-

Step 1: Login to the OCBC Digital app

- Ensure that the OCBC Digital app on your registered device is updated and in-app notifications are enabled.

-

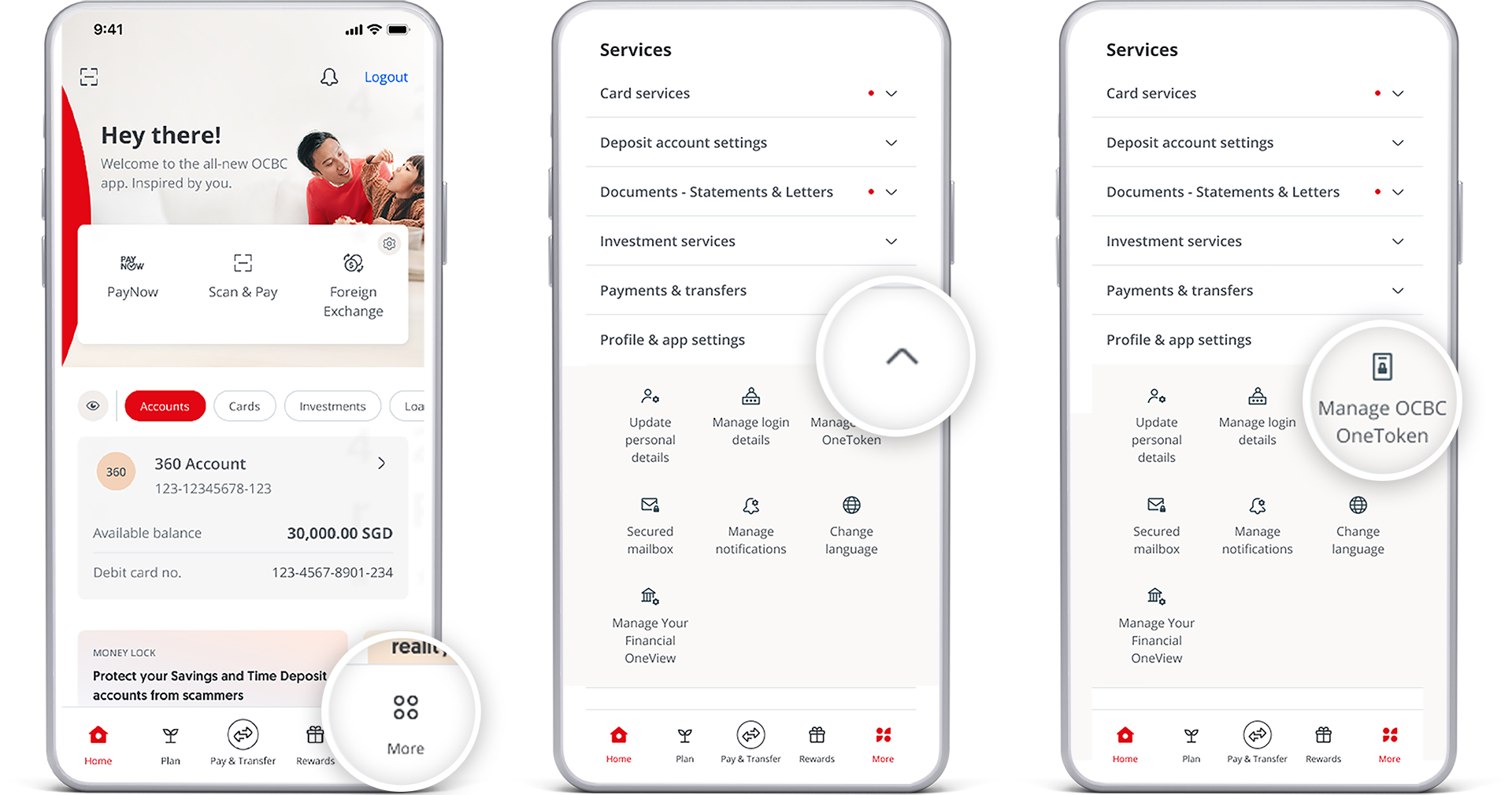

Step 2: View settings

- Tap on “Profile & Settings”

