Singapore Economy: A stunning year in 2025

Singapore’s advance 4Q25 growth accelerated to 5.7% YoY (1.9% QoQ sa; seasonally adjusted), up from 4.3% YoY (2.4% QoQ sa) as the manufacturing sector surged 15% YoY on the back of outperformance in pharmaceutical and electronics.

Notwithstanding an eventful year of US tariffs and geopolitical uncertainties, this positive outcome was faster than the 5% YoY growth seen in 4Q24.

Strong manufacturing growth

Notably, the manufacturing growth of 15% YoY was the fastest since 4Q21 (16% YoY), whereas the construction and services sectors saw some moderation in growth to 4.2% YoY and 3.8% YoY respectively, versus the 5.1% YoY and 4.1% YoY seen in 3Q25.

The manufacturing sector was mainly powered by a pharmaceutical and sustained AI-related semiconductor, server and server-related demand. For services, the wholesale & retail trade and transportation & storage industries picked up speed in 4Q25 at 3.9% YoY (3Q: 3.7%), but the momentum in infocomms, finance & insurance and professional services (4.2% versus 4.5% YoY) and accommodation & food services, real estate, administrative & support services and other services (3.2% versus 4.0%) moderated.

The wholesale trade sector saw strong sales of telecoms & computer equipment and electronic components, while the transportation & storage sector registered resilient support from the water and air transport segments. The infocomms sector was aided by IT and information services demand, while professional services continued to see support from head offices & business representative offices segment. Banking and insurance also boosted the finance & insurance sector, and robust international visitor arrivals also led growth in the accommodation sector. The construction sector was aided by ongoing public and private sector construction activities.

2025 growth was the fastest pace since 2021

Singapore’s full-year 2025 GDP growth of 4.8% YoY, beat 2024’s 4.4% YoY and marked the fastest pace of growth since 2021 (9.8% YoY) and well above medium-term trend growth. This impressive outcome marked a significant upward revision from earlier forecasts that had projected slower growth and reflected a resilient global economy and export demand, some front-loading ahead of reciprocal tariff pressures and also broad-based gains across key sectors. MTI had recently upgraded its full-year 2025 GDP growth forecast to around 4% in November. In particular, the manufacturing sector led the vanguard at 7.6% YoY (fastest since 2021’s growth rate of 13.3%), followed by construction at 4.1% YoY (easing from 2024’s 4.5%) and services at 4.1% (also easing from 2024’s 4.4%). Singapore’s 4Q25 and full-year 2025 GDP performance showcased economic resilience through broad-based and diversified strengths in manufacturing, services, and construction.

Another good year in 2026?

Will Singapore be third time lucky in 2026 in terms of exceeding the 1-3% YoY official GDP growth forecast? Our 2026 GDP growth forecast remains at 2% YoY, assuming that manufacturing growth will ease to around 2.2% YoY due to the high base in 2025, while construction remains resilient around 4.8% amid ongoing public infrastructure projects (e.g. Changi T5, Tuas port and North-South corridor) and services growth moderates to around 3.0% as wholesale trade activity normalises.

At this juncture, the global economy is tipped to continue to grow at 3.1% in 2026 versus 3.2% in 2025 and 3.3% in 2024, according to the IMF.

Our 2026 forecast for key regional economies like China is 4.7% YoY (versus close to the 5% target in 2025) with similar mild moderations in the ASEAN economies, barring unexpected surprises on the global trade, tariff and geopolitical fronts.

While US sectoral tariffs are still pending, with semiconductors and pharmaceuticals of critical interest to many Asian economies including Singapore, the hope is that just like how reciprocal tariffs have materialised and been lowered with bilateral trade deals, eventually the bark may be worse than the bite.

Meanwhile, visitor arrivals, especially for MICE activities should remain conducive and private consumption is likely to be supported by the resilient domestic labour market.

President Donald Trump finally unveiled on 3 April 2025 a blanket tariff on 10% on all imports into the US as well as reciprocal tariffs on several countries. We believe this is not the end of road for tariffs. There is still room for negotiation, retaliation and further potential escalation.

