The Gold Reset: Dawn of a new era

Our constructive outlook for gold remains intact. Structural demand continues to underpin the market—led by persistent central bank buying and wider investor participation. These factors help explain why dips still attract buyers.

Lim Yuin

Chief Investment Strategist,

Lion Global Investors

Gold has entered 2026 not as a safe-haven trade of the moment, but as the centerpiece of a deeper structural repricing in global markets.

OCBC Group Research has raised its forecast for the price of gold to US$5,600 per ounce by end-2026, reflecting the historic shift in how investors, institutions, and governments view the metal’s role in the financial system.

This transformation is driven by three converging forces: central bank diversification, the debasement of fiat currencies, and persistent geopolitical instability.

Central bank diversification

Perhaps the most powerful underpinning of gold’s performance is the scale and consistency of central bank demand. Over the past three years, central banking buying has exceeded 1,000 tonnes annually. Emerging markets have accelerated acquisitions as part of a broader strategy to reduce dependence on the US dollar after the freezing of Russian foreign reserves in 2022. Gold, immune to sanctions and counterparty risk, has become the asset of strategic neutrality.

This steady, price-insensitive buying creates a fundamental support level. Even as private investment flows fluctuate, the ongoing build-up of sovereign reserves means that dips in price often meet strong institutional demand. In effect, central banks now function as a stabilising force, cushioning the downside while leaving ample room for upside repricing.

Debasement of fiat currencies

Alongside structural buying, a growing number of investors are turning to gold as defense against the creeping “fiscal dominance” that defines today’s macro environment. With global debt levels soaring and governments facing limited political appetite for austerity, central banks remain under pressure to maintain accommodative monetary conditions. High debt burdens constrain policy choices, making it difficult to raise rates aggressively without triggering financial stress. This environment naturally erodes confidence in the long-term purchasing power of fiat currencies.

The reallocation to gold can therefore be read as a collective hedge against what some call “monetary dilution”—the gradual debasement of paper money through chronic deficits and balance sheet expansion. When investors no longer see sovereign bonds as risk-free stores of value, gold assumes that mantle by default. Its lack of yield becomes less of a drawback and more of a badge of independence.

Consistent geopolitical instability

The current decade’s fractured geopolitical order adds another layer of support. Conflicts in Eastern Europe and the Middle East, escalating trade tensions between the US and China, and renewed talk of sanctions against emerging economies have collectively reinforced gold’s traditional appeal as a crisis hedge. Each incident reminds markets that geopolitical shocks can materialize rapidly and that financial systems are increasingly weaponized.

Unlike currencies or government securities, gold carries no allegiance and no liability. It can be held discreetly, transferred easily, and functions as a universal unit of value recognized across borders. For both governments and private investors, these qualities make it indispensable in an uncertain world.

Tight global supply

On the supply side, the picture is equally supportive. Global mine output has plateaued, constrained by declining ore grades, environmental regulations, and the rising costs of new discoveries. Even with sustained high prices, meaningful increases in production appear limited in the near term. This inelastic supply curve means that new demand translates disproportionately into price gains.

The overall risk profile is therefore asymmetric. Central bank accumulation anchors the downside, while the upside remains open-ended—especially if a broader crisis of confidence in sovereign debt markets emerges. Investors do not need gold to outperform all assets; they need it to excel when everything else falters.

Gold belongs to a diversified portfolio

From a portfolio construction standpoint, gold’s role as a diversifier is perhaps more relevant than ever. Its historical low correlation with both equities and bonds allows it to preserve capital in environments where traditional assets move in tandem—such as during inflation shocks or policy missteps. Beyond diversification, gold serves three other key functions: it protects against long-term inflation, preserves purchasing power, and provides optionality during extreme market stress.

In practical terms, a strategic allocation to gold—whether through physical holdings or gold-backed instruments—acts as portfolio insurance. It is the asset investors hope never to need, yet are relieved to own when uncertainty surges. Given today’s convergence of fiscal risks, geopolitical volatility, and persistent inflationary pressures, that insurance is not a luxury but a necessity.

President Donald Trump finally unveiled on 3 April 2025 a blanket tariff on 10% on all imports into the US as well as reciprocal tariffs on several countries. We believe this is not the end of road for tariffs. There is still room for negotiation, retaliation and further potential escalation.