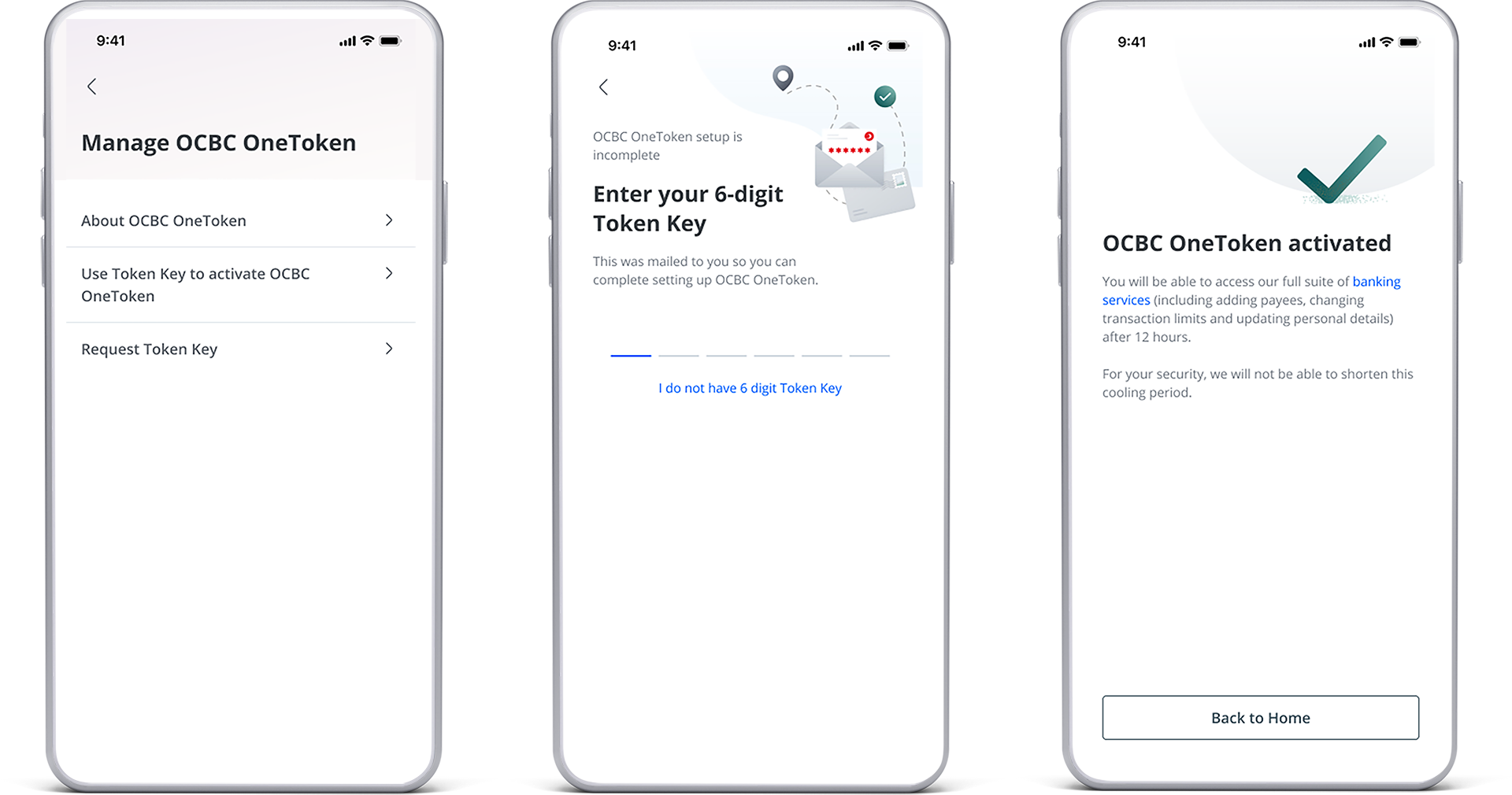

- Tap on "Manage OCBC OneToken"

-

Step 3: Activate your OCBC OneToken

Select “Activate with SMS OTP and Token Key”