Our analysis of tariffs has spanned from blanket tariffs, like what we got on 3 April 2025, to reciprocal tariffs, to sector specific tariffs. The ASEAN economies we cover were hard hit by tariffs as we had expected but the magnitude of the hit is much larger than we anticipated. This is partly based on the US computation of the tariffs imposed on it by trading nations resulting in hefty tariff rates and subsequently discounted differential tariffs.

Both are dramatic in their magnitude. These will have implications for growth, inflation, and fiscal and monetary policies. Admittedly, there are still some uncertainties. This pertains to the room to retaliate and/or negotiate. Although US Treasury Secretary Scott Bessent warned against retaliation, the strategy adopted by trading partners remains to be seen.

Significant downside risks to growth

Within ASEAN, Cambodia, Laos, Vietnam and Myanmar bear the bigger brunt of tariff increases, in terms of the magnitude of higher differential tariffs. This is followed by Thailand, Indonesia, Malaysia and the Philippines. India’s differential tariffs of 27% seems marginal compared to the long list of trade restrictions mentioned in the 2025 National Trade Estimate (NTE).

The blanket tariffs will come into effect on 5 April 2025, while reciprocal tariffs will come into effect on 9 April 2025. There are still some exemptions under the reciprocal tariff arrangements, including those items that are already under investigation including copper, pharmaceuticals, semiconductors, lumber articles, certain critical minerals, energy and energy products. There is a risk of tariffs on these products or higher blanket tariffs down the road.

