We warmly welcome

all customers of the

National Australia Bank

We are very happy to welcome you to OCBC Bank.

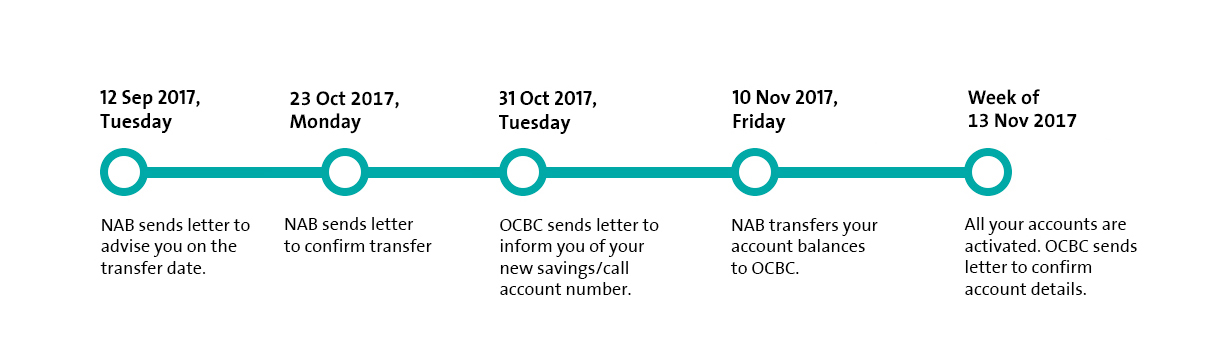

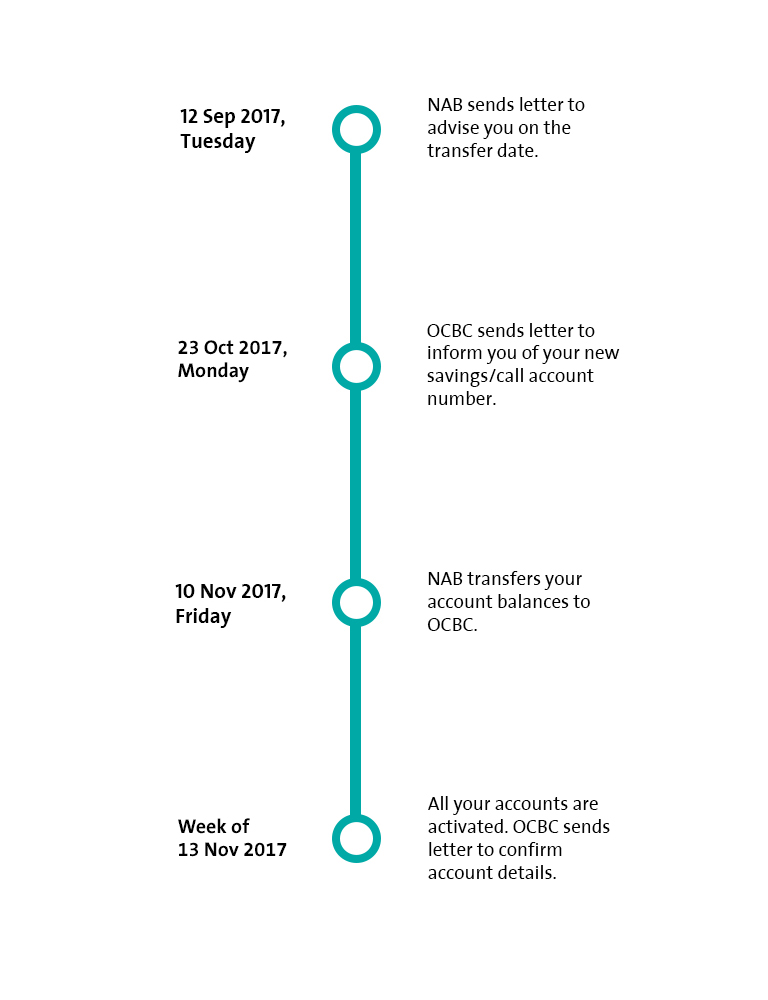

As we transfer your banking relationship from National Australia Bank (NAB), we will be sharing key updates and information with you through this website. Here, you will find details about the key milestones over the next few months, as well as some actions that you will need to take.

