EXTRACASH LOAN

Get extra cash easily, whenever and wherever you are

We will review your application and assess whether instant approval can be provided based on the Terms and Conditions and at our sole discretion.

Get cash loan of up to 6 times* your monthly income, with fixed repayments over 12 to 60 months.

*if your annual income is $120,000 and above

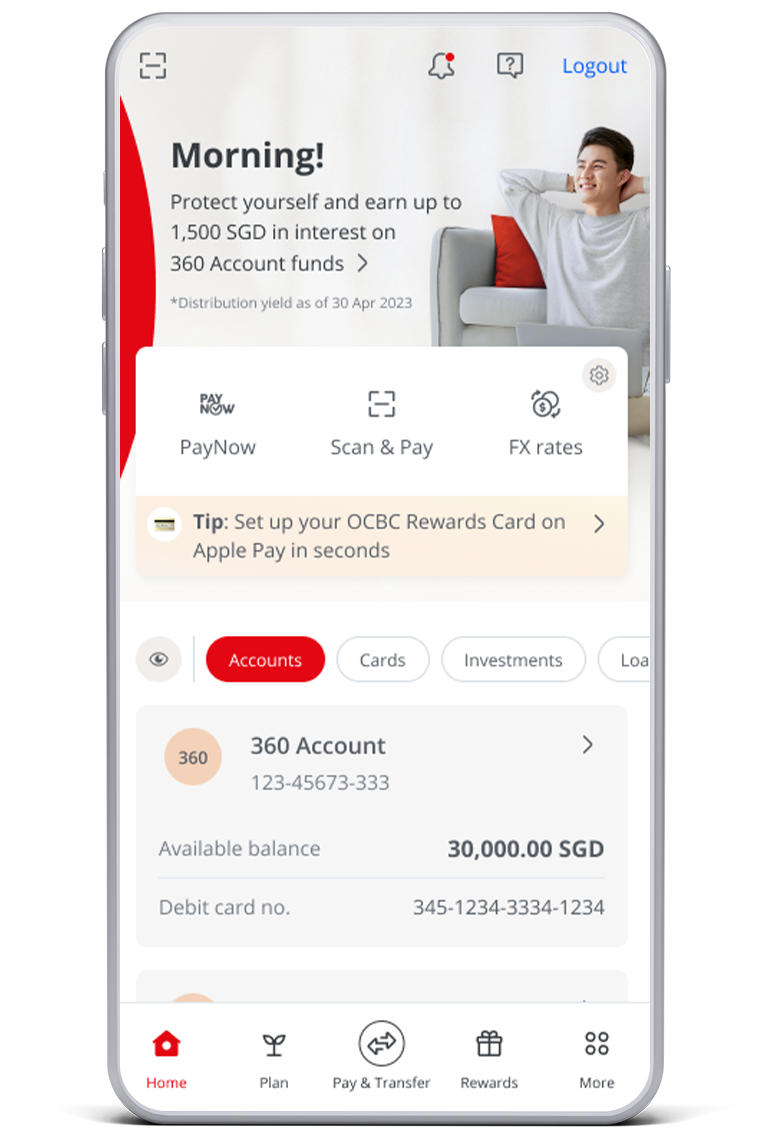

Apply for an ExtraCash Loan on the OCBC app in just a few steps:

Apply for an ExtraCash Loan on the OCBC app in just a few steps:

For annual income

Approved loan amount

$4,500

Processing fee

$100

Disbursed loan

$4,400

- Interest rate

(monthly rest rate)¹ - Interest rate

(flat rate equivalent - for reference only)¹ - Effective

Interest Rate (EIR)² - Monthly instalment³

| Repayment period | Interest rate (monthly rest rate)¹ |

Interest rate (flat rate equivalent - for reference only)¹ |

Effective Interest Rate (EIR)² |

Monthly instalment³ |

|---|---|---|---|---|

| 12 months | 22% per annum | 12.31% per annum | 26.39% per annum | $422 |

| 24 months | 12.25% per annum | 24.37% per annum | $234 | |

| 36 months | 12.50% per annum | 23.67% per annum | $172 | |

| 48 months | 12.81% per annum | 23.31% per annum | $142 | |

| 60 months | 13.14% per annum | 23.10% per annum | $124 |

¹Interest on loan amount is calculated based on a monthly rest method. As some financial institutions may present the interest rate as a flat rate, we have included the flat rate equivalent for comparison. Flat rate equivalent is calculated based on a front-end add-on calculation method and is for reference purposes only.

² Effective Interest Rate is inclusive of a one-time processing fee.

³ Instalment amounts are calculated based on a fixed monthly instalment payment option and are simplified for illustration purposes.

Find out your monthly repayment

Calculate your monthly repayment

Here is how much you need to pay

Your monthly payment

S$0.00

Processing fee

S$0.00

Amount disbursed

S$0.00

Interest rate per annum

0.00%

Effective Interest Rate (EIR) per annum

0.00%

Eligibility requirements

Minimum age

21 years old

Annual income

$20,000 and above for Singaporeans and Singapore PRs

What to submit

Fees

Late fee

$80

Early partial/full repayment fee

3% of amount to be repaid

($1,000 minimum repayment)

1 month interest in lieu will be charged if redemption is done immediately

Restructuring fee

3% of outstanding loan amount

Terms and conditions

Important notices

Note that due to rounding, the final instalment amount will be slightly different from the other instalments.

Credit Bureau Singapore

Please note that additional time may be needed to review your application as Credit Bureau Singapore will be synchronising data from 12am to 8am daily.

Myinfo

Myinfo will be temporarily unavailable from 2am to 8.30am every Wednesday and Sunday due to scheduled maintenance.

System Maintenance

Please note that your product may not be availed to you instantly during system maintenance hours between 9.30pm to 6am.

Online Application

- You will be required to submit your income information via CPF login, so please make sure you have your Singpass username and password ready.

- Please ensure you have a printer with you as you will need to print and send the completed forms to us.

Apply for ExtraCash Loan today

Copy of NRIC (front and back)

- Copy of Passport

- Copy of Employment Pass or Work Permit (at least 6 months' validity)

If residential or mailing address differs from that in NRIC: Most recent original/soft copy telephone bill OR utility bill OR bank statement

Most recent original/soft copy telephone bill OR utility bill OR bank statement

If salary is not credited to an OCBC account, submit any of the 2 combinations below:

- Latest CPF statement with full contribution history (at least 3 months) AND Latest Income Tax Notice of Assessment

- Latest computerized/soft copy payslip AND Latest bank statement showing employer’s name for salary crediting

OR Latest CPF statement with full contribution history (at least 3 months)

OR Latest Income Tax Notice of Assessment

Last 12 months’ CPF contribution history statement OR Latest Income Tax Notice of Assessment

Employment history < 3 months

- Original company letter certifying employment start date and salary AND

- Latest computerized/soft copy payslips OR Bank statement showing salary crediting

| Prevailing interest rate | Interest rate if we do not receive minimum repayment by the due date |

| 22.90% | 28.00% |

| 28.00% | 36.00% |

| 29.80% (for customers with an annual income of S$20,000 to S$29,999) | 36.00% |