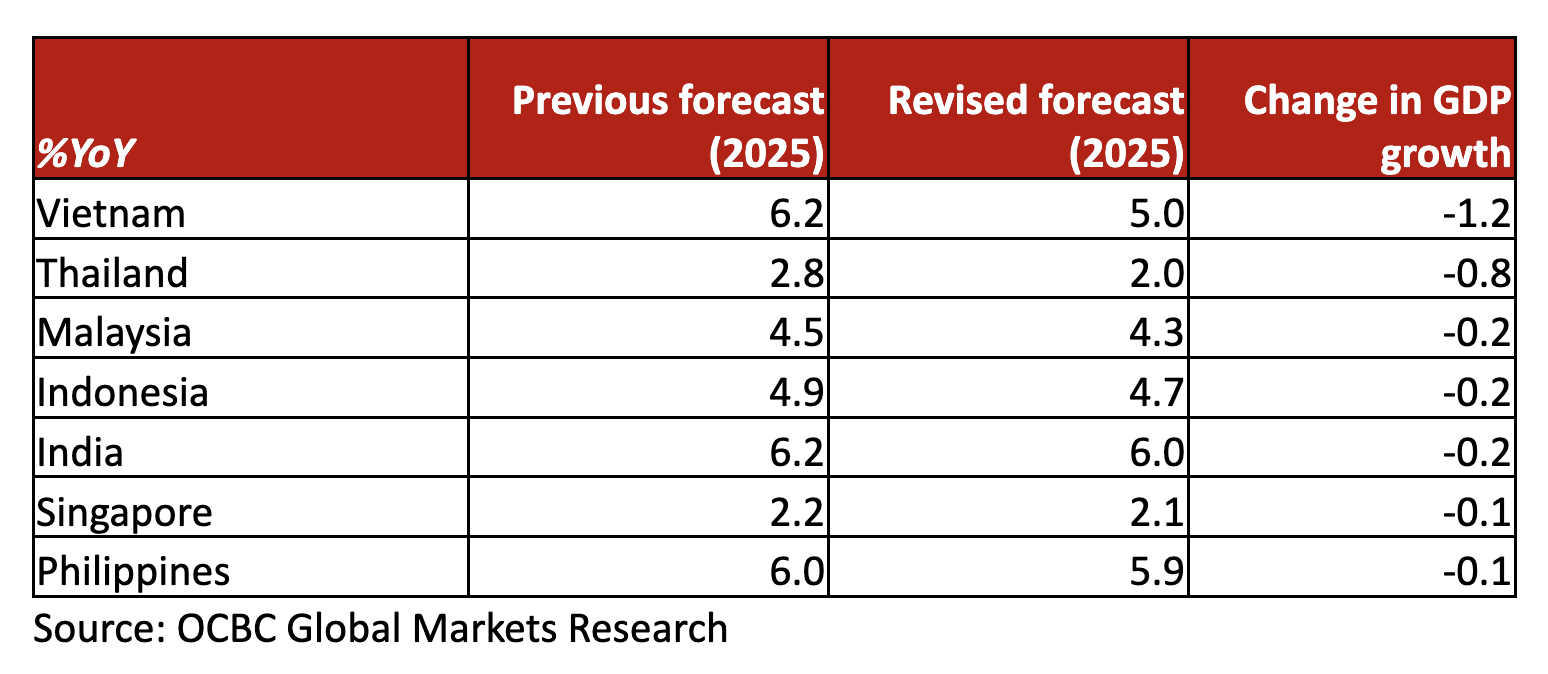

The sharp escalation of tariffs rates, if realised, will have a hard-hitting impact on economic growth through the export channels. Based on import elasticities and our back of the envelope calculations, Vietnam will be hardest hit with GDP growth, followed by Thailand and Malaysia while Indonesia and India could be more insulated. Philippines, by our estimates, will be least impacted.

