage arising in connection with, or as a result of, any person acting on any information provided in this document. Please do not reproduce or share any of the information in this document without our written permission.