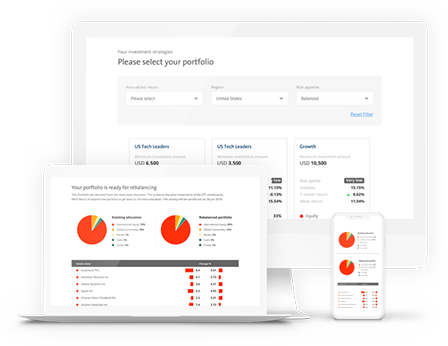

Mainland European Technology

The Mainland European Technology portfolio is designed to capture the performance of selected stocks in the Information Technology sector in France and Germany. All stocks in the portfolio pass our QVM (Quality, Value and Momentum) framework. The portfolio is benchmarked against the iShares Euro Stoxx 50 UCITS ETF.

Very Low -

Very Low -  Medium Risk

Medium Risk

High -

High -