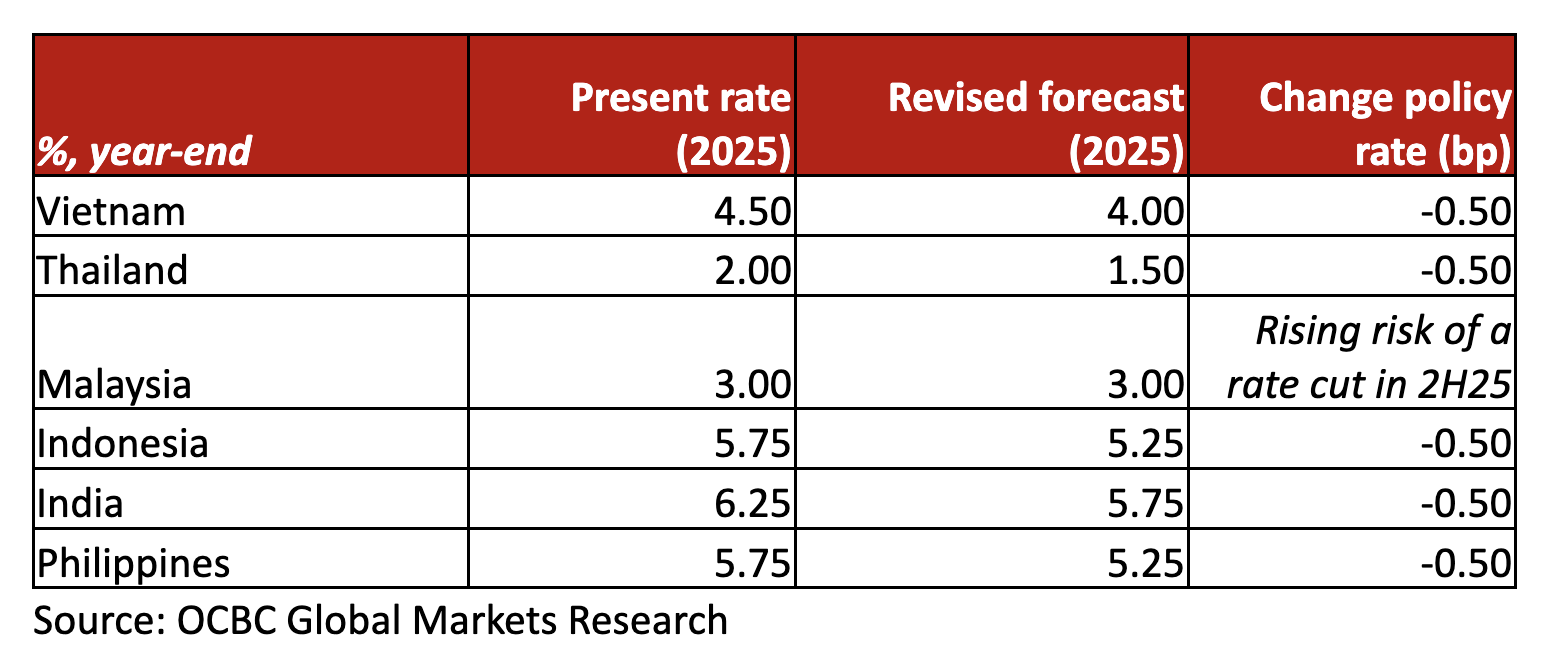

Central banks more inclined to support growth

We now expect regional central banks to become more supportive of growth, particularly in 2H25. We are adding rate cuts to our Vietnam, Thailand, Indonesia and India forecasts. We expect the State Bank of Vietnam and Bank of Thailand to cut by an additional 50 basis points (bps) in 2H25, while Bank Indonesia and Reserve Bank of India will likely cut by an additional 25bps on top our current forecast of 25bps. This implies an additional 50bps in rate cuts by end-2025. Although the growth impact is limited for Philippines, we expect that the country’s central bank, Bangko Sentral ng Pilipinas (BSP), will take the opportunity to lower rates further to mitigate downside risks. We, therefore, expect a cumulative 50bps in rate cuts in 2025.

Singapore: Still cautious

The silver lining is that 10% is relatively mild compared to China, Vietnam and many of the other ASEAN countries. Singapore’s resilience will depend on how well it adapts to shifting trade flows, potentially benefiting from companies diversifying away from the more heavily tariffed countries, while managing broader economic uncertainties and financial market volatility. But the indirect impact is through knock on effects through our role as trading, logistics and financial hubs. For Singapore, the top three NODX (non-oil domestic export) markets in 2024 are China (17%), US (15.8%) and Malaysia (8.7%). Moreover, there was no specific sectoral tariffs on semiconductors or pharmaceutical industries for instance. But the caveat is we have to wait and see what happens in the coming days and weeks.

For now, it is too early to say what the tariffs mean for Singapore. But the odds may be slightly skewed towards an easing of policy by Monetary Authority of Singapore.

Vietnam: Hardest hit

We reduce our 2025 GDP growth forecast to 5.0% YoY versus our previous forecast of 6.2%. Vietnam’s exports to the US totalled US$119.4bn in 2024, which can be reduced by as much as 35-40%, by our estimates. The impact on economic growth, however, is not straightforward particularly for 2025 considering that 1Q25 GDP growth was already relatively resilient at 6.6% YoY, by our estimates. Moreover, with semiconductors exports still exempted from the reciprocal tariffs’ announcements, the hit to exports will likely be reduced.

The authorities have been negotiating with the US in terms of trying to reduce tariffs and raising imports from the US. While the outcomes are still uncertain, we expect the authorities to remain focussed on expediting infrastructure spending and diversifying trade partners. The higher reciprocal tariffs on most goods, and likely impending tariffs on semiconductors, suggests that fiscal and monetary policies will have to be nimble. We now expect the State Bank of Vietnam to reduce its policy rate by 50bps this year compared to our previous forecast of no change.

Thailand: Next in line

The reciprocal tariff rates imposed on Thailand is 37%. Vuttikrai Leewiraphan, permanent secretary at the Ministry of Commerce, estimated that exports could be hit by US$7-8bn if tariffs on Thailand’s exports to the US were raised by 11%. This suggests a significant impact. However, with certain key items still exempt from tariffs (for the moment), we expect the hit to growth to remain significant at 0.8 percentage points (pp). We, therefore, reduce our 2025 GDP growth forecast to 2.0% from 2.8%.

While the authorities have been transparent about their intent to negotiate with the US, and the Thai authorities have agreed to import certain goods from the US, the outcome of further negotiations and the fate of the semiconductor tariffs remain uncertain. We now expect the Bank of Thailand (BoT) to reduce its policy rate by 50bps in 2025 to further bolster downside risks to growth, with the government continuing to pursue supportive fiscal policies.