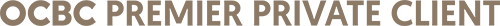

Our analysis of tariffs has spanned from blanket tariffs, like what we got on 3 April 2025, to reciprocal tariffs, to sector specific tariffs. The ASEAN economies we cover were hard hit by tariffs as we had expected but the magnitude of the hit is much larger than we anticipated. This is partly based on the US computation of the tariffs imposed on it by trading nations resulting in hefty tariff rates and subsequently discounted differential tariffs.

Both are dramatic in their magnitude. These will have implications for growth, inflation, and fiscal and monetary policies. Admittedly, there are still some uncertainties. This pertains to the room to retaliate and/or negotiate. Although US Treasury Secretary Scott Bessent warned against retaliation, the strategy adopted by trading partners remains to be seen.

Significant downside risks to growth

Within ASEAN, Cambodia, Laos, Vietnam and Myanmar bear the bigger brunt of tariff increases, in terms of the magnitude of higher differential tariffs. This is followed by Thailand, Indonesia, Malaysia and the Philippines. India’s differential tariffs of 27% seems marginal compared to the long list of trade restrictions mentioned in the 2025 National Trade Estimate (NTE).

The blanket tariffs will come into effect on 5 April 2025, while reciprocal tariffs will come into effect on 9 April 2025. There are still some exemptions under the reciprocal tariff arrangements, including those items that are already under investigation including copper, pharmaceuticals, semiconductors, lumber articles, certain critical minerals, energy and energy products. There is a risk of tariffs on these products or higher blanket tariffs down the road.

The sharp escalation of tariffs rates, if realised, will have a hard-hitting impact on economic growth through the export channels. Based on import elasticities and our back of the envelope calculations, Vietnam will be hardest hit with GDP growth, followed by Thailand and Malaysia while Indonesia and India could be more insulated. Philippines, by our estimates, will be least impacted.

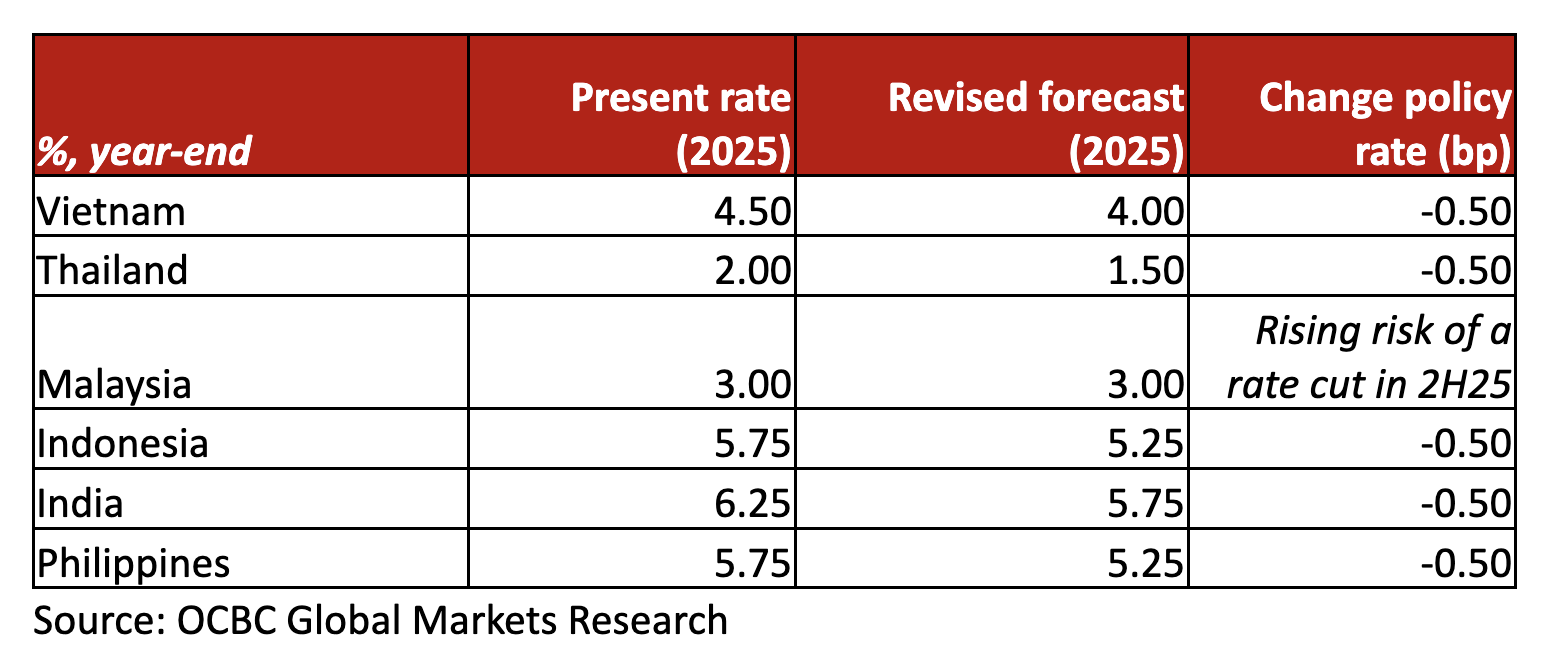

Central banks more inclined to support growth

We now expect regional central banks to become more supportive of growth, particularly in 2H25. We are adding rate cuts to our Vietnam, Thailand, Indonesia and India forecasts. We expect the State Bank of Vietnam and Bank of Thailand to cut by an additional 50 basis points (bps) in 2H25, while Bank Indonesia and Reserve Bank of India will likely cut by an additional 25bps on top our current forecast of 25bps. This implies an additional 50bps in rate cuts by end-2025. Although the growth impact is limited for Philippines, we expect that the country’s central bank, Bangko Sentral ng Pilipinas (BSP), will take the opportunity to lower rates further to mitigate downside risks. We, therefore, expect a cumulative 50bps in rate cuts in 2025.

Singapore: Still cautious

The silver lining is that 10% is relatively mild compared to China, Vietnam and many of the other ASEAN countries. Singapore’s resilience will depend on how well it adapts to shifting trade flows, potentially benefiting from companies diversifying away from the more heavily tariffed countries, while managing broader economic uncertainties and financial market volatility. But the indirect impact is through knock on effects through our role as trading, logistics and financial hubs. For Singapore, the top three NODX (non-oil domestic export) markets in 2024 are China (17%), US (15.8%) and Malaysia (8.7%). Moreover, there was no specific sectoral tariffs on semiconductors or pharmaceutical industries for instance. But the caveat is we have to wait and see what happens in the coming days and weeks.

For now, it is too early to say what the tariffs mean for Singapore. But the odds may be slightly skewed towards an easing of policy by Monetary Authority of Singapore.

Vietnam: Hardest hit

We reduce our 2025 GDP growth forecast to 5.0% YoY versus our previous forecast of 6.2%. Vietnam’s exports to the US totalled US$119.4bn in 2024, which can be reduced by as much as 35-40%, by our estimates. The impact on economic growth, however, is not straightforward particularly for 2025 considering that 1Q25 GDP growth was already relatively resilient at 6.6% YoY, by our estimates. Moreover, with semiconductors exports still exempted from the reciprocal tariffs’ announcements, the hit to exports will likely be reduced.

The authorities have been negotiating with the US in terms of trying to reduce tariffs and raising imports from the US. While the outcomes are still uncertain, we expect the authorities to remain focussed on expediting infrastructure spending and diversifying trade partners. The higher reciprocal tariffs on most goods, and likely impending tariffs on semiconductors, suggests that fiscal and monetary policies will have to be nimble. We now expect the State Bank of Vietnam to reduce its policy rate by 50bps this year compared to our previous forecast of no change.

Thailand: Next in line

The reciprocal tariff rates imposed on Thailand is 37%. Vuttikrai Leewiraphan, permanent secretary at the Ministry of Commerce, estimated that exports could be hit by US$7-8bn if tariffs on Thailand’s exports to the US were raised by 11%. This suggests a significant impact. However, with certain key items still exempt from tariffs (for the moment), we expect the hit to growth to remain significant at 0.8 percentage points (pp). We, therefore, reduce our 2025 GDP growth forecast to 2.0% from 2.8%.

While the authorities have been transparent about their intent to negotiate with the US, and the Thai authorities have agreed to import certain goods from the US, the outcome of further negotiations and the fate of the semiconductor tariffs remain uncertain. We now expect the Bank of Thailand (BoT) to reduce its policy rate by 50bps in 2025 to further bolster downside risks to growth, with the government continuing to pursue supportive fiscal policies.

Malaysia: Waiting for semiconductor tariffs

We reduce our 2025 GDP growth forecast to 4.3% YoY from 4.5% given the impact of weaker external demand as most of Malaysia’s trading partners are hit by tariffs. The relief for Malaysia’s exports, for the moment, is that semiconductor exports are still exempt from the reciprocal tariffs. This accounts for approximately a third of total exports to the US. Given the nature of the reciprocal tariff announcements, it seems like only a matter of time before semiconductor exports are slapped with tariffs. This will have a more significant impact on Malaysia’s GDP growth. The authorities have said that they will not pursue retaliatory tariffs and opt for negotiations.

While the stance of fiscal and monetary policy may not make dramatic shifts, it will likely lean towards becoming more growth supportive. The government plans to rationalise RON95 prices in a bid to reduce fuel subsidy expenditures. The government has stated that low-income groups will not be impacted. We see rising risks that this implementation could be delayed particularly if tariffs on semiconductor exports to the US are announced before 2H25.

If this price change materialises, Bank Negara Malaysia will be more inclined to look through supply-side shocks, but this will impact the timing of potential rate cuts to mitigate downside risks to growth. BNM could open the door to rate cuts in late 2025 or early 2026. If the price change is delayed, BNM could ease sooner.

Indonesia: Surprisingly hard hit

The reciprocal tariff rate of 32% is substantial and one of the most surprising, by our estimates. The economy is already hard hit by perceived uncertainties around domestic policy direction and cloudy fiscal policy outlook given weaker-than-expected revenue collections and budget reallocations. The higher-than-expected tariff rate will exacerbate these risks. We reduce our 2025 GDP growth forecast to 4.7% from 4.9% and expect that the worsening of current account deficit (1.4% of GDP in 2025 versus 0.6% in 2024) will put further pressure on the economy to maintain strong capital inflows even as the outlook for the latter remains uncertain.

The government and central bank will need to be nimble in their policy approach to prevent a further backsliding of sentiment. The government will have to ramp up communications and improve its perceived image on policy making.

Bank Indonesia (BI) has tied further rate cuts to the stability of the Indonesian Rupiah as the downside risks to growth becoming increasingly obvious. It is worth noting that the anecdotal activity data during the Eid holidays have been lower compared to 2024. We expect BI to now cut by a cumulative 50bps in 2025, compared to 25bps previously. However, the timing for BI rate cuts needs to become more proactive and less tied to currency outcomes to enable more timely growth support.

Philippines: Better by comparison

The reciprocal tariffs at 18% is the lowest in the region and the impact on GDP growth will also be concomitantly lower. Like Malaysia, Philippines exports to the US is biased towards semiconductors, which are still exempt from tariffs at the moment.

We expect GDP growth to be slightly lower at 5.9% YoY in 2025 versus 6.0%, previously. We expect BSP to follow on with two 25bps rate cuts for the rest of 2025, particularly as headline inflation remains well within BSP’s 2-4% target range.

India: In the middle but limited impact

India’s tariff rate of 27% looks more manageable compared to regional peers. However, there will be a modest hit to growth of 0.2pp considering weaker external demand. As a predominantly domestic demand driven economy, the impact of higher tariffs from the US will likely have sector specific impacts.

From a policy perspective, further simplification of non-tariff trade measures and continued negotiations with the US will likely keep the Indian economy in good stead. The Reserve Bank of India (RBI) has increased banking sector liquidity to allow for further rate cuts, in our view. We expect the RBI to reduce its policy rate by two 25bps rate cuts for the rest of 2025.

FDI investment flows could change

The reciprocal tariffs on ASEAN and India will hurt the ‘China+1’ strategy that has benefited the region for some years now. Although China’s tariff rate is still higher at 54% (reciprocal 34% plus previously imposed 20%), the elevated tariffs on Cambodia and Vietnam suggest that the allure of shifting production to these economies is reduced compared prior to the tariffs. It will, however, take time for global supply chains to adjust and in the interim, firms will either need to bear the brunt of the tariffs or pass it onto the consumer, complicating the picture for price pressures.

In the interim, the ASEAN markets will remain vigilant of lower goods coming in from China. China’s surplus with the ASEAN markets increased significantly in 2024 and we do not rule out further measures from these economies to protect against the inflows of goods at reduced prices from China.