Please refer to the deposit and loan account sections to understand the changes when your accounts are transferred to OCBC Bank (OCBC).

If you have any questions, feel free to contact us.

We look forward to be at your service.

Timeline

- Items Requiring Your Attention

- What Will Change

- What Will Not Change

How do I instruct OCBC on my accounts after the transfer?

You can enjoy multiple convenient options to access your accounts and to give instructions to us 24 x 7.

Do sign-up for our online and mobile banking services for personal account or corporate account or continue to instruct us in writing.

You may visit our conveniently located branches and Premier Banking Centres, or send your written instructions to any of our locations.

OCBC Premier Banking customers can contact your Relationship Manager to assist you. Get to know more about OCBC’s Premier Banking services and how our team of Relationship Managers, Relationship Officers and Wealth Advisors can help you with your banking and financial need.

How do I transfer funds from overseas to OCBC?

Inform your remitting bank to pay as follows:

Beneficiary Bank

Oversea-Chinese Banking Corporation Limited

Singapore

SWIFT Code: OCBCSGSG or OCBCSGSGXXX

CHIPS UID: 010275

Intermediary Bank (For USD transfers)

JP Morgan Chase Bank, New York

New York, USA

SWIFT Code: CHASUS33

ABA Routing No.:FW02100002

CHIPS UID: CP0002

Please indicate the account number and account name as maintained with OCBC accordingly.

For funds crediting to Foreign Currency account, please indicate the 3-digit account currency code which is part of the account number e.g. 501123456201USD

For same-day crediting, remitting bank must inform Oversea-Chinese Banking Corporate Ltd, Singapore to confirm payment by authenticated SWIFT or test telex by 4pm Singapore time (for crediting into Foreign Currency Account) and 4.30pm Singapore time (for crediting into Singapore Dollars account).

How do I apply for internet banking?

If you are in Singapore, the fastest way to apply for internet banking is to visit our branch.

If you are not in Singapore, please complete and mail in the completed Apply for Online Banking form.

Update your existing GIRO and standing instructions linked to your NAB deposit account.

After the transfer date, your existing GIRO and standing instructions linked to your NAB deposit account will be discontinued. You will need to update your payment instructions with your new OCBC account number or make alternative arrangements.

Update your mailing address.

We will not be able to hold your physical mail for your collection after the transfer. Do ensure that your mailing address is updated with NAB before the transfer or please update us by completing the form for personal account or corporate account after the transfer to ensure timely receipt of communications.

Differences between NAB and OCBC Deposit Accounts.

Differences between NAB and OCBC Deposit Accounts for:

- SGD Deposits (Personal Accounts)

- FCY Deposits (Personal Accounts)

- SGD Deposits (Corporate Accounts)

- FCY Deposits (Corporate Accounts)

We would like to inform you that OCBC Bank has established two wholly-owned subsidiaries in Singapore and Malaysia to process certain selected transactions for OCBC Bank’s customers and for this purpose, customer information may be disclosed to these subsidiaries. Please be assured that customer information will continue to remain within the OCBC Group, subject to any mandatory disclosure required by the relevant regulatory authorities.

NAB Deposit Account Terms and Conditions will be replaced on 2 April 2018

The terms of your NAB deposit holdings will be replaced on 2 April 2018.

Some of the key changes include, but not limited to:

- You will only receive monthly statements if there are transactions within the month.

- You may update your signature or appoint another person to operate your account. If you wish to change the account ownership by adding or removing account holders, we will need you to open a new account.

- Do note that the original sum placed in a receipt is fixed during the tenure. Topping up of funds to the original sum placed is not allowed, but you may choose to place the funds under a new Time Deposit receipt. For example, if your original receipt was S$100,000 and you wish to increase to S$150,000, the additional S$50,000 will be in placed under a new receipt of S$50,000 and the original receipt remains at S$100,000.