-

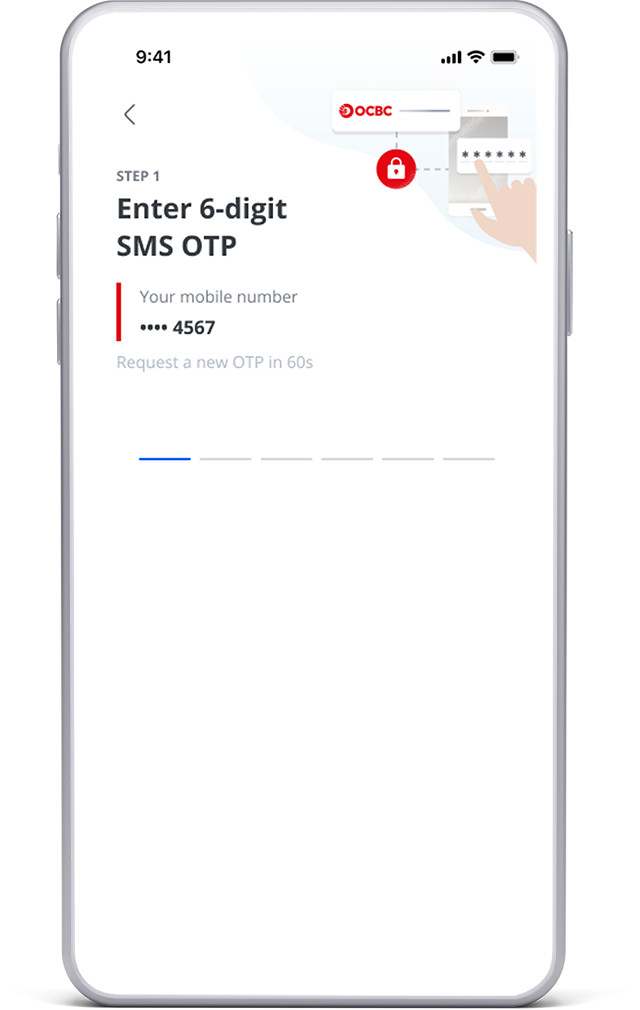

Step 4: Enter your SMS one-time password (OTP)

- Follow the on-screen instructions

- A 6-digit SMS OTP will be sent to your mobile number via SMS

- Enter the SMS OTP

-

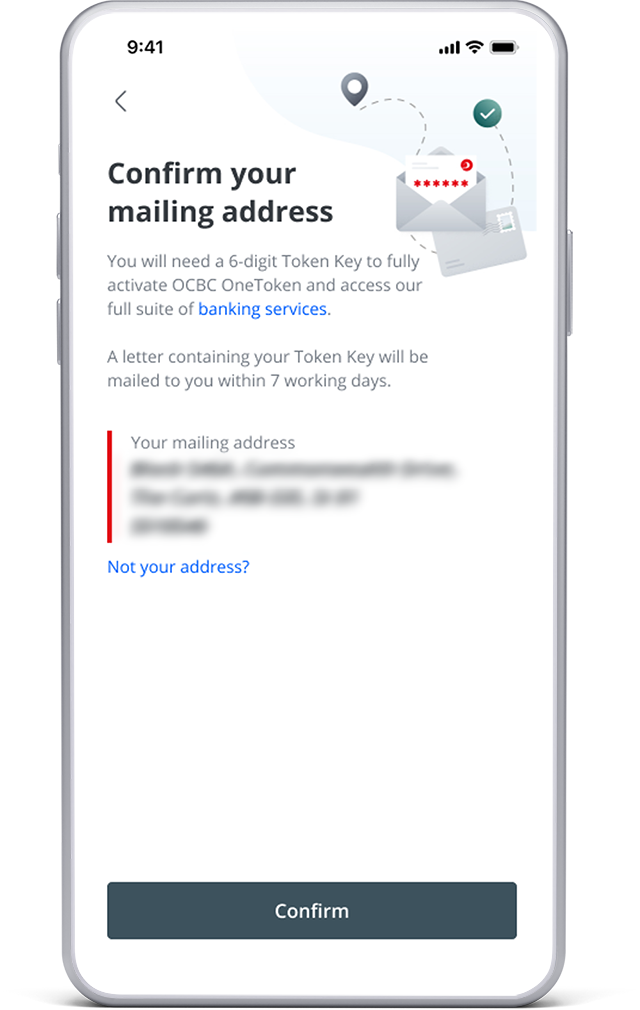

Step 5: Confirm your mailing address

Tap “Confirm” to confirm your mailing address that the Token Key will be sent to via mail.

-

Step 6: Your OCBC OneToken is almost fully activated

- Only low risk transactions can be carried out with OCBC OneToken, e.g. Bill payment, funds transfer to existing payee.

- For high risk transactions such as adding payees, changing personal particulars and changing transaction limits, you will need to complete activation with a 6-digit Token Key. You will receive it via mail within 7 days.

