Still medium-term positive on gold

Oil

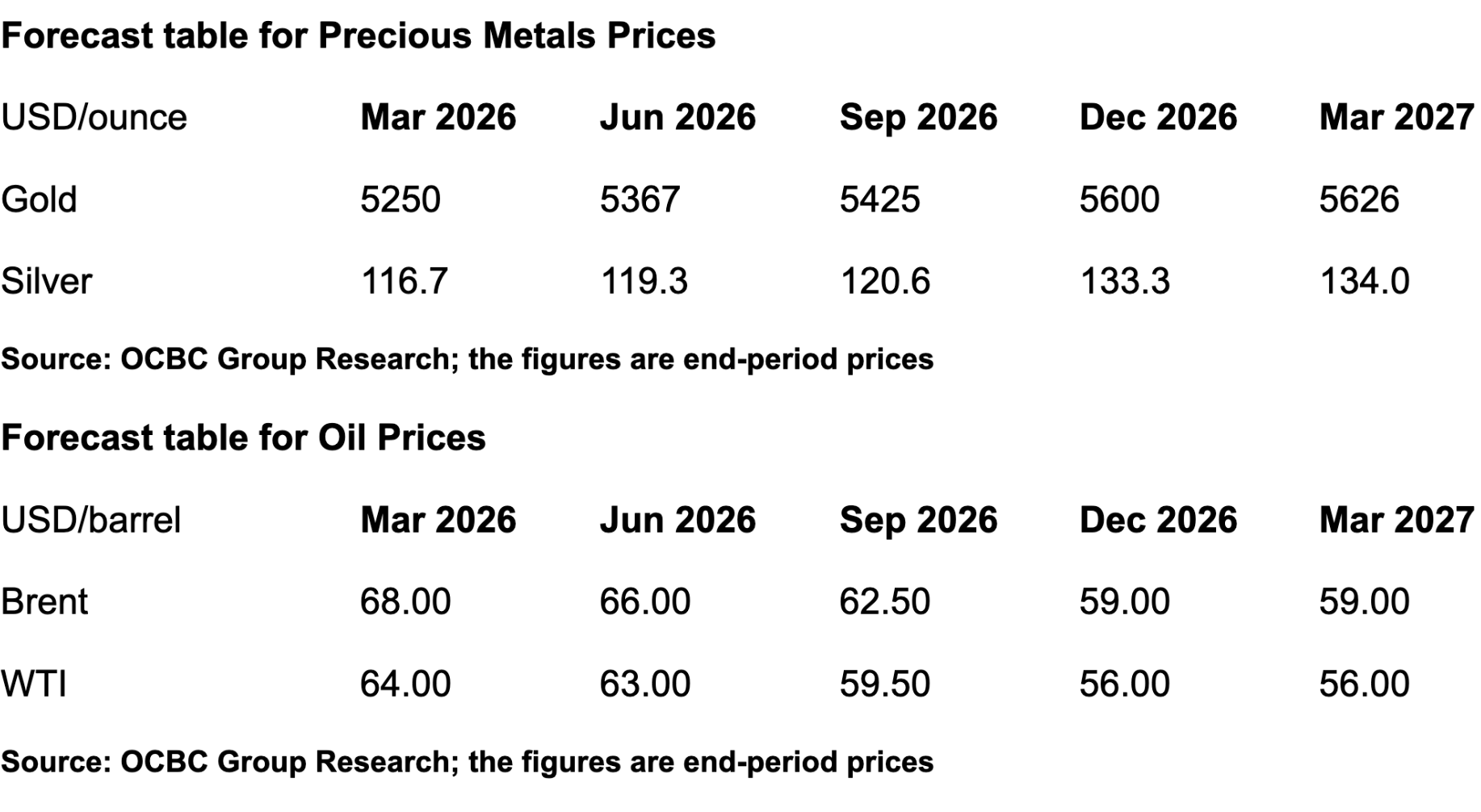

The global crude oil market remains exposed to shifting geopolitical risks. Geopolitical risks, including unrests in Iran, US strikes on Venezuela, and the Russia-Ukraine conflict are adding volatility to oil markets and temporarily supporting prices. Supply risks in Iran are unlikely to ease quickly. Increased tensions between the US and Iran – with the US having dispatched naval assets to the Middle East – has heightened disruption risks of Iran’s 1.9 million barrel per day of oil exports. The US' proposed peace plan for Russia and Ukraine could significantly impact oil supply, with potential outcomes ranging from supply disruptions to additional Russian crude entering the market.