Malaysia: Waiting for semiconductor tariffs

We reduce our 2025 GDP growth forecast to 4.3% YoY from 4.5% given the impact of weaker external demand as most of Malaysia’s trading partners are hit by tariffs. The relief for Malaysia’s exports, for the moment, is that semiconductor exports are still exempt from the reciprocal tariffs. This accounts for approximately a third of total exports to the US. Given the nature of the reciprocal tariff announcements, it seems like only a matter of time before semiconductor exports are slapped with tariffs. This will have a more significant impact on Malaysia’s GDP growth. The authorities have said that they will not pursue retaliatory tariffs and opt for negotiations.

While the stance of fiscal and monetary policy may not make dramatic shifts, it will likely lean towards becoming more growth supportive. The government plans to rationalise RON95 prices in a bid to reduce fuel subsidy expenditures. The government has stated that low-income groups will not be impacted. We see rising risks that this implementation could be delayed particularly if tariffs on semiconductor exports to the US are announced before 2H25.

If this price change materialises, Bank Negara Malaysia will be more inclined to look through supply-side shocks, but this will impact the timing of potential rate cuts to mitigate downside risks to growth. BNM could open the door to rate cuts in late 2025 or early 2026. If the price change is delayed, BNM could ease sooner.

Indonesia: Surprisingly hard hit

The reciprocal tariff rate of 32% is substantial and one of the most surprising, by our estimates. The economy is already hard hit by perceived uncertainties around domestic policy direction and cloudy fiscal policy outlook given weaker-than-expected revenue collections and budget reallocations. The higher-than-expected tariff rate will exacerbate these risks. We reduce our 2025 GDP growth forecast to 4.7% from 4.9% and expect that the worsening of current account deficit (1.4% of GDP in 2025 versus 0.6% in 2024) will put further pressure on the economy to maintain strong capital inflows even as the outlook for the latter remains uncertain.

The government and central bank will need to be nimble in their policy approach to prevent a further backsliding of sentiment. The government will have to ramp up communications and improve its perceived image on policy making.

Bank Indonesia (BI) has tied further rate cuts to the stability of the Indonesian Rupiah as the downside risks to growth becoming increasingly obvious. It is worth noting that the anecdotal activity data during the Eid holidays have been lower compared to 2024. We expect BI to now cut by a cumulative 50bps in 2025, compared to 25bps previously. However, the timing for BI rate cuts needs to become more proactive and less tied to currency outcomes to enable more timely growth support.

Philippines: Better by comparison

The reciprocal tariffs at 18% is the lowest in the region and the impact on GDP growth will also be concomitantly lower. Like Malaysia, Philippines exports to the US is biased towards semiconductors, which are still exempt from tariffs at the moment.

We expect GDP growth to be slightly lower at 5.9% YoY in 2025 versus 6.0%, previously. We expect BSP to follow on with two 25bps rate cuts for the rest of 2025, particularly as headline inflation remains well within BSP’s 2-4% target range.

India: In the middle but limited impact

India’s tariff rate of 27% looks more manageable compared to regional peers. However, there will be a modest hit to growth of 0.2pp considering weaker external demand. As a predominantly domestic demand driven economy, the impact of higher tariffs from the US will likely have sector specific impacts.

From a policy perspective, further simplification of non-tariff trade measures and continued negotiations with the US will likely keep the Indian economy in good stead. The Reserve Bank of India (RBI) has increased banking sector liquidity to allow for further rate cuts, in our view. We expect the RBI to reduce its policy rate by two 25bps rate cuts for the rest of 2025.

FDI investment flows could change

The reciprocal tariffs on ASEAN and India will hurt the ‘China+1’ strategy that has benefited the region for some years now. Although China’s tariff rate is still higher at 54% (reciprocal 34% plus previously imposed 20%), the elevated tariffs on Cambodia and Vietnam suggest that the allure of shifting production to these economies is reduced compared prior to the tariffs. It will, however, take time for global supply chains to adjust and in the interim, firms will either need to bear the brunt of the tariffs or pass it onto the consumer, complicating the picture for price pressures.

In the interim, the ASEAN markets will remain vigilant of lower goods coming in from China. China’s surplus with the ASEAN markets increased significantly in 2024 and we do not rule out further measures from these economies to protect against the inflows of goods at reduced prices from China.