-

Step 7: Upon receiving your PIN mailer, enter your 6-digit Token Key

- A 6-digit Token Key letter will be mailed to you to your registered address

- Upon receiving your PIN mailer, log in to your Mobile Banking app

- On the menu list, go to “Profile & Settings” > “Manage OCBC OneToken” > “Enter Activation Code”

- Enter your 6-digit Token Key

-

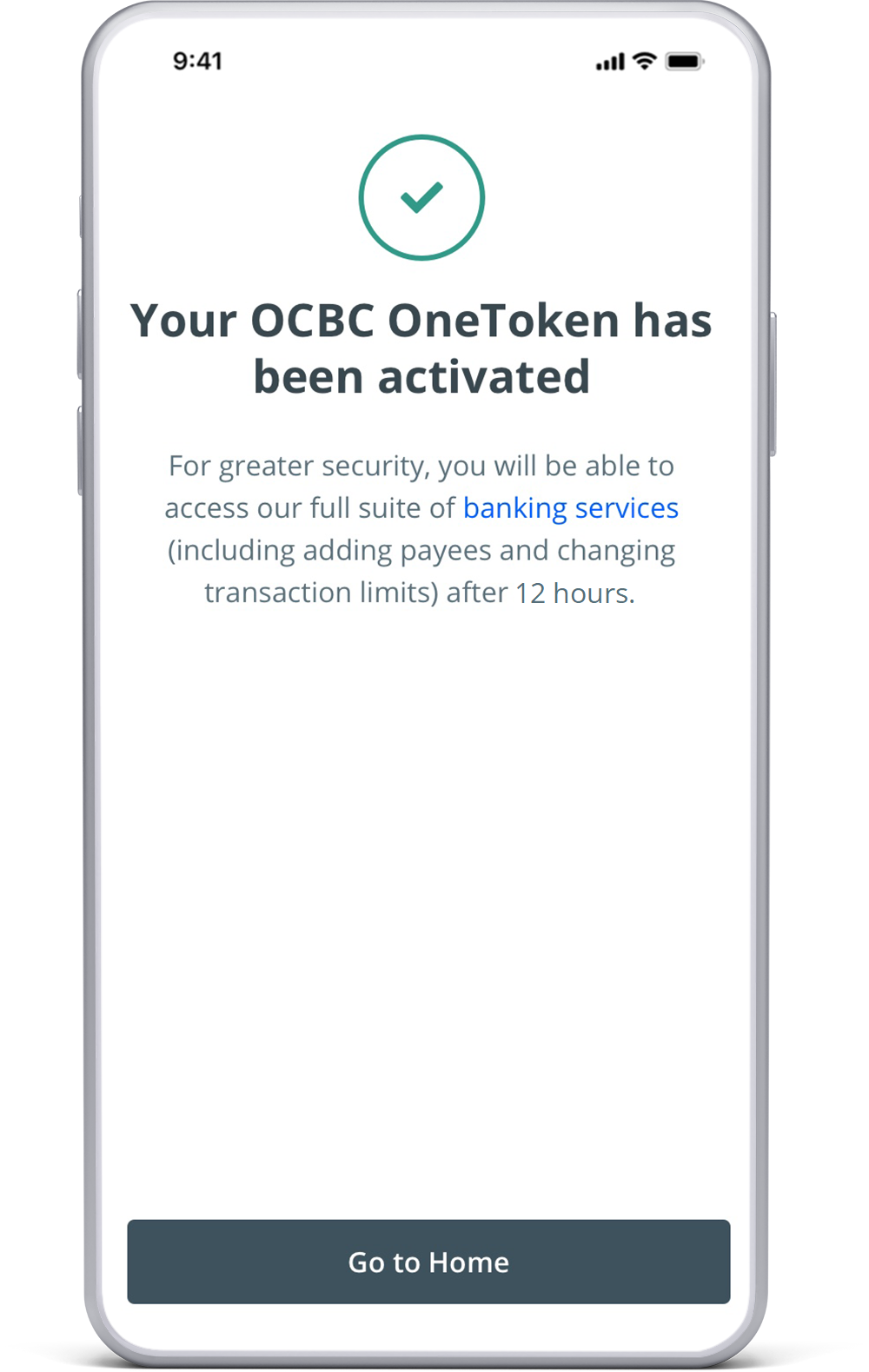

Step 8: Your OCBC OneToken will be fully activated after 12 hours

For your security, to access services like adding payees, changing transaction limits and updating personal details, you must wait up to 12 hours for OCBC OneToken to be fully activated.

Security advisory: Do NOT share your One-Time Password (OTP) with or provide your OneToken authorisation to anyone without knowing the intended purpose. Never share your OTP with family and friends, phishing websites, OCBC Bank staff or the police. Always go to https://www.ocbc.com/login or use the OCBC Digital app to make your transactions.