Ride out market cycles: Balance your portfolio for long term wealth creation

Dealing with unpredictability

Economic and financial market performance was hardly predictable during the throes of the Covid-19 crisis in 2020. Countries that took decisive, quick and forceful action to contain the spread of the virus have enjoyed better economic outcomes versus those that delayed such action.

And while most developed countries posted negative growth, Asian economies – including China, Taiwan and Vietnam – boasted positive year-on-year increase in GDP, buttressed by their efficient containment of Covid-19.

A year later, the US economy, with considerable help from widespread vaccinations and unprecedented fiscal and monetary policy support, has seen its position shift from laggard to leader, potentially leapfrogging most of the developed world and some of the emerging countries in terms of economic growth, if the International Monetary Fund’s (IMF) projections are to be believed.

On the equity market front, growth sectors including information technology, communication services and health care did phenomenally well in 2020, as investors ploughed into the work-from-home trade. Fast forward a year later, market leadership has also flipped, with cyclicals like energy, industrials and financials powering ahead of high-growth sectors on the back of expectations of stronger economic performance and sharp earnings recovery.

The point is, it is difficult to predict with any degree of precision how markets and economies would perform, even up against a common macro-economic and public health shock like Covid-19. Financial markets, especially, are fickle beasts. There are just too many variables to consider, and what we thought ought to play out may not always turn out that way.

As it stands, the global economic recovery has been uneven, largely determined by access to and pace of vaccinations as well as the path of the virus and its variants. While the outlook in 2021 is decidedly brighter with the discovery and distribution of vaccines, there is still a great deal of uncertainty. Pinpointing the winners and losers may be challenging amid the shifting macro-economic landscape.

Hence, it’s never wise to concentrate investments in any single regional market, asset class or individual security, based on just predictions or expectations alone. “Don’t put all your eggs in one basket,” goes a familiar investment adage. One can efficiently summarise the essential point of the phrase in just one word: Diversification.

Variety is the spice of life

The benefit of diversification is easy to appreciate. The whole idea is to reduce the overall risk of a portfolio by investing in assets that are lowly correlated or uncorrelated with each other, such that the rise in value of one asset could potentially offset the fall of another, hence keeping the value of the entire portfolio somewhat stable and less volatile.

The traditional equity-bond split was built on the premise that should one’s equity holdings fall in value because of some market ruction, bond holdings should inversely rise in value as bonds are typically in high demand during such risk-off episodes.

While investors may not be able to enjoy the full extent of the equity market upside given that a meaningful proportion of their holdings are in bonds, diversification still helps reduce the overall risk of the portfolio and mitigate the downside should equities take a turn for the worst. After all, there’s no guarantee that a single asset class or geographical market can outperform consistently over time. Claiming that one can somehow always pick out the top performing asset is certainly hubris.

Difficult to pick the winners

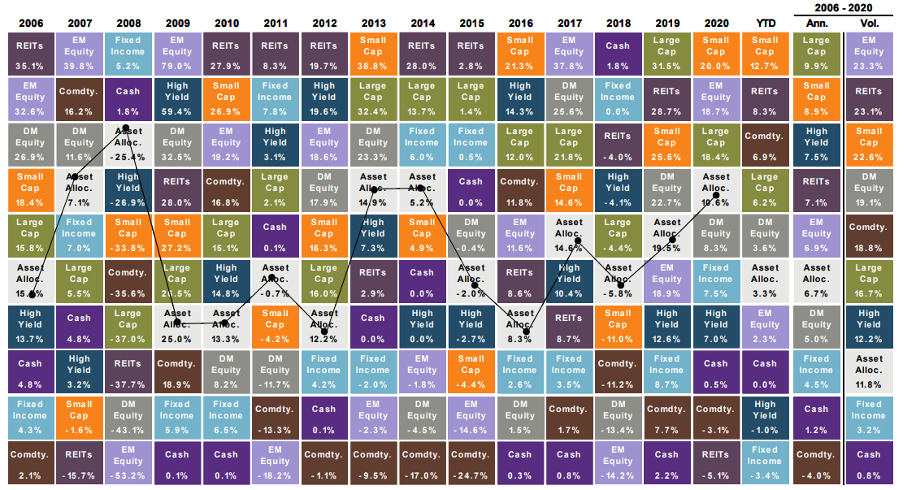

To prove this, just consider the smorgasbord of colours in the table below, which shows the annual returns for various asset classes over the years. The top row indicates the best performing asset class in each year, from 2006 to 2020.

Notice that there isn’t a specific asset class that out-performs consistently year after year. The rankings of these asset classes change every year, and it is difficult to predict accurately at any given time which would dominate, and which would sink.

Table 1: Asset class returns

Source: JP Morgan Asset Management, Guide to the Markets, 2Q2021, Data as of 31 March 2021

Asset allocation matters

As such, amid a particularly uncertain environment, investors should ensure portfolios are well-diversified to manage the downside risks.

Indeed, getting the right mix of assets is integral to maintaining robust portfolios. This varies from person to person and will be determined by his or her risk profile, their goals and personal circumstances.

Over the long term, proper asset allocation is one of the most important determinants of an investor’s financial well-being. Misaligned portfolios, or those that are overly concentrated in a single asset class or geographical market can derail the chances of achieving one’s long-term investment objectives.

All about balance

To improve diversification within portfolios, investors should consider alternative asset classes, beyond just traditional stocks and bonds. Alternative assets like real estate, hedge funds and private equity may potentially lower portfolio risk as its return drivers are markedly different from either equities or bonds.

Investors should also be mindful about their regional exposure. While domestic assets provide the comfort of familiarity, investors should avoid home bias and expand their regional horizon. An unconstrained, global approach to investing necessarily expands the opportunity set, allowing investors to secure potentially higher returns from other fast-growing regions around the world.

Investors should also review and rebalance their portfolios from time to time to ensure its composition remains well-balanced. A robust review process allows investors to take stock of the progress of their portfolios and adjust where necessary. They may readjust positions to fortify defences, take profit where its good, cut losses where it’s necessary, rotate from overvalued assets to undervalued ones and potentially gather some dry powder to tap investment opportunities as and when they arise. Importantly, it ensures that the portfolio’s make-up stays relevant to changing macro-economic circumstances.

Ultimately, a well-diversified portfolio can offer greater stability and potentially higher risk-adjusted returns over the long run relative to a pure equity or fixed income play. This may be appealing to investors trying to navigate choppy markets and a macro-outlook that seems rife with uncertainties.

- The content in this report is either written by OCBC Wealth Management or a third party commissioned by Oversea-Chinese Banking Corporation Limited (“OCBC Bank”, “us”, “we” or “our”). Some of the contents in this report are summaries of the investment ideas and recommendations set out in research reports disseminated by OCBC Bank and its respective associated and connected corporations ("OCBC Group"). For any interest that OCBC Group might have in the securities and/or issuers of the securities, you may request for a copy of the relevant report from your relationship manager.

- Any opinions or views of third parties expressed in this document are those of the third parties identified, and do not represent views of Oversea-Chinese Banking Corporation Limited.

- This information is intended for general circulation and / or discussion purposes only. It does not consider the specific investment objectives, financial situation or needs of any particular person.

- Before you make an investment, please seek advice from your Relationship Manager regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs.

- If you choose not to do so, you should consider if the investment product is suitable for you and conduct your own assessments and due diligence on the investment product.

- We are not making an offer, solicit to buy or sell or subscribe for any security or financial instrument, enter into any transaction or participate in any trading or investment strategy with you through this document. Nothing in this document shall be deemed as an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into any transaction or to participate in any particular trading or investment strategy.

- No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice.

- OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

- Investments are subject to investment risks, including the possible loss of the principal amount invested. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures, predictions or projections are not necessarily indicative of future or likely performance.

- Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way.

- The information in and contents of this document may not be reproduced or disseminated in whole or in part without OCBC Bank’s written consent.

- OCBC Bank, its related companies, and their respective directors and/or employees (collectively “Related Persons”) may, or might have in the future, interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.

- You must read the Offer Document/Indicative Term Sheet/Product Highlight Sheet before deciding whether or not to purchase the investment product, copies of which may be obtained from your relationship manager.

- Any hyperlink to any third party article, or other website or webpage (including any websites or webpages owned, operated and maintained by third parties) is for informational purposes only and for your convenience only and is not an endorsement or verification of any such article, website or webpage by OCBC Bank and should only be accessed at your own risk. OCBC Bank does not review the contents of any such articles, website or webpage, and shall not be liable to any person for the same.

- Investors should note that there are necessarily limitations and difficulties in using any graph, chart, formula or other device to determine whether or not, or if so, when to, make an investment.

- Where the contents have not been identified as summaries of the investment ideas and recommendations set out in research reports disseminated by the OCBC Group, the information is not intended to constitute research analysis or recommendation and should not be treated as such.

Foreign Currency

- Foreign currency investments or deposits are subject to inherent exchange rate fluctuation that may provide opportunities and risks. Consequently, exchange rate fluctuations may affect the value of your foreign currency investments or deposits.

- Earning on foreign currency investments or deposits may change depending on the exchange rates prevalent at the time of their at maturity if you choose to convert.

- Exchange controls may apply to certain foreign currencies from time to time.

- Any pre-termination costs will be taken and deducted from your deposit directly and without notice.

Cross-Border Marketing Disclaimers