- For corporate AUD & NZD call accounts, interest payment will be discontinued after 31 March 2018.

- For personal accounts, instructions to us are to be given in writing, through electronic banking options or you may contact your OCBC Premier Banking Relationship Manager for assistance. We may not be able to process instructions through fax, phone or email.

More info on your deposit account:

- SGD Call Deposits – Personal

- FCY Call Deposits – Personal

- SGD Call Deposits – Corporate

- FCY Call Deposits – Corporate

For a full listing, please refer to the Terms and Conditions in the links below:

NAB's fees and charges will no longer be applicable.

Do note that NAB's Guide to Fees and Charges and General Information Deposit Account will no longer be applicable after the transfer.

Please click on the following links to refer to OCBC’s Pricing Guides:

- Personal Banking

- Premier Banking

- Business Banking (local incorporation)

- Business Banking (foreign incorporation)

Please refer to our website at www.ocbc.com for information regarding OCBC products and services. OCBC services could differ from services provided by NAB. Services listed under General Service Fees in NAB’s Guide to Fees and Charges which will not be supported by OCBC are as follows:

- Opening accounts with other branches of our bank located overseas

- Witnessing of documentation

- Relaying messages by fax or courier to other branches of our bank located overseas

Eligible accounts are aggregated and insured under Singapore Deposit Insurance Scheme.

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$50,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

For NAB Multi-Currency Call Account (Personal).

There will be no changes to the following :

- The signing conditions i.e. who is authorised to give instructions to us

- The way interest is computed

- No minimum daily average balance to avoid service fee

- No service fee

We will also not charge any monthly maintenance fee on your account.

For NAB Multi-Currency Term Deposit Account (Personal & Corporate).

There will be no change to your original instructions to us on

- Tenure

- Interest rate

- Deposit amount

- Maturity instruction

If the deposit maturity instruction with NAB currently is to credit an account not with NAB or OCBC, we will automatically roll-over the funds when the deposit receipt matures. Please let us know at least 2 business days before the receipt maturity date if you do not wish to roll-over and provide us with your maturity instructions.

For accounts without maturity instructions, we will arrange to renew your deposit at the same or the next closest tenure available in OCBC at our prevailing board rates.

- Items Requiring Your Attention

- What Will Change

- What Will Not Change

How do I instruct OCBC on my accounts after the transfer?

You can enjoy multiple convenient options to access your accounts and to give instructions to us 24 x 7.

Do sign-up for our online and mobile banking services for personal account or corporate accounts, or continue to instruct us in writing.

You may visit our conveniently located branches and Premier Banking Centres, or send your written instructions to any of our locations.

OCBC Premier Banking customers can contact your Relationship Manager to assist you. Get to know more about OCBC’s Premier Banking services and how our team of Relationship Managers, Relationship Officers and Wealth Advisors can help you with your banking and financial need.

Continue to renew your fire insurance policy.

After the transfer, please continue to renew the fire insurance on your property.

For landed property owners, we may contact you to furnish the latest fire insurance policy and to arrange for the endorsement on the policy in OCBC’s name.

Should you require switching of loan currencies.

Currency switch is available for accounts transferred from NAB with the currency switch feature. We will check the Letter of Offer issued by NAB. If this term is not stated, or if there are changes in other terms and conditions, currency switch will be a situation of "refinancing" in regulations requiring a review of Total Debt Servicing Ratio and further documents may be required.

Terms of OCBC’s Currency Switch

- Currency switch is limited to changing the base currency of the existing loan into either Singapore Dollars (SGD) or the currency where the property collateral is located.

- Currency switch will be performed without any processing fee for the first application only. Thereafter a processing fee of S$500.00 in the existing base currency is payable for each subsequent currency switch request (to be deducted from your deposit account linked to the loan account)

- The maximum number of currency switches that can be requested for this loan is 5 times during the loan tenor.

Please call us if you intend to activate currency switch. We require 3 full working days to process your application because we reed to retrieve your original contract and perform a review on your account.

How do I transfer funds from overseas to OCBC to pay my loan?

To fund OCBC loan payment, transfer funds into the deposit account linked to the loan account. Inform your remitting bank to pay as follows:

Beneficiary Bank

Oversea-Chinese Banking Corporation Limited

Singapore

SWIFT Code: OCBCSGSG or OCBCSGSGXXX

CHIPS UID: 010275

Intermediary Bank (For USD transfers)

JP Morgan Chase Bank, New York

New York, USA

SWIFT Code: CHASUS33

ABA Routing No.:FW021000021

CHIPS UID: CP0002

Please indicate the account number and account name as maintained with OCBC accordingly.

For funds crediting to Foreign Currency account, please indicate the 3-digit account currency code which is part of the account number e.g. 501123456201USD

For same-day crediting, remitting bank must inform Oversea-Chinese Banking Corporate Ltd, Singapore to confirm payment by authenticated SWIFT or test telex by 4pm Singapore time (for crediting into Foreign Currency Account) and 4.30pm Singapore time (for crediting into Singapore Dollars account).

Do note the SGD10 processing fee for funds remitted into your account.

What is my instalment amount?

The first instalment to be paid will be the amount recorded in your NAB account.

When the interest rate is changed at the next funding period (in OCBC this is known as the "Rate Review Date"), OCBC will give you one month to adjust to the revised instalment amount.

For example, your loan interest rate was revised on the 20th November 2017. Your instalment due on 1 December 2017 will remain the same as the previous instalment amount as communicated by NAB and in our welcome letter dated 16 November 2017. The revised instalment will only apply from 2 January 2018.

As interest rate is fixed for 3 months, the instalment amount is also fixed for the next 3 months, i.e. the instalment for January, February and March 2018 will be the same.

What are OCBC's prepayment penalties?

For NAB accounts, all prepayment penalties are waived for notifications received until end February 2018.

From 1 March 2018, the notice period will be as follows:

- 30 days' notice for prepayment

- 90 days' notice for full redemption

As the prepayment / redemption notice requirement is waived from now until end February 2018, please state a specific date for prepayment / redemption. Otherwise, the 1-month notice period for prepayment and 3-month notice period for full redemption will be applied.

How do I inform OCBC of my intention to partially prepay or payoff the loan?

Please complete the form called Pay Your Home Loan or Term Loan in Advance

Submit the form at any branch or mail to:

OCBC Bank

Consumer Loan Operations

11 Tampines Central 1

#07-00 OCBC Tampines Centre One

Singapore 529542

Attention: Secured Loan Mortgage (Overseas Properties)

If you are selling your property, your solicitor should write in to OCBC to request for redemption statement. Note that prepayment fees will be waived for all notices receive until end February 2018.

Thereafter, 90 days’ notice or interest-in-lieu of shortfall in notice period applies.

You will receive quarterly interest rate change advices and annual loan statement

- As interest rate is changed every 3 months, you will receive quarterly rate change advices. This interest rate change advice will only reflect the first property pledged for your loan. Hence, if the loan is secured by multiple properties, only the first property will be reflected in view of the space limitation on the interest rate change advice. Please note that we will issue an annual statement for your tax submission.

- For your 2018 tax submission, you will have to tally interest in 3 components as follows:

- Before 13 Nov 2017: Refer to NAB’s quarterly statement

- From 13 Nov 2017 – 31 Dec 2017: OCBC’s 31 Dec 2017 statement

- From 1 Jan 2018 till 30 Apr 2018 (UK/NZ): OCBC’s 30 Apr 2018 statement

- From 1 Jan 2018 till 30 Jun 2018 (Australia): OCBC’s 30 Jun 2018 statement

Loan payments are due on the first business day of each month.

At NAB, your loan payments are due monthly according to the day of your first loan disbursement. OCBC instalments are always due on the first business day of each month.

OCBC will automatically deduct the instalment due from the deposit account attached to your loan account on the first business day of each month. Please fund this account to ensure prompt instalment payment.

We have arranged for the first instalment with OCBC to be due on the 1st business day of the second month after the transfer. If your instalment due date with NAB falls on or before the transfer, your first instalment with OCBC will be due on the 1st business day of the next month after the transfer.

For illustrative purpose:

Existing NAB Instalment Due Date |

First Instalment with OCBC |

|---|---|

1 November 2017, Wed |

1 December 2017, Fri |

10 November 2017, Fri |

1 December 2017, Fri |

13 November 2017, Mon |

2 January 2017, Tue |

30 November 2017, Thu |

2 January 2017, Tue |

If you do not make payments within 7 days after the due date, there will be a late fee of $80 in the respective loan currency. For example, if your loan is in AUD, the late fee would be AUD80. After the transfer, do let us know If you have issues resulting in delay in paying your first instalment with OCBC, and we will be happy to review the waiver of any late charges for the first instalment.

Changes made to your first instalment due with OCBC.

The first instalment amount due to be paid to OCBC will be the latest instalment recorded in your NAB account. When the interest rate is changed at the next funding period, OCBC will give you one month to adjust to the revised instalment amount.

For example, your loan interest rate is revised on the 20 November 2017 . Your instalment due on 1 December 2017 will remain the same as the previous instalment amount. The revised instalment will only apply from 2 January 2018.

NAB Lending Rate will be replaced by OCBC’s 3-month Cost of Funds in the loan currency.

There is no change to the spread above NAB’s Lending Rate on your account. For example, your NAB loan interest rate is NAB Lending Rate + 1.50% p.a. When interest rate is changed at the next funding period, the loan interest rate will be changed to OCBC Cost of Fund + 1.50%.

Currency and tenor of your loan will remain the same.

There will be no change to the currency and tenor of your loan.

Interest computation method on your loan account will remain the same.

There will be no change to the way in which interest is computed on your loan account.

Loan spread on your loan account will remain the same.

There will be no change on the loan spread on your loan account.

What will change is that OCBC’s Cost of Fund rate which will apply from the next funding period as recorded in your NAB account.

For example, your current NAB loan interest rate is NAB Lending Rate + 1.50% p.a. , which will change to OCBC Cost of Fund + 1.50%.

Interest only loans will continue

- If your account is on interest only for a defined period or until maturity as per terms with NAB, OCBC will maintain the interest only payment period, provided that there are no changes to the Letter of Offer issued by NAB. If there are changes to the terms stated in the Letter of Offer, OCBC will restructure the loan and the new loan granted will be on instalment payment mode.

- 5 working days before month end, system will generate an advice on the amount to be paid. Please fund your deposit account so that we can automatically deduct the interest amount on the first working day of the following month.

About OCBC Group

OCBC Bank is well-known to be the longest established Singapore bank. OCBC Bank has a footprint in other core markets – Malaysia, Indonesia and Greater China. It has blended its 85-year heritage and world-class financial strength with a comprehensive product mix, cutting-edge financial technology (fintech) and a laser focus on engaging customers in fresh ways.

In recent years, OCBC Bank has strongly enhanced its integrated wealth management platform – through which deep relationships with new customers can be quickly forged. The product capabilities sit on a common platform which draws on the combined expertise of OCBC Bank and its subsidiaries. OCBC offers market-leading insurance products from Great Eastern Holdings, equities and bond funds from Lion Global Investors, brokerage services from OCBC Securities and private banking services from the fast-expanding Bank of Singapore.

OCBC Banking Services

Enjoy access to a suite of products and services

OCBC Digital Advantage

OCBC enables you to have the convenience to take your banking needs wherever you go with OCBC Online Banking and OCBC Mobile Banking.

View, pay, invest and manage your money anywhere, anytime with our world class Digital services such as OCBC OneTouch, OCBC Pay Anyone and OCBC OneWealth.

OCBC Premier Banking

OCBC Premier Banking is committed to listening and understanding your goals to deliver tailored solutions from a comprehensive product range to meet your needs. Let our expert team of OCBC Wealth Panel provide you with in depth and timely wealth advisory.

To experience the difference today, please leave your contact details with us or call 1800 PREMIER (773 6437).

Contact Us

-

For personal accounts

Call our hotline

(+65) 6363 3333 -

For corporate accounts

Call our hotline

(+65) 6538 1111 -

Complete enquiry form