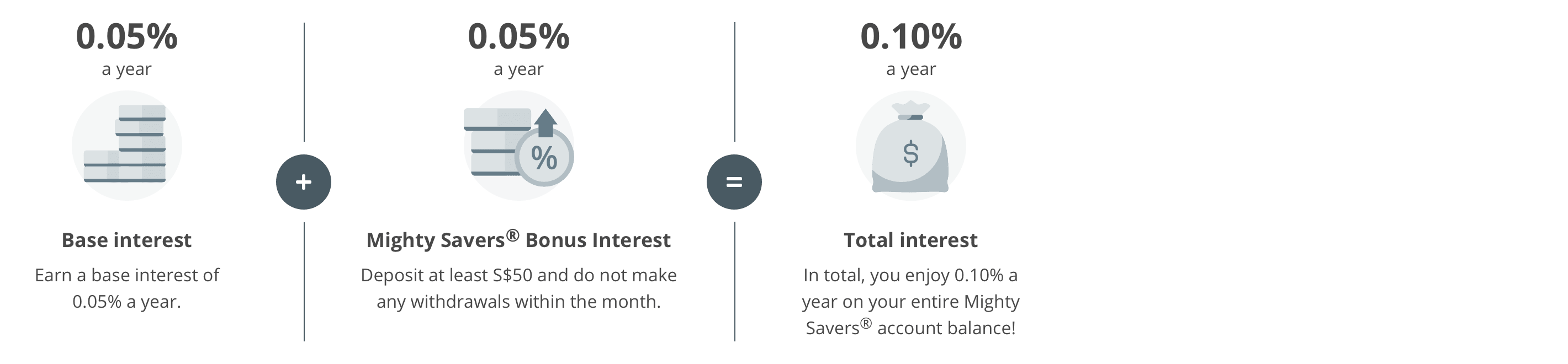

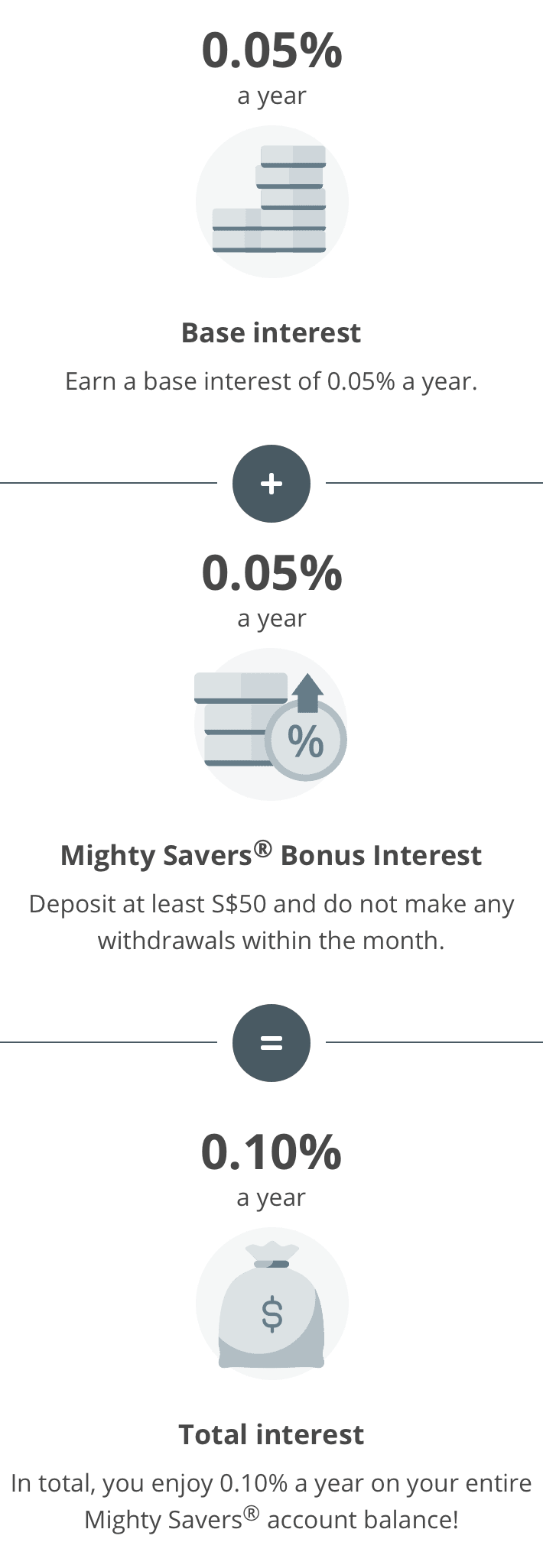

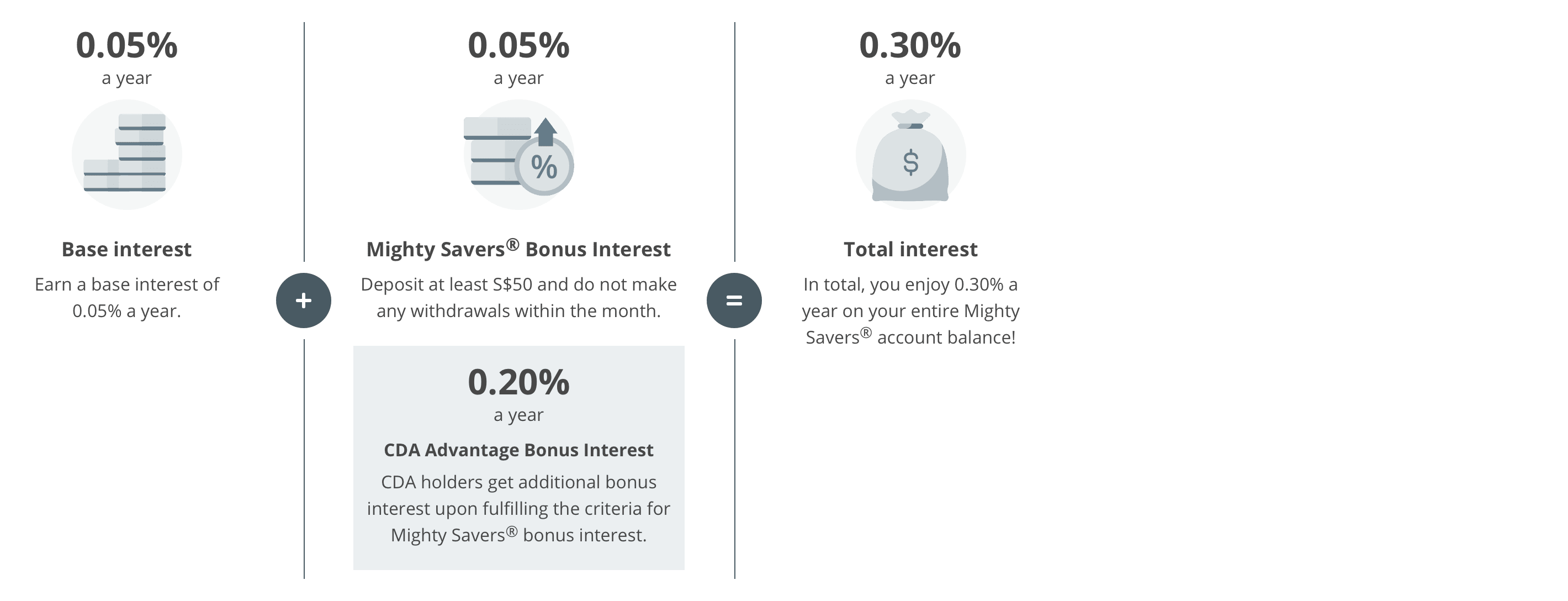

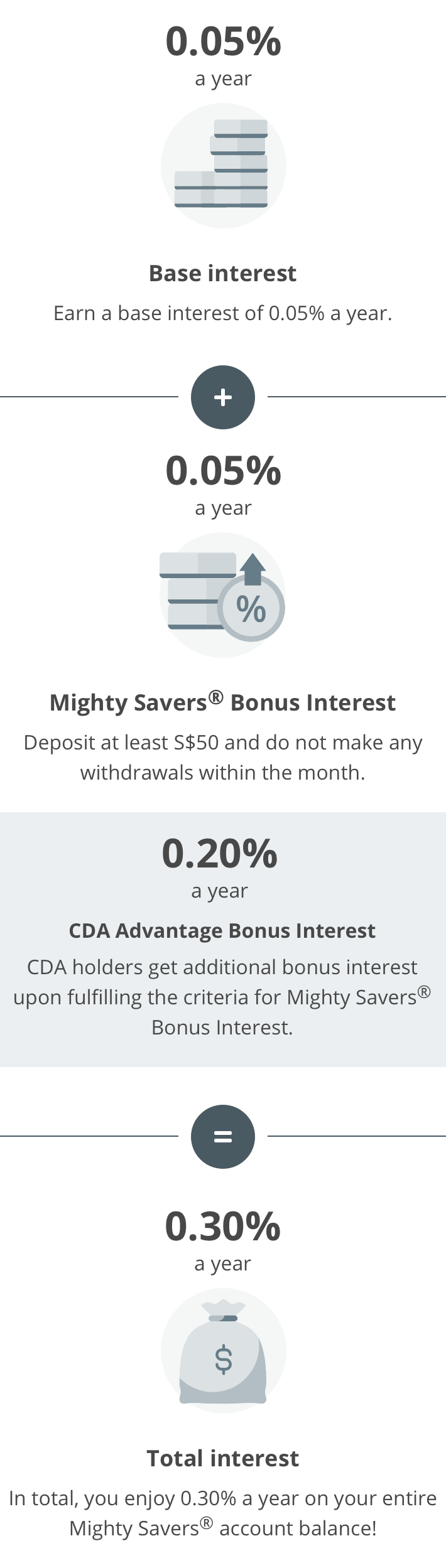

You get 2 categories of interest on your account every month.

1. Base interest:

This interest is accrued daily based on your account's day-end balance and you will receive this at the end of the month.

2. Bonus interest:

You earn a bonus interest on your account’s average daily balance and you will receive this on the 1st business day of the following month.

- Earn a Bonus Interest of 0.05% a year for months when you do not make any withdrawals and deposit at least S$50.

- Earn a CDA Advantage Bonus Interest if you are an OCBC Child Development Account holder.