Venezuela’s political situation remains uncertain following the US capture of President Maduro. Threats of near-term disruptions to Venezuela are receding as the US appears focused on keeping oil flowing post-Maduro. Venezuela is a small oil producer but has the largest oil reserves globally. However, it is too early to assume upside to longer-term production in Venezuela given uncertainty over whether political transition will deliver long-term policy stability – which is critical for attracting private investments to rehabilitate Venezuela’s dilapidated infrastructure. Oil prices have rallied on geopolitical headlines although spikes are likely to stay contained as crude oil production looks set to outpace demand in 2026. We maintain our forecast for Brent to bottom near USD59/barrel by year-end, pending clarity on Venezuela’s new government and its resource policy. OPEC’s pause in quota hikes, supports a soft floor for Brent in the high-US$50s. China’s ongoing strategic oil stockpiling could continue to keep stockpile outside of China relatively low.

Precious Metals

Gold

Gold rose to a fresh all-time high of USD5,595/oz on 29 January. Earlier remarks from President Trump signalling tolerance for USD weakness, alongside renewed concerns over a potential US government shutdown and geopolitical risks in Venezuela, Greenland and Iran reinforced demand for safe-haven assets. Demand has also broadened beyond central banks. Reports indicated that Tether added around 27 tonnes of gold in 4Q25, bringing total holdings to approximately 140 tonnes, with purchases reportedly continuing at a steady pace. This highlights growing institutional and retail participation in gold alongside official-sector demand.

Price action, however, has been volatile. Following a sharp and rapid rally, gold corrected significantly into month-end. The pullback coincided with the US averting a government shutdown, reports of potential geopolitical de-escalation involving Iran, and market speculation around a less-dovish Fed leadership scenario, which triggered a broader cross-asset pullback and a rebound in the USD.

The pullback in gold towards end-January is broadly consistent with our recent near-term assessment that elevated price levels increase the precious metal’s near-term sensitivity to macro repricing, particularly around the US Dollar and yield dynamics. As such, greater two-way volatility should not be unexpected.

We see the recent pullback as a normalisation phase rather than a shift in the underlying trend. In the coming weeks, prices are likely to trade with higher volatility as markets digest recent gains and reassess positioning and sentiments. Rising government debt burdens, geopolitical concerns and policy unpredictability remain some of the drivers underpinning the constructive outlook in the medium term but 2-way swings may weigh on sentiments in the near term.

Silver

Silver prices experienced an exceptionally volatile month in January, surging to an intraday high of above USD120/oz (29 January) before undergoing a sharp and rapid correction into end-month. The magnitude and speed of the pullback underscore silver’s inherently higher beta profile relative to gold, particularly when prices move into overextended territory.

The recent correction appears to have been driven by position-adjustment dynamics. As prices accelerated higher, the market became increasingly vulnerable to sharp, liquidity-driven reversals, especially as profit-taking and margin-related selling were triggered. Importantly, the pullback should be viewed as a healthy correction. Industrial demand themes, particularly from Solar PV (Photovoltaic), grid modernisation, and AI-related infrastructure continue to provide a strong structural underpinning.

That said, the recent episode highlights an important signpost for investors - as prices move higher rapidly, volatility and drawdown risks increase non-linearly. Silver’s rallies tend to overshoot, and corrections can be sharp even within a broader uptrend. This argues for disciplined position sizing and a more tactical approach to entry points, rather than chasing momentum at extremes.

In the interim, the speed of the recent unwind and its inherently higher two-way volatility may temporarily weigh on near-term sentiment, despite supportive fundamentals.

Currency

US dollars (USD)

Renewed USD weakness has caught many investors off guard, prompting fresh debate about how much further the USD can fall. President Trump’s brief on‑off threats over Greenland have amplified concerns over erratic policymaking and revived the 2025 de‑dollarisation narrative. Speculation around possible US-Japan joint intervention to weaken the USD versus the Japanese Yen (JPY) has also raised questions about whether US policymakers are becoming more tolerant of a softer USD. Several USD downside risks we had previously highlighted – volatile US policy signals and concerns over Fed independence – have now materialised, contributing to the latest bout of USD softness. The decline could extend if investors remain unconvinced that “maximum US policy uncertainty” has passed. In response, we have raised our exchange rate between the Euro (EUR) and US Dollar - EURUSD forecast to 1.23 from 1.20 to reflect the risk of a deeper USD slide. That said, any further weakness is likely to be more contained than in 2025, when tariff‑induced recession fears triggered a sharper selloff. Today’s backdrop is different - US data remains resilient, contrasting with dovish Fed pricing, and should help limit the depth of additional USD downside.

Japanese Yen (JPY)

The JPY has strengthened recently against the USD on reports that the New York Fed conducted rate checks for the US Treasury Department, fuelling speculation of possible coordinated JPY‑buying by Japan and the US. Despite the intervention chatter, we do not have strong conviction that USDJPY can sustainably trade much below 150. We maintain our end‑2026 USDJPY forecast at 149. A more constructive JPY outlook would require a meaningfully more hawkish BOJ stance and clearer evidence that rising long‑end JGB (Japanese Government Bond) yields are triggering capital repatriation. For now, fiscal pledges toward further budget loosening could continue weighing on the JPY.

Chinese Yuan (CNY)

USDCNY continued to trade with a heavy downward bias for the month of January. Even the daily USDCNY fix by the PBOC has been set lower, breaking below the psychological 7.00 for the first time on 23rd January. The fix was subsequently set lower at 6.9755 (on 28 January). This was the strongest CNY fix (versus the USD) in over 32 months, reinforcing a deliberate move to steer the Chinese currency on a gradual appreciation path. While the intensity of the fix may have picked up, it remains modest, and we believe policymakers are likely to continue to maintain an orderly and measured pace of RMB appreciation. This approach aims to prevent markets from rushing to offload the USD in a disorderly manner, thereby avoiding any abrupt price fluctuations and ensuring orderly market dynamics.

Singapore Dollar (SGD)

USDSGD has continued to trade lower, breaching multi-year lows. Spillover gains from moves in the JPY and Renminbi and a softer USD backdrop have been some of the key drivers weighing on USDSGD. In the recent MAS policy decision (on 29 January), the central bank kept its monetary policy settings unchanged for the third consecutive meeting and delivered a hawkish tilt. It upgraded the 2026 headline and core inflation forecasts from 0.5-1.5% to 1-2%. Market expectations for the MAS to tighten at some point down the road may continue to anchor relative strength in SGD against its trading partners. In light of recent market developments, including shifts in the USD and expectations about MAS’ policy stance, we have revised our USDSGD forecasts lower.

The information provided herein is intended for general circulation and/or discussion purposes only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The information in this document is not intended to constitute research analysis or recommendation and should not be treated as such.

Without prejudice to the generality of the foregoing, please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase the investment product. In the event that you choose not to seek advice from a financial adviser, you should consider whether the product in question is suitable for you. This does not constitute an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into a transaction or to participate in any particular trading or investment strategy.

The information provided herein may contain projections or other forward looking statement regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures are not necessarily indicative of future or likely performance. Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same. Investments are subject to investment risks, including the possible loss of the principal amount invested.

The Bank, its related companies, their respective directors and/or employees (collectively “Related Persons”) may or might have in the future interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. The Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.

No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (including without limitation any statement, figures, opinion, view or estimate) provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

The contents hereof may not be reproduced or disseminated in whole or in part without OCBC Bank's written consent. The contents are a summary of the investment ideas and recommendations set out in Bank of Singapore and OCBC Bank reports. Please refer to the respective research report for the interest that the entity might have in the investment products and/or issuers of the securities.

Investments are subject to investment risks, including the possible loss of the principal amount invested. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures, predictions or projections are not necessarily indicative of future or likely performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

This document may be translated into the Chinese language. If there is any difference between the English and Chinese versions, the English version will apply.

Foreign Currency disclaimer

- Foreign currency investments or deposits are subject to inherent exchange rate fluctuation that may provide opportunities and risks. Consequently, exchange rate fluctuations may affect the value of your foreign currency investments or deposits.

- Earning on foreign currency investments or deposits may change depending on the exchange rates prevalent at the time of their maturity if you choose to convert.

- Exchange controls may apply to certain foreign currencies from time to time.

- Any pre-termination costs will be taken and deducted from your deposit directly and without notice.

Cross-Border Marketing Disclaimers

OCBC Bank's cross border marketing disclaimers relevant for your country of residence.

Collective Investment Schemes

- A copy of the prospectus of each fund is available and may be obtained from the fund manager or any of its approved distributors. Potential investors should read the prospectus for details on the relevant fund before deciding whether to subscribe for, or purchase units in the fund.

- The value of the units in the funds and the income accruing to the units, if any, may fall or rise. Please refer to the prospectus of the relevant fund for the name of the fund manager and the investment objectives of the fund.

- Investment involves risks. Past performance figures do not reflect future performance.

- Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way.

- For funds that are listed on an approved exchange, investors cannot redeem their units of those funds with the manager or may only redeem units with the manager under certain specified conditions. The listing of the units of those funds on any approved exchange does not guarantee a liquid market for the units.

- The indicative distribution rate may not be achieved and is not an indication, forecast, or projection of the future performance of the Fund.

Any opinions or views of third parties expressed in this document are those of the third parties identified, and do not represent views of Oversea-Chinese Banking Corporation Limited (“OCBC Bank”, “us”, “we